Final TANF Rule as published in the Federal Register 4/12/1999

Final TANF Rule as published in the Federal Register 4/12/1999

Final TANF Rule as published in the Federal Register 4/12/1999

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Federal</strong> <strong>Register</strong> / Vol. 64, No. 69 / Monday, April <strong>12</strong>, <strong>1999</strong> / <strong>Rule</strong>s and Regulations<br />

annual report h<strong>as</strong> not changed s<strong>in</strong>ce <strong>the</strong><br />

previous annual report, <strong>the</strong> State may<br />

reference this <strong>in</strong>formation <strong>in</strong> lieu of resubmission.<br />

(e) If a State makes a substantive<br />

change <strong>in</strong> certa<strong>in</strong> data elements <strong>in</strong><br />

paragraphs (b) and (c) of this section, it<br />

must file a copy of <strong>the</strong> change with <strong>the</strong><br />

next quarterly data report or <strong>as</strong> an<br />

amendment to its State Plan. The State<br />

must also <strong>in</strong>dicate <strong>the</strong> effective date of<br />

<strong>the</strong> change. This requirement is<br />

applicable to <strong>the</strong> follow<strong>in</strong>g data<br />

elements:<br />

(1) Paragraphs (b)(1), (b)(2), and (b)(3)<br />

of this section; and<br />

(2) Paragraphs (c)(1), (c)(2), (c)(3),<br />

(c)(6), (c)(7), and (c)(8) of this section.<br />

§ 265.10 When is <strong>the</strong> annual report due?<br />

The annual report required by § 265.9<br />

is due at <strong>the</strong> same time <strong>as</strong> <strong>the</strong> fourth<br />

quarter <strong>TANF</strong> Data Report.<br />

Note: The follow<strong>in</strong>g appendices will not<br />

appear <strong>in</strong> <strong>the</strong> Code of <strong>Federal</strong> Regulations.<br />

Appendices<br />

Appendix A—<strong>TANF</strong> Data Report—Section<br />

One (Disaggregated Data Collection for<br />

Families Receiv<strong>in</strong>g Assistance under <strong>the</strong><br />

<strong>TANF</strong> Program)<br />

Appendix B—<strong>TANF</strong> Data Report—Section<br />

Two (Disaggregated Data Collection for<br />

Families No Longer Receiv<strong>in</strong>g Assistance<br />

under <strong>the</strong> <strong>TANF</strong> Program)<br />

Appendix C—<strong>TANF</strong> Data Report—Section<br />

Three (Aggregated Data Collection for<br />

Families Apply<strong>in</strong>g for, Receiv<strong>in</strong>g, and No<br />

Longer Receiv<strong>in</strong>g Assistance under <strong>the</strong><br />

<strong>TANF</strong> Program)<br />

Appendix D—<strong>TANF</strong> F<strong>in</strong>ancial Report<br />

Appendix E—SSP–MOE Data Report—<br />

Section One (Disaggregated Data Collection<br />

for Families Receiv<strong>in</strong>g Assistance under<br />

<strong>the</strong> Separate State Programs)<br />

Appendix F—SSP–MOE Data Report—<br />

Section Two (Disaggregated Data<br />

Collection for Families No Longer<br />

Receiv<strong>in</strong>g Assistance under <strong>the</strong> Separate<br />

State Programs)<br />

Appendix G—SSP–MOE Data Report—<br />

Section Three (Aggregated Data Collection<br />

for Families Receiv<strong>in</strong>g Assistance under<br />

<strong>the</strong> Separate State Programs)<br />

Appendix H—C<strong>as</strong>eload Reduction Report<br />

Appendix I—Annual Report on State<br />

Ma<strong>in</strong>tenance-of-Effort Programs<br />

Appendix A—<strong>TANF</strong> Data Report—Section<br />

One Disaggregated Data Collection for<br />

Families Receiv<strong>in</strong>g Assistance under <strong>the</strong><br />

<strong>TANF</strong> Program<br />

Instructions and Def<strong>in</strong>itions<br />

General Instruction: The State agency or<br />

Tribal grantee should collect and report data<br />

for each data element. The data must be<br />

complete (unless explicitly <strong>in</strong>structed to<br />

leave <strong>the</strong> field blank) and accurate (i.e,<br />

correct).<br />

An ‘‘Unknown’’ code may appear only on<br />

four sets of data elements ([#32 and #67] Date<br />

of Birth, [#33 and #68] Social Security<br />

Number, [#41 and #74] Educational Level,<br />

and [#42 and #75] Citizenship/Alienage). For<br />

<strong>the</strong>se data elements, unknown is not an<br />

acceptable code for <strong>in</strong>dividuals who are<br />

members of <strong>the</strong> eligible family (i.e., family<br />

affiliation code ‘‘1’’).<br />

There are five data elements for which<br />

States have <strong>the</strong> option to report b<strong>as</strong>ed on<br />

