(2nd Debate) Julian Callow

(2nd Debate) Julian Callow

(2nd Debate) Julian Callow

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

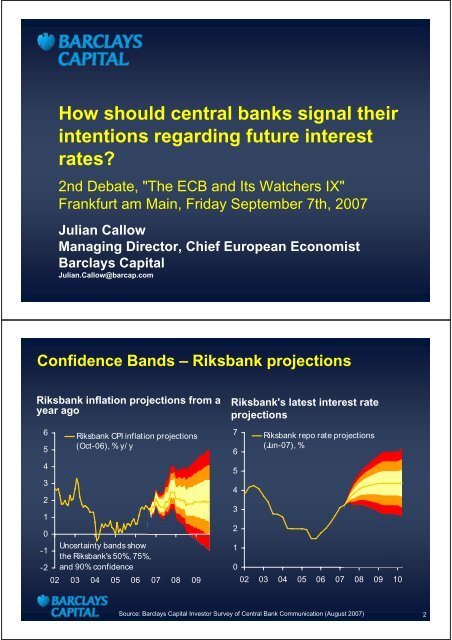

How should central banks signal their<br />

intentions regarding future interest<br />

rates?<br />

<strong>2nd</strong> <strong>Debate</strong>, "The ECB and Its Watchers IX"<br />

Frankfurt am Main, Friday September 7th, 2007<br />

<strong>Julian</strong> <strong>Callow</strong><br />

Managing Director, Chief European Economist<br />

Barclays Capital<br />

<strong>Julian</strong>.<strong>Callow</strong>@barcap.com<br />

Confidence Bands – Riksbank projections<br />

Riksbank inflation projections from a<br />

year ago<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

Riksbank CPI inflation projections<br />

(Oct-06), % y/ y<br />

Uncertainty bands show<br />

the Riksbank's 50%, 75%,<br />

1<br />

and 90% confidence 0<br />

02 03 04 05 06 07 08 09<br />

Riksbank's latest interest rate<br />

projections<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

Riksbank repo rate projections<br />

(Jun-07), %<br />

02 03 04 05 06 07 08 09 10<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

2

Central banks’ interest rate projections<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

Reserve Bank of New<br />

Zealand<br />

95 98 01 04 07 10<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Norges Bank Sveriges Riksbank<br />

95 98 01 04 07 10<br />

Source: Bank of Canada, Norges Bank, Riksbank, Barclays Capital.<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

04 05 06 07 08 09 10<br />

Barclays Capital Investor Survey of Central Bank<br />

Communication (2007)<br />

North<br />

America: 219<br />

Survey conducted: 1 -24 August, 2007; 1183 respondents<br />

Geographical breakdown<br />

Rest of World:<br />

96<br />

UK: 248<br />

Asia ex Japan:<br />

65<br />

Japan: 93<br />

Europe<br />

ex UK:<br />

462<br />

Academic: 5<br />

Non-financial<br />

firm: 80<br />

Central bank:<br />

47<br />

Hedge fund:<br />

109<br />

Institutional representation<br />

Press/ media:<br />

53<br />

Other: 110<br />

For further information on the survey methodology and results, please contact:<br />

Lauren Ungerleider (Lauren.Ungerleider@barcap.com)<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

3<br />

Asset<br />

management:<br />

380<br />

Commercial<br />

bank: 399<br />

4

Personal understanding of central banks'<br />

objectives<br />

Question 1 - How confident are you in your understanding of the following<br />

central banks' objectives (ie, concerning variables such as inflation,<br />

employment, asset prices, money growth, exchange rates, etc.)?<br />

Fed<br />

ECB<br />

BoE<br />

BoJ<br />

Very confident Confident Fairly confident Not confident Confused<br />

3%<br />

22%<br />

25%<br />

21%<br />

16%<br />

40%<br />

47%<br />

44%<br />

31%<br />

27%<br />

24%<br />

37% 35% 8%<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Personal understanding of CBs' predictability<br />

