Annual - Aramex

Annual - Aramex

Annual - Aramex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mission and Purpose<br />

Mission<br />

To be recognized as one of the top five global logistics and express transportation service<br />

providers by the year 2010<br />

Purpose<br />

To enable and facilitate regional and global trade and commerce

Delivery has no limits<br />

2008 marked the unveiling of a new <strong>Aramex</strong> corporate image that is<br />

designed to catch up with the rapid growth of the company.<br />

The new, crystallized brand signals <strong>Aramex</strong>’s evolution into a major<br />

global logistics player. Our new slogan – “delivery unlimited” –<br />

simply and confidently states that we deliver everything from a<br />

single package to a comprehensive logistics solution. We deliver<br />

ideas and innovation. We deliver on our promises to our customers,<br />

our communities and the environment.

Reach has no limits<br />

We continue our global expansion by assuming creative<br />

asset-light investments through franchising and joint<br />

ventures in emerging markets such as Asia, Eastern Europe<br />

and Sub-Saharan Africa.<br />

In 2008, we opened a new ground operations hub in<br />

Singapore, formed a joint venture in Jakarta, and established<br />

new franchises in Bangladesh, Vietnam, Nepal, Cambodia,<br />

Azerbaijan, Georgia, Ghana and Mauritius.

Determination has no limits<br />

Sportsmanship and teamwork are integral to <strong>Aramex</strong> culture; our<br />

people are driven by unwavering willpower and a winning spirit.<br />

Our internal sports activities in 2008 included the 2nd<br />

Basketball Tournament in Beirut and Gulf Soccer Cup in Bahrain.<br />

On the public field, <strong>Aramex</strong> left a strong fingerprint at Dubai<br />

Corporate Games, while our runners picked up trophies from<br />

Cyprus to Austria and most importantly during the Des Sables<br />

six-day desert challenge in Morocco.<br />

In 2008 <strong>Aramex</strong> sponsored the AFC Champions<br />

League, Asia’s premier football tournament<br />

<strong>Aramex</strong>'s inter-basketball tournaments foster the<br />

spirit of sportsmanship between our employees

Tomorrow has no limits<br />

The year following the release of our first Sustainability<br />

Report witnessed a number of milestones in our<br />

sustainable business strategy. Assigning the new<br />

position of Chief Sustainability and Compliance Officer<br />

is one of them.<br />

Environmental Sustainability is at the core of our<br />

strategy. In 2008 we introduced hybrid vehicles in our<br />

fleet to reduce our carbon footprint and biodegradable<br />

pouches to reduce waste impact. The company’s<br />

<strong>Annual</strong> Leaders Conference addressed socially and<br />

environmentally sustainable practices and featured<br />

many responsible activities, including the utilization of<br />

digital documents to reduce printed material, natural<br />

gifts that were handmade by local communities and<br />

bicycle transportation to reduce carbon emissions.<br />

<strong>Aramex</strong> Leaders attending the "Changing<br />

Today, Protecting Tomorrow" conference in<br />

Sharm El-Sheikh, Egypt<br />

Driven by its commitment to sustainability of<br />

the environment, <strong>Aramex</strong> switched to using<br />

biodegradable pouches in its operations.

<strong>Aramex</strong> Founder and CEO Fadi Ghandour<br />

graciously accepting the ‘Businessman of<br />

the Year’ award at the 9th annual Arabian<br />

Business Achievement Awards.

Innovation has no limits<br />

Our innovation and responsible approaches towards all<br />

stakeholders have been recognized by the industry.<br />

<strong>Aramex</strong> was acclaimed for its outstanding achievements<br />

in third party logistics (3PL) and corporate social<br />

responsibility (SCR), as it scooped up trophies at the<br />

annual Supply Chain and Transport Awards (SCATA).<br />

The Green Association presented <strong>Aramex</strong> with the 2008<br />

Gold International Green Apple Award for Environmental<br />

Best Practice and Sustainable Development in the Asian<br />

region.

Volunteers sorting aid supplies at an <strong>Aramex</strong><br />

Logistics Center, as part of the Deliver Hope to<br />

Gaza campaign.<br />

Children participating in one of the youth<br />

development activities at Ruwwad; a non-profit<br />

organization led by <strong>Aramex</strong> that aims to enable<br />

marginalized communities to reach for a better future.

Hope has no limits<br />

We contribute to the progress of our communities<br />

by supporting the same values we nurture in our<br />

internal environment. By partnering with other<br />

socially responsible organizations, <strong>Aramex</strong><br />

provides its transportation network and logistical<br />

expertise to support worthy causes.<br />

Among the initiatives that <strong>Aramex</strong> supported in<br />

2008 were: UNICEF’s Send a Card, Save a Life<br />

annual greeting cards campaign across the GCC;<br />

the Arab Fund for Arts and Culture, an independent<br />

initiative committed to empowering artists,<br />

authors and filmmakers across the region; Call for<br />

Life campaign held on behalf of the Children’s<br />

Cancer Center of Lebanon; Dubai Cares’ Million<br />

Book Challenge, an empowering literacy project to<br />

provide children around the world with access to<br />

books; and the Hikmat Road Safety program in<br />

Jordan.<br />

With the conclusion of 2008, <strong>Aramex</strong> launched a<br />

successful emergency donations campaign in the<br />

UAE and Jordan to collect and deliver aid supplies<br />

to the afflicted people in Gaza.

<strong>Annual</strong><br />

Report 2008<br />

I<br />

Dear Stakeholders,<br />

Abdullah Al Mazroui<br />

Chairman<br />

Two Thousand and Eight was an eventful year for <strong>Aramex</strong>, remarkably<br />

a year of robust growth in the midst of economic turbulences<br />

that provoked extreme uncertainty and prompted a thorough reevaluation<br />

of old practices, performance, goals, and vision.<br />

<strong>Aramex</strong>’s financial results for 2008 have been very consistent<br />

with previous years. Our revenues grew by 17%, reaching AED<br />

2.08 billion, and net profits increased by 21%, hitting AED 147.3<br />

million. Moreover, we retain a cash position of AED 344 million in<br />

our balance sheet.<br />

Our logistics and supply chain operation experienced 24%<br />

growth, largely due to innovative solutions and enhancements<br />

in infrastructure coupled with a market trend that favours<br />

outsourcing. Land freight, a cost-effective transportation service<br />

well-suited for these difficult times, has also grown substantially.<br />

Adapting to the tumult--and thriving while doing so--has proved to<br />

us that our business model is the right one. It is resilient, flexible,<br />

agile, quick to capitalize on opportunities and just as efficient in<br />

adjusting to crisis.<br />

From the outset, <strong>Aramex</strong>’s vision has been simple: Our life will<br />

always revolve around our people, our clients, and our community.<br />

Fadi Ghandour<br />

Founder and CEO<br />

This vision and the strategies that articulate it place the interests<br />

of our stakeholders at the center of our endeavors and ensure that<br />

they are the primary beneficiaries of our success.<br />

And hence <strong>Aramex</strong>’s vision dictates that we maintain a healthy<br />

balance between financial returns and social and environmental<br />

considerations. We believe that businesses truly flourish when<br />

they invest in their communities. Creating the position of Chief<br />

Sustainability Officer was therefore an essential step towards<br />

anchoring our responsible practices and systemizing our role as<br />

a corporate citizen. Thanks to this approach, <strong>Aramex</strong> is the first<br />

express and logistics company to introduce hybrid vehicles to its<br />

fleet in the Middle East and to use biodegradable pouches across<br />

its global network. And proud though we are of our track record in<br />

pursuing new environmentally friendly practices and introducing<br />

new technologies to our network, we are working very hard to<br />

make sure that our current accomplishments are the forerunners<br />

of much bolder ones.<br />

Our commitment to a healthier future was also reflected in several<br />

projects through which we leveraged our know-how and network<br />

of partners to maximise impact. Our partnership with UNICEF’s<br />

“Send a Card, Save a Life” greetings cards campaign in the GCC,<br />

our logistics assistance to the Dubai Care “Million Book Challenge,”

and our support of the Arab Fund for Arts and Culture are among<br />

the programs we embarked upon in 2008.<br />

We have also expanded our community outreach and youth<br />

empowerment activities through Ruwwad, Entrepreneurs for<br />

Development, a region-wide Corporate Social Responsibility<br />

initiative that focuses on offering better education and employment<br />

opportunities to underprivileged youth through creative schemes<br />

that focus on activism, volunteerism, and entrepreneurship.<br />

Ruwwad, which commenced in East Amman, now includes the<br />

north and south of Jordan and a community in Cairo, Egypt. Plans<br />

for Lebanon, Syria, and Palestine are already underway.<br />

Promoting excellence in research and nurturing the region's<br />

intellectual capital are also part of <strong>Aramex</strong>’s push in the education<br />

field. We are providing, over a four-year period, a scholarship fund<br />

to Middle Eastern scholars participating in the Middle East Studies<br />

Association Conference and sponsoring the Best Student Prize Paper.<br />

Needless to say, we are very grateful that our community recognizes<br />

such efforts. In 2008, <strong>Aramex</strong> received The Environmental Green<br />

