Annual Report for the year ended 31 December 2008

Annual Report for the year ended 31 December 2008

Annual Report for the year ended 31 December 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

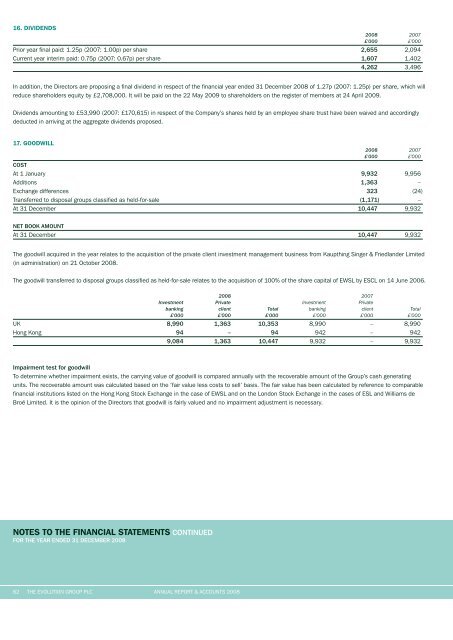

16. diVidends<br />

notes to tHe FinanCial statements CONTINuED<br />

FOR THE YEAR ENDED <strong>31</strong> DECEMBER <strong>2008</strong><br />

62 The evoluTion Group plc AnnuAl reporT & AccounTs <strong>2008</strong><br />

<strong>2008</strong> 2007<br />

£'000 £'000<br />

prior <strong>year</strong> final paid: 1.25p (2007: 1.00p) per share 2,655 2,094<br />

current <strong>year</strong> interim paid: 0.75p (2007: 0.67p) per share 1,607 1,402<br />

4,262 3,496<br />

in addition, <strong>the</strong> Directors are proposing a final dividend in respect of <strong>the</strong> financial <strong>year</strong> <strong>ended</strong> <strong>31</strong> <strong>December</strong> <strong>2008</strong> of 1.27p (2007: 1.25p) per share, which will<br />

reduce shareholders equity by £2,708,000. it will be paid on <strong>the</strong> 22 May 2009 to shareholders on <strong>the</strong> register of members at 24 April 2009.<br />

Dividends amounting to £53,990 (2007: £170,615) in respect of <strong>the</strong> company’s shares held by an employee share trust have been waived and accordingly<br />

deducted in arriving at <strong>the</strong> aggregate dividends proposed.<br />

17. GoodWill<br />

<strong>2008</strong> 2007<br />

£'000 £'000<br />

COST<br />

At 1 January 9,932 9,956<br />

Additions 1,363 –<br />

exchange differences 323 (24)<br />

Transferred to disposal groups classified as held-<strong>for</strong>-sale (1,171) –<br />

At <strong>31</strong> <strong>December</strong> 10,447 9,932<br />

NET BOOk AMOuNT<br />

At <strong>31</strong> <strong>December</strong> 10,447 9,932<br />

The goodwill acquired in <strong>the</strong> <strong>year</strong> relates to <strong>the</strong> acquisition of <strong>the</strong> private client investment management business from Kaupthing singer & Friedlander limited<br />

(in administration) on 21 october <strong>2008</strong>.<br />

The goodwill transferred to disposal groups classified as held-<strong>for</strong>-sale relates to <strong>the</strong> acquisition of 100% of <strong>the</strong> share capital of eWsl by escl on 14 June 2006.<br />

<strong>2008</strong> 2007<br />

Investment Private Investment Private<br />

banking client Total banking client Total<br />

£'000 £'000 £'000 £'000 £'000 £'000<br />

uK 8,990 1,363 10,353 8,990 – 8,990<br />

hong Kong 94 – 94 942 – 942<br />

9,084 1,363 10,447 9,932 – 9,932<br />

Impairment test <strong>for</strong> goodwill<br />

To determine whe<strong>the</strong>r impairment exists, <strong>the</strong> carrying value of goodwill is compared annually with <strong>the</strong> recoverable amount of <strong>the</strong> Group’s cash generating<br />

units. The recoverable amount was calculated based on <strong>the</strong> ‘fair value less costs to sell’ basis. The fair value has been calculated by reference to comparable<br />

financial institutions listed on <strong>the</strong> hong Kong stock exchange in <strong>the</strong> case of eWsl and on <strong>the</strong> london stock exchange in <strong>the</strong> cases of esl and Williams de<br />

Broë limited. it is <strong>the</strong> opinion of <strong>the</strong> Directors that goodwill is fairly valued and no impairment adjustment is necessary.

![2. Front continued [c87307] - The Evolution Group PLC](https://img.yumpu.com/19604468/1/184x260/2-front-continued-c87307-the-evolution-group-plc.jpg?quality=85)