Annual Report for the year ended 31 December 2008

Annual Report for the year ended 31 December 2008

Annual Report for the year ended 31 December 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Award levels have been determined in <strong>the</strong> light of <strong>the</strong> impact on<br />

shareholders’ dilution. At <strong>the</strong> <strong>year</strong> end <strong>the</strong> dilution (as defined by <strong>the</strong><br />

guidelines of <strong>the</strong> Association of British insurers) arising from <strong>the</strong> Group’s<br />

discretionary schemes was 9.7% (2007: 9.7%) taking into account own<br />

shares purchased by <strong>the</strong> Group’s employee trust to satisfy outstanding<br />

awards. This level of dilution reflects our undertaking to keep dilution<br />

capped at 12% as detailed at <strong>the</strong> time of <strong>the</strong> adoption of <strong>the</strong> per<strong>for</strong>mance<br />

share plan at <strong>the</strong> 2006 <strong>Annual</strong> General Meeting. This excludes <strong>the</strong><br />

impact of <strong>the</strong> psp which is a separate scheme approved by shareholders<br />

in addition to <strong>the</strong> existing discretionary schemes and is subject to <strong>the</strong><br />

per<strong>for</strong>mance conditions detailed above. The Remuneration Committee<br />

keeps <strong>the</strong> levels of dilution under regular review.<br />

awards to <strong>the</strong> esl chief executive officer<br />

in <strong>the</strong> 2006 Remuneration <strong>Report</strong> it was reported that two fur<strong>the</strong>r<br />

awards under <strong>the</strong> 2002 Esis of 500,000 shares would be made to<br />

Andrew umbers in 2007 and <strong>2008</strong> which would be subject to three<br />

<strong>year</strong>s vesting. Following discussions between <strong>the</strong> Group Chief Executive<br />

Officer and members of <strong>the</strong> Committee <strong>the</strong> allocation of <strong>the</strong> 2007<br />

award was deferred until following <strong>the</strong> announcement of <strong>the</strong> Group’s<br />

preliminary results. Following completion of his 2007 appraisal and<br />

<strong>the</strong> approval of <strong>the</strong> Remuneration Committee on 27 March <strong>2008</strong> and<br />

recognising certain undertakings made to Andrew umbers at <strong>the</strong> time<br />

of his joining <strong>the</strong> Group, Andrew umbers was awarded 500,000 shares<br />

under <strong>the</strong> 2002 Esis on <strong>the</strong> 28 March <strong>2008</strong>. Call rights will be granted<br />

and <strong>the</strong> shares will vest on <strong>31</strong> January 2010 subject to Andrew umbers<br />

remaining with <strong>the</strong> Group up to that date. The final 500,000 tranche of<br />

this award was made on <strong>the</strong> 30 <strong>December</strong> <strong>2008</strong> vesting on <strong>31</strong> January<br />

2011.<br />

The evolution group share incentive plan (“sip”)<br />

Executive Directors are eligible to participate in <strong>the</strong> Evolution Group<br />

share incentive plan (“sip”). The sip is an HMRC approved plan open to<br />

all uK permanent employees. Eligible employees may contribute up to<br />

£125 each month and <strong>the</strong> trustee of <strong>the</strong> plan uses <strong>the</strong> money to buy<br />

partnership shares on <strong>the</strong>ir behalf. The Company issues an equivalent<br />

number of matching shares, with <strong>the</strong> equivalent cost met by <strong>the</strong><br />

employing company. partnership and matching shares are eligible <strong>for</strong><br />

dividends and dividend shares are acquired on receipt of <strong>the</strong> relevant<br />

paid amounts. On 15 January <strong>2008</strong> <strong>the</strong> Committee agreed to <strong>the</strong> award<br />

of free shares under <strong>the</strong> sip <strong>for</strong> up to a maximum of £3,000 per<br />

employee. in order to qualify <strong>for</strong> £1,000 of shares employees must have<br />

been employed <strong>for</strong> a period of 12 continuous months. £2,000 worth of<br />

shares were awarded <strong>for</strong> 3 <strong>year</strong>s service and £3,000 worth of shares<br />