3% 1%<br />

6%<br />

1%<br />

7% 1%<br />

Question 2 - How confident are you in your understanding of these CBs’<br />

"reaction functions" (ie., how each CB would respond to changes in the<br />

outlook for inflation, activity & other variables, eg. asset prices, given<br />

their objectives)?<br />

Fed<br />

ECB<br />

BoE<br />

BoJ<br />

Very confident Confident Fairly confident Not confident Confused<br />

2%<br />

16%<br />

15%<br />

10%<br />

13%<br />

43%<br />

47%<br />

45%<br />

35%<br />

35% 41%<br />

29%<br />

30%<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

10%<br />

10%<br />

6%<br />

9%<br />

1%<br />

1%<br />

2%<br />

5<br />

6

Markets’ understanding<br />

Question 3 - Based on your perceptions of those you work with, how well do<br />

you feel the financial markets understand the central banks' objectives<br />

and "reaction functions"?<br />

Fed<br />

ECB<br />

BoE<br />

BoJ<br />

Very well Well Fairly well Not well Not at all well<br />

2%<br />

14%<br />

13%<br />

11%<br />

17%<br />

38%<br />

43%<br />

43%<br />

41%<br />

38%<br />

33%<br />

34%<br />

32%<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Economic agents’ understanding<br />

9%<br />

8%<br />

11%<br />

Question 4 - In your view, how well do the 'economic agents' (ie, price &<br />

wage setters) within each country/region broadly understand the<br />

objectives & reaction functions of the CB responsible there for monetary<br />

policy?<br />

Fed<br />

ECB<br />

BoE<br />

BoJ<br />

Very confident Confident Fairly confident Not confident Confused<br />

8%<br />

6%<br />

7%<br />

1%<br />

17%<br />

31%<br />

33%<br />

31%<br />

38%<br />

39%<br />

40%<br />

42%<br />

36%<br />

21%<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

8%<br />

16%<br />

17%<br />

1%<br />

1%<br />

2%<br />

2%<br />

3%<br />

2%<br />

8%<br />

7<br />

8

Communication of envisaged future policy action<br />

(1)<br />

Question 5 - Do you think central banks should communicate to financial<br />

markets the course of monetary policy action they envisage announcing<br />

at their subsequent policy meeting?<br />

Full results Asia ex Japan Europe ex UK Japan UK North America<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Yes - at all times Yes - as a general<br />

rule<br />

Yes - but only<br />

occasionally<br />

No - not necessary<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Communication of envisaged future policy action<br />

(2)<br />

Question 5 - Do you think CBs should communicate to financial markets the<br />

course of monetary policy action they envisage announcing at their<br />

subsequent policy meeting?<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Full Results Results during 1 - 12 August Results during 13 - 24 August<br />

Yes - at all times<br />

unless prior<br />

communication is<br />

impossible<br />

Yes - as a general<br />

rule<br />

Yes - but only<br />

occasionally<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

No - not necessary<br />

9<br />

10

Communication of envisaged future policy action<br />

(3)<br />

Question 5 - Do you think central banks should communicate to financial<br />

markets the course of monetary policy action they envisage announcing<br />

at their subsequent policy meeting?<br />

Yes - at all times<br />

Yes - as a general rule<br />

Yes - but only occasionally<br />

No - not necessary<br />

Wish-list (1)<br />

Asset<br />

mgnt<br />

15%<br />

41%<br />

18%<br />

27%<br />

Commercia<br />

l bank<br />

17%<br />

51%<br />

16%<br />

17%<br />

Hedge<br />

fund<br />

7%<br />

41%<br />

18%<br />

34%<br />

Central<br />

bank<br />

24%<br />

38%<br />

20%<br />

18%<br />

Nonfinancial<br />

firm<br />

12%<br />

54%<br />

17%<br />

17%<br />

Academi<br />

c<br />

25%<br />

50%<br />

0%<br />

25%<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Question 6 - In your opinion, how important is it for CBs to publish the<br />

following?<br />

Essential Important Useful Not important Distracting<br />

Statement post policy change<br />

Policy analysis reports<br />

Minutes of policy meeting<br />

Summary projections<br />

Statement post policy inaction<br />

Press conference with Q+A<br />

Detailed info. on projections<br />

Votes of policy makers<br />

Transcript<br />

WPs/ Thematic research<br />

Other<br />

19%<br />

48%<br />

17%<br />

16%<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

11<br />

12

Wish-list (2)<br />

Question 6 - In your opinion, how important is it for CBs to publish the<br />

following?<br />

Scale 1~5, where 1 = distracting; 2 = not important; 3 = useful; 4 = important; 5 = essential<br />