Apple Award, The Supply Chain and Transport Awards (SCATA)<br />

for outstanding achievements in Third Party Logistics (3PL) and<br />

Corporate Social Responsibility, and Arabian Business Magazine’s<br />

<strong>Annual</strong><br />

Report 2008<br />

“Businessman of the Year” award which honoured Fadi Ghandour,<br />

the founder and CEO of <strong>Aramex</strong>.<br />

On the regional expansion front, <strong>Aramex</strong> inaugurated a 20,000 sqm<br />

state-of-the-art facility at the Jebel Ali Free Zone in Dubai that is<br />

wholly dedicated to InfoFort, the leading records management<br />

company in the Middle East.<br />

Franchising has proven to be another successful strategy in<br />

boosting <strong>Aramex</strong>’s geographic reach, We are setting up a franchise<br />

support program that will allow young businesses in Georgia,<br />

Ghana, Azerbaijan, Cambodia, and Mauritius to realize their<br />

entrepreneurial ambitions. At the same time, we are looking for<br />

prospects in Africa and Eastern Europe.<br />

Clearly, without the support of our people, <strong>Aramex</strong>’s ambitions<br />

would still be the stuff of dreams. We thank you for your continuous<br />

support and your confidence in this company and its vision.<br />

Abdullah Al Mazroui Fadi Ghandour<br />

Chairman Founder and CEO<br />

II

<strong>Annual</strong><br />

Report 2008<br />

III<br />

About the Company:<br />

<strong>Aramex</strong> PJSC is a Public Joint Stock Company registered in the Emirate of Dubai, UAE on 15 February 2005 under the UAE Federal Law No 8<br />

of 1984 (as amended).<br />

The principal activities of the company are to invest in the freight, express, logistics and supply chain management businesses through<br />

acquiring and owning controlling interests in one or more of the existing companies in the Middle East and other parts of the world.<br />

The company’s registered office is: Office No 5, Abdul Rahman Al Zaroani real estate, Plot 221-121, Dubai Airport, Deira, Dubai, United Arab<br />

Emirates.<br />

On 22 June 2005, the company acquired 100% shareholding in <strong>Aramex</strong> International Limited, a company incorporated under the laws of<br />

Bermuda. The following section presents information about <strong>Aramex</strong> International Limited for the years 2004 and 2005 and information<br />

about <strong>Aramex</strong> PJSC for the years 2006, 2007 and 2008:

Selected Financial Data<br />

<strong>Annual</strong><br />

Report 2008<br />

The below schedule presents selected consolidated financial data of <strong>Aramex</strong> PJSC for the years 2006, 2007 and 2008, and data of <strong>Aramex</strong><br />

International Limited for the years 2004 and 2005. These statements have been prepared in accordance with international financial reporting<br />

standards.<br />

* <strong>Aramex</strong> International Limited numbers for the years 2004 and 2005 have been translated from US Dollars to UAE Dirhams using an exchange<br />

rate of US$ 1 = AED 3.6726<br />

Consolidated Income Statements<br />

(In Thousands of UAE Dirhams)<br />

(Year Ended December 31)<br />

Revenues<br />

2004 2005 2006 2007 2008<br />

International express 294,523 369,119 439,769 519,085 610,343<br />

Freight forwarding 245,308 282,985 611,188 823,993 912,599<br />

Domestic express 93,093 120,874 176,962 224,988 295,665<br />

Logistics 3,182 7,496 52,626 106,766 132,654<br />

Publications and distribution 29,873 33,426 34,565 35,952 35,955<br />

Others 27,174 39,952 48,693 73,004 92,738<br />

Total Revenues 693,152 853,852 1,363,803 1,783,788 2,079,954<br />

Shipping costs 377,617 447,320 743,966 948,133 1,041,971<br />

Gross profit 315,536 406,532 619,838 835,654 1,037,983<br />

Operating expenses 93,633 119,117 191,911 268,548 364,961<br />

Selling, general and administrative expenses 163,985 200,957 318,605 424,095 497,797<br />

Operating income 57,917 86,458 109,322 143,011 175,225<br />

Interest income 889 753 8,564 8,070 5,375<br />

Interest expense (856) (895) (3,309) (4,131) (3,442)<br />

Gain (loss) on sale of fixed assets (15) 249 (544) (298) (853)<br />

Exchange gain (loss) (584) 1,508 (967) 3,442 1,771<br />

Other income (loss) 624 341 375 422 1,869<br />

Income before income taxes 57,976 88,415 113,441 150,516 179,945<br />

Provision for income taxes (3,239) (3,925) (4,437) (9,450) (10,573)<br />

Minority interests (7,151) (10,087) (13,780) (19,515) (22,051)<br />

Net Income 47,586 74,403 95,223 121,551 147,321<br />

IV

<strong>Annual</strong><br />

Report 2008<br />

V<br />

Consolidated Balance Sheet Data<br />

(In Thousands of UAE Dirhams)<br />

(Year Ended December 31)<br />

Balance sheet data: 2004 2005 2006 2007 2008<br />

Working capital 85,832 47,505 272,102 344,452 447,668<br />

Total assets 281,824 439,122 1,512,415 1,674,836 1,845,307<br />

Total liabitlies & Minority Interest 148,035 263,193 364,219 389,661 437,768<br />

Total shareholders equity 133,789 175,929 1,148,196 1,285,175 1,407,539<br />

- - - - -<br />

History and Development of <strong>Aramex</strong><br />

The company is a provider of international and domestic express package delivery, freight forwarding, logistics and other transportation<br />

services primarily to, from and within the Middle East and South Asia. The company has expanded its presence in Europe by acquiring<br />

TwoWay Vanguard, a logistics and freight service provider that has offices in the Netherlands, Ireland and the United Kingdom. Historically,<br />

the majority of the company’s business has been derived from its international express package delivery operations. The company believes<br />

that these international express delivery operations, combined with its network of stations, have provided the company with a solid<br />

infrastructure for the development of additional products, such as the company’s freight forwarding services, domestic express delivery<br />

services and shopping services.<br />

Since its inception in 1982, <strong>Aramex</strong> has expanded its station/office network to include 309 offices in 200 major cities with more than 7,600<br />

employees as of December 2008.<br />

The company is a founding member and chair of the Global Distribution Alliance (GDA), comprising of over 40 leading logistics and<br />

transportation providers with over 12,000 offices worldwide, more than 66,000 employees, an excess of 33,000 vehicles and operations in<br />

more than 220 countries throughout the world. The Global Distribution Alliance is strategically positioned to provide swift and reliable global<br />

transportation solutions. Each individual member of the alliance provides extensive coverage and in-depth expertise in a different region<br />

of the world. Together, the members provide total world coverage with thorough local knowledge, ensuring an exceptional service in every<br />

corner of the globe. The alliance offers comprehensive tracking facilities utilizing state-of-the-art <strong>Aramex</strong> technology, allowing alliance<br />

members, agents and customers to track and trace their shipments anywhere in the world with the click of a button.<br />

<strong>Aramex</strong> shares were traded on the NASDAQ Stock Market from January 1997 to April 2002 under the symbol “ARMX”. The company was<br />

acquired by a private equity firm pursuant to a U.S. cash tender that closed at the night of February 7, 2002 with approximately 96% of the<br />

outstanding shares validly tendered prior to the expiration of the offer. The acquisition was executed on a leveraged basis and the company<br />

was subsequently de-listed from NASDAQ on April 9, 2002.<br />

On June 22, 2005 the company was acquired by Arab International Logistics PJSC, a publicly traded company on Dubai Financial Market that<br />

was later renamed to <strong>Aramex</strong> PJSC.<br />

Business Overview<br />

The following discussion provides a summary of the key services provided by the company:<br />

International Express Delivery Services<br />

Express shipments consist of small packages, typically ranging in weight from 0.1 kilograms to 50 kilograms, with time-sensitive delivery<br />

requirements. The company offers its international express delivery services to both retail and wholesale express accounts and offers its<br />

customers the ability to track their shipments on the World Wide Web through the company’s Web site (www.aramex.com).<br />

Retail express delivery customers include trading companies, pharmaceutical companies, banks, service and information companies and<br />

manufacturing and regional distribution companies, and is not concentrated in any one industry.