<strong>for</strong> five or more <strong>year</strong>s services. On 18 January <strong>2008</strong> Alex snow was<br />

awarded 2,658 free shares an Andrew umbers was awarded 868<br />

free shares.<br />

direcTors' remuneraTion reporT CONTiNuED<br />

<strong>for</strong> The <strong>year</strong> <strong>ended</strong> <strong>31</strong> december<br />

34 THE EvOluTiON GROup plC ANNuAl REpORT & ACCOuNTs <strong>2008</strong><br />

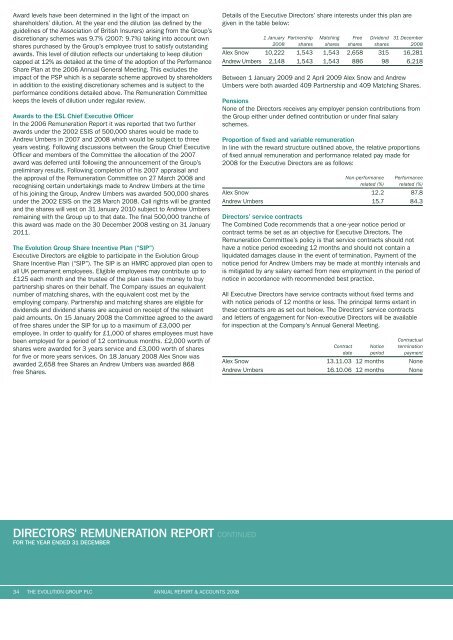

Details of <strong>the</strong> Executive Directors’ share interests under this plan are<br />

given in <strong>the</strong> table below:<br />

1 January Partnership Matching Free Dividend <strong>31</strong> <strong>December</strong><br />

<strong>2008</strong> shares shares shares shares <strong>2008</strong><br />

Alex snow 10,222 1,543 1,543 2,658 <strong>31</strong>5 16,281<br />

Andrew umbers 2,148 1,543 1,543 886 98 6,218<br />

Between 1 January 2009 and 2 April 2009 Alex snow and Andrew<br />

umbers were both awarded 409 partnership and 409 Matching shares.<br />

pensions<br />

None of <strong>the</strong> Directors receives any employer pension contributions from<br />

<strong>the</strong> Group ei<strong>the</strong>r under defined contribution or under final salary<br />

schemes.<br />

proportion of fixed and variable remuneration<br />

in line with <strong>the</strong> reward structure outlined above, <strong>the</strong> relative proportions<br />

of fixed annual remuneration and per<strong>for</strong>mance related pay made <strong>for</strong><br />

<strong>2008</strong> <strong>for</strong> <strong>the</strong> Executive Directors are as follows:<br />

Non-per<strong>for</strong>mance Per<strong>for</strong>mance<br />

related (%) related (%)<br />

Alex snow 12.2 87.8<br />

Andrew umbers 15.7 84.3<br />

directors’ service contracts<br />

The Combined Code recommends that a one-<strong>year</strong> notice period or<br />

contract terms be set as an objective <strong>for</strong> Executive Directors. The<br />

Remuneration Committee’s policy is that service contracts should not<br />

have a notice period exceeding 12 months and should not contain a<br />

liquidated damages clause in <strong>the</strong> event of termination. payment of <strong>the</strong><br />

notice period <strong>for</strong> Andrew umbers may be made at monthly intervals and<br />

is mitigated by any salary earned from new employment in <strong>the</strong> period of<br />

notice in accordance with recomm<strong>ended</strong> best practice.<br />

All Executive Directors have service contracts without fixed terms and<br />

with notice periods of 12 months or less. The principal terms extant in<br />

<strong>the</strong>se contracts are as set out below. The Directors’ service contracts<br />

and letters of engagement <strong>for</strong> Non-executive Directors will be available<br />

<strong>for</strong> inspection at <strong>the</strong> Company’s <strong>Annual</strong> General Meeting.<br />

Contract Notice<br />

Contractual<br />

termination<br />

date period payment<br />

Alex snow 13.11.03 12 months None<br />

Andrew umbers 16.10.06 12 months None

![2. Front continued [c87307] - The Evolution Group PLC](https://img.yumpu.com/19604468/1/184x260/2-front-continued-c87307-the-evolution-group-plc.jpg?quality=85)