MVI Planning Forums - Kantar Retail iQ

MVI Planning Forums - Kantar Retail iQ

MVI Planning Forums - Kantar Retail iQ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>MVI</strong> <strong>Planning</strong> <strong>Forums</strong><br />

April 28-29, 2009 | Jersey City, NJ<br />

May 5-6, 2009 | San Diego, CA<br />

Last year won’t help.<br />

New Plans For All<br />

Fresh Assumptions To Sharpen Your Business Plans<br />

Next year won’t be a straight line iteration out of the recent past. In fact, looking at historical<br />

data may be downright misleading. <strong>MVI</strong> helps you assess and fine-tune your strategic plan—<br />

and aids you in building an accurate view of next year’s business in each major channel and<br />

the 5 year trends at your key retailers.<br />

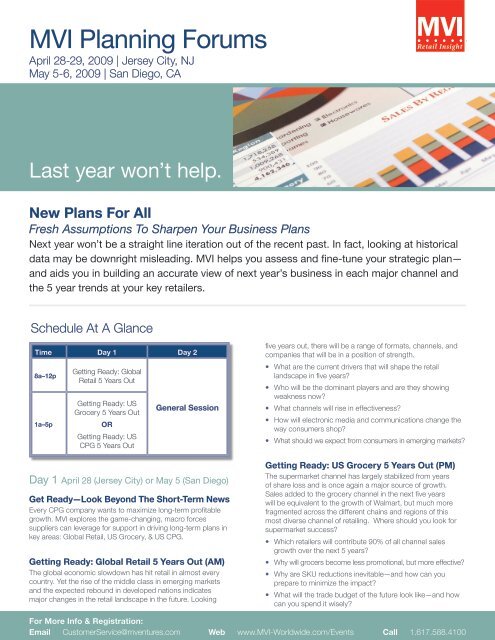

Schedule At A Glance<br />

Time Day 1 Day 2<br />

8a–12p<br />

1a–5p<br />

Getting Ready: Global<br />

<strong>Retail</strong> 5 Years Out<br />

Getting Ready: US<br />

Grocery 5 Years Out<br />

OR<br />

Getting Ready: US<br />

CPG 5 Years Out<br />

General Session<br />

Day 1 April 28 (Jersey City) or May 5 (San Diego)<br />

Get Ready—Look Beyond The Short-Term News<br />

Every CPG company wants to maximize long-term profitable<br />

growth. <strong>MVI</strong> explores the game-changing, macro forces<br />

suppliers can leverage for support in driving long-term plans in<br />

key areas: Global <strong>Retail</strong>, US Grocery, & US CPG.<br />

Getting Ready: Global <strong>Retail</strong> 5 Years Out (AM)<br />

The global economic slowdown has hit retail in almost every<br />

country. Yet the rise of the middle class in emerging markets<br />

and the expected rebound in developed nations indicates<br />

major changes in the retail landscape in the future. Looking<br />

five years out, there will be a range of formats, channels, and<br />

companies that will be in a position of strength.<br />

• What are the current drivers that will shape the retail<br />

landscape in five years?<br />

• Who will be the dominant players and are they showing<br />

weakness now?<br />

•<br />

What channels will rise in effectiveness?<br />

• How will electronic media and communications change the<br />

way consumers shop?<br />

•<br />

What should we expect from consumers in emerging markets?<br />

Getting Ready: US Grocery 5 Years Out (PM)<br />

The supermarket channel has largely stabilized from years<br />

of share loss and is once again a major source of growth.<br />

Sales added to the grocery channel in the next five years<br />

will be equivalent to the growth of Walmart, but much more<br />

fragmented across the different chains and regions of this<br />

most diverse channel of retailing. Where should you look for<br />

supermarket success?<br />

• Which retailers will contribute 90% of all channel sales<br />

growth over the next 5 years?<br />

•<br />

Why will grocers become less promotional, but more effective?<br />

• Why are SKU reductions inevitable—and how can you<br />

prepare to minimize the impact?<br />

• What will the trade budget of the future look like—and how<br />

can you spend it wisely?<br />

For More Info & Registration:<br />

Email CustomerService@mventures.com Web www.<strong>MVI</strong>-Worldwide.com/Events Call 1.617.588.4100

