CV - Universitat Pompeu Fabra

CV - Universitat Pompeu Fabra

CV - Universitat Pompeu Fabra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

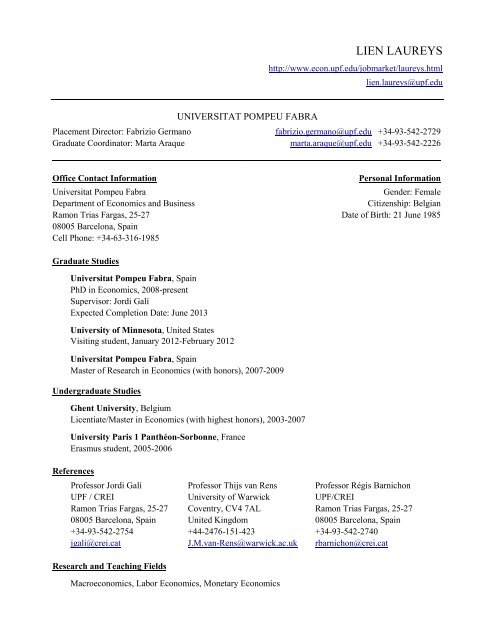

UNIVERSITAT POMPEU FABRA<br />

LIEN LAUREYS<br />

http://www.econ.upf.edu/jobmarket/laureys.html<br />

lien.laureys@upf.edu<br />

Placement Director: Fabrizio Germano fabrizio.germano@upf.edu +34-93-542-2729<br />

Graduate Coordinator: Marta Araque marta.araque@upf.edu +34-93-542-2226<br />

Office Contact Information Personal Information<br />

<strong>Universitat</strong> <strong>Pompeu</strong> <strong>Fabra</strong> Gender: Female<br />

Department of Economics and Business Citizenship: Belgian<br />

Ramon Trias Fargas, 25-27 Date of Birth: 21 June 1985<br />

08005 Barcelona, Spain<br />

Cell Phone: +34-63-316-1985<br />

Graduate Studies<br />

<strong>Universitat</strong> <strong>Pompeu</strong> <strong>Fabra</strong>, Spain<br />

PhD in Economics, 2008-present<br />

Supervisor: Jordi Galí<br />

Expected Completion Date: June 2013<br />

University of Minnesota, United States<br />

Visiting student, January 2012-February 2012<br />

<strong>Universitat</strong> <strong>Pompeu</strong> <strong>Fabra</strong>, Spain<br />

Master of Research in Economics (with honors), 2007-2009<br />

Undergraduate Studies<br />

Ghent University, Belgium<br />

Licentiate/Master in Economics (with highest honors), 2003-2007<br />

University Paris 1 Panthéon-Sorbonne, France<br />

Erasmus student, 2005-2006<br />

References<br />

Professor Jordi Galí Professor Thijs van Rens Professor Régis Barnichon<br />

UPF / CREI University of Warwick UPF/CREI<br />

Ramon Trias Fargas, 25-27 Coventry, <strong>CV</strong>4 7AL Ramon Trias Fargas, 25-27<br />

