Download PDF agenda - Euromoney Conferences

Download PDF agenda - Euromoney Conferences

Download PDF agenda - Euromoney Conferences

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

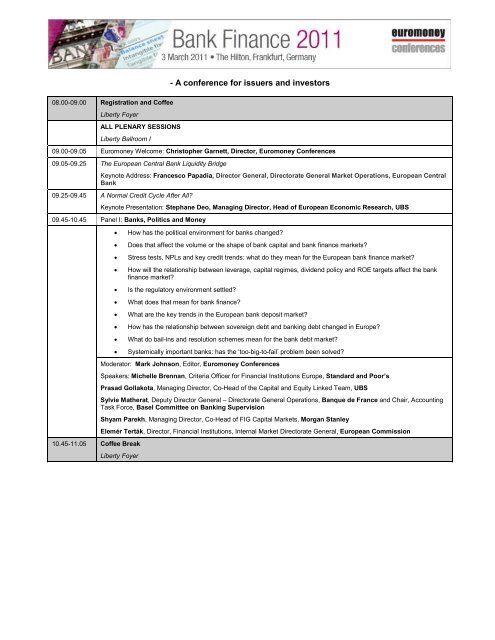

08.00-09.00 Registration and Coffee<br />

Liberty Foyer<br />

ALL PLENARY SESSIONS<br />

Liberty Ballroom I<br />

- A conference for issuers and investors<br />

09.00-09.05 <strong>Euromoney</strong> Welcome: Christopher Garnett, Director, <strong>Euromoney</strong> <strong>Conferences</strong><br />

09.05-09.25 The European Central Bank Liquidity Bridge<br />

Keynote Address: Francesco Papadia, Director General, Directorate General Market Operations, European Central<br />

Bank<br />

09.25-09.45 A Normal Credit Cycle After All?<br />

Keynote Presentation: Stephane Deo, Managing Director, Head of European Economic Research, UBS<br />

09.45-10.45 Panel I: Banks, Politics and Money<br />

10.45-11.05 Coffee Break<br />

• How has the political environment for banks changed?<br />

• Does that affect the volume or the shape of bank capital and bank finance markets?<br />

• Stress tests, NPLs and key credit trends: what do they mean for the European bank finance market?<br />

• How will the relationship between leverage, capital regimes, dividend policy and ROE targets affect the bank<br />

finance market?<br />

• Is the regulatory environment settled?<br />

• What does that mean for bank finance?<br />

• What are the key trends in the European bank deposit market?<br />

• How has the relationship between sovereign debt and banking debt changed in Europe?<br />

• What do bail-ins and resolution schemes mean for the bank debt market?<br />

• Systemically important banks: has the ‘too-big-to-fail’ problem been solved?<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conferences</strong><br />

Speakers: Michelle Brennan, Criteria Officer for Financial Institutions Europe, Standard and Poor’s<br />

Prasad Gollakota, Managing Director, Co-Head of the Capital and Equity Linked Team, UBS<br />

Sylvie Matherat, Deputy Director General – Directorate General Operations, Banque de France and Chair, Accounting<br />

Task Force, Basel Committee on Banking Supervision<br />

Shyam Parekh, Managing Director, Co-Head of FIG Capital Markets, Morgan Stanley<br />

Elemér Terták, Director, Financial Institutions, Internal Market Directorate General, European Commission<br />

