- Page 4: Now Available from the Publishers o

- Page 8: TABLE OF CONTENTS Foreword ........

- Page 12: ! FOREWORD The 1993 Paper Recycling

- Page 18: sustainable market, there has to be

- Page 22: NEWSPAPER When discussion turns to

- Page 26: closed plants have added to OCC end

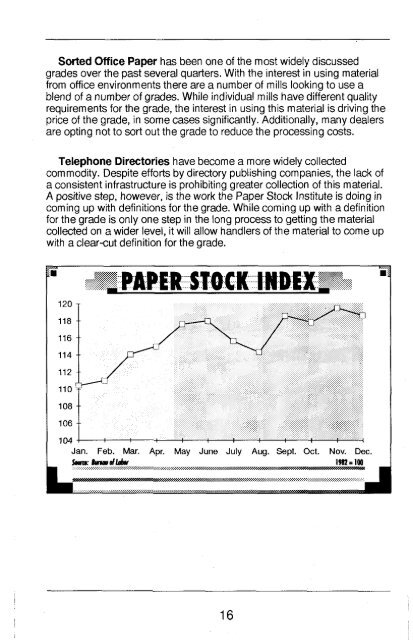

- Page 30: Sorted Office Paper has been one of

- Page 34: Groundwood - Groundwood paper conta

- Page 38: Republic Gypsum, Hutchinson, Kans.

- Page 42: Alabama Joe Piper Inc., 265 Riverch

- Page 46: Alabama Royal St. Junk Co., Inc., P

- Page 50: Arizona Prescoff Beard Recycling, 2

- Page 54: CALIFORNIA Anaheim CVT Recycling, 2

- Page 58: California Bakersfield Baldwin Park

- Page 62: California Burbank Burbank Recycle,

- Page 66:

California Corte Madera Pacific For

- Page 70:

California ReCyCo, Inc., 929 N. Map

- Page 74:

California La Mirada Star Scrap Met

- Page 78:

California Lana Beach Bel-Art Paper

- Page 82:

California Commercial Waste Paper,

- Page 86:

California South Coast Recycling, 4

- Page 90:

California Newark North Hollywood A

- Page 94:

East Coast Operations 324 Newport S

- Page 98:

California Pomona Garden State Pape

- Page 102:

California Riverside Waste Paper Co

- Page 106:

1 I California West Coast Salvage a

- Page 110:

California Waste Management - Great

- Page 114:

California Sun Valley Paper Stock,

- Page 118:

California Weyerhaeuser Paper Compa

- Page 122:

Colorado Rocky Mountain Battery Ser

- Page 126:

Connecticut RRT Empire,211 Murphy R

- Page 130:

Connecticut Woodpulp International,

- Page 134:

Connecticut Wethers field Loretta R

- Page 138:

Florida Clearwater Mac Bay, Inc., 9

- Page 142:

Florida Hollv Hill lnverness Citrus

- Page 146:

Florida Miami A-1 Shredding & Waste

- Page 150:

Florida Recyco of Miami, Inc., 9016

- Page 154:

Florida Recycle America - Orange Co

- Page 158:

Florida Mid South Converting/Sales,

- Page 162:

Florida Venice Venice Scrap Metal,

- Page 166:

Georgia Austell Caraustar Industrie

- Page 170:

Georgia Garden Citw La Grange Bacon

- Page 174:

Georaia Marietta Nahunfa Ralph’s

- Page 178:

Georaia Riceboro Interstate Paper C

- Page 182:

HAWAII Aiea International Metals, I

- Page 186:

Illinois Belleville Belleville Recy

- Page 190:

Illinois Marcells Paper & Metal, In

- Page 194:

Illinois Wolf Mill Supply Co., Inc.

