Poverty & Inequalities Profile - Falkirk 2010 - Falkirk Council

Poverty & Inequalities Profile - Falkirk 2010 - Falkirk Council

Poverty & Inequalities Profile - Falkirk 2010 - Falkirk Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Poverty</strong> & <strong>Inequalities</strong> <strong>Profile</strong><br />

<strong>Falkirk</strong> 2009<br />

Financial Security<br />

The Scottish Household Survey is carried out by the Scottish Government biannually for local authorities. There are 3<br />

questions that ask respondents about financial situation such as bank and building society accounts, how they are<br />

coping and savings. People in poverty are less likely to have bank accounts for various reasons. The Banking Code<br />

2005 states that if a bank has a basic bank account option, they should be opened to those who require one or<br />

specifically ask. However, not all banks have this option and they are not usually advertised.<br />

Opening a bank account can be difficult for a number of reasons, for example, due to a previous bank account being<br />

frozen, overdrawn or if the individual is bankrupt, bad credit history or even a lack of credit history. There are also<br />

problems in terms of providing the normal acceptable forms of identification such as a passport or a driving licence<br />

and issues around proof of address and differences in surnames amongst family members.<br />

Table 6:% of households where respondent has a Table 7:% of households describing themselves as<br />

bank, building society or credit union account coping well or very well financially<br />

2003-2004 2005-2006 2007-2008<br />

99-00 01-02 03-04 05-06 07-08<br />

<strong>Falkirk</strong> 92.9 91.5 90.9 <strong>Falkirk</strong> 41.6 50.1 55.3 40.9 53.6<br />

Scotland 89.6 91.3 91.0 Scotland 40.3 46.8 46.8 47.2 51.4<br />

Source: Scottish Household Survey Source: Scottish Household Survey<br />

In <strong>Falkirk</strong>, the number of people without a bank or building society account in 2007/08 was 90.9%; this is slightly lower<br />

than previous years. This shows that people may be experiencing financial difficulties. This is slightly lower than the<br />

Scottish figure, however, where the number of people in <strong>Falkirk</strong> with bank or building society accounts has decreased;<br />

the Scottish figures have increased from 2003/04 to 2007/08.<br />

Table 7 shows that in 2007/08 53.6% of <strong>Falkirk</strong> stated that they were coping well or very well financially. This is<br />

higher than the Scottish rate of 51.4%. While Scotland’s rates have increased over the years, <strong>Falkirk</strong> has fluctuated.<br />

This may reflect the economy, but could also be due to the survey sample of the Scottish Household Survey. It is<br />

important to note that this is before the economic recession and that this figure may have changed considerably.<br />

Table 8: % of households that have some savings<br />

1999-2000 2001-2002 2003-2004 2005-2006 2007-2008<br />

<strong>Falkirk</strong> 55.7 58.1 59.2 46.1 50.9<br />

Scotland 53.3 53.4 53.3 50.8 49.5<br />

Source: Scottish Household Survey<br />

Being able to save increases an individual’s resilience to debt and poverty. Savings can help in times of being made<br />

unemployed, illness and also for emergencies. However, there are many low income individuals and families that are<br />

unable to save, and this leaves them vulnerable to debt and stress and can also lead to loans from doorstep lenders.<br />

It also affects the ability to plan ahead. The table above shows that <strong>Falkirk</strong> had a higher level of savers than Scotland<br />

in 2007/08, with 50.9% saving. However, with the economic recession, this may have changed significantly while<br />

more people fall into debt.<br />

Fuel <strong>Poverty</strong><br />

Fuel <strong>Poverty</strong> is the inability to afford adequate warmth in the home. It is defined as having to spend 10% or more of<br />

income to meet recognized heating standards. Extreme poverty is defined as having to spend 20% or more of annual<br />

income on fuel. An adequate temperature is taken to be the World Health Organisation standard of 21°C in living<br />

rooms and 18°C in other rooms.<br />

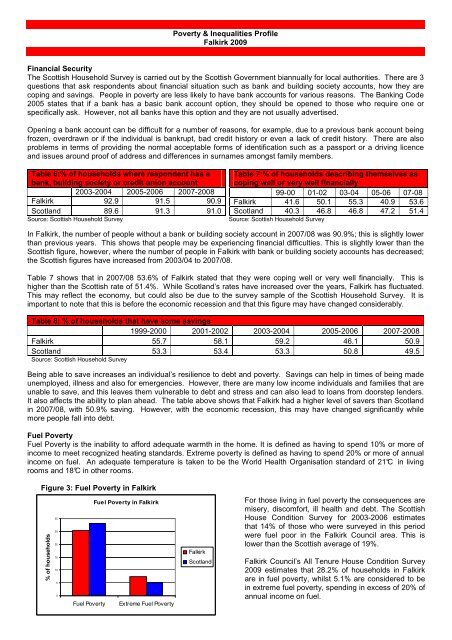

Figure 3: Fuel <strong>Poverty</strong> in <strong>Falkirk</strong><br />

% of households<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Fuel <strong>Poverty</strong> in <strong>Falkirk</strong><br />

Fuel <strong>Poverty</strong> Extreme Fuel <strong>Poverty</strong><br />

<strong>Falkirk</strong><br />

Scotland<br />

For those living in fuel poverty the consequences are<br />

misery, discomfort, ill health and debt. The Scottish<br />

House Condition Survey for 2003-2006 estimates<br />

that 14% of those who were surveyed in this period<br />

were fuel poor in the <strong>Falkirk</strong> <strong>Council</strong> area. This is<br />

lower than the Scottish average of 19%.<br />

<strong>Falkirk</strong> <strong>Council</strong>’s All Tenure House Condition Survey<br />

2009 estimates that 28.2% of households in <strong>Falkirk</strong><br />

are in fuel poverty, whilst 5.1% are considered to be<br />

in extreme fuel poverty, spending in excess of 20% of<br />

annual income on fuel.