08005 Barcelona, Spain United Kingdom 08005 Barcelona, Spain<br />

+34-93-542-2754 +44-2476-151-423 +34-93-542-2740<br />

jgali@crei.cat J.M.van-Rens@warwick.ac.uk rbarnichon@crei.cat<br />

Research and Teaching Fields<br />

Macroeconomics, Labor Economics, Monetary Economics

Teaching Experience<br />

Spring 2012 Advanced Macroeconomics II (graduate), UPF<br />

Teaching assistant for Jordi Galí and Thijs van Rens<br />

Spring 2011 Advanced Macroeconomics II (graduate), UPF<br />

Teaching assistant for Jordi Galí and Thijs van Rens<br />

Spring 2010 Advanced Macroeconomics II (graduate), UPF<br />

Teaching assistant for Jordi Galí and Thijs van Rens<br />

Winter 2010 Statistics (undergraduate),UPF<br />

Teaching assistant for Alejandra Cabaña<br />

Winter 2010 Game Theory (undergraduate), UPF<br />

Teaching assistant for Fabrizio Germano<br />

Spring 2009 Advanced Macroeconomics II (graduate), UPF<br />

Teaching assistant for Jordi Galí and Thijs van Rens<br />

Spring 2009 Applied Macroeconomics (undergraduate), UPF<br />

Teaching assistant for Andrea Caggese<br />

Winter 2009 Financial Economics (undergraduate), UPF<br />

Teaching assistant for Josep Perelló<br />

Research Experience<br />

2009-2010 Research assistant for Jordi Galí<br />

Conferences<br />

Dec 2012 Spanish Economic Association Annual Meeting (Vigo) - scheduled<br />

Jun 2012 Annual Search and Matching Meeting (Cyprus)<br />

Aug 2011 European Economic Association Meeting (Oslo)<br />

Jun 2011 XVI Workshop on Dynamic Macroeconomics (Vigo)<br />

Seminars<br />

2008-2012 Macroeconomics Breakfast Seminar (UPF/CREI)<br />

Nov 2012 Macroeconomics Seminar (<strong>Universitat</strong> Autònoma de Barcelona)<br />

Oct 2012 Macro Group (University of Warwick)<br />

Feb 2012 Workshop in Trade and Development (University of Minnesota)<br />

Honors, Scholarships, and Fellowships:<br />

Oct 2010-present FPU Grant by the Ministry of Education of the Spanish Government<br />

Jan-Sep 2010 FI AGAUR Grant by the Catalan Government<br />

Languages<br />

Dutch (native), English (Fluent), French (Fluent), Spanish (Fluent)<br />

2

Research Papers<br />

The Cost of Human Capital Depreciation during Unemployment (Job Market Paper)<br />

There is evidence that workers’ skills erode during periods of unemployment. This issue seems of particular<br />

concern now that unemployment duration has increased in the Great Recession. I argue that loss of skill<br />

during unemployment generates an externality in job creation: firms ignore how their hiring decisions affect<br />

the skill composition of the unemployment pool, and hence the output produced by new hires. Overall, job<br />

creation is too low, but contrary to conventional wisdom less so in recessions than in booms. The larger<br />

share of job-seekers with eroded skills in the unemployment pool in recessions lowers the social cost of<br />

having a worker losing her skills because it decreases the expected difference in productivity between a new<br />

hire and a job-seeker with eroded skills. As a consequence, everything else equal, loss of skill during<br />

unemployment may warrant procyclical employment subsidies.<br />

Optimal Monetary Policy in the Presence of Human Capital Depreciation during Unemployment<br />

This paper looks at how the prescription for conducting monetary policy changes once it is taken into<br />

account that workers’ human capital depreciates during periods of unemployment. Human capital<br />

depreciation during unemployment is introduced into an otherwise standard New Keynesian model with<br />

search frictions in the labor market. Skill erosion has potential implications for optimal monetary policy<br />

because in its presence the flexible-price allocation is not constrained-efficient. This is a consequence of a<br />

composition externality related to job creation: firms ignore how their hiring decisions affect the extent to<br />

which the unemployed workers’ skills erode, and hence the output that can be produced by new matches.<br />

Although optimal price inflation is no longer zero, strict inflation targeting is shown to stay close to the<br />

optimal policy.<br />

Fiscal Stimulus and Labor Market Outcomes: The Role of Short-Run Wealth Effects and Wage<br />

Rigidity<br />

How does the effect of an increase in government spending on labor market outcomes depend on the shortrun<br />

wealth effect? In a classical framework, the role of the short-run wealth effect in generating a positive<br />

employment response is crucial because it drives the increase in labor supply which induces this response. In<br />

a New Keynesian framework with sticky prices and wages, the short-run wealth effect plays a less important<br />

role because fiscal stimulus also increases labor demand. I find that higher degrees of wage rigidity lower the<br />

role of the short-run wealth effect in obtaining a given employment increase: more rigid wages reduce the<br />

importance of an increase in labor supply to limit the upward pressure on wages triggered by the increase in<br />

labor demand. Moreover, an increase in government spending only decreases the unemployment rate when<br />

the labor demand effect more than offsets the increase in labor supply.<br />

3