- Page 200:

1 I 1 Illinois Gurnee C.H. Oscarson

- Page 204:

i Illinois Mundelein Alan Josephsen

- Page 208:

I Mansfield, Mass., St. Paul, Mn. I

- Page 212:

Illinois Schaumburg Universal Fiber

- Page 216:

i Indiana Goshen Goshen Iron & Meta

- Page 220:

I 1 I 1 Peru Indiana Plymouth Harry

- Page 224:

i i Iowa Superior Waste Systems, 20

- Page 228:

I I i Kansas Tama Packaging Corpora

- Page 232:

Lexington ~ ~ ~ ~ ~ ~~ ~ ~ Kentuckv

- Page 236:

Jefferson Louisiana Lake Charles Wa

- Page 240:

Sulphur Recycling, 708 East Napoleo

- Page 244:

1 Maine Waste Management of Maine-P

- Page 248:

I i Wrvland Tel. (301) 355-5800. FA

- Page 252:

I Maryland Dorsey Weyerhaeuser Pape

- Page 258:

A ttleboro Waste Management, P.O. B

- Page 262:

Massachusetts East Weymouth Fall Ri

- Page 266:

h&ssachusetts New Bedford A.W. Mart

- Page 270:

Massachusetts Salem Sharon Hanna Pa

- Page 274:

Massachusetts Weston New England Pa

- Page 278:

Michigan International Paper Recycl

- Page 282:

142

- Page 286:

Michiaan Midland Brady Recycling, 3

- Page 290:

Michigans largest Packer of Since 1

- Page 294:

Michigan Wyoming Recycle America of

- Page 298:

Minnesota Pioneer Paper Stock Co.,

- Page 302:

Mississippi Petal Hattiesburg Waste

- Page 306:

I S murfit Recycling Company I "Ame

- Page 310:

Missouri North Kansas City Columbia

- Page 314:

Montana E.J. Keeley Co., Inc., 400

- Page 318:

I New Hammhire Gonic Waste Manageme

- Page 322:

New Jbrsey Bridgeport CRlnc., P.O.

- Page 326:

New Jersey U.S. Pulp & Paper, 1101

- Page 330:

iEk /ZOZZARO BROS, INCS 36 CHESTNUT

- Page 334:

New Arsey John Rocco Scrap Material

- Page 338:

New Jersey Garfield Garden State Pa

- Page 342:

._-__ New .Ic?rsev --.-- Renco Cart

- Page 346:

VPONTE & SONS, INC. Leaders in Sale

- Page 350:

M. Ephraim Gypsum Paper Fiber Corp.

- Page 354:

I New Jersey Ocean Twp. Monmouth Pr

- Page 358:

... NO. 1 IN RECYCLING. . . f '" AW

- Page 362:

New Jersey Rochelle Park Saddle Bro

- Page 366:

New Jersev Vineland Joseph J. Giord

- Page 370:

NEW YORK Albany Ash Trading Corp.,

- Page 374:

New York Peter, Peter, Paper Eater,

- Page 378:

New York Advance Paper Recycling Co

- Page 382:

I i New York Rinaldi Recycling Co.,

- Page 386:

New York Ursula Products, Inc., 636

- Page 390:

New York Colonie (Albany) Yank Wast

- Page 394:

New York Green Island R. Freedman &

- Page 400:

Macedon Alpco Inc., Recycling Div.,

- Page 404:

BROKERS EXPORTERS TEL: (919) 846-88

- Page 408:

I 1 Bulkley Dunton & Co., 271 Madis

- Page 412:

New York Sisco Traders, 150 Nassau

- Page 416:

I New Yo& Recycle Material Inc., Di

- Page 420:

i New York Staten Island Canusa Cor

- Page 424:

“Established 1924 ’’ DEMATTEO

- Page 428:

Harmon Associates World Wide Wastep

- Page 432:

North Carolina $I & W Waste Co., P.