<strong>Annual</strong><br />

Report 2008<br />

Wholesale express delivery customers consist primarily of: (a) other members of the Global Distribution Alliance, and (b) Express delivery<br />

companies with express packages that have an <strong>Aramex</strong> destination and require <strong>Aramex</strong>’s network to deliver their shipments. The end-user<br />

remains a customer of <strong>Aramex</strong>’s wholesale client.<br />

Freight Forwarding Services<br />

The company offers a wide range of freight forwarding services including air, land and ocean transport. Forwarding of loose cargo or<br />

consolidated freight, warehousing, customs clearance and break-bulk services and inter-modal transportation such as air/land, sea/land,<br />

etc., are some of the additional services on offer by <strong>Aramex</strong> today. Freight shipments typically have gross weights in excess of 50 kilograms<br />

on average. These require more specialized handling and are normally less time-sensitive than express shipments. <strong>Aramex</strong> provides full<br />

“door-to-door” services from, to and within the Middle East, South Asia and Western Europe, mainly in the United Kingdom, Netherlands<br />

and Ireland. A significant portion of the Company’s freight forwarding business involves consignee sales (or routed imports) and, to a lesser<br />

extent, exports by air, ocean and land modes.<br />

<strong>Aramex</strong> launched its freight forwarding business in 1987 out of selected stations, and from 1993, at every <strong>Aramex</strong> station in the <strong>Aramex</strong><br />

network. Whereas express shipments in the <strong>Aramex</strong> network virtually always pass through one of its international hubs or gateways, freight<br />

forwarding shipments are routed directly from origin to destination on board the operating carriers that are active on these routes or on the<br />

wings of the commercial lift available on city-pair basis around the globe. Usually the freight route is selected to best suit the size, weight<br />

and time-sensitivity of the shipment on hand.<br />

The company continued in 2008 to expand the ground transportation portion of its freight forwarding business. Ground transportation<br />

shipments typically consist of a wide range of materials ranging from heavy-weight packages, high-value electronics, computer equipment<br />

and other similar electronic items, to heavy machinery and household goods that do not have as time-sensitive delivery requirements as<br />

the small packages sent by the Company’s express delivery system. The inland service delivers shipments at lower costs than express<br />

delivery shipments or than the air freight delivery system. The Company usually delivers its ground transportation shipments by truck<br />

and inland hauling. The Company wet-leases most of the trucks it uses for these services today. Wet-leases are leases from local trucking<br />

companies of vehicles, drivers and other personnel needed to complete the service. Leases with owner-operator drivers is the system that<br />

worked best in 2008.<br />

The company started providing such ground transportation and land freight services in 1998 through a network of trucking routes from<br />

Dubai, UAE, to each of Riyadh, Jeddah and Dammam in Saudi Arabia and Amman in Jordan. At present the company has expanded its ground<br />

transportation network in the Gulf Council Countries (GCC) by adding additional routes linking Dubai to each of Muscat (Oman), Kuwait City<br />

(Kuwait), Manama (Bahrain) and Doha (Qatar) and the rest of Saudi Arabia. This expansion included such routes as Dubai/Amman, Amman/<br />

Beirut, Istanbul/Levant, Istanbul/Saudi and Cairo/Khartoum runs. The company has also established extensions from several of these cities<br />

to surrounding areas. The company has focused on the expansion of its ground transportation network in the GCC due to its belief that such<br />

a region constitutes a number of highly under-developed markets with rising demand for “efficient” ground transportation delivery services<br />

between them. The company plans to further expand its ground transportation network in the Middle East at large and in the Gulf and Levant<br />

regions in particular, according to the increasing demands of its local and network clients.<br />

Logistics Services<br />

The company offers third-party logistics services through a network of logistics facilities located at major areas in the GCC, Middle East,<br />

North Africa and West Europe regions. Three of these centers are located at free zones in Jebel Ali in the UAE, Bahrain and Queen Alia<br />

International Airport in Jordan. The company also has several local logistics centers in Saudi Arabia, Lebanon, Jordan, Egypt, Kuwait and<br />

the USA. <strong>Aramex</strong> operates a logistics network in Europe in key locations such as Amsterdam, Manchester and Dublin.<br />

A wide range of services is offered through these centers including warehousing and its management, distribution, supply chain management,<br />

customs brokerage, order fulfillment, inventory management and value-added services. The company also offers multiple storage options<br />

that range from temperature-controlled to rack, bulk and open-yard.<br />

The logistics centers are operated using world-class warehousing systems and are monitored 24 hours a day. All shipments coming in and<br />

out of the logistics centers can be monitored and tracked on the World Wide Web through the company’s Web site (www.aramex.com).<br />

Domestic Express Delivery Services<br />

The company has developed an extensive network for the express delivery of small parcels, and has the capability to pick-up and deliver<br />

shipments from city to city in every country in which it operates, thereby satisfying customers’ local distribution and information needs.<br />

Customers of these domestic express delivery services include e-commerce-related businesses, local distributors, pharmaceutical<br />

companies and banks.<br />

VI

<strong>Annual</strong><br />

Report 2008<br />

VII<br />

Document Management Services<br />

In early 2005 <strong>Aramex</strong> acquired InfoFort, a leading document records management company in the Middle East and North Africa. InfoFort<br />

offers a full range of comprehensive information storage, management and production services including record management, off-site data<br />

protection, digital archiving, secure shredding and film & sound archives. The company has further strengthened its market positioning by<br />

acquiring the UAE-based Docman Limited in November 2006 and more recently the UAE-based Metrofile Middle East LLC, which specializes<br />

in document and records storage, scanning and management services.<br />

In April 2008 InfoFort inaugurated its 20,000 sqm facility at Jebel Ali Free Zone, in Dubai Emirate. The AED 55 million center is the regional<br />

hub for InfoFort’s network of Records Management Centers in Saudi, Egypt, Jordan, Oman, Bahrain, Kuwait and Qatar.<br />

U.S. and U.K. Mail Forwarding<br />

In 2000, the company started offering a specialized service called Shop&Ship. The service provides customers with personal mailing<br />

addresses in the U.S. and the U.K. to use for receiving correspondence as well as personal and business packages such as Internet orders,<br />

gifts, magazine subscriptions, bank statements, etc. The company forwards the mailbox contents to the customer at their local address in<br />

any of the 20 countries in which this service is available and charges shipping fees.<br />

More recently the company has expanded this shopping service to include placing orders for clients through internet shopping sites,<br />

especially sites that do not offer international shipping options.<br />

Magazines & Newspaper Distribution<br />

In November 2002, the company acquired Jordan Distribution Agency, which is the leading distributor of foreign and local publications,<br />

including mass circulation of the major newspapers in Jordan. The company has introduced the latest distribution mechanisms to the new<br />

acquisition and expanded its network in the country.<br />

Customers<br />

The company has a diverse customer base, totaling over 50,000 accounts in the year 2008, which spans a broad geographic area,<br />

concentrated mainly in the Middle East, Europe, South Asia and North America, and includes companies in a wide range of industries. Its<br />

customers, both retail and wholesale, are also diverse in terms of their service needs. The company’s customers are not concentrated in<br />

any one particular industry, but typical customers include trading companies, pharmaceutical companies, banks, service and information<br />

companies, manufacturing and regional distribution companies and express companies. The broad range of services, which the company<br />

offers, has developed in response to the growing diversity of its customers. The company’s customers are making increased use of the high<br />

value-added services provided by the company, from express services to door-to-door airfreight forwarding to customized special services.<br />

