Environmental Services Stock Index_Q1 2012_vFINAL - Lincoln ...

Environmental Services Stock Index_Q1 2012_vFINAL - Lincoln ...

Environmental Services Stock Index_Q1 2012_vFINAL - Lincoln ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

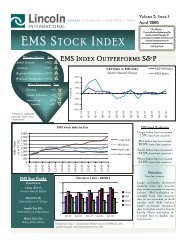

LI <strong>Environmental</strong> <strong>Services</strong> <strong>Stock</strong> <strong>Index</strong> Rises 11.0% in <strong>Q1</strong>; M&A Activity Remains Stable<br />

Qtr-over-Qtr Performance<br />

Outperformers* Change<br />

Veolia Environement S.A. 29.0%<br />

U.S. Ecology, Inc. 20.1%<br />

RPS Group plc 15.8%<br />

Underperformers* Change<br />

Casella Waste Systems Inc. -6.7%<br />

TRC Companies Inc. -7.2%<br />

SNC-Lavalin Group Inc. -23.2%<br />

* Based on quarter-over-quarter share price<br />

performance<br />

Market Intelligence<br />

• 3/27/<strong>2012</strong>: The S.M. Stoller Corporation, a<br />

portfolio company of Capital Partners, is<br />

currently seeking environmental add-ons with<br />

revenue between $5-$50 million<br />

• 3/14/<strong>2012</strong>: Ragn-Sells, the Estonian waste<br />

management company, might supplement<br />

organic growth with acquisitions<br />

• 3/6/<strong>2012</strong>: TRC Companies has indicated that<br />

selective acquisitions to expand its<br />

environmental business are part of its growth<br />

strategy moving forward<br />

• 3/2/<strong>2012</strong>: Veolia has initiated the process of<br />

selling its U.S. solid waste activities and<br />

regulated water activities in the UK<br />

• 2/28/<strong>2012</strong>: Arcadis has a €100 million war<br />

chest for acquisitions in Asia<br />

• 2/10/<strong>2012</strong>: HEPACO, an environmental<br />

services portfolio company of Carousel<br />

Capital, is actively seeking add-ons<br />

• 2/9/<strong>2012</strong>: Allied Industries, a provider of<br />

environmental remediation services, is looking<br />

to expand its geographic footprint in the U.S.<br />

through acquisitions<br />

• 2/6/<strong>2012</strong>: URS Corporation is actively<br />

looking for acquisition targets in Canada and<br />

Australia, while Indian and Chinese<br />

companies also are of interest<br />

• 1/17/<strong>2012</strong>: Clean Harbors is seeking<br />

acquisitions to further expand its presence in<br />

emerging North American oilfields, such as<br />

the Marcellus Shale and Bakken Shale<br />

<strong>Lincoln</strong> International <strong>Environmental</strong> <strong>Services</strong> <strong>Stock</strong> <strong>Index</strong> (“LI ESSI”)<br />

<strong>Q1</strong> <strong>2012</strong><br />

The LI ESSI is a market cap-weighted composite stock index similar to the S&P 500 <strong>Index</strong>. Given the broad<br />

scope of <strong>Environmental</strong> <strong>Services</strong>, the LI ESSI is comprised of companies that generate a meaningful portion of<br />

revenue from their involvement in a variety of subsectors, including Consulting & Engineering, Recycling &<br />

Refurbishment, Remediation & Construction and Waste Collection & Disposal. A full list of the companies<br />

included in the LI ESSI can be found on the back page.<br />

200%<br />

150%<br />

100%<br />

50%<br />

10.0x<br />

8.0x<br />

6.0x<br />

8.5x<br />

<strong>Stock</strong> <strong>Index</strong> Change<br />

Enterprise Value (1) / LTM EBITDA Multiples<br />

Source: Capital IQ as of 3/30/<strong>2012</strong><br />

(1) Enterprise Value is calculated as market capitalization plus total net debt, preferred equity and minority interest<br />

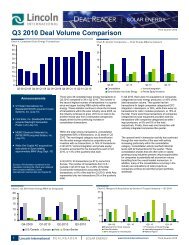

<strong>Environmental</strong> <strong>Services</strong> M&A Activity<br />

Global deal volume in the <strong>Environmental</strong> <strong>Services</strong> space remained relatively stable over the previous several<br />

quarters. A list of select M&A transactions from <strong>Q1</strong> <strong>2012</strong> can be found on the back page.<br />

100<br />

75<br />

50<br />

25<br />

0<br />

1 <strong>Lincoln</strong> International M a r k e t U p d a t e <strong>Environmental</strong> <strong>Services</strong> © <strong>2012</strong> <strong>Lincoln</strong> International LLC<br />

<strong>Q1</strong> <strong>2012</strong><br />

8.7x<br />

9.3x<br />

9.0x<br />

Q2-2010 Q3-2010 Q4-2010 <strong>Q1</strong>-2011 Q2-2011 Q3-2011 Q4-2011 <strong>Q1</strong>-<strong>2012</strong><br />

