Download - Hong Kong Institute of Certified Public Accountants

Download - Hong Kong Institute of Certified Public Accountants

Download - Hong Kong Institute of Certified Public Accountants

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

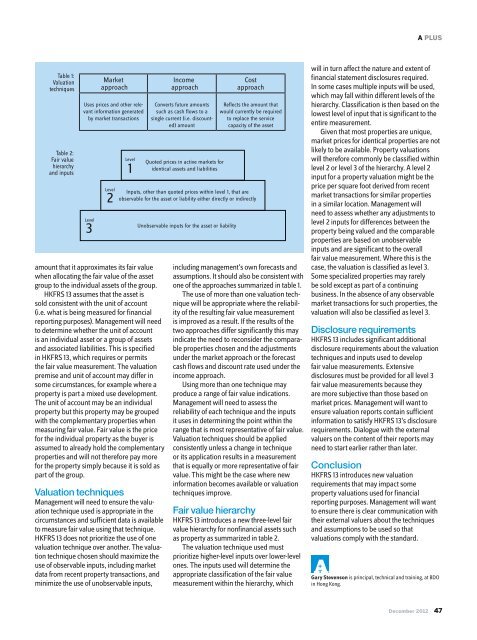

Table 1:<br />

Valuation<br />

techniques<br />

Table 2:<br />

Fair value<br />

hierarchy<br />

and inputs<br />

Market<br />

approach<br />

Uses prices and other relevant<br />

information generated<br />

by market transactions<br />

Level<br />

3<br />

Level<br />

2<br />

Level<br />

1<br />

amount that it approximates its fair value<br />

when allocating the fair value <strong>of</strong> the asset<br />

group to the individual assets <strong>of</strong> the group.<br />

HKFRS 13 assumes that the asset is<br />

sold consistent with the unit <strong>of</strong> account<br />

(i.e. what is being measured for financial<br />

reporting purposes). Management will need<br />

to determine whether the unit <strong>of</strong> account<br />

is an individual asset or a group <strong>of</strong> assets<br />

and associated liabilities. This is specified<br />

in HKFRS 13, which requires or permits<br />

the fair value measurement. The valuation<br />

premise and unit <strong>of</strong> account may differ in<br />

some circumstances, for example where a<br />

property is part a mixed use development.<br />

The unit <strong>of</strong> account may be an individual<br />

property but this property may be grouped<br />

with the complementary properties when<br />

measuring fair value. Fair value is the price<br />

for the individual property as the buyer is<br />

assumed to already hold the complementary<br />

properties and will not therefore pay more<br />

for the property simply because it is sold as<br />

part <strong>of</strong> the group.<br />

Valuation techniques<br />

Management will need to ensure the valuation<br />

technique used is appropriate in the<br />

circumstances and sufficient data is available<br />

to measure fair value using that technique.<br />

HKFRS 13 does not prioritize the use <strong>of</strong> one<br />

valuation technique over another. The valuation<br />

technique chosen should maximize the<br />

use <strong>of</strong> observable inputs, including market<br />

data from recent property transactions, and<br />

minimize the use <strong>of</strong> unobservable inputs,<br />

Income<br />

approach<br />

Converts future amounts<br />

such as cash flows to a<br />

single current (i.e. discounted)<br />

amount<br />

Quoted prices in active markets for<br />

identical assets and liabilities<br />

Cost<br />

approach<br />

Reflects the amount that<br />

would currently be required<br />

to replace the service<br />

capacity <strong>of</strong> the asset<br />

Inputs, other than quoted prices within level 1, that are<br />

observable for the asset or liability either directly or indirectly<br />

Unobservable inputs for the asset or liability<br />

including management’s own forecasts and<br />

assumptions. It should also be consistent with<br />

one <strong>of</strong> the approaches summarized in table 1.<br />

The use <strong>of</strong> more than one valuation technique<br />

will be appropriate where the reliability<br />

<strong>of</strong> the resulting fair value measurement<br />

is improved as a result. If the results <strong>of</strong> the<br />

two approaches differ significantly this may<br />

indicate the need to reconsider the comparable<br />

properties chosen and the adjustments<br />

under the market approach or the forecast<br />

cash flows and discount rate used under the<br />

income approach.<br />

Using more than one technique may<br />

produce a range <strong>of</strong> fair value indications.<br />

Management will need to assess the<br />

reliability <strong>of</strong> each technique and the inputs<br />

it uses in determining the point within the<br />

range that is most representative <strong>of</strong> fair value.<br />

Valuation techniques should be applied<br />

consistently unless a change in technique<br />

or its application results in a measurement<br />

that is equally or more representative <strong>of</strong> fair<br />

value. This might be the case where new<br />

information becomes available or valuation<br />

techniques improve.<br />

Fair value hierarchy<br />

HKFRS 13 introduces a new three-level fair<br />

value hierarchy for nonfinancial assets such<br />

as property as summarized in table 2.<br />

The valuation technique used must<br />

prioritize higher-level inputs over lower-level<br />

ones. The inputs used will determine the<br />

appropriate classification <strong>of</strong> the fair value<br />

measurement within the hierarchy, which<br />

A PLUS<br />

will in turn affect the nature and extent <strong>of</strong><br />

financial statement disclosures required.<br />

In some cases multiple inputs will be used,<br />

which may fall within different levels <strong>of</strong> the<br />

hierarchy. Classification is then based on the<br />

lowest level <strong>of</strong> input that is significant to the<br />

entire measurement.<br />

Given that most properties are unique,<br />

market prices for identical properties are not<br />

likely to be available. Property valuations<br />

will therefore commonly be classified within<br />

level 2 or level 3 <strong>of</strong> the hierarchy. A level 2<br />

input for a property valuation might be the<br />

price per square foot derived from recent<br />

market transactions for similar properties<br />

in a similar location. Management will<br />

need to assess whether any adjustments to<br />

level 2 inputs for differences between the<br />

property being valued and the comparable<br />

properties are based on unobservable<br />

inputs and are significant to the overall<br />

fair value measurement. Where this is the<br />

case, the valuation is classified as level 3.<br />

Some specialized properties may rarely<br />

be sold except as part <strong>of</strong> a continuing<br />

business. In the absence <strong>of</strong> any observable<br />

market transactions for such properties, the<br />

valuation will also be classified as level 3.<br />

Disclosure requirements<br />

HKFRS 13 includes significant additional<br />

disclosure requirements about the valuation<br />

techniques and inputs used to develop<br />

fair value measurements. Extensive<br />

disclosures must be provided for all level 3<br />

fair value measurements because they<br />

are more subjective than those based on<br />

market prices. Management will want to<br />

ensure valuation reports contain sufficient<br />

information to satisfy HKFRS 13’s disclosure<br />

requirements. Dialogue with the external<br />

valuers on the content <strong>of</strong> their reports may<br />

need to start earlier rather than later.<br />

Conclusion<br />

HKFRS 13 introduces new valuation<br />

requirements that may impact some<br />

property valuations used for financial<br />

reporting purposes. Management will want<br />

to ensure there is clear communication with<br />

their external valuers about the techniques<br />

and assumptions to be used so that<br />

valuations comply with the standard.<br />

Gary Stevenson is principal, technical and training, at BDO<br />

in <strong>Hong</strong> <strong>Kong</strong>.<br />

December 2012 47