Geographic Breakdown of Revenues<br />

The company sells its services primarily to customers in the Middle East, Europe, South Asia and North America. Revenues are generally<br />

recognized at the source, i.e., by the station, which invoices the end customer. The table below shows the breakdown of revenues (in millions<br />

of Dirhams) by geographic region for 2008 and 2007.<br />

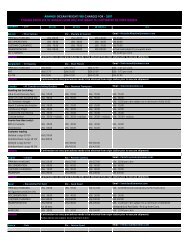

Year 2008<br />

Description International Express<br />

29%<br />

Freight Forwarding<br />

44%<br />

Domestic & Others<br />

27%<br />

Total Company<br />

100%<br />

Middle east 713.8 79.2% 638.9 59.6% 463.3 80.9% 1,816.0 71.2%<br />

Europe 61.8 7.7% 325.5 30.4% 80.1 14.0% 467.4 18.3%<br />

North America 50.3 3.0% 41.4 3.9% 1.9 0.3% 93.6 3.7%<br />

Asia & Indian Subcontinent 78.7 10.2% 65.7 6.1% 27.5 4.8% 171.9 6.7%<br />

Elimination (294.4) 0.0% (158.8) 0.0% (15.8) 0.0% (468.9) 0.0%<br />

Total 610.3 100% 912.6 100% 557.0 100% 2,080.0 100%

Year 2007<br />

Description International Express<br />

29%<br />

Freight Forwarding<br />

46%<br />

Domestic & Others<br />

25%<br />

<strong>Annual</strong><br />

Report 2008<br />

VIII<br />

Total Company<br />

100%<br />

Middle east 578.3 76.7% 537.4 56.3% 356.4 78.2% 1,472.2 68.1%<br />

Europe 65.1 9.4% 342.9 35.9% 72.6 14.0% 480.6 22.2%<br />

North America 36.7 3.1% 29.5 3.1% 2.4 3.4% 68.6 3.2%<br />

Asia & Indian Subcontinent 73.4 10.8% 45.1 4.7% 23.0 4.4% 141.6 6.5%<br />

Elimination (234.4) 0.0% (131.0) 0.0% (13.8) 0.0% (379.2)<br />

Total 519.1 100% 824.0 100% 440.7 100% 1,783.8 100%<br />

Seasonality<br />

The company’s business is seasonal in nature. Historically, the company experiences a decrease in demand for its services during the first<br />

and third quarters, the post-winter holiday and summer vacation seasons. The company traditionally experiences its highest volume in the<br />

fourth quarter due to the holiday season. The seasonality of the company’s sales may cause a variation in its quarterly operating results, and<br />

a significant decrease in second or fourth quarter revenues may have an adverse effect on the company’s results of operations for that fiscal<br />

year. However, local Middle East and Islamic holidays vary from year-to-year, as a result, the Company’s seasonality may shift over time.<br />

Results of Operations<br />

The following table sets forth -for the periods indicated- the percentages of total revenues represented by certain items reflected in the<br />

company’s consolidated statements of income:<br />

Revenues<br />

2004 2005 2006 2007 2008<br />

% % % % %<br />

International express 42.5 43.2 32.2 29.1 29.3<br />

Freight forwarding 35.4 33.1 44.8 46.2 43.9<br />

Domestic express 13.4 14.2 13.0 12.6 14.2<br />

Logistics 0.5 0.9 3.9 6.0 6.4<br />

Publications and distribution 4.3 3.9 2.5 2.0 1.7<br />

Others 3.9 4.7 3.6 4.1 4.5<br />

Total Revenues 100.0 100.0 100.0 100.0 100.0<br />

Shipping costs 54.5 52.4 54.6 53.2 50.1<br />

Gross profit 45.5 47.6 45.4 46.8 49.9<br />

Operating expenses 13.5 14.0 14.1 15.1 17.5<br />

Selling, general and administrative expenses 23.7 23.5 23.4 23.8 23.9<br />

Operating income 8.4 10.1 8.0 8.0 8.4<br />

Income before income taxes 8.4 10.4 8.3 8.4 8.7<br />

Provision for income taxes 0.5 0.5 0.3 0.5 0.5<br />

Minority interests 1.0 1.2 1.0 1.1 1.1<br />

Net Income 6.9 8.7 7.0 6.8 7.1

<strong>Annual</strong><br />

Report 2008<br />

IX<br />

Impact of Inflation and Currency Fluctuations<br />

The company does not believe that inflation or currency fluctuations have had a material adverse effect on revenues and results of<br />

operations. However, demand for the company’s services is influenced by general economic conditions, including inflation and currency<br />

fluctuations. Periods of economic recession, high inflation or devaluation of currencies -in countries in which the company operates- could<br />

have a material adverse effect on the express and freight forwarding industry and the company’s results of operations.<br />

Strategy<br />

The company’s strategy comprises of the following key elements aimed to grow <strong>Aramex</strong> into the top five global logistics and transportation<br />

service providers:<br />

Geographic Expansion through Acquisitions: Expand into key geographic areas that are main pillars in global trade through acquisitions. Such<br />

acquisitions will secure the Global Distribution Alliance, develop a more secure global network and provide <strong>Aramex</strong> with sources for growth.<br />

Globalizing the Brand through Franchising: To supplement the acquisition strategy, <strong>Aramex</strong> plans on expanding its brand by franchising in<br />

developing countries. This will provide <strong>Aramex</strong> with a revenue stream and expand the brand with minimal capital requirement.<br />

Leveraging Existing Infrastructure: To further leverage the existing regional infrastructure, <strong>Aramex</strong> plans on expanding its supply chain<br />

management and document storage services to existing <strong>Aramex</strong> locations within the Middle East and South Asia, and to continue to invest<br />

in the company’s logistics infrastructure in the region.<br />

Organic growth: The company plans to continue to capitalize on its reputation as a quality service provider offering a one-stop shop of<br />

transportation and logistics solutions. A large part of this strategy involves the continued development by the company of customized<br />

solutions for its clients in the areas of (i) Express and freight transportation solutions by air, sea and land (ii) Warehousing (iii) Value added<br />

logistics services and (iv) Supply chain solutions<br />

Continued emphasis on technology: The company continues to invest in technology to increase the efficiency of its operations, enhance<br />

the quality of service, increase sales and foster growth. The company believes that constant improvements in its communications network<br />

and information systems, such as linking all of the company’s offices via an on-line, real-time communications network, and the ability of<br />

customers to have direct connectivity to the Company’s network, will yield continued improvements in the quality and efficiency of the<br />

operational and customer service processes which in turn will improve the company’s operational results.<br />

Board of Directors<br />

The following table sets forth the names of the Company’s Directors:<br />

Name Position<br />

Mr. Abdullah Mazrui Chairman<br />

Mr. Fadi Ghandour Founder, Chief Executive Officer and Director<br />

Mr. Helal Al Merri Director<br />

Mr. Ahmad Al-Badi Director<br />

Mr. Arif Naqvi Director<br />

Sheikh Tareq Qassimi Director<br />

Mr. Ayed Aljeaid Director<br />

Mr. Mohammed Ali Al Hasimi Director

<strong>Aramex</strong> PJSC and its subsidiaries<br />

Consolidated financial statements<br />

31 December 2008<br />

<strong>Annual</strong><br />

Report 2008<br />

1

<strong>Annual</strong><br />

Report 2008<br />

2<br />

Contents Page<br />

Directors’ report 3<br />

Independent auditors’ report 4<br />

Consolidated income statement 5<br />

Consolidated balance sheet 6<br />

Consolidated statement of cash flows 7<br />

Consolidated statement of changes in equity 8 - 9<br />

Notes 10 - 38

Directors’ Report<br />

Dear Shareholders,<br />

<strong>Annual</strong><br />

Report 2008<br />

We have concluded year 2008 with a strong financial performance; <strong>Aramex</strong> revenues grew from AED 1.8 billion<br />

to AED 2.1 billion, an increase of 17% compared to year 2007. Furthermore, net profits increased by 21% over<br />

the same period, from AED 122 million to AED 147 million.<br />

We were able to maintain our revenue growth and profit margins at a very healthy level, a result of serious<br />

cost cutting measures taken to control the upward spiraling costs in the first 9 months of the year<br />

