The 3rd Annual Asia Forex Forum - Euromoney Conferences

The 3rd Annual Asia Forex Forum - Euromoney Conferences

The 3rd Annual Asia Forex Forum - Euromoney Conferences

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

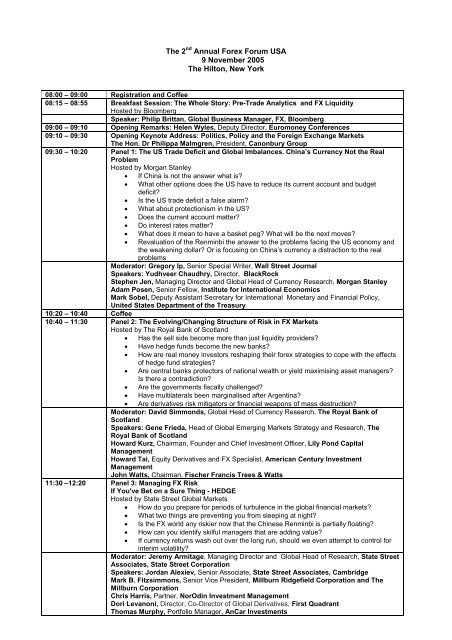

<strong>The</strong> 2 nd <strong>Annual</strong> <strong>Forex</strong> <strong>Forum</strong> USA<br />

9 November 2005<br />

<strong>The</strong> Hilton, New York<br />

08:00 – 09:00 Registration and Coffee<br />

08:15 – 08:55 Breakfast Session: <strong>The</strong> Whole Story: Pre-Trade Analytics and FX Liquidity<br />

Hosted by Bloomberg<br />

Speaker: Philip Brittan, Global Business Manager, FX, Bloomberg<br />

09:00 – 09:10 Opening Remarks: Helen Wyles, Deputy Director, <strong>Euromoney</strong> <strong>Conferences</strong><br />

09:10 – 09:30 Opening Keynote Address: Politics, Policy and the Foreign Exchange Markets<br />

<strong>The</strong> Hon. Dr Philippa Malmgren, President, Canonbury Group<br />

09:30 – 10:20 Panel 1: <strong>The</strong> US Trade Deficit and Global Imbalances. China’s Currency Not the Real<br />

Problem<br />

Hosted by Morgan Stanley<br />

• If China is not the answer what is?<br />

• What other options does the US have to reduce its current account and budget<br />

deficit?<br />

• Is the US trade deficit a false alarm?<br />

• What about protectionism in the US?<br />

• Does the current account matter?<br />

• Do interest rates matter?<br />

• What does it mean to have a basket peg? What will be the next moves?<br />

• Revaluation of the Renminbi the answer to the problems facing the US economy and<br />

the weakening dollar? Or is focusing on China’s currency a distraction to the real<br />

problems<br />

Moderator: Gregory Ip, Senior Special Writer, Wall Street Journal<br />

Speakers: Yudhveer Chaudhry, Director, BlackRock<br />

Stephen Jen, Managing Director and Global Head of Currency Research, Morgan Stanley<br />

Adam Posen, Senior Fellow, Institute for International Economics<br />

Mark Sobel, Deputy Assistant Secretary for International Monetary and Financial Policy,<br />

United States Department of the Treasury<br />

10:20 – 10:40 Coffee<br />

10:40 – 11:30 Panel 2: <strong>The</strong> Evolving/Changing Structure of Risk in FX Markets<br />

Hosted by <strong>The</strong> Royal Bank of Scotland<br />

• Has the sell side become more than just liquidity providers?<br />

• Have hedge funds become the new banks?<br />

• How are real money investors reshaping their forex strategies to cope with the effects<br />

of hedge fund strategies?<br />

• Are central banks protectors of national wealth or yield maximising asset managers?<br />

Is there a contradiction?<br />

• Are the governments fiscally challenged?<br />

• Have multilaterals been marginalised after Argentina?<br />

• Are derivatives risk mitigators or financial weapons of mass destruction?<br />

Moderator: David Simmonds, Global Head of Currency Research, <strong>The</strong> Royal Bank of<br />

Scotland<br />

Speakers: Gene Frieda, Head of Global Emerging Markets Strategy and Research, <strong>The</strong><br />

Royal Bank of Scotland<br />

Howard Kurz, Chairman, Founder and Chief Investment Officer, Lily Pond Capital<br />

Management<br />

Howard Tai, Equity Derivatives and FX Specialist, American Century Investment<br />

Management<br />

John Watts, Chairman, Fischer Francis Trees & Watts<br />

11:30 –12:20 Panel 3: Managing FX Risk<br />

If You've Bet on a Sure Thing - HEDGE<br />

Hosted by State Street Global Markets<br />

• How do you prepare for periods of turbulence in the global financial markets?<br />

• What two things are preventing you from sleeping at night?<br />

• Is the FX world any riskier now that the Chinese Renminbi is partially floating?<br />