Average mark<br />

Statement post policy change<br />

Statement post policy inaction<br />

Minutes of policy meeting<br />

Policy analysis reports<br />

Summary projections<br />

Press conference with Q+A<br />

Votes of policy makers<br />

Detailed info. on projections<br />

Transcript<br />

WPs/Thematic research<br />

Wish-list (3)<br />

Asia ex<br />

Japan<br />

4.7<br />

4.3<br />

4.2<br />

3.9<br />

4.0<br />

3.7<br />

3.8<br />

3.8<br />

3.6<br />

3.2<br />

Europe<br />

ex UK<br />

4.7<br />

4.1<br />

3.9<br />

4.1<br />

4.0<br />

3.7<br />

3.4<br />

3.5<br />

3.2<br />

3.3<br />

Japan<br />

4.8<br />

4.1<br />

4.4<br />

4.2<br />

3.9<br />

3.9<br />

3.8<br />

3.5<br />

3.5<br />

3.4<br />

4.7<br />

3.8<br />

4.2<br />

4.3<br />

4.0<br />

3.5<br />

3.6<br />

3.6<br />

3.1<br />

3.3<br />

North<br />

America<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Question 6 - In your opinion, how important is it for CBs to publish the<br />

following?<br />

Average mark*<br />

Statement post policy change<br />

Statement post policy inaction<br />

Minutes of policy meeting<br />

Policy analysis reports<br />

Summary projections<br />

Press conference with Q+A<br />

Votes of policy makers<br />

Detailed info. on projections<br />

Transcript<br />

WPs/Thematic research<br />

Asse<br />

t<br />

mgnt<br />

4.7<br />

4.1<br />

4.1<br />

4.1<br />

4.0<br />

3.5<br />

3.4<br />

3.5<br />

3.3<br />

3.4<br />

Commercia<br />

l bank<br />

4.7<br />

4.1<br />

4.2<br />

4.0<br />

4.1<br />

3.7<br />

3.5<br />

3.7<br />

3.4<br />

3.2<br />

Hedg<br />

e<br />

fund<br />

4.5<br />

3.9<br />

4.1<br />

4.2<br />

4.0<br />

3.3<br />

3.5<br />

3.7<br />

3.4<br />

3.4<br />

Central<br />

bank<br />

*Scale 1 to 5, where 1 = distracting; 2 = not important; 3 = useful; 4 = important; 5 = essential<br />

4.8<br />

4.4<br />

4.1<br />

4.3<br />

4.1<br />

3.9<br />

3.5<br />

3.7<br />

3.0<br />

3.7<br />

4.1<br />

3.7<br />

3.5<br />

3.7<br />

3.2<br />

3.2<br />

UK<br />

Nonfinancia<br />

l firm<br />

4.6<br />

4.1<br />

3.9<br />

4.2<br />

4.6<br />

4.2<br />

4.2<br />

4.1<br />

4.2<br />

3.3<br />

3.6<br />

3.8<br />

3.6<br />

3.4<br />

Academi<br />

c<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

4.6<br />

4.4<br />

3.6<br />

4.6<br />

4.2<br />

3.2<br />

3.4<br />

3.0<br />

2.6<br />

3.0<br />

Rest<br />

of<br />

World<br />

4.8<br />

4.3<br />

4.2<br />

4.3<br />

4.3<br />

3.7<br />

3.4<br />

3.9<br />

3.4<br />

3.5<br />

Othe<br />

r<br />

4.7<br />

4.1<br />

4.0<br />

4.2<br />

4.2<br />

3.7<br />

3.5<br />

3.8<br />

3.3<br />

3.3<br />

13<br />

14

Overall assessment of central banks’<br />

communication<br />

Question 7 - Please give a mark which conveys your overall sense of how<br />

well the following central banks communicate with the markets and<br />

broader economic agents (1 = lowest, 10 = highest communication<br />

abilities)<br />

Full Results Results during 1 - 12 August Results during 13 - 24 August<br />

7.4 7.5 7.3 7.2 7.3 7.1 6.9 6.9 6.8<br />

Fed ECB BoE BoJ<br />

5.1<br />

4.9<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Overall assessment of central banks’ communication<br />