ei<strong>the</strong>r <strong>the</strong> budget month or <strong>the</strong> report<strong>in</strong>g<br />

month. These are: #16 Amount of Food<br />

Stamps Assistance; #19 Amount of Child<br />

Support; #20 Amount of Families C<strong>as</strong>h<br />

Resources; #64 Amount of Earned Income;<br />

and [#35 and #76] Amount of Unearned<br />

Income. Whichever choice <strong>the</strong> State selects<br />

must be used for all families reported each<br />

month and must be used for all months <strong>in</strong><br />

<strong>the</strong> fiscal year.<br />

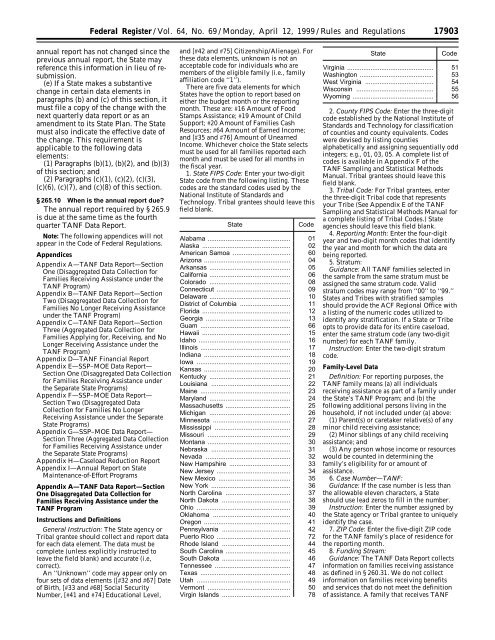

1. State FIPS Code: Enter your two-digit<br />

State code from <strong>the</strong> follow<strong>in</strong>g list<strong>in</strong>g. These<br />

codes are <strong>the</strong> standard codes used by <strong>the</strong><br />

National Institute of Standards and<br />

Technology. Tribal grantees should leave this<br />

field blank.<br />

State Code<br />

Alabama .............................................. 01<br />

Al<strong>as</strong>ka ................................................. 02<br />

American Samoa ................................ 60<br />

Arizona ................................................ 04<br />

Arkans<strong>as</strong> ............................................. 05<br />

California ............................................. 06<br />

Colorado ............................................. 08<br />

Connecticut ......................................... 09<br />

Delaware ............................................. 10<br />

District of Columbia ............................ 11<br />

Florida ................................................. <strong>12</strong><br />

Georgia ............................................... 13<br />

Guam .................................................. 66<br />

Hawaii ................................................. 15<br />

Idaho ................................................... 16<br />

Ill<strong>in</strong>ois .................................................. 17<br />

Indiana ................................................ 18<br />

Iowa .................................................... 19<br />

Kans<strong>as</strong> ................................................ 20<br />

Kentucky ............................................. 21<br />

Louisiana ............................................ 22<br />

Ma<strong>in</strong>e .................................................. 23<br />

Maryland ............................................. 24<br />

M<strong>as</strong>sachusetts .................................... 25<br />

Michigan ............................................. 26<br />

M<strong>in</strong>nesota ........................................... 27<br />

Mississippi .......................................... 28<br />

Missouri .............................................. 29<br />

Montana .............................................. 30<br />

Nebr<strong>as</strong>ka ............................................ 31<br />

Nevada ............................................... 32<br />

New Hampshire .................................. 33<br />

New Jersey ......................................... 34<br />

New Mexico ........................................ 35<br />

New York ............................................ 36<br />

North Carol<strong>in</strong>a .................................... 37<br />

North Dakota ...................................... 38<br />

Ohio .................................................... 39<br />

Oklahoma ........................................... 40<br />

Oregon ................................................ 41<br />

Pennsylvania ...................................... 42<br />

Puerto Rico ......................................... 72<br />

Rhode Island ...................................... 44<br />

South Carol<strong>in</strong>a .................................... 45<br />

South Dakota ...................................... 46<br />

Tennessee .......................................... 47<br />

Tex<strong>as</strong> .................................................. 48<br />

Utah .................................................... 49<br />

Vermont .............................................. 50<br />

Virg<strong>in</strong> Islands ...................................... 78<br />

17903<br />

State Code<br />

Virg<strong>in</strong>ia ................................................ 51<br />

W<strong>as</strong>h<strong>in</strong>gton ......................................... 53<br />