• How can you identify skilful managers that are adding value?<br />

• If currency returns wash out over the long run, should we even attempt to control for<br />

interim volatility?<br />

Moderator: Jeremy Armitage, Managing Director and Global Head of Research, State Street<br />

Associates, State Street Corporation<br />

Speakers: Jordan Alexiev, Senior Associate, State Street Associates, Cambridge<br />

Mark B. Fitzsimmons, Senior Vice President, Millburn Ridgefield Corporation and <strong>The</strong><br />

Millburn Corporation<br />

Chris Harris, Partner, NorOdin Investment Management<br />

Dori Levanoni, Director, Co-Director of Global Derivatives, First Quadrant<br />

Thomas Murphy, Portfolio Manager, AnCar Investments

12:20 – 14:00 Lunch<br />

14:00 – 14:50 Panel 4: Emerging Markets as a Source of Alpha<br />

Hosted by Bank of America<br />

• Global liquidity, commodity prices and prospects for total return in emerging markets<br />

• How will BRICs (Brazil, Russia, India, and China) re-shape the world economy and<br />

financial markets<br />

• Evolution of different currency regimes<br />

• How will the move to flexibility in the Renminbi impact volatility and will <strong>Asia</strong> become a<br />

Renminbi bloc?<br />

• Prospects for further EU convergence<br />

• Options and derivatives as a source of alpha<br />

• Liquidity<br />

• Hot picks, favourite currencies and why<br />

Moderator: Lawrence Goodman, Managing Director, Global Head of Emerging Markets<br />

Currency Strategy, Bank of America<br />

Speakers: James Barrineau, Senior Vice President, Alliance Capital<br />

Joseph Portera, Jr. Managing Director, and Global Sovereign Manager, MacKay Shields<br />

LLC<br />

Matias Silvani, Vice President and Senior Economist, JPMorgan Asset Management<br />

Peter Willett, Senior Currency Portfolio Manager, State Street Global Advisors<br />

14:50 – 15:40 Panel 5: Making Money in FX<br />

Hosted by Goldman Sachs<br />

• Do technicals work in making money in FX?<br />

• Do fundamentals correlate to FX movements?<br />

• Will FX markets continue to distinguish between G20 and other markets?<br />

• What correlations matter most to FX markets? Rates? Equities Commodities?<br />

Inflation?<br />

Moderator: Paul Young, Managing Director, Head of Foreign Exchange Strategy, Goldman<br />

Sachs<br />

Speakers: Felix Adam, Founder and Chairman, ACT Currency Partner<br />

Ron DiRusso, Portfolio Manager, Hyman Beck & Co<br />

Michael Huttman, Chief Investment Officer, Millennium Global Investments<br />

Arun Muralidhar, Chairman, Mcube Investment Technologies and Managing Director, FX<br />

Concepts<br />

Robert Savage, Managing Director, Foreign Exchange, Goldman Sachs<br />

Howard Spector, FX Strategist, Tudor Investment Corp<br />

15:40 – 16:00 Coffee<br />

16:00 – 16:50 Panel 6: Commodities and Currencies: Diversifying Risk Across Markets<br />

Hosted by JPMorgan<br />

• Are commodity and currency markets merging in the new era of rising inflation?<br />

• Where are the next big risks for oil, and which way are they biased?<br />

• How has the relation between energy prices and growth changed since the 1970s and<br />

1980s shocks?<br />

• How should we analyze pass-through from oil prices to FX?<br />

• Will gold turn into the "currency" of choice in the post-Greenspan era?<br />

Moderator: Rebecca Patterson Vice President and Senior Global Currency Strategist,<br />

JPMorgan<br />

Speakers: Adnan Akant, Managing Director and Head of FX, Fischer Francis Trees & Watts<br />

Dennis Gartman, Editor, <strong>The</strong> Gartman Letter<br />

Katherine Spector, Vice President and Global Head of Energy Strategy, JPMorgan<br />

Maxime Tessier, Vice President, Currency Management, TAL Asset Management<br />

16:50 – 17:15 Head to Head Debate: Safe as Houses: Can US Consumers Continue to Bribe the World<br />

Economy? A Debate as to Whether the Housing Lead US Consumer Boom will End in a<br />

Hard or Soft Landing.<br />

Moderator: Dennis Gartman, Editor, <strong>The</strong> Gartman Letter<br />

Speakers: Adam Posen, Senior Fellow, Institute for International Economics<br />

John R. Taylor, Jr, Chairman & CEO, FX Concepts<br />

17:15 – 17:20 Closing Remarks: Helen Wyles, Deputy Director, <strong>Euromoney</strong> <strong>Conferences</strong><br />

NB: <strong>Euromoney</strong> <strong>Conferences</strong> reserve the right to amend the program and is not responsible for cancellations due to unforeseen<br />

circumstances. <strong>Euromoney</strong> <strong>Conferences</strong> accepts no responsibility for statements made orally or in written material distributed by<br />

any of its speakers at its conferences. In addition, <strong>Euromoney</strong> <strong>Conferences</strong> are not responsible for any copying, republication or<br />

redistribution of such statements.