Going forward, <strong>Aramex</strong> is well positioned to deal with the challenges ahead in year 2009. We continue to<br />

maintain a very healthy balance sheet with little debt and our non-asset based business model enables us to<br />

maintain flexibility in our costs<br />

We are confident of our ability to achieve long term sustainable growth for the company despite the challenges<br />

ahead in 2009.<br />

Abdullah Al Mazroui Fadi Ghandour<br />

Chairman Founder and CEO<br />

3

<strong>Annual</strong><br />

Report 2008<br />

4<br />

Independent auditors’ report<br />

The Shareholders<br />

<strong>Aramex</strong> PJSC<br />

Report on the consolidated financial statements<br />

We have audited the accompanying consolidated financial statements of <strong>Aramex</strong> PJSC (“the Company”) and its subsidiaries (collectively<br />

referred to as «the Group»), which comprise the consolidated balance sheet as at 31 December 2008, and the consolidated income statement,<br />

the consolidated statement of changes in equity and the consolidated cash flow statement for the year then ended, and a summary of<br />

significant accounting policies and other explanatory notes.<br />

Management’s responsibility for the financial statements<br />

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with<br />

International Financial Reporting Standards. This responsibility includes designing, implementing and maintaining internal controls relevant<br />

to the preparation and fair presentation of the financial statements that are free from material misstatement, whether due to fraud or error;<br />

selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.<br />

Auditors’ responsibility<br />

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in<br />

accordance with International Standards on Auditing. Those standards require that we comply with relevant ethical requirements and plan<br />

and perform the audit to obtain reasonable assurance whether the financial statements are free of material misstatement.<br />

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The<br />

procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the financial statements,<br />

whether due to fraud or error. In making those risk assessments, we consider internal controls relevant to the entity’s preparation and fair<br />

presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the<br />

purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness<br />

of accounting principles used and reasonableness of accounting estimates made by management, as well as evaluating the overall<br />

presentation of the financial statements.<br />

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.<br />

Opinion<br />

In our opinion the consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group<br />

as at 31 December 2008, and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance<br />

with International Financial Reporting Standards and comply with the relevant Articles of the Company and the UAE Federal Law No. 8 of<br />

1984 (as amended).<br />

Report on other legal and regulatory requirements<br />

As required by the UAE Federal Law No. 8 of 1984 (as amended), we further confirm that we have obtained all information and explanations<br />

necessary for our audit, that proper financial records have been kept by the Company and the contents of the Directors’ report which relates<br />

to these consolidated financial statements are in agreement with the Company’s financial records. We are not aware of any violation of<br />

the above-mentioned Law and the Articles of Association having occurred during the year ended 31 December 2008, which may have had a<br />

material adverse effect on the business of the Company or its financial position.<br />

Vijendranath Malhotra Date: 26 February 2009<br />

(Registration: No. B48)<br />

Dubai, United Arab Emirates

<strong>Aramex</strong> PJSC and its subsidiaries<br />

Consolidated income statement<br />

for the year ended 31 December 2008<br />

Note 2008 2007<br />

AED’000 AED’000<br />

Revenue 6 2,079,954 1,783,788<br />

Cost of services 7 (1,041,971) (948,132)<br />

------------ -----------<br />

Gross profit 1,037,983 835,656<br />

Other operating expenses 8 (364,961) (268,548)<br />

Selling expenses (99,230) (79,224)<br />

General and administrative expenses 9 (398,567) (344,871)<br />

Other income (net) 10 2,787 3,566<br />

---------- ----------<br />

Result from operating activities 178,012 146,579<br />

---------- ----------<br />

Finance income 5,375 8,070<br />

Finance expense (3,442) (4,132)<br />

------- -------<br />

Net finance income 11 1,933 3,938<br />

------- -------<br />

Profit before income tax 179,945 150,517<br />

Income tax expense 12 (10,573) (9,450)<br />

---------- ----------<br />

Profit for the year 169,372 141,067<br />

====== ======<br />

Attributable to:<br />

Equity holders of the Company 147,321 121,552<br />

Minority interest 22,051 19,515<br />

---------- ----------<br />

Profit for the year 169,372 141,067<br />

====== ======<br />

Basic earnings per share (AED) 30 0.122 0.100<br />

==== ====<br />

The notes on pages 10 to 38 are an integral part of these consolidated financial statements.<br />

The independent auditors’ report is set out on page 4<br />

<strong>Annual</strong><br />

Report 2008<br />

5

<strong>Annual</strong><br />

Report 2008<br />

6<br />

Consolidated balance sheet<br />

as at 31 December 2008<br />

Note 2008 2007<br />

AED’000 AED’000<br />

Assets<br />

Property, plant and equipment 13 240,367 192,986<br />

Goodwill 14 805,443 803,399<br />

Other intangible assets 15 2,776 3,493<br />

Available for sale investments 16 3,301 17,040<br />

Other non-current assets 17 4,350 1,496<br />

Deferred tax assets 12 964 2,428<br />

--------- ---------<br />

Total non-current assets 1,057,201 1,020,842<br />

--------- ---------<br />

Cash in hand and at bank 18 343,827 238,856<br />

Trade receivables 19 346,270 319,152<br />

Other current assets 20 98,009 95,985<br />

--------- ---------<br />

Total current assets 788,106 653,993<br />

--------- ---------<br />

Total assets 1,845,307 1,674,835<br />

======= =======<br />

Equity<br />

Share capital 21 1,210,000 1,100,000<br />

Statutory reserve 22(a) 25,698 13,699<br />

Fair value reserve 22(b) 581 14,320<br />

Translation reserve 22(c) (6,126) 3,694<br />

Retained earnings 23 177,386 153,464<br />

------------ ------------<br />

Total equity attributable to equity holders of the Company 1,407,539 1,285,177<br />

------------ ------------<br />

Minority interest 28,956 25,444<br />

--------- ---------<br />

Total equity 1,436,495 1,310,621<br />

--------- ---------<br />

Liabilities<br />

Loans and borrowings - non current 24 15,767 14,707<br />

Employees’ end of service benefits 25 52,010 39,428<br />

Deferred tax liabilities 12 597 539<br />

--------- ---------<br />

Total non-current liabilities 68,374 54,674<br />

--------- ---------<br />

Bank overdrafts 26 14,300 20,191<br />

Loans and borrowings - current 24 11,698 13,056<br />

Trade payables 27 113,175 132,093<br />

Other current liabilities 28 201,265 144,200<br />

---------- ----------<br />

Total current liabilities 340,438 309,540<br />

---------- ----------<br />

Total liabilities 408,812 364,214<br />

------------ ------------<br />

Total equity and liabilities 1,845,307 1,674,835<br />

======= =======<br />

The notes on pages 10 to 38 are an integral part of these consolidated financial statements.<br />

The Board of Directors authorized these consolidated financial statements on 25 February 2009.<br />

