2012 Sustainability selection - SBM Offshore

2012 Sustainability selection - SBM Offshore

2012 Sustainability selection - SBM Offshore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

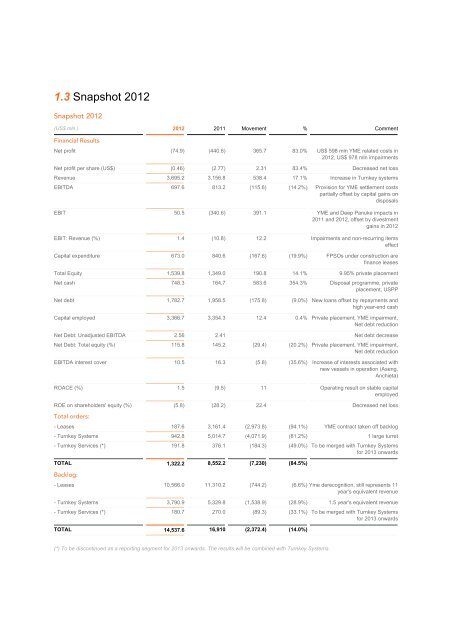

1.3 Snapshot <strong>2012</strong><br />

Snapshot <strong>2012</strong><br />

(US$ mln.) <strong>2012</strong> 2011 Movement % Comment<br />

Financial Results<br />

Net profit (74.9) (440.6) 365.7 83.0% US$ 598 mln YME related costs in<br />

<strong>2012</strong>, US$ 978 mln impairments<br />

Net profit per share (US$) (0.46) (2.77) 2.31 83.4% Decreased net loss<br />

Revenue 3,695.2 3,156.8 538.4 17.1% Increase in Turnkey systems<br />

EBITDA 697.6 813.2 (115.6) (14.2%) Provision for YME settlement costs<br />

partially offset by capital gains on<br />

disposals<br />

EBIT 50.5 (340.6) 391.1 YME and Deep Panuke impacts in<br />

2011 and <strong>2012</strong>, offset by divestment<br />

gains in <strong>2012</strong><br />

EBIT: Revenue (%) 1.4 (10.8) 12.2 Impairments and non-recurring items<br />

effect<br />

Capital expenditure 673.0 840.6 (167.6) (19.9%) FPSOs under construction are<br />

finance leases<br />

Total Equity 1,539.8 1,349.0 190.8 14.1% 9.95% private placement<br />

Net cash 748.3 164.7 583.6 354.3% Disposal programme, private<br />

placement, USPP<br />

Net debt 1,782.7 1,958.5 (175.8) (9.0%) New loans offset by repayments and<br />

high year-end cash<br />

Capital employed 3,366.7 3,354.3 12.4 0.4% Private placement, YME impairment,<br />

Net debt reduction<br />

Net Debt: Unadjusted EBITDA 2.56 2.41 Net debt decrease<br />

Net Debt: Total equity (%) 115.8 145.2 (29.4) (20.2%) Private placement, YME impairment,<br />

Net debt reduction<br />

EBITDA interest cover 10.5 16.3 (5.8) (35.6%) Increase of interests associated with<br />

new vessels in operation (Aseng,<br />

Anchieta)<br />

ROACE (%) 1.5 (9.5) 11 Operating result on stable capital<br />

employed<br />

ROE on shareholders' equity (%) (5.8) (28.2) 22.4 Decreased net loss<br />

Total orders:<br />

- Leases 187.6 3,161.4 (2,973.8) (94.1%) YME contract taken off backlog<br />

- Turnkey Systems 942.8 5,014.7 (4,071.9) (81.2%) 1 large turret<br />

- Turnkey Services (*) 191.8 376.1 (184.3) (49.0%) To be merged with Turnkey Systems<br />

for 2013 onwards<br />

TOTAL 1,322.2 8,552.2 (7,230) (84.5%)<br />

Backlog:<br />

- Leases 10,566.0 11,310.2 (744.2) (6.6%) Yme derecognition, still represents 11<br />

year's equivalent revenue<br />

- Turnkey Systems 3,790.9 5,329.8 (1,538.9) (28.9%) 1.5 year's equivalent revenue<br />

- Turnkey Services (*) 180.7 270.0 (89.3) (33.1%) To be merged with Turnkey Systems<br />

for 2013 onwards<br />

TOTAL 14,537.6 16,910 (2,372.4) (14.0%)<br />

(*) To be discontinued as a reporting segment for 2013 onwards. The results will be combined with Turnkey Systems.