(2)<br />

Question 7 - Please give a mark which conveys your overall sense of how<br />

well the following central banks communicate with the markets and<br />

broader economic agents (1 = lowest, 10 = highest communication<br />

abilities)<br />

Average<br />

Fed<br />

ECB<br />

BoE<br />

BoJ<br />

Average<br />

Fed<br />

ECB<br />

BoE<br />

BoJ<br />

Asset<br />

mgnt<br />

7.3<br />

7.3<br />

7.0<br />

5.0<br />

Asia ex<br />

Japan<br />

7.7<br />

7.4<br />

6.8<br />

5.5<br />

Commercial<br />

bank<br />

7.5<br />

7.2<br />

6.8<br />

5.2<br />

Europe ex<br />

UK<br />

7.5<br />

7.4<br />

6.8<br />

5.1<br />

Hedge<br />

fund<br />

7.1<br />

7.0<br />

6.8<br />

4.2<br />

Japan<br />

7.3<br />

6.9<br />

6.9<br />

4.7<br />

Central<br />

bank<br />

7.9<br />

7.9<br />

7.3<br />

6.1<br />

UK<br />

7.1<br />

6.9<br />

6.9<br />

4.8<br />

Nonfinancial<br />

firm<br />

7.3<br />

6.8<br />

6.9<br />

5.2<br />

North<br />

America<br />

7.2<br />

7.0<br />

7.0<br />

5.1<br />

Academic<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

6.8<br />

5.2<br />

8.2<br />

3.8<br />

5.2<br />

Rest of<br />

World<br />

7.7<br />

7.4<br />

7.1<br />

5.6<br />

Other<br />

7.5<br />

7.1<br />

6.9<br />

5.4<br />

15<br />

16

Investor perceptions of CB inflation commitment<br />

(1)<br />

Question 8 - Some members of the FRS have said they believe the inflation<br />

rate for the US "core" PCE deflator should reside in a "comfort zone" of<br />

1-2%. How determined do you think the Fed is to realise this during the<br />

next five years?<br />

Highly determined Reasonably determined<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Not very determined Not at all determined<br />

Asia ex Japan Europe ex<br />

UK<br />

Japan UK North<br />

America<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Rest of<br />

World<br />

Investor perceptions of CB inflation commitment<br />

(2)<br />

Question 9 - The ECB/Eurosystem has said that its definition of price<br />

stability is "below, but close to, 2%", with reference to the HICP. How<br />

determined do you think the ECB/Eurosystem is to realise this during the<br />

next five years?<br />

Highly determined Reasonably determined<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Not very determined Not at all determined<br />

Asia ex Japan Europe ex<br />

UK<br />

Japan UK North<br />

America<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

Rest of<br />

World<br />

17<br />

18

Investor perceptions of CB inflation commitment<br />

(3)<br />

Market perception on Fed determination to<br />

realise annual inflation rate for US core PCE<br />

deflator of 1-2pc during next 5yrs<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

19%<br />

64%<br />

17%<br />

1%<br />

Highly Reasonably Not very Not at all<br />

determined determined determined determined<br />

Disclaimer<br />

Market perception on ECB determination to<br />

realise price stability below/close to 2%<br />

with reference to HICP during next 5yrs<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

40%<br />

50%<br />

9%<br />

1%<br />

Highly Reasonably Not very Not at all<br />

determined determined determined determined<br />

Note: this shows mean values and excludes responses for “no comment” and “no view”<br />

Source: Barclays Capital Investor Survey of Central Bank Communication (August 2007)<br />

The person named as the author of this report hereby certifies that: (i) all of the views expressed in the research report accurately reflect my personal views about the<br />

subject securities and issuers; and (ii) no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views<br />

expressed in the research report.<br />

For disclosures on issuers in this report see:<br />

https://ecommerce.barcap.com/research/cgi-bin/public/disclosuresSearch.pl<br />

Any reference to Barclays Capital includes its affiliates.<br />

Barclays Capital does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that Barclays Capital may<br />

have a conflict of interest that could affect the objectivity of this report.<br />