__________ _____ _____ __________ _____ _____ __________ _____ _____<br />

Abdullah Al Mazrui Fadi Ghandour Emad Shishtawi<br />

Chairman (Director, President & CEO) (Vice President Finance)<br />

The independent auditors’ report is set out on page 4

Consolidated statement of cash flows<br />

for the year ended 31 December 2008<br />

2008 2007<br />

AED’000 AED’000<br />

Cash flows from operating activities<br />

Profit for the year before income tax<br />

Adjustments for:<br />

179,945 150,517<br />

Depreciation 43,228 34,742<br />

Amortization of intangible assets 717 862<br />

Provision for doubtful debts (net) 9,981 6,751<br />

Provision for employees’ end of service benefits 15,747 13,289<br />

Net finance income (1,933) (3,938)<br />

Loss on sale of property, plant and equipment 853 298<br />

Profit on sale of investment (512) -<br />

---------- ----------<br />

Operating profit before working capital changes 248,026 202,521<br />

Change in trade receivables (37,098) (64,248)<br />

Change in other current assets (2,024) (17,655)<br />

Change in trade payables (18,918) 14,555<br />

Change in other current liabilities 53,643 20,515<br />

Employees’ end of service benefits paid (2,970) (5,113)<br />

Directors’ fees paid (1,400) (800)<br />

---------- ----------<br />

Cash generated by operations 239,259 149,775<br />

Income tax paid (5,631) (7,815)<br />

---------- ----------<br />

Net cash from operating activities 233,628 141,960<br />

---------- ----------<br />

Cash flows from investing activities<br />

Acquisition of property, plant and equipment (96,614) (97,828)<br />

Proceeds from sale of property, plant and equipment 1,666 786<br />

Acquisition of intangible assets - (742)<br />

Consideration paid for acquisition of GDA Singapore - (1,635)<br />

Adjustment to goodwill - (40)<br />

Acquisition of minority interest (2,044) (5,907)<br />

Proceeds from sale of available for sale investment 512 -<br />

Change in other non-current assets (2,855) 6,953<br />

Change in margin deposits (735) (1,383)<br />

Interest income received 5,375 8,070<br />

---------- ----------<br />

Net cash used in investing activities (94,695) (91,726)<br />

---------- ----------<br />

Cash flows from financing activities<br />

Interest paid (3,442) (4,132)<br />

Net movement in bank borrowings (299) 6,078<br />

Dividends paid to minority shareholders (20,035) (14,346)<br />

Amount paid to former shareholders of Two Way - (16,522)<br />

Net other movements in minority interest 1,495 1,270<br />

---------- ----------<br />

Net cash used in financing activities (22,281) (27,652)<br />

---------- ----------<br />

Net increase in cash and cash equivalents 116,652 22,582<br />

Cash and cash equivalents at beginning of the year 212,602 190,447<br />

Effect of exchange rate changes on cash held (6,526) (427)<br />

---------- ----------<br />

Cash and cash equivalents at end of the year (note 18) 322,728 212,602<br />

====== ======<br />

The notes on pages 10 to 38 are an integral part of these consolidated financial statements.<br />

The independent auditors’ report is set out on page 4<br />

<strong>Annual</strong><br />

Report 2008<br />

7

<strong>Annual</strong><br />

Report 2008<br />

8<br />

Consolidated statement of changes in equity<br />

for the year ended 31 December 2008<br />

Attributable to the equity holders of the Company<br />

Share capital Translation Statutory Fair value Retained Minority Total<br />

Number Amount reserve reserve reserve earnings Total interest equity<br />

AED’000 AED’000 AED’000 AED’000 AED’000 AED’000 AED’000<br />

Balance at 1 January 2007 1,000,000,000 1,000,000 1,785 1,978 - 144,433 1,148,196 19,287 1,167,483<br />

----------------- ------------ -------- ------- -------- ---------- ------------ -------- ------------<br />

Directors’ fees paid (refer note 23 (b)) - - - - - (800) (800) - (800)<br />

Translation adjustment - - 1,909 - - - 1,909 (147) 1,762<br />

Net change in fair value of available<br />

for sale investments (refer note 16) - - - - 14,320 - 14,320 - 14,320<br />

----------------- ------------ ------- ------- -------- ---------- --------- --------- ---------<br />

Total income and expense recognized - - 1,909 - 14,320 (800) 15,429 (147) 15,282<br />

directly in equity<br />

Profit for the year - - - - - 121,552 121,552 19,515 141,067<br />

----------------- ------------ ------- ------- -------- ---------- ---------- --------- ----------<br />

Total recognized income and expense - - 1,909 - 14,320 120,752 136,981 19,368 156,349<br />

Bonus shares issued (refer note 21) 100,000,000 100,000 - - - (100,000) - - -<br />

Transfer to statutory reserve - - - 11,721 - (11,721) - - -<br />

Acquisition of minority interest - - - - - - - (282) (282)<br />

(refer note 5)<br />

Dividends paid during the year - - - - - - - (14,346) (14,346)<br />

Net other movements during the year - - - - - - - 1,417 1,417<br />

----------------- ------------ ------- -------- -------- ---------- ------------ --------- ------------<br />

Balance at 31 December 2007 1,100,000,000 1,100,000 3,694 13,699 14,320 153,464 1,285,177 25,444 1,310,621<br />

========== ======= ==== ===== ===== ====== ======= ===== =======

Consolidated statement of changes in equity<br />

for the year ended 31 December 2008<br />

Attributable to the equity holders of the Company<br />

Share capital Translation Statutory Fair value Retained Minority Total<br />

Number Amount reserve reserve reserve earnings Total interest equity<br />

AED’000 AED’000 AED’000 AED’000 AED’000 AED’000 AED’000<br />

Balance at 1 January 2008 1,100,000,000 1,100,000 3,694 13,699 14,320 153,464 1,285,177 25,444 1,310,621<br />

----------------- ------------ ------- ------- -------- ---------- ------------ --------- ------------<br />

Directors’ fees paid (refer note 23 (b)) - - - - - (1,400) (1,400) - (1,400)<br />

Translation adjustment - - (9,820) - - - (9,820) 168 (9,652)<br />

Adjustment on sale of available<br />

for sale investments (refer note 16) - - - - (665) - (665) - (665)<br />

Net change in fair value of available<br />

for sale investments (refer note 16) - - - - (13,074) - (13,074) - (13,074)<br />

----------------- ------------ -------- ------- -------- ---------- ---------- ---- -----------<br />

Total income and expense recognized - - (9,820) - (13,739) (1,400) (24,959) 168 (24,197)<br />

directly in equity<br />

Profit for the year - - - - - 147,321 147,321 22,051 169,372<br />

----------------- ------------ -------- ------- -------- ---------- ---------- --------- ----------<br />

Total recognized income and expense - - (9,820) - (13,739) 145,921 122,362 22,219 144,581<br />

Bonus shares issued (refer note 21) 110,000,000 110,000 - - - (110,000) - - -<br />

Transfer to statutory reserve - - - 11,999 - (11,999) - - -<br />

Acquisition of minority interest - - - - - - - (144) (144)<br />

(refer note 5)<br />

Dividends paid during the year - - - - - - - (20,035) (20,035)<br />

Net other movements during the year - - - - - - - 1,472 1,472<br />

----------------- ------------ -------- -------- ----- ---------- ------------ --------- -------------<br />

Balance at 31 December 2008 1,210,000,000 1,210,000 (6,126) 25,698 581 177,386 1,407,539 28,956 1,436,495<br />

========== ======= ==== ===== ===== ====== ======= ===== =======<br />

<strong>Annual</strong><br />

Report 2008<br />

In accordance with the interpretation of Article 118 of the UAE Federal Law No. 8 of 1994 by the Ministry of Economy & Commerce, directors’ fees have been treated as an appropriation<br />

of shareholders’ funds.<br />

9<br />

The notes on pages 10 to 38 are an integral part of these consolidated financial statements.

