mapinfomag_spring200..

mapinfomag_spring200..

mapinfomag_spring200..

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

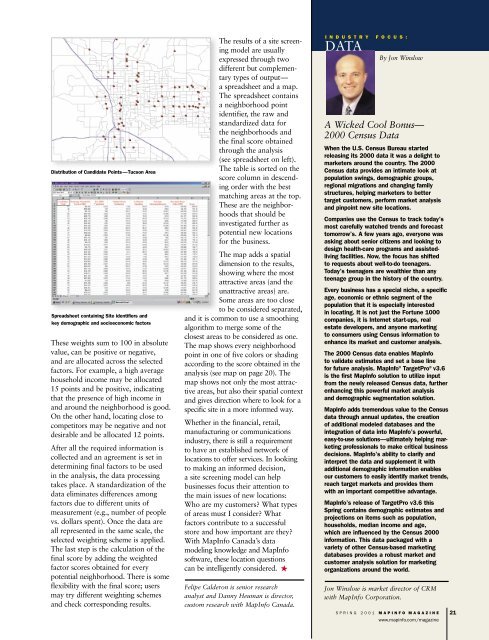

Distribution of Candidate Points—Tucson Area<br />

Spreadsheet containing Site identifiers and<br />

key demographic and socioeconomic factors<br />

These weights sum to 100 in absolute<br />

value, can be positive or negative,<br />

and are allocated across the selected<br />

factors. For example, a high average<br />

household income may be allocated<br />

15 points and be positive, indicating<br />

that the presence of high income in<br />

and around the neighborhood is good.<br />

On the other hand, locating close to<br />

competitors may be negative and not<br />

desirable and be allocated 12 points.<br />

After all the required information is<br />

collected and an agreement is set in<br />

determining final factors to be used<br />

in the analysis, the data processing<br />

takes place. A standardization of the<br />

data eliminates differences among<br />

factors due to different units of<br />

measurement (e.g., number of people<br />

vs. dollars spent). Once the data are<br />

all represented in the same scale, the<br />

selected weighting scheme is applied.<br />

The last step is the calculation of the<br />

final score by adding the weighted<br />

factor scores obtained for every<br />

potential neighborhood. There is some<br />

flexibility with the final score; users<br />

may try different weighting schemes<br />

and check corresponding results.<br />

The results of a site screening<br />

model are usually<br />

expressed through two<br />

different but complementary<br />

types of output—<br />

a spreadsheet and a map.<br />

The spreadsheet contains<br />

a neighborhood point<br />

identifier, the raw and<br />

standardized data for<br />

the neighborhoods and<br />

the final score obtained<br />

through the analysis<br />

(see spreadsheet on left).<br />

The table is sorted on the<br />

score column in descending<br />

order with the best<br />

matching areas at the top.<br />

These are the neighborhoods<br />

that should be<br />

investigated further as<br />

potential new locations<br />

for the business.<br />

The map adds a spatial<br />

dimension to the results,<br />

showing where the most<br />

attractive areas (and the<br />

unattractive areas) are.<br />

Some areas are too close<br />

to be considered separated,<br />

and it is common to use a smoothing<br />

algorithm to merge some of the<br />

closest areas to be considered as one.<br />

The map shows every neighborhood<br />

point in one of five colors or shading<br />

according to the score obtained in the<br />

analysis (see map on page 20). The<br />

map shows not only the most attractive<br />

areas, but also their spatial context<br />

and gives direction where to look for a<br />

specific site in a more informed way.<br />

Whether in the financial, retail,<br />

manufacturing or communications<br />

industry, there is still a requirement<br />

to have an established network of<br />

locations to offer services. In looking<br />

to making an informed decision,<br />

a site screening model can help<br />

businesses focus their attention to<br />

the main issues of new locations:<br />

Who are my customers? What types<br />

of areas must I consider? What<br />

factors contribute to a successful<br />

store and how important are they?<br />

With MapInfo Canada’s data<br />

modeling knowledge and MapInfo<br />

software, these location questions<br />

can be intelligently considered.<br />

Felipe Calderon is senior research<br />

analyst and Danny Heuman is director,<br />

custom research with MapInfo Canada.<br />

I N D U S T R Y F O C U S :<br />

DATA<br />

By Jon Winslow<br />

A Wicked Cool Bonus—<br />

2000 Census Data<br />

When the U.S. Census Bureau started<br />

releasing its 2000 data it was a delight to<br />

marketers around the country. The 2000<br />

Census data provides an intimate look at<br />

population swings, demographic groups,<br />

regional migrations and changing family<br />

structures, helping marketers to better<br />

target customers, perform market analysis<br />

and pinpoint new site locations.<br />

Companies use the Census to track today’s<br />

most carefully watched trends and forecast<br />

tomorrow’s. A few years ago, everyone was<br />

asking about senior citizens and looking to<br />

design health-care programs and assistedliving<br />

facilities. Now, the focus has shifted<br />

to requests about well-to-do teenagers.<br />

Today’s teenagers are wealthier than any<br />

teenage group in the history of the country.<br />

Every business has a special niche, a specific<br />

age, economic or ethnic segment of the<br />

population that it is especially interested<br />

in locating. It is not just the Fortune 1000<br />

companies, it is Internet start-ups, real<br />

estate developers, and anyone marketing<br />

to consumers using Census information to<br />

enhance its market and customer analysis.<br />

The 2000 Census data enables MapInfo<br />

to validate estimates and set a base line<br />

for future analysis. MapInfo ® TargetPro ® v3.6<br />

is the first MapInfo solution to utilize input<br />

from the newly released Census data, further<br />

enhancing this powerful market analysis<br />

and demographic segmentation solution.<br />

MapInfo adds tremendous value to the Census<br />

data through annual updates, the creation<br />

of additional modeled databases and the<br />

integration of data into MapInfo’s powerful,<br />

easy-to-use solutions—ultimately helping marketing<br />

professionals to make critical business<br />

decisions. MapInfo’s ability to clarify and<br />

interpret the data and supplement it with<br />

additional demographic information enables<br />

our customers to easily identify market trends,<br />

reach target markets and provides them<br />

with an important competitive advantage.<br />

MapInfo’s release of TargetPro v3.6 this<br />

Spring contains demographic estimates and<br />

projections on items such as population,<br />

households, median income and age,<br />

which are influenced by the Census 2000<br />

information. This data packaged with a<br />

variety of other Census-based marketing<br />

databases provides a robust market and<br />

customer analysis solution for marketing<br />

organizations around the world.<br />

Jon Winslow is market director of CRM<br />

with MapInfo Corporation.<br />

SPRING 2001 MAPINFO MAGAZINE<br />

www.mapinfo.com/magazine<br />

21