IRS Circular 230 Prepared Materials Disclaimer: Barclays Capital and its affiliates do not provide tax advice and nothing contained herein should be construed to be tax advice. Please be advised that any<br />

discussion of U.S. tax matters contained herein (including any attachments) (i) is not intended or written to be used, and cannot be used, by you for the purpose of avoiding U.S. tax-related penalties; and<br />

(ii) was written to support the promotion or marketing of the transactions or other matters addressed herein. Accordingly, you should seek advice based on your particular circumstances from an<br />

independent tax advisor.<br />

This publication has been prepared by Barclays Capital (‘Barclays Capital’) – the investment banking division of Barclays Bank PLC. This publication is provided to you for information purposes only. Prices<br />

shown in this publication are indicative and Barclays Capital is not offering to buy or sell or soliciting offers to buy or sell any financial instrument. Other than disclosures relating to Barclays Capital, the<br />

information contained in this publication has been obtained from sources that Barclays Capital knows to be reliable, but we do not represent or warrant that it is accurate or complete. The views in this<br />

publication are those of Barclays Capital and are subject to change, and Barclays Capital has no obligation to update its opinions or the information in this publication. Barclays Capital and its affiliates and<br />

their respective officers, directors, partners and employees, including persons involved in the preparation or issuance of this document, may from time to time act as manager, co-manager or underwriter of<br />

a public offering or otherwise, in the capacity of principal or agent, deal in, hold or act as market-makers or advisors, brokers or commercial and/or investment bankers in relation to the securities or related<br />

derivatives which are the subject of this publication.<br />

Neither Barclays Capital, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of<br />

this publication or its contents. The securities discussed in this publication may not be suitable for all investors. Barclays Capital recommends that investors independently evaluate each issuer, security or<br />

instrument discussed in this publication, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in<br />

relevant economic markets (including changes in market liquidity). The information in this publication is not intended to predict actual results, which may differ substantially from those reflected.<br />

This communication is being made available in the UK and Europe to persons who are investment professionals as that term is defined in Article 19 of the Financial Services and Markets Act 2000<br />

(Financial Promotion Order) 2005. It is directed at persons who have professional experience in matters relating to investments. The investments to which it relates are available only to such persons and<br />

will be entered into only with such persons. Barclays Capital - the investment banking division of Barclays Bank PLC, authorised and regulated by the Financial Services Authority (‘FSA’) and member of the<br />

London Stock Exchange.<br />

BARCLAYS CAPITAL INC. IS DISTRIBUTING THIS MATERIAL IN THE UNITED STATES AND, IN CONNECTION THEREWITH, ACCEPTS RESPONSIBILITY FOR ITS CONTENTS. ANY U.S. PERSON<br />

WISHING TO EFFECT A TRANSACTION IN ANY SECURITY DISCUSSED HEREIN SHOULD DO SO ONLY BY CONTACTING A REPRESENTATIVE OF BARCLAYS CAPITAL INC. IN THE U.S., 200<br />

Park Avenue, New York, New York 10166.<br />

Subject to the conditions of this publication as set out above, ABSA CAPITAL, the Investment Banking Division of ABSA Bank Limited, an authorised financial services provider (Registration No.:<br />

1986/004794/06), is distributing this material in South Africa. Any South African person or entity wishing to effect a transaction in any security discussed herein should do so only by contacting a<br />

representative of ABSA Capital in South Africa, ABSA TOWERS NORTH, 180 COMMISSIONER STREET, JOHANNESBURG, 2001. ABSA CAPITAL IS AN AFFILIATE OF BARCLAYS CAPITAL.<br />

Non-U.S. persons should contact and execute transactions through a Barclays Bank PLC branch or affiliate in their home jurisdiction unless local regulations permit otherwise.<br />

Barclays Bank PLC Frankfurt Branch is distributing this material in Germany under the supervision of Bundesanstalt fuer Finanzdienstleistungsaufsicht.<br />

Copyright Barclays Bank PLC (2007). All rights reserved. No part of this publication may be reproduced in any manner without the prior written permission of Barclays Capital or any of its affiliates.<br />

Barclays Bank PLC is registered in England No. 1026167. Registered office 1 Churchill Place, London, E14 5HP.<br />

Additional information regarding this publication will be furnished upon request. [070425EUD]<br />

19<br />

20