<strong>Annual</strong><br />

Report 2008<br />

10<br />

Notes<br />

(forming part of the consolidated financial statements)<br />

1- Legal status and principal activities<br />

<strong>Aramex</strong> PJSC (“the Company”) is a Public Joint Stock Company registered in the Emirate of Dubai, UAE on 15 February 2005 under UAE Federal<br />

law No 8 of 1984 (as amended). The consolidated financial statements of the Company as at 31 December 2008 comprise the Company and<br />

its subsidiaries (collectively referred to as “the Group” and individually as “Group entities”).<br />

The principal activities of the Company is to invest in the freight, express, logistics and supply chain management businesses through<br />

acquiring and owning controlling interests in companies in the Middle East and other parts of the world.<br />

The Company’s registered office is, Office No 5, Abdul Rahman Al Zaroani real estate, Plot 121-221, Dubai Airport, Deira, Dubai, United Arab Emirates.<br />

On 22 June 2005, the Company acquired 100% shareholding in <strong>Aramex</strong> International Limited (“AIL”) from <strong>Aramex</strong> Holding Limited, a related<br />

party incorporated under the laws of Bermuda.<br />

AIL provides transportation solutions including express delivery and freight forwarding services mainly to/from countries in the Middle East.<br />

For the purpose of the express business, AIL utilizes its main stations (hubs) in Dubai and London. AIL’s operations are managed through<br />

a regional office, which was registered in Jordan on 15 March 1988 under the name of AIL (“the Regional Office”) pursuant to the foreign<br />

companies law No. (58) of 1985. The operations of the Regional Office are facilitated by the hubs of the <strong>Aramex</strong> network.<br />

The Company was listed on the Dubai Financial Market on 9 July 2005.<br />

2- Basis of preparation<br />

Statement of compliance<br />

The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and the<br />

requirements of the UAE Federal law No. 8 of 1984 (as amended).<br />

Basis of measurement<br />

These consolidated financial statements have been prepared under the historical cost convention basis, except for available for sale<br />

investments and derivative financial instruments, which are measured at fair value.<br />

Functional and presentation currency<br />

These consolidated financial statements are presented in United Arab Emirates (“AED”), which is the Company’s functional currency. All<br />

financial information presented in AED has been rounded to the nearest thousand, except wherever stated otherwise.<br />

Use of estimates and judgments<br />

The preparation of financial statements requires management to make judgments, estimates and assumptions that affect the application<br />

of accounting policies and reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.<br />

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in<br />

which the estimate is revised and in any future periods affected.<br />

In particular, information about significant areas of estimation uncertainty and critical judgements in applying accounting policies that<br />

have the most significant effect on the amount recognized in the financial statements are described in note 36.<br />

3- Significant accounting policies<br />

The following accounting policies, which comply with IFRS, have been applied consistently to all periods presented in these consolidated<br />

financial statements, and have been applied consistently by Group entities.

Notes (Continued)<br />

3- Significant accounting policies (Continued)<br />

Basis of consolidation<br />

<strong>Annual</strong><br />

Report 2008<br />

Subsidiaries<br />

Subsidiaries are entities controlled by the Group. Control exists when the Group has the power to govern the financial and operating policies of an<br />

entity so as to obtain benefits from its activities. In assessing control, potential voting rights that presently are exercisable are taken into account.<br />

The financial statements of the subsidiaries are included in the consolidated financial statements from the date that control commences until<br />

the date that control ceases. Refer to note 34 for the list of significant subsidiaries included in these consolidated financial statements.<br />

Special purpose entities<br />

Special purpose entities (“SPEs”) are consolidated if, based on an evaluation of the substance of the relationship of the entity with the Group<br />

and the SPEs risks and rewards, the Group concludes that it controls the SPEs.<br />

Transactions eliminated on consolidation<br />

Intra-group balances and transactions, and any unrealized income and expenses arising from intra-group transactions, are eliminated in full<br />

in preparing the consolidated financial statements. Unrealized losses are eliminated in the same way as unrealized gains, but only to the<br />

extent that there is no evidence of impairment.<br />

Foreign currency<br />

Foreign currency transactions<br />

Transactions in foreign currencies are translated to the respective functional currencies of the Group entities at exchange rates ruling at the<br />

dates of the transactions. Monetary assets and liabilities denominated in foreign currencies at the reporting date are retranslated to the<br />

respective functional currencies at the exchange rate at that date. Non-monetary assets and liabilities denominated in foreign currencies,<br />

which are stated at historical cost, are translated to the functional currency at the exchange rate ruling on the date of the transaction.<br />

Realized and unrealized exchange gains and losses are accounted for in the income statement.<br />

Foreign operations<br />

The financial statements of foreign subsidiaries where the local currency is their functional currency (substantially all stations) are translated<br />

into AED using exchange rates in effect at the reporting date for assets and liabilities and average exchange rates during the reporting<br />

period for results of operations. Adjustments resulting from translation of financial statements are reflected as a separate component of<br />

shareholders’ equity.<br />

Exchange gains and losses resulting from transactions of the Group which are made in currencies different from their own are included in the<br />

income statement as they occur. The revenue and expenses of foreign operations in hyperinflationary economies are translated to AED at<br />

the exchange rates ruling at the balance sheet date. Prior to translating the financial statements of foreign operations in hyperinflationary<br />

economies, the financial statements are restated to account for changes in the general purchasing power of the local currency.<br />

Foreign exchange gains and losses arising from a monetary item receivable from or payable to a foreign operation, the settlement of which<br />

is neither planned nor likely in the foreseeable future, are considered to form part of the net investment in a foreign operation and are<br />

recognised directly in equity.<br />

Revenue<br />

Revenue represents the value of services rendered to customers and is stated net of discounts and sales taxes or similar levies.<br />

Revenue recognition<br />

Express revenue is recognized upon receipt of shipment from the customer.<br />

Freight forwarding revenue is recognized upon the delivery of freight to the destination or to the air carrier.<br />

Catalogue shopping and shop ‘n’ ship services revenue is recognized upon the receipt of the merchandise by the customers.<br />

Revenue from magazines and newspapers distribution is recognized when it is delivered to the customers.<br />

Revenue from logistics and document storage services is recognized when the services are rendered.<br />

Cash and cash equivalents<br />

Cash and cash equivalents comprises cash balances, short term deposits, call deposits and current account with banks. For the purpose<br />

of the consolidated statement of cash flows, bank overdrafts that are repayable on demand and form an integral part of the Group’s cash<br />

management are included as a component of cash and cash equivalents. Restricted cash primarily represented by margin deposits are not<br />

included within cash and cash equivalents.<br />

11

<strong>Annual</strong><br />

Report 2008<br />

12<br />

Notes (Continued)<br />

3- Significant accounting policies (Continued)<br />

Property, plant and equipment<br />

Recognition and measurement<br />

Items of property, plant and equipment are measured at cost less accumulated depreciation and accumulated impairment losses (see accounting<br />

policy on impairment), if any. Cost includes expenditures that are directly attributable to the acquisition of the asset. The cost of self constructed<br />

assets includes cost of material and direct labour, any other costs directly attributable to bringing the asset to a working condition for its<br />

intended use, and the costs of dismantling and removing the items and restoring the site on which they are located. Purchased software that<br />

is integral to the functionality of the related equipment is capitalized as part of that equipment. When parts of an item of property, plant and<br />

equipment have different useful lives, they are accounted for as separate items (major components) of property, plant and equipment.<br />

Subsequent costs<br />

The cost of replacing part of an item of property, plant and equipment is recognised in the carrying amount of the item if it is probable that<br />

future economic benefits embodied within the part will flow to the Group and its cost can be measured reliably. The cost of the day to day<br />

servicing of property, plant and equipment are recognised in the income statement as incurred.<br />

Depreciation<br />

Depreciation is charged in the income statement on a straight-line basis over the estimated useful lives of each part of an item of property,<br />

plant and equipment. Leased assets are depreciated over the shorter of the lease terms or their useful lives. Land is not depreciated.<br />

The estimated useful lives for the current and comparative periods are as follows:<br />

Leasehold improvements<br />

Life (years)<br />

4-7<br />

Building 14-15<br />

Furniture and fixtures 5-10<br />

Office equipment 3-7<br />

Computers 3-5<br />

Vehicles 4-5<br />

The depreciation methods, useful lives and residual values are reassessed at the reporting date.<br />

Intangible assets<br />

Goodwill<br />

Goodwill (including negative goodwill) arises on acquisition of subsidiaries, associates and joint ventures.<br />

On acquisition of subsidiaries, goodwill represents the excess of the cost of the acquisition over the Group’s interest in the net fair value<br />

of the identifiable assets, liabilities and contingent liabilities of the acquiree at the date of acquisition. Negative goodwill arising on an<br />

acquisition is recognized immediately in the income statement.<br />

Cost of acquisition also includes contingent consideration. A liability is recognised for contingent consideration as soon as the payment<br />

becomes probable and the amount can be measured reliably. The purchase price is subsequently adjusted against goodwill or negative<br />

goodwill if the estimate of the amount payable is revised.<br />

Goodwill arising on the acquisition of minority interest in a subsidiary represents the excess of the cost of the additional investment over<br />

the carrying amount of net assets acquired at the date of exchange.<br />

Subsequent to the initial measurement, goodwill is measured at cost less accumulated impairment losses.<br />

Other intangible assets<br />

Intangible assets, other than goodwill, that are acquired by the Group and which have finite useful lives, are stated at cost less accumulated<br />

amortization and accumulated impairment losses, if any. Amortisation is recognized in the income statement on a straight line basis over<br />

the estimated useful lives of intangible assets. The estimated useful life of the other intangible assets is between 3 to 10 years.<br />

Prepaid agency fees<br />

Amounts paid in advance to agents to purchase or alter their agency rights are accounted for as prepayments. As these amounts are paid in lieu of<br />

annual payments they are expensed to the income statement over the period equivalent to the number of years of agency fees paid in advance.

