Investor Relations and Regulation FD

Investor Relations and Regulation FD

Investor Relations and Regulation FD

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

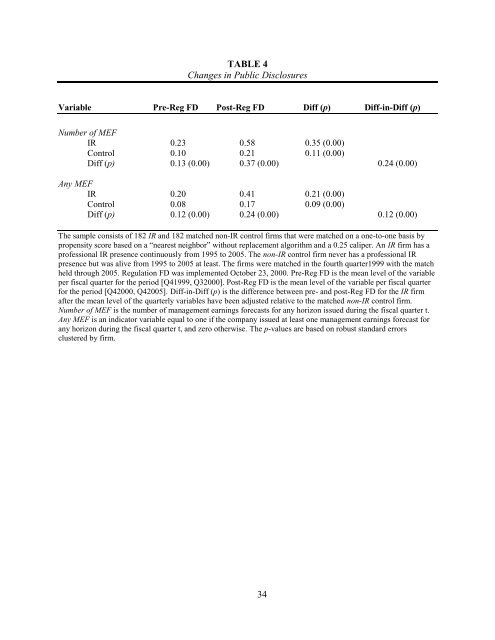

TABLE 4<br />

Changes in Public Disclosures<br />

Variable Pre-Reg <strong>FD</strong> Post-Reg <strong>FD</strong> Diff (p) Diff-in-Diff (p)<br />

Number of MEF<br />

IR 0.23 0.58 0.35 (0.00)<br />

Control 0.10 0.21 0.11 (0.00)<br />

Diff (p) 0.13 (0.00) 0.37 (0.00) 0.24 (0.00)<br />

Any MEF<br />

IR 0.20 0.41 0.21 (0.00)<br />

Control 0.08 0.17 0.09 (0.00)<br />

Diff (p) 0.12 (0.00) 0.24 (0.00) 0.12 (0.00)<br />

The sample consists of 182 IR <strong>and</strong> 182 matched non-IR control firms that were matched on a one-to-one basis by<br />

propensity score based on a “nearest neighbor” without replacement algorithm <strong>and</strong> a 0.25 caliper. An IR firm has a<br />

professional IR presence continuously from 1995 to 2005. The non-IR control firm never has a professional IR<br />

presence but was alive from 1995 to 2005 at least. The firms were matched in the fourth quarter1999 with the match<br />

held through 2005. <strong>Regulation</strong> <strong>FD</strong> was implemented October 23, 2000. Pre-Reg <strong>FD</strong> is the mean level of the variable<br />

per fiscal quarter for the period [Q41999, Q32000]. Post-Reg <strong>FD</strong> is the mean level of the variable per fiscal quarter<br />

for the period [Q42000, Q42005]. Diff-in-Diff (p) is the difference between pre- <strong>and</strong> post-Reg <strong>FD</strong> for the IR firm<br />

after the mean level of the quarterly variables have been adjusted relative to the matched non-IR control firm.<br />

Number of MEF is the number of management earnings forecasts for any horizon issued during the fiscal quarter t.<br />

Any MEF is an indicator variable equal to one if the company issued at least one management earnings forecast for<br />

any horizon during the fiscal quarter t, <strong>and</strong> zero otherwise. The p-values are based on robust st<strong>and</strong>ard errors<br />

clustered by firm.<br />

34