West Virg<strong>in</strong>ia ...................................... 54<br />

Wiscons<strong>in</strong> ........................................... 55<br />

Wyom<strong>in</strong>g ............................................. 56<br />

2. County FIPS Code: Enter <strong>the</strong> three-digit<br />

code established by <strong>the</strong> National Institute of<br />

Standards and Technology for cl<strong>as</strong>sification<br />

of counties and county equivalents. Codes<br />

were devised by list<strong>in</strong>g counties<br />

alphabetically and <strong>as</strong>sign<strong>in</strong>g sequentially odd<br />

<strong>in</strong>tegers; e.g., 01, 03, 05. A complete list of<br />

codes is available <strong>in</strong> Appendix F of <strong>the</strong><br />

<strong>TANF</strong> Sampl<strong>in</strong>g and Statistical Methods<br />

Manual. Tribal grantees should leave this<br />

field blank.<br />

3. Tribal Code: For Tribal grantees, enter<br />

<strong>the</strong> three-digit Tribal code that represents<br />

your Tribe (See Appendix E of <strong>the</strong> <strong>TANF</strong><br />

Sampl<strong>in</strong>g and Statistical Methods Manual for<br />

a complete list<strong>in</strong>g of Tribal Codes.) State<br />

agencies should leave this field blank.<br />

4. Report<strong>in</strong>g Month: Enter <strong>the</strong> four-digit<br />

year and two-digit month codes that identify<br />

<strong>the</strong> year and month for which <strong>the</strong> data are<br />

be<strong>in</strong>g reported.<br />

5. Stratum:<br />

Guidance: All <strong>TANF</strong> families selected <strong>in</strong><br />

<strong>the</strong> sample from <strong>the</strong> same stratum must be<br />

<strong>as</strong>signed <strong>the</strong> same stratum code. Valid<br />

stratum codes may range from ‘‘00’’ to ‘‘99.’’<br />

States and Tribes with stratified samples<br />

should provide <strong>the</strong> ACF Regional Office with<br />

a list<strong>in</strong>g of <strong>the</strong> numeric codes utilized to<br />

identify any stratification. If a State or Tribe<br />

opts to provide data for its entire c<strong>as</strong>eload,<br />

enter <strong>the</strong> same stratum code (any two-digit<br />

number) for each <strong>TANF</strong> family.<br />

Instruction: Enter <strong>the</strong> two-digit stratum<br />

code.<br />

Family-Level Data<br />

Def<strong>in</strong>ition: For report<strong>in</strong>g purposes, <strong>the</strong><br />

<strong>TANF</strong> family means (a) all <strong>in</strong>dividuals<br />

receiv<strong>in</strong>g <strong>as</strong>sistance <strong>as</strong> part of a family under<br />

<strong>the</strong> State’s <strong>TANF</strong> Program; and (b) <strong>the</strong><br />

follow<strong>in</strong>g additional persons liv<strong>in</strong>g <strong>in</strong> <strong>the</strong><br />

household, if not <strong>in</strong>cluded under (a) above:<br />

(1) Parent(s) or caretaker relative(s) of any<br />

m<strong>in</strong>or child receiv<strong>in</strong>g <strong>as</strong>sistance;<br />

(2) M<strong>in</strong>or sibl<strong>in</strong>gs of any child receiv<strong>in</strong>g<br />

<strong>as</strong>sistance; and<br />

(3) Any person whose <strong>in</strong>come or resources<br />

would be counted <strong>in</strong> determ<strong>in</strong><strong>in</strong>g <strong>the</strong><br />

family’s eligibility for or amount of<br />

<strong>as</strong>sistance.<br />

6. C<strong>as</strong>e Number—<strong>TANF</strong>:<br />

Guidance: If <strong>the</strong> c<strong>as</strong>e number is less than<br />

<strong>the</strong> allowable eleven characters, a State<br />

should use lead zeros to fill <strong>in</strong> <strong>the</strong> number.<br />

Instruction: Enter <strong>the</strong> number <strong>as</strong>signed by<br />

<strong>the</strong> State agency or Tribal grantee to uniquely<br />

identify <strong>the</strong> c<strong>as</strong>e.<br />

7. ZIP Code: Enter <strong>the</strong> five-digit ZIP code<br />

for <strong>the</strong> <strong>TANF</strong> family’s place of residence for<br />

<strong>the</strong> report<strong>in</strong>g month.<br />

8. Fund<strong>in</strong>g Stream:<br />

Guidance: The <strong>TANF</strong> Data Report collects<br />

<strong>in</strong>formation on families receiv<strong>in</strong>g <strong>as</strong>sistance<br />

<strong>as</strong> def<strong>in</strong>ed <strong>in</strong> § 260.31. We do not collect<br />

<strong>in</strong>formation on families receiv<strong>in</strong>g benefits<br />

and services that do not meet <strong>the</strong> def<strong>in</strong>ition<br />

of <strong>as</strong>sistance. A family that receives <strong>TANF</strong>