Notes (Continued)<br />

3- Significant accounting policies (Continued)<br />

Financial instruments<br />

<strong>Annual</strong><br />

Report 2008<br />

Non-derivative financial instruments<br />

Non-derivative financial instruments comprise available for sale investments, trade receivables, other receivables, cash in hand and at bank,<br />

trade payables, current and non-current liabilities and loans and borrowings from banks.<br />

Non-derivative financial instruments are recognized initially at fair value plus for instruments not at fair value through profit or loss any directly<br />

attributable transaction costs. Subsequent to initial recognition non-derivative financial instruments are measured as described below.<br />

A financial instrument is recognized if the Group becomes a party to the contractual provisions of the instrument. Financial assets are<br />

derecognized if the Group’s contractual rights to the cash flows from the financial assets expire or if the Group transfers the financial asset<br />

to another party without retaining control or substantially all risks and rewards of the asset. Regular way purchases and sales of financial<br />

assets are accounted for at trade date, i.e., the date that the Group commits itself to purchase or sell the asset. Financial liabilities are<br />

derecognized if the Group’s obligations specified in the contract expire or are discharged or cancelled.<br />

Available for sale financial assets<br />

The Group’s investments in certain equity securities are classified as available for sale financial assets. Subsequent to initial recognition,<br />

they are measured at fair value and changes therein, other than impairment losses and foreign exchange gains and losses on available<br />

for sale monetary items, are recognised directly in equity. When an investment is derecognized, the cumulative gain or loss in equity is<br />

transferred to the income statement.<br />

Other<br />

Other non derivative financial assets are measured at amortized cost using the effective interest method less any impairment losses.<br />

Derivative financial instruments<br />

The Group holds derivative financial instruments to hedge its foreign currency risk exposures. Embedded derivatives are separated from the<br />

host contract and accounted for separately if the economic characteristics and risks of the host contract and the embedded derivative are<br />

not closely related, a separate instrument with the same terms as the embedded derivative would meet the definition of a derivative, and<br />

the combined instrument is not measured at fair value through profit or loss.<br />

Derivatives are recognised initially at fair value; attributable transaction costs are recognised in profit or loss when incurred. Subsequent to<br />

initial recognition, derivatives are measured at fair value, and changes therein are accounted for as described below.<br />

Economic hedges<br />

Hedge accounting is not applied to derivative instruments that economically hedge monetary assets and liabilities denominated in<br />

foreign currencies. Changes in the fair value of such derivatives are recognised in the income statement as part of foreign currency gains<br />

and losses.<br />

Impairment<br />

Financial assets<br />

A financial asset is considered to be impaired if objective evidence indicates that one or more events have had a negative effect on the<br />

estimated future cash flows of that asset.<br />

An impairment loss in respect of a financial asset measured at amortized cost is calculated as the difference between its carrying amount,<br />

and the present value of the estimated future cash flows discounted at the original effective interest rate. Individually significant financial<br />

assets are tested for impairment on an individual basis. The remaining financial assets are assessed collectively in groups that share similar<br />

credit risk characteristics. All impairment losses are recognized in the income statement. An impairment loss is reversed if the reversal can<br />

be related objectively to an event occurring after the impairment loss was recognized.<br />

Non-financial assets<br />

The carrying amounts of the Group’s non-financial assets, are reviewed at each reporting date to determine whether there is any indication<br />

of impairment. If any such indication exists then the asset’s recoverable amount is estimated. For goodwill and intangible assets that have<br />

indefinite useful lives or that are not yet available for use, recoverable amount is estimated at each reporting date. An impairment loss is<br />

recognized if the carrying amount of an asset or its cash generating unit exceeds its recoverable amount. Impairment losses are recognized<br />

in the income statement.<br />

13

<strong>Annual</strong><br />

Report 2008<br />

14<br />

Notes (Continued)<br />

3- Significant accounting policies (Continued)<br />

Financial instruments (Continued)<br />

The recoverable amount of an asset or its cash generating unit is the greater of its value in use and its fair value less costs to sell. In<br />

assessing value in use, the estimated future cash flows are discounted to their present value using a pre tax discount rate that reflects<br />

current market assessments of time value of money and risks specific to the asset. For the purpose of impairment testing, assets are<br />

grouped together into the smallest group of assets that generates cash inflows from continuing use that are largely independent of the cash<br />

inflows of other assets or groups of assets (the “cash-generating unit”). The goodwill acquired in a business combination, for the purpose of<br />

impairment testing, is allocated to cash-generating units that are expected to benefit from the synergies of the combination.<br />

An impairment loss in respect of goodwill is not reversed. In respect of other assets, impairment losses recognised in prior periods are<br />

assessed at each reporting date for any indications that the loss has decreased or no longer exists. An impairment loss is reversed if there<br />

has been a change in the estimates used to determine the recoverable amount. An impairment loss is reversed only to the extent that the<br />

asset’s carrying amount does not exceed the carrying amount that would have been determined, net of depreciation or amortisation, if no<br />

impairment loss had been recognised.<br />

Provisions<br />

A provision is recognized if, as a result of a past event, the Group has a present legal or constructive obligation that can be estimated<br />

reliably, and it is probable that an outflow of economic benefits will be required to settle the obligation.<br />

Employees’ end of service benefits<br />

The provision for employees’ end of service benefits, disclosed as a long-term liability, is calculated in accordance with the UAE Federal<br />

Labour Law. Some of the Company’s subsidiaries are also required, by their respective labour laws, to provide indemnity payments upon<br />

termination of relationship with their employees. The benefit accrues to employees on a pro-rata basis during their employment period and<br />

is based on each employee’s current salary.<br />

Leases<br />

Finance leases<br />

Leases in terms of which the Group assumes substantially all the risks and rewards of ownership are classified as finance leases. Upon<br />

initial recognition the leased asset is measured at an amount equal to the lower of its fair value and the present value of the minimum lease<br />

payments. Subsequent to initial recognition, the asset is accounted for in accordance with the accounting policy applicable to that asset.<br />

Operating leases<br />

Payments made under operating lease are recognized in the income statement on a straight-line basis over the terms of the lease. Lease<br />

incentives received are recognized in the income statement as an integral part of the total lease expense, over the term of the lease. The<br />

Group leases land, office premises, warehouses and transportation equipment under various operating leases, some of which are renewable<br />

annually.<br />

Finance income and expenses<br />

Finance income comprises interest income on funds invested. Interest income is recognized as it accrues, using the effective interest rate method.<br />

Finance expense comprises interest expense on borrowings. All borrowing costs are recognized in the income statement using the effective<br />

interest rate method. However, borrowing costs that are directly attributable to the acquisition or construction of property, plant and<br />

equipment are capitalized as part of the cost of that asset. Capitalization of borrowing costs ceases when substantially all the activities<br />

necessary to prepare the asset for its intended use or sale are complete.<br />

Income taxes<br />

The Group provides for income taxes in accordance with IAS 12. As the Company is incorporated in the UAE, profits from operations of the Company<br />

are not subject to taxation. However, certain subsidiaries of the Company are based in taxable jurisdictions and are therefore liable to tax. Income<br />