Annual - Aramex

Annual - Aramex

Annual - Aramex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes (Continued)<br />

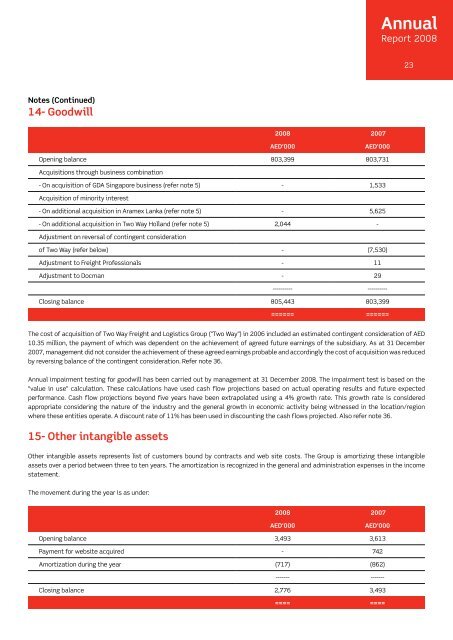

14- Goodwill<br />

2008 2007<br />

AED’000 AED’000<br />

Opening balance 803,399 803,731<br />

Acquisitions through business combination<br />

- On acquisition of GDA Singapore business (refer note 5) - 1,533<br />

Acquisition of minority interest<br />

- On additional acquisition in <strong>Aramex</strong> Lanka (refer note 5) - 5,625<br />

- On additional acquisition in Two Way Holland (refer note 5) 2,044 -<br />

Adjustment on reversal of contingent consideration<br />

of Two Way (refer below) - (7,530)<br />

Adjustment to Freight Professionals - 11<br />

Adjustment to Docman - 29<br />

---------- ----------<br />

Closing balance 805,443 803,399<br />

====== ======<br />

<strong>Annual</strong><br />

Report 2008<br />

The cost of acquisition of Two Way Freight and Logistics Group (“Two Way”) in 2006 included an estimated contingent consideration of AED<br />

10.35 million, the payment of which was dependent on the achievement of agreed future earnings of the subsidiary. As at 31 December<br />

2007, management did not consider the achievement of these agreed earnings probable and accordingly the cost of acquisition was reduced<br />

by reversing balance of the contingent consideration. Refer note 36.<br />

<strong>Annual</strong> impairment testing for goodwill has been carried out by management at 31 December 2008. The impairment test is based on the<br />

“value in use” calculation. These calculations have used cash flow projections based on actual operating results and future expected<br />

performance. Cash flow projections beyond five years have been extrapolated using a 4% growth rate. This growth rate is considered<br />

appropriate considering the nature of the industry and the general growth in economic activity being witnessed in the location/region<br />

where these entities operate. A discount rate of 11% has been used in discounting the cash flows projected. Also refer note 36.<br />

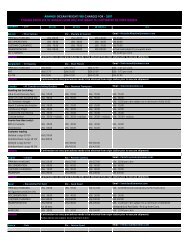

15- Other intangible assets<br />

Other intangible assets represents list of customers bound by contracts and web site costs. The Group is amortizing these intangible<br />

assets over a period between three to ten years. The amortization is recognized in the general and administration expenses in the income<br />

statement.<br />

The movement during the year is as under:<br />

2008 2007<br />

AED’000 AED’000<br />

Opening balance 3,493 3,613<br />

Payment for website acquired - 742<br />

Amortization during the year (717) (862)<br />

------- -------<br />

Closing balance 2,776 3,493<br />

==== ====<br />

23