<strong>MVI</strong> <strong>Planning</strong> <strong>Forums</strong><br />

April 28-29, 2009 | Jersey City, NJ<br />

May 5-6, 2009 | San Diego, CA<br />

Getting Ready: US CPG 5 Years Out (PM)<br />

As companies build their plans for an admittedly challenging<br />

2010, many are also looking to retool their 3- to 5-year<br />

strategic plans. Even in an uncertain environment, having a<br />

long-term destination and vision of where your company and<br />

category are going is fundamentally important to success. In<br />

this session, <strong>MVI</strong> will explore the key retailer and competitive<br />

drivers pressuring CPG companies to adapt to a changing<br />

marketplace—as well as evaluating what best-in-class<br />

companies are doing today to position themselves for the<br />

future. Questions answered include:<br />

• How can you best manage and differentiate increasingly<br />

demanding customers?<br />

• What are the skills and capabilities required to compete in<br />

tomorrow’s marketplace?<br />

• What are the core organizational processes that need<br />

revisiting?<br />

• Why is there continued blurring between trade marketing,<br />

shopper marketing, and brand marketing—and how can you<br />

define them successfully?<br />

• Why do you need much greater financial acumen across all<br />

of your customer-facing organizations?<br />

Day 2 April 29 (Jersey City) or May 6 (San Diego)<br />

General Session<br />

<strong>Retail</strong> Alchemy: The Hard, Smart Work and Inspiration<br />

Required to Drive Profitable Growth In 2010-2012<br />

Bryan Gildenberg, CKO, <strong>MVI</strong><br />

As <strong>MVI</strong> looks out to 2010-2012, we see a world where the raw<br />

materials for growth are going to be harder to come by—as<br />

your customers may not be growing as fast…and may not be<br />

as committed to developing growth through national brands as<br />

they have been in the past. Our <strong>Planning</strong> <strong>Forums</strong> break down<br />

these key assumptions by channel. In the Keynote speech,<br />

<strong>MVI</strong> Chief Knowledge Officer Bryan Gildenberg will outline<br />

the major factors influencing the retail landscape—those<br />

making growth more challenging as well as the key growth<br />

opportunities. He will explain why “alchemy” (the quest to turn<br />

everyday materials into gold) is a useful metaphor for the work<br />

facing CPG brandowners searching for profitable growth in<br />

today’s retail environment.<br />

Value Discounters—Suddenly Serious<br />

David Marcotte, Director of <strong>Retail</strong> Insights—The Americas, <strong>MVI</strong><br />

It has been easy in the past decade to write off value discount<br />

as a channel of clearance, damages, and cheap knock-off<br />

product. No longer. With comp sales increasing in double<br />

digits and almost a thousand stores slated to be opened in<br />

2009, value discount is a very serious channel. <strong>MVI</strong> describes<br />

this “moving target” and assesses changes vendors will need<br />

to make to hit and win.<br />

Mass—Target Needs You, You Need Walmart<br />

Leon Nicholas, Director of <strong>Retail</strong> Insights—Mass & Club, <strong>MVI</strong><br />

Though the recession has favored the Mass channel, the<br />

planning assumptions required are quite different for Walmart<br />

and Target. Do your Target plans reflect their focus on value,<br />

SKU (and vendor) reduction, and new supplier collaboration<br />

efforts? Do your Walmart plans account for unbeatable prices,<br />

the CSI, and clean floors? Nicholas outlines how to grow<br />

share, differently, with both of these retailers.<br />

Grocery—The Easy Answer is Wrong<br />

John Rand, Director of <strong>Retail</strong> Insights—Grocery, <strong>MVI</strong><br />

The Supermarket Channel is the most established and<br />

most familiar segment of most vendors’ businesses, but the<br />

underlying models and assumptions have not kept up with the<br />

changes sweeping through the industry. The recession will<br />

only accelerate these changes and every CPG supplier needs<br />

to reconsider the fundamentals of the grocery opportunity.<br />

Rand reviews the size of the prize and defines the new rules for<br />

excellence in grocery sales and marketing.