- Page 436:

I North Carolina kMid-South Metals,

- Page 440:

Thomasville North Carolina I ’L&C

- Page 444:

I Ohio Barberlon Maxwell Recycling,

- Page 448:

Ohio BFI - Cleveland Recyclery, 282

- Page 452:

I Ohio Elvria - Elyria Paper & Salv

- Page 456:

I I I Ohio Medina Medina Paper Recy

- Page 460:

Ohio Norfh Lima (Youngsfown) Associ

- Page 464:

i Oklahoma Woosfer Metallics Recycl

- Page 468:

I I Oregon Eugene Eugene Mission In

- Page 472:

With a reputation to be Proud of 4

- Page 476:

i Pennsylvania Bensalem Viking Fibr

- Page 480:

I Pennsylvania Conshohocken Vento,

- Page 484:

I Pennsylvania Automated Recycling

- Page 488:

i 1 Pennsylvania Hollidaysburg Joe

- Page 492:

Pennsylvania Norristo wn A.J. Catag

- Page 496:

I Pennsylvania Chas. Piacentino Inc

- Page 500:

Primos NU-Way Trash Removal, P.O. B

- Page 504:

Pennsylvania Waste Management of In

- Page 508:

I ~ Pawtucket Berger 8, Company, 12

- Page 512:

NOT ONE BUT. . . 22 Paper Stock Pro

- Page 516:

Southern Paper Stock Co. your best

- Page 520:

i Tennessee Chattanooga BFI of Tenn

- Page 524:

I Tennessee Ira Levy & Assoc.,P.O.

- Page 528:

I Texas Carrollton Weyerhaeuser Rec

- Page 532:

1 Texas Fort Worth Document Destruc

- Page 536:

Texas Vista Fibers, Div. of Allied

- Page 540:

I I Vennont UTAH Murray Interwest P

- Page 544:

Virginia Chesapeake Tidewater Fibre

- Page 548:

I Vig jnia Richmond Commodity Recyc

- Page 552:

West Coast Operations 41 22 East Ch

- Page 556:

I ! Washington Kirkand Pacific Coas

- Page 560:

Washington Rabanco Recycling, 2733

- Page 564:

~ 1 i Wisconsin Keyser Quality Supp

- Page 568:

I Wisconsin Western Wisconsin Recyc

- Page 572:

I i Wisconsin Waste Management of M

- Page 576:

Wisconsin Standard Scrap Metal Ltd.

- Page 580:

1 Edmonton British Columbia BFI, Lt

- Page 584:

CANADA. NOVA SCOTIA New Mines Josep

- Page 588:

I Ontario Concord BFI, Ltd., 550 Bo

- Page 592:

1 Ontario CRlnc., 400 Commissioners

- Page 596:

Completely automatic press for new

- Page 600:

Quebec Portneuf J. Ford & Co., Ltd.

- Page 604:

i ENGLAND France Abingdon, Oxon Sou

- Page 608:

j Ifa/y Industrial Metallics, Rusto

- Page 612:

i Puerto Rico Mexico, D. F. Pronapa

- Page 616:

United Arab Emirates AI Khobar Mare

- Page 620:

! I ALABAMA Albertville Keyes Fibre

- Page 624:

ARIZONA Arkansas Flagstaff Orchids

- Page 628:

California La Palma Orchid Paper Pr

- Page 632:

I i Connecticut Lunday-Thagard Roof

- Page 636:

Hialeah Atlas Tissue Mills, 3725 E.

- Page 640:

Georaia " Brunswick . Brunswick Pul

- Page 644:

Alton Illinois Aurora Aurora Paperb

- Page 648:

I Indiana Eaton Rock-Tenn Co., Rout

- Page 652:

I KENTUCKY Louisiana Ha wes wile Wi

- Page 656:

Maine Lincoln Lincoln Pulp & Paper

- Page 660:

Massachusetts Boston Patriot Paper

- Page 664:

Michigan South Hadley Decorative-Sp

- Page 668:

i Monroe Michiaan Monroe Paper Co.,

- Page 672:

I MINNESOTA Mississippi Grand Rapid

- Page 676:

Berlin James River Corp., 650 Main

- Page 680:

New Jersey Garwood Garwood Paperboa

- Page 684:

New York James River Corp., 695 Wes

- Page 688:

I New York Mechanicville Tagsons Pa

- Page 692:

NORTH CAROLINA Canton LChampion Int

- Page 696:

I Ohio PM Company, 24 Triangle Park

- Page 700:

OMahoma Toronto Valley Converting C

- Page 704:

I Pennsylvania Pilot Rock Wood Fibe

- Page 708:

Pennsylvania Lock Haven Internation

- Page 712:

SOUTH CAROLINA Tennessee Beech Isla

- Page 716:

I Texas Ponderosa Fibres, 1531 N. T

- Page 720:

VERMONT Vitginia Bra ff Ieboro Spec

- Page 724:

WASHINGTON Washington Bellingham Ge

- Page 728:

I 1 WISCONSIN Wisconsin Appleton Fo

- Page 732:

I Wisconsin Geo. A. Whiting Paper C

- Page 736:

We’ve got the rail system for you

- Page 740:

i NEW BRUNSWICK Bathurst Consolidat

- Page 744:

Quebec Noranda Forest Recycled Pape

- Page 748:

i Quebec Mwog Orford Recycling, Inc

- Page 752:

American Newspaper Publishers Assoc

- Page 756:

Paper Stock Institute of America, 1

- Page 760:

ALASKA State Dept. of Environmental

- Page 764:

California Municipality Berkeley De

- Page 768:

I California Pasadena City of Pasad

- Page 772:

District of Columbia State Departme

- Page 776:

I Georgia Fort Myers City of Ft. My

- Page 780:

! Illinois Municipality Boise City

- Page 784:

I 1 8 I Kansas South Bend Solid Was

- Page 788:

Municipality Lafayeite Environmenta

- Page 792:

i Michigan Department of Environmen

- Page 796:

I Mississippi Office of Waste Manag

- Page 800:

New Hampshire Solid and Hazardous W

- Page 804:

New Jersev Union Utilities Authorit

- Page 808:

New Yo& County Erie Dept. of Public

- Page 812:

1 NORTH DAKOTA State North Dakota R

- Page 816:

I Pennsylvania Municipality Eugene

- Page 820:

I SOUTH CAROLINA South Dakota State

- Page 824:

I Vermont Houston City of Houston,

- Page 828:

i Washington Roanoke Roanoke City P

- Page 832:

I Wyoming County Milwaukee Milwauke

- Page 836:

A.6. Consolidated Waste Management,

- Page 840:

i Allegheny Paper Shredders Corpora

- Page 844:

Balemaster, 980 Crown Court, Crown

- Page 848:

Buckhorn Canada, Inc., 2775 Slouch

- Page 852:

Chem-tainer Industries, 361 Neptune

- Page 856:

Compac Specialties, Inc., 136 E. 6t

- Page 860:

Eidal Shredders, P.O. Box 529, West

- Page 864:

433 ning Introducing EPCO'S EX-72r

- Page 868:

Global Strapping Systems, Inc., 103

- Page 872:

i @ Office Paper Recycling System @

- Page 876:

K-PAC Division of Krause Corporatio

- Page 880:

Lummus Development Corp., P. 0. Box

- Page 884:

Mij. Bronneberg Helmond B.V., Haags

- Page 888:

P ul Combimng unmatched product thr

- Page 892:

“For your WASTE MANAGEMENT needs

- Page 896:

i Safco Diversified Recycling Syste

- Page 900:

Thomas P. Stevens, Inc., 2569 Dixie

- Page 904:

NATIONAL DISTRIBUTORS 3M, Commercia

- Page 908:

CONSULTANTS Robert V. Adelman, Cons

- Page 912:

Manifold Colored Ledger(39) Sorted

- Page 916:

2150 Sales Corp ...................

- Page 920:

BFI of Florda . Inc ...............

- Page 924:

I Dean wiping Cloth Corp ..........

- Page 928:

Howard Zuker Associates .. .98 Hub

- Page 932:

Michael Ruzzo Industries Inc ......

- Page 936:

Pontiac Recvclers. Inc. ...........

- Page 940:

Smurfit Recycling .. ..............

- Page 944:

Waste Management of Houston . 269 W

- Page 948:

ADVERTISER INDEX ABC Baling Wire Su

- Page 952:

ADVERTISER INDEX Mosley Machinery C

- Page 956:

6LP S3lON

- Page 960:

18P S310N