Investor Relations and Regulation FD

Investor Relations and Regulation FD

Investor Relations and Regulation FD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

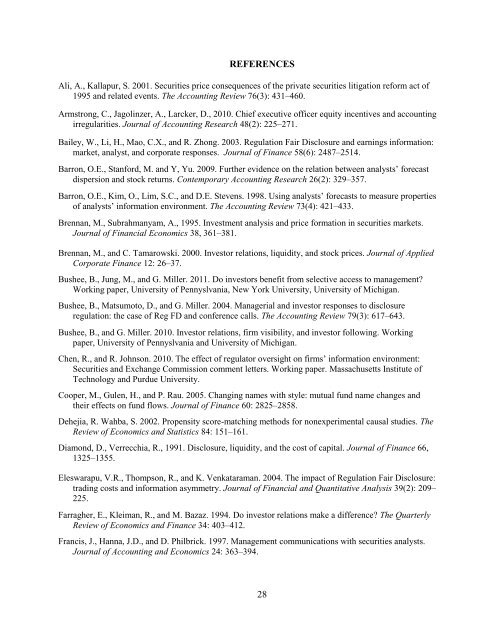

REFERENCES<br />

Ali, A., Kallapur, S. 2001. Securities price consequences of the private securities litigation reform act of<br />

1995 <strong>and</strong> related events. The Accounting Review 76(3): 431–460.<br />

Armstrong, C., Jagolinzer, A., Larcker, D., 2010. Chief executive officer equity incentives <strong>and</strong> accounting<br />

irregularities. Journal of Accounting Research 48(2): 225–271.<br />

Bailey, W., Li, H., Mao, C.X., <strong>and</strong> R. Zhong. 2003. <strong>Regulation</strong> Fair Disclosure <strong>and</strong> earnings information:<br />

market, analyst, <strong>and</strong> corporate responses. Journal of Finance 58(6): 2487–2514.<br />

Barron, O.E., Stanford, M. <strong>and</strong> Y, Yu. 2009. Further evidence on the relation between analysts’ forecast<br />

dispersion <strong>and</strong> stock returns. Contemporary Accounting Research 26(2): 329–357.<br />

Barron, O.E., Kim, O., Lim, S.C., <strong>and</strong> D.E. Stevens. 1998. Using analysts’ forecasts to measure properties<br />

of analysts’ information environment. The Accounting Review 73(4): 421–433.<br />

Brennan, M., Subrahmanyam, A., 1995. Investment analysis <strong>and</strong> price formation in securities markets.<br />

Journal of Financial Economics 38, 361–381.<br />

Brennan, M., <strong>and</strong> C. Tamarowski. 2000. <strong>Investor</strong> relations, liquidity, <strong>and</strong> stock prices. Journal of Applied<br />

Corporate Finance 12: 26–37.<br />

Bushee, B., Jung, M., <strong>and</strong> G. Miller. 2011. Do investors benefit from selective access to management?<br />

Working paper, University of Pennyslvania, New York University, University of Michigan.<br />

Bushee, B., Matsumoto, D., <strong>and</strong> G. Miller. 2004. Managerial <strong>and</strong> investor responses to disclosure<br />

regulation: the case of Reg <strong>FD</strong> <strong>and</strong> conference calls. The Accounting Review 79(3): 617–643.<br />

Bushee, B., <strong>and</strong> G. Miller. 2010. <strong>Investor</strong> relations, firm visibility, <strong>and</strong> investor following. Working<br />

paper, University of Pennyslvania <strong>and</strong> University of Michigan.<br />

Chen, R., <strong>and</strong> R. Johnson. 2010. The effect of regulator oversight on firms’ information environment:<br />

Securities <strong>and</strong> Exchange Commission comment letters. Working paper. Massachusetts Institute of<br />

Technology <strong>and</strong> Purdue University.<br />

Cooper, M., Gulen, H., <strong>and</strong> P. Rau. 2005. Changing names with style: mutual fund name changes <strong>and</strong><br />

their effects on fund flows. Journal of Finance 60: 2825–2858.<br />

Dehejia, R. Wahba, S. 2002. Propensity score-matching methods for nonexperimental causal studies. The<br />

Review of Economics <strong>and</strong> Statistics 84: 151–161.<br />

Diamond, D., Verrecchia, R., 1991. Disclosure, liquidity, <strong>and</strong> the cost of capital. Journal of Finance 66,<br />

1325–1355.<br />

Eleswarapu, V.R., Thompson, R., <strong>and</strong> K. Venkataraman. 2004. The impact of <strong>Regulation</strong> Fair Disclosure:<br />

trading costs <strong>and</strong> information asymmetry. Journal of Financial <strong>and</strong> Quantitative Analysis 39(2): 209–<br />

225.<br />

Farragher, E., Kleiman, R., <strong>and</strong> M. Bazaz. 1994. Do investor relations make a difference? The Quarterly<br />

Review of Economics <strong>and</strong> Finance 34: 403–412.<br />

Francis, J., Hanna, J.D., <strong>and</strong> D. Philbrick. 1997. Management communications with securities analysts.<br />

Journal of Accounting <strong>and</strong> Economics 24: 363–394.<br />

28