Information Circular - About TELUS

Information Circular - About TELUS

Information Circular - About TELUS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mandate<br />

The mandate of the Pension Committee is to oversee the<br />

administration, financial reporting and investment activities of<br />

the Pension Plan for Management and Professional Employees<br />

of <strong>TELUS</strong> Corporation, the <strong>TELUS</strong> Defined Contribution<br />

Pension Plan, the <strong>TELUS</strong> Edmonton Pension Plan, the <strong>TELUS</strong><br />

Corporation Pension Plan, the <strong>TELUS</strong> Québec Defined Benefit<br />

Pension Plan, any successor plans, related supplemental<br />

retirement arrangements as mandated by the Board, and<br />

any related trust funds (collectively, the Pension Plans).<br />

The Committee is responsible for reporting to the Board in<br />

respect of the actuarial soundness of the Pension Plans,<br />

the administrative aspects of the Pension Plans, investment<br />

policy, the performance of the investment portfolios and<br />

compliance with government legislation. The Committee may,<br />

from time to time, recommend to the Board for approval,<br />

fundamental changes in the nature of the pension arrangement<br />

for any Pension Plan, and changes in the governance<br />

structure for the Pension Plans.<br />

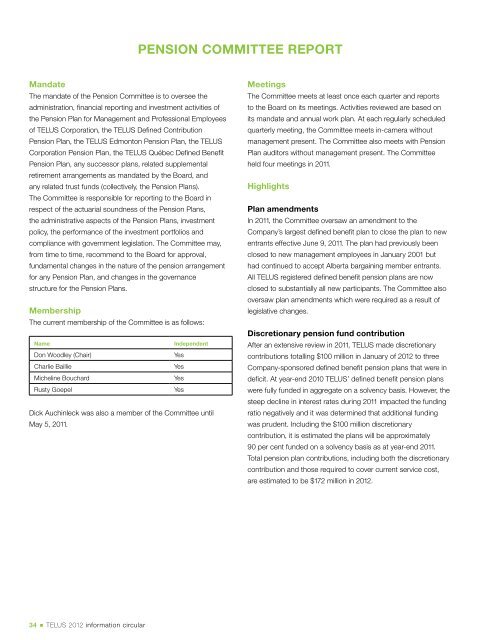

Membership<br />

The current membership of the Committee is as follows:<br />

Name Independent<br />

Don Woodley (Chair) Yes<br />

Charlie Baillie Yes<br />

Micheline Bouchard Yes<br />

Rusty Goepel Yes<br />

Dick Auchinleck was also a member of the Committee until<br />

May 5, 2011.<br />

34 . <strong>TELUS</strong> 2012 information circular<br />

PENSION COMMITTEE rEPOrT<br />

Meetings<br />

The Committee meets at least once each quarter and reports<br />

to the Board on its meetings. Activities reviewed are based on<br />

its mandate and annual work plan. At each regularly scheduled<br />

quarterly meeting, the Committee meets in-camera without<br />

management present. The Committee also meets with Pension<br />

Plan auditors without management present. The Committee<br />

held four meetings in 2011.<br />

Highlights<br />

Plan amendments<br />

In 2011, the Committee oversaw an amendment to the<br />

Company’s largest defined benefit plan to close the plan to new<br />

entrants effective June 9, 2011. The plan had previously been<br />

closed to new management employees in January 2001 but<br />

had continued to accept Alberta bargaining member entrants.<br />

All <strong>TELUS</strong> registered defined benefit pension plans are now<br />

closed to substantially all new participants. The Committee also<br />

oversaw plan amendments which were required as a result of<br />

legislative changes.<br />

Discretionary pension fund contribution<br />

After an extensive review in 2011, <strong>TELUS</strong> made discretionary<br />

contributions totalling $100 million in January of 2012 to three<br />

Company-sponsored defined benefit pension plans that were in<br />

deficit. At year-end 2010 <strong>TELUS</strong>’ defined benefit pension plans<br />

were fully funded in aggregate on a solvency basis. However, the<br />

steep decline in interest rates during 2011 impacted the funding<br />

ratio negatively and it was determined that additional funding<br />

was prudent. Including the $100 million discretionary<br />

contribution, it is estimated the plans will be approximately<br />

90 per cent funded on a solvency basis as at year-end 2011.<br />

Total pension plan contributions, including both the discretionary<br />

contribution and those required to cover current service cost,<br />

are estimated to be $172 million in 2012.

![DISK004:[98CLG6.98CLG3726]BA3726A.;28 - About TELUS](https://img.yumpu.com/16786670/1/190x245/disk00498clg698clg3726ba3726a28-about-telus.jpg?quality=85)