47<br />

Source: Capital IQ as of 3/30/<strong>2012</strong><br />

LI <strong>Environmental</strong> <strong>Services</strong> <strong>Stock</strong> <strong>Index</strong><br />

S&P 500 <strong>Index</strong><br />

0%<br />

Q2-2010 Q3-2010 Q4-2010 <strong>Q1</strong>-2011 Q2-2011 Q3-2011 Q4-2011 <strong>Q1</strong>-<strong>2012</strong><br />

67<br />

72<br />

61<br />

Note: Represents closed M&A transactions for targets classified under relevant SIC codes and through tracking an industry watch list<br />

8.4x<br />

Quarterly M&A Activity<br />

7.9x<br />

Qtr-over-Qtr<br />

11.0%<br />

12.0%<br />

8.0x<br />

27.7%<br />

36.7%<br />

8.5x<br />

56 57 57 54<br />

Q2-2010 Q3-2010 Q4-2010 <strong>Q1</strong>-2011 Q2-2011 Q3-2011 Q4-2011 <strong>Q1</strong>-<strong>2012</strong><br />

YTD

LI <strong>Environmental</strong> <strong>Services</strong> <strong>Stock</strong> <strong>Index</strong> Data ($ in millions, except per share data)<br />

Current 52-Wk Market Enterprise Diluted LTM EV / LTM LTM Growth EBITDA Net Debt/<br />

Price High Cap Value EPS Rev Rev EBITDA EBIT Rev EBITDA Margin EBITDA<br />

AECOM Technology Corporation $ 22.37 $ 28.90 $ 2,620 $ 3,412 $ 2.28 $ 8,130 0.4x 7.3x 9.1x 16% 9% 5.8% 1.6x<br />

AMEC plc 17.54 19.31 5,742 4,919 0.98 5,164 1.0x 10.6x 12.7x 11% 11% 9.0% (1.8x)<br />

Arcadis NV 20.47 22.93 1,419 1,763 1.53 2,638 0.7x 7.9x 9.7x 1% 1% 8.5% 1.5x<br />

Casella Waste Systems Inc. 6.23 7.24 168 643 (0.93) 481 1.3x 7.7x 25.0x 3% (12% ) 17.4% 5.7x<br />

Clean Harbors, Inc. 67.33 71.63 3,583 3,861 2.39 1,984 1.9x 11.3x 17.6x 15% 12% 17.2% 0.8x<br />

Progressive Waste Solutions Ltd. 21.85 25.29 2,561 3,898 (1.63) 1,840 2.1x 7.2x 13.8x 29% 33% 29.6% 2.4x<br />

Republic <strong>Services</strong>, Inc. 30.56 33.10 11,309 18,167 1.56 8,193 2.2x 7.3x 11.5x 1% (1% ) 30.5% 2.7x<br />

RPS Group plc 3.75 4.07 801 838 0.21 717 1.2x 8.6x 12.4x 15% 6% 13.6% 0.4x<br />

SNC-Lavalin Group Inc. 40.26 60.47 6,085 7,049 2.48 7,191 1.0x 9.6x 11.8x 27% (6% ) 10.2% 1.3x<br />

Stericycle, Inc. 83.64 95.71 7,089 8,480 2.69 1,676 5.1x 16.7x 19.1x 16% 14% 30.4% 2.7x<br />

Suez Environnement Company SA 15.02 20.56 7,616 20,139 0.78 19,394 1.0x 7.3x 14.4x 7% 4% 14.2% 3.7x<br />

Tetra Tech Inc. 26.36 26.49 1,664 1,696 1.43 1,879 0.9x 8.3x 11.4x 23% 23% 10.9% 0.2x<br />

TRC Companies Inc. 6.11 9.01 170 165 0.33 275 0.6x 7.8x 10.2x 16% nmf 7.7% (0.2x)<br />

URS Corporation 42.52 47.16 3,385 3,855 (6.03) 9,545 0.4x 6.2x 8.1x 4% (2% ) 6.5% 0.6x<br />

US Ecology, Inc. 21.74 21.77 398 435 1.01 155 2.8x 8.9x 13.4x 48% 52% 31.6% 0.7x<br />

Veolia Environnement S.A. 16.25 29.79 8,211 31,415 (1.28) 38,772 0.8x 7.5x 16.5x 3% (0% ) 10.8% 4.7x<br />

Waste Connections Inc. 32.53 35.95 4,009 5,201 1.45 1,505 3.5x 10.7x 16.2x 14% 15% 32.4% 2.4x<br />

Waste Management, Inc. 34.96 39.69 16,175 26,067 2.04 13,378 1.9x 7.9x 12.5x 7% 2% 24.7% 2.9x<br />