Liberty Foyer

11.05-11.50 Workshop A<br />

Hosted by: Credit Suisse<br />

Liberty Ballroom I<br />

Contingent Capital<br />

11.55-12.40 Workshop C<br />

- A conference for issuers and investors<br />

• Summary of regulatory developments<br />

• Rabobank and Credit Suisse case studies<br />

Speakers: Sandeep Agarwal, Managing Director,<br />

Head of Financial Institutions Debt Capital Markets,<br />

Europe, Credit Suisse<br />

Khalid Krim, Head of European Hybrid Capital<br />

Structuring, Credit Suisse<br />

Chris Tuffey, Managing Director, Head of<br />

European Syndicate, Credit Suisse<br />

Hosted by: Deutsche Bank<br />

Liberty Ballroom I<br />

Managing the Regulatory Avalanche<br />

• Capital management: reconciling<br />

objectives and (re)defining stakeholders<br />

• Meeting capital requirements<br />

- capital issuance<br />

- management of deductions<br />

• Basel III capital management and pitfalls<br />

• Design of new-style capital instruments<br />

• What else to expect from regulators?<br />

Speakers: Andreas Boeger, Managing Director,<br />

Co-Head of Capital Solutions Europe & CEEMEA,<br />

Deutsche Bank<br />

Workshop B<br />

Hosted by: Morgan Stanley<br />

Liberty Ballroom II<br />

Asset-Based Funding and Capital<br />

Funding<br />

Capital<br />

• Public transactions: securitization and covered<br />

bonds<br />

• ECB, EIB secured funding facilities<br />

• Bilateral funding facilities and contingent liquidity<br />

o Common structures<br />

o Investor base and appetite<br />

• De-risking strategies and regulatory capital<br />

optimisation<br />

• Asset and portfolio sales<br />

• Good bank, bad bank<br />

• Investor base and demand<br />

Case studies<br />

Speakers: Cecile Houlot, Managing Director, Head<br />

of European Securitization and Asset Solutions, Morgan<br />

Stanley<br />

Beatriz Martin Jimenez, Managing Director, Fixed Income<br />

Division, Morgan Stanley<br />

Workshop D<br />

Hosted by: Citi<br />

Liberty Ballroom II<br />

Hybrid Tier 1, CoCos, Tier 2 and Bail-ins - do we really<br />

need all of these?<br />

• Do we need so many different capital instruments?<br />

o Hybrid Tier 1<br />

o CoCos<br />

o Tier 2<br />

o Bail-in senior<br />

• What are the different roles they might play in the<br />

capital structure?<br />

• How should the different instruments interact?<br />

• Will there be a sufficient market?<br />

• What will it mean to be a SIFI?<br />

• Isn't liquidity at least as important as capital?<br />

Speakers: Chris Lees, Managing Director, Head of<br />

European FIG DCM, Citi<br />

Simon McGeary, Managing Director, Head of European<br />

New Products, Citi

12.40-13.40 Lunch<br />

Liberty Foyer<br />

13.40-14.30 Panel II: Bank Capital<br />

- A conference for issuers and investors<br />

• How close are European banks to achieving required levels of capital?<br />

• How much more do banks need to do?<br />

• Has the Basle Committee achieved regulatory certainty?<br />

• ‘Seven percent by 2019,’: is the phase-in too slow?<br />

• The ‘Swiss Finish’: How important is the role of national capital requirements?<br />

• What is the role of regulatory capital buffers?<br />

• How important are counter-cyclical buffers?<br />

• The end of the shadow banking system: is regulatory arbitrage truly dead or set to burst out in new forms?<br />

• Contingent-capital: a solution or dead end?<br />

• Are there other forms of loss-absorption instruments available?<br />

• Will bank hybrid instruments make a comeback in 2011?<br />

• Will the subordinated market remain open for European banks?<br />

• Are rating agencies up to speed on capital instruments in the new environment?<br />

Moderator: Hélène Durand, Fixed Income Editor, EuroWeek<br />

Speakers: Sandeep Agarwal, Managing Director, Head of Financial Institutions Debt Capital Markets, Europe, Credit<br />

Suisse<br />

Norbert Dorr, Head of Capital Management and Planning, Group Treasury, Commerzbank<br />

Simon McGeary, Managing Director, Head of European New Products Group, Citi<br />

Steven Penketh, Managing Director, Barclays Treasury<br />

14.35-15.25 Panel III: Bank Funding: Is the Toolkit Half-Empty or Half-Full?<br />

• Will senior debt markets remain volatile in 2011?<br />

• What do bail-ins and resolution mean for the senior debt market?<br />

• Are covered bonds the ‘new senior debt’?<br />

• How important will the retail bid be for bank debt?<br />

• What does Solvency II mean for bank finance?<br />

• How will treasurers adapt to new bank liquidity requirements?<br />

• Have the inter-bank markets returned to normal?<br />

• Is the repo market functioning properly?<br />

• Can over-dependent banks be nursed back from addiction to the ECB liquidity window?<br />

• How will new capital constraints affect the relationship between the bank treasury and front-line operating<br />

departments?<br />

• How fast is asset-liability thinking changing within banks?<br />

• Securitisation 2.0: can the market come back?

15.25-15.45 Coffee Break<br />

- A conference for issuers and investors<br />

Moderator: Katie Llanos-Small, Deputy Fixed Income Editor, EuroWeek<br />

Speakers: John-Paul Coleman, Head of Term Funding and Capital Raising, Royal Bank of Scotland<br />

Fernando Cuesta, Head of Funding, Caja Madrid<br />

Pierre Menet, Deputy Chief Executive Officer, Société Générale SCF<br />

Mauricio Noé, Managing Director, Financial Institutions Group, Deutsche Bank<br />

Michael Wagner, Partner, Oliver Wyman<br />

Liberty Foyer<br />

15.45-16.05 Is Inflation Back?<br />

Keynote Address: Yves Mersch, Governor, Banque centrale du Luxembourg<br />

16.05-16.55 Panel IV: Investor Panel: The Appetite for Bank Securities<br />

• What are the key patterns of demand and supply in the European bank securities market?<br />

• Will volatility continue?<br />

• Do bank debt investors believe the stress tests?<br />

• Are more vigorous stress tests needed?<br />

• Is the banking system the weak point in climbing out of the European debt crisis?<br />

• How do investors view the relationship between sovereign and banking debt?<br />

• What do new loss-absorption requirements mean for the market for bank debt?<br />

• How are investors seeking pricing points in such a changed environment?<br />

• Will investors extend duration?<br />

• How important is the bank bid for bank debt?<br />

• How important is the insurance bid for bank debt?<br />

• What is the relationship between the euro bank debt market and other sectors such as the Yankee market?<br />

• Will the appetite for banking debt continue to be re-oriented towards home markets?<br />

• How important is the retail bid?<br />

• Will the market continue to become a more fragmented, two-tier market?<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conferences</strong><br />

Speakers: Christian Eckert, Head of Portfolio Management Fixed Income, Union Investment<br />

Thomas Höfer, Head of Financial Credit Europe, Deutsche Asset Management<br />

Olaf Pimper, Director, Treasury/Liquidity Portfolio Management, Commerzbank Group<br />

Alex Veroude, Head of Credit, Insight Investment<br />

16.55-18.00 Cocktail Reception<br />

Liberty Foyer<br />

NB <strong>Euromoney</strong> <strong>Conferences</strong> reserves the right to amend the programme and is not responsible for cancellations due to unforeseen circumstances. <strong>Euromoney</strong> <strong>Conferences</strong><br />

accepts no responsibility for statements made orally or in written material distributed by any of its speakers at its conferences. In addition, <strong>Euromoney</strong> <strong>Conferences</strong> is not<br />

responsible for any copying, republication or redistribution of such statements.