<strong>MVI</strong> <strong>Planning</strong> <strong>Forums</strong><br />

April 28-29, 2009 | Jersey City, NJ<br />

May 5-6, 2009 | San Diego, CA<br />

Chain Drug—Re-<strong>Planning</strong> for an Uncertain Reality<br />

Brendan Langan, Director of <strong>Retail</strong> Insights—Drug, <strong>MVI</strong><br />

Chain drug may be better insulated than some channels, but<br />

it’s not immune to the weakening economy. The 3 biggest<br />

players are reacting very differently: CVS Caremark is staying<br />

the course and focusing on destination healthcare and beauty,<br />

Walgreens is embarking on a multi-year transformation in the<br />

midst of slowing growth, and Rite-Aid is living on borrowed<br />

time as it balances financial and retail realities. <strong>MVI</strong> assesses<br />

the health and future prospects of the channel…and shares<br />

our latest near- and mid-term growth projections and<br />

assumptions for Walgreens, CVS, and Rite Aid.<br />

For More Information & Registration<br />

Email CustomerService@mventures.com<br />

Web www. <strong>MVI</strong>-Worldwide. com/Events<br />

Call 1.617.588.4100<br />

Full Day Rate USD 1650 1/2 Day Rate USD 895<br />

Multi-day/multi-seat rates available. Please contact <strong>MVI</strong> for details.<br />

<strong>MVI</strong> accepts Visa, MasterCard, American Express, Discover.<br />

Logistics<br />

Name Company<br />

Address City<br />

April 28-29 | Jersey City, NJ<br />

Hyatt Regency Jersey City<br />

Two Exchange Place<br />

Jersey City, NJ 07302<br />

201-469-4750<br />

Room rate: USD225<br />

Cut-off date: 4/6/09<br />

State/Country Postal Code<br />

Telephone Email<br />

Credit Card q AmEx q MasterCard q Visa q Discover Card Number<br />

Expiration Date Signature (required)<br />

Club—<strong>Planning</strong> for the New Member Decision Tree<br />

Bryan Gildenberg, Chief Knowledge Officer, <strong>MVI</strong><br />

The Club retailers have performed well in the midst of the<br />

recession, attracting new members and getting existing<br />

members to alter their shopping criteria. As the value equation<br />

changes, new opportunities have arisen to align with private<br />

labels, capture the trade-out of services, and capitalize on new<br />

promotional tactics. Gildenberg maps out how the clubs’ role<br />

in the retail ecosystem has changed and describes how your<br />

plans will need to reflect this new reality.<br />

May 5-6 | San Diego, CA<br />

Hyatt Regency La Jolla<br />

3777 La Jolla Village Drive<br />

San Diego, CA 92122<br />

858-522-1234<br />

Room rate: USD189<br />

Cut-off date: 4/8/09<br />

Orders totaling less than USD 5,000 require payment at time of registration. Session fee includes continental breakfast and lunch each day and hard copies of relevant <strong>MVI</strong> training outlines.<br />

Website subscribers have access to soft copies online. Cancellations/Substitutions Cancellations received in writing 10 days before the program will qualify for a credit on a future <strong>MVI</strong> program.<br />

Substitutions must be communicated and are allowed at any time. <strong>MVI</strong> is unable to issue refunds for cancellations. If, due to travel restrictions, security issues or other business reasons, <strong>MVI</strong><br />

determines that it is not preferable to deliver its traditional classroom programs (such as Workshops and <strong>Forums</strong>), <strong>MVI</strong> reserves the right to substitute comparable, alternative learning systems<br />

(such as interactive Webcasts) in their place. Content Speakers and topics subject to change. <strong>MVI</strong> specifically disclaims any liability for the editorial content of the presentations made by non-<br />

<strong>MVI</strong> speakers, which wholly originates with the speakers. The analysis and conclusions presented by <strong>MVI</strong> represent the opinions of the company. The views expressed do not necessarily reflect<br />

those of the retailers under discussion, nor are they endorsed or otherwise supported by the management of those retailers. Sessions may be taped by <strong>MVI</strong> for internal training purposes.