Mean 1.6x 8.8x 13.6x 14% 10% 17.3% 1.8x<br />

Median 1.1x 7.9x 12.6x 14% 6% 13.9% 1.5x<br />

Adjusted Mean (excludes highest and lowest value) 1.5x 8.5x 13.3x 13% 8% 17.1% 1.8x<br />

Source: Capital IQ as of 3/30/<strong>2012</strong><br />

Select M&A Transactions ($ in millions)<br />

Enterprise EV / LTM<br />

Closed Target Target Description Acquirer Value Rev. EBITDA<br />

Announced Gall Thomson <strong>Environmental</strong> Ltd. Anti-pollution and safety components for the oil and gas industry Phoenix Equity Partners $119 3.9x 7.4x<br />

Announced Thermo Fluids, Inc. Provides non-hazardous waste management services Heckmann Corporation $245 1.8x 7.9x<br />

Announced Utilities, Inc. Provider of water and wastewater utility services Corix Utilities, Inc. - - -<br />

Mar-12 Diversified Well Logging, LLC Mud logging services to the onshore and offshore oil and gas industry Rock Hill Capital Group, LLC - - -<br />

Mar-12 WCA Waste Corporation Non-hazardous solid waste collection and processing services Macquarie Infrastructure Partners $804 3.1x 13.9x<br />

Mar-12 National Response Corporation <strong>Environmental</strong>, industrial and emergency response services J.F. Lehman & Company $97 - -<br />

Mar-12 First Tee Transport, LLC Solid waste transportation services Custom Ecology, Inc. - - -<br />

Mar-12 C&V Portable Accommodations Ltd. Provides oilfield and portable accommodation services Signal Hill Equity Partners Inc. - - -<br />

Mar-12 Central NDT Provider of inspection services to the oil and gas pipeline industry Applied Consultants - - -<br />

Mar-12 ATC Group <strong>Services</strong> Inc. <strong>Environmental</strong> management, engineering and testing services Cardno Limited $106 0.6x 6.6x<br />

Feb-12 Asset Recovery Corp. Provider of e-recycling solutions for electronic equipment Arrow Electronics, Inc. - - -<br />

Feb-12 Reliable <strong>Environmental</strong> Transport, Inc. Provides hazardous and non-hazardous waste transportation services Waste Management of West Seneca - - -<br />

Feb-12 ECS Refining Texas, LLC Recycler of electronic waste products ZS Fund L.P. - - -<br />

Feb-12 Stella <strong>Environmental</strong> <strong>Services</strong> Transfer station solid waste management services Aperion Management, LLC - - -<br />

Feb-12 Vinton Scrap & Metals Scrap metal recycling services OmniSource Corporation - - -<br />

Jan-12 Waste Reduction Consultants, Inc. Provider of environmental expense management services Cass Information Systems Inc. - - -<br />

Source: Capital IQ, Mergermarket, Company Filings as of 3/30/<strong>2012</strong><br />

About <strong>Lincoln</strong> International<br />

<strong>Lincoln</strong> International specializes in merger and acquisition<br />

advisory services, debt advisory services, private capital<br />

raising and restructuring advice on mid-market transactions.<br />

<strong>Lincoln</strong> International also provides fairness opinions,<br />

valuations and pension advisory services on a wide range of<br />

transaction sizes. With 12 offices (three in the Americas, two<br />

in Asia and seven in Europe) and strategic partnerships with<br />

leading institutions in China and Korea, <strong>Lincoln</strong> International<br />

has strong local knowledge and contacts in the key global<br />

economies. The firm provides clients with senior-level<br />

attention, in-depth industry expertise and integrated<br />

resources. By being focused and independent, <strong>Lincoln</strong><br />

International serves its clients without conflicts of interest.<br />

More information about <strong>Lincoln</strong> International can be obtained<br />

at www.lincolninternational.com.<br />

Contributor:<br />

Anthony Cardona, Analyst<br />

acardona@lincolninternational.com<br />

Officer Contacts<br />

NORTH AMERICA<br />

Saurin Mehta<br />

Director<br />

smehta@lincolninternational.com<br />

+1-312-580-5806<br />

<strong>Lincoln</strong> International’s Global Footprint<br />

AMSTERDAM<br />

MOSCOW<br />

Robert T. Brown<br />

Managing Director &<br />

Co-President North America<br />

rbrown@lincolninternational.com<br />

+1-312-580-8340<br />

LOS ANGELES<br />

PARIS TOKYO<br />

2 <strong>Lincoln</strong> International M a r k e t U p d a t e <strong>Environmental</strong> <strong>Services</strong> © <strong>2012</strong> <strong>Lincoln</strong> International LLC<br />

<strong>Q1</strong> <strong>2012</strong><br />

CHICAGO<br />

MUMBAI<br />

FRANKFURT<br />

NEW YORK<br />

LONDON<br />

MADRID<br />

VIENNA