Modelling the accruals process and assessing unexpected accruals*

Modelling the accruals process and assessing unexpected accruals*

Modelling the accruals process and assessing unexpected accruals*

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(i.e., <strong>the</strong> initiation of abnormal <strong>accruals</strong>). The difference between reported <strong>and</strong> underlying<br />

t u, t<br />

income ( CNI CNI ) is abnormal <strong>accruals</strong> if <strong>the</strong>re is no distortion in reported cash flow.<br />

The main implication from <strong>the</strong> abnormal <strong>accruals</strong> model is that abnormal <strong>accruals</strong> are driven by<br />

a change in accounting policy <strong>and</strong> forward income growth. Reported income will be distorted<br />

upward when income growth is positive <strong>and</strong> when <strong>the</strong>re is accounting aggression <strong>and</strong>/or an<br />

increase in <strong>the</strong> aggression level. Similarly, <strong>the</strong>re will be a negative distortion in reported income<br />

when income growth is positive <strong>and</strong> <strong>the</strong>re is conservatism <strong>and</strong>/or an increase in <strong>the</strong> conservatism<br />

level. If one restricts <strong>the</strong> proportion of future underlying income shifted to <strong>the</strong> current period to<br />

be <strong>the</strong> same as <strong>the</strong> proportion of current underlying income shifted to <strong>the</strong> past (i.e., mt1, t mt,<br />

t1),<br />

<strong>the</strong> distortion in reported income is totally driven by <strong>the</strong> growth in income. Under such a<br />

restriction where <strong>the</strong> level of accounting distortions are constant or permanent, <strong>the</strong> model yields<br />

<strong>the</strong> well documented effect that firms tend to understate income when permanent conservatism is<br />

associated with positive growth, with <strong>the</strong> opposite being true for permanent aggression. 13<br />

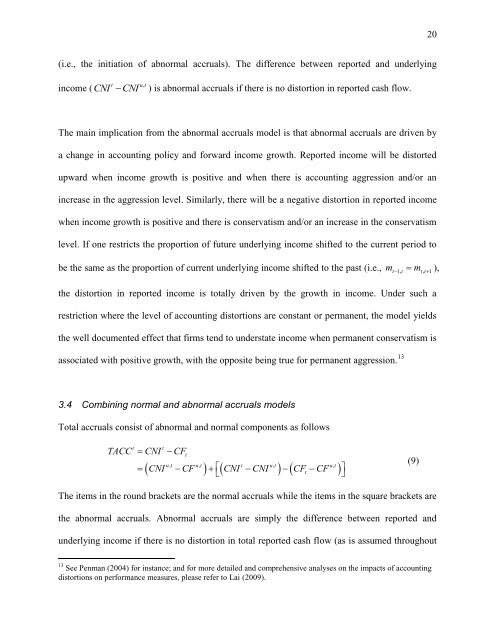

3.4 Combining normal <strong>and</strong> abnormal <strong>accruals</strong> models<br />

Total <strong>accruals</strong> consist of abnormal <strong>and</strong> normal components as follows<br />

t t<br />

TACC CNICFt u, t u, t t u, t u, t<br />

CNI CF CNI CNI CFt CF <br />

<br />

<br />

The items in <strong>the</strong> round brackets are <strong>the</strong> normal <strong>accruals</strong> while <strong>the</strong> items in <strong>the</strong> square brackets are<br />

<strong>the</strong> abnormal <strong>accruals</strong>. Abnormal <strong>accruals</strong> are simply <strong>the</strong> difference between reported <strong>and</strong><br />

underlying income if <strong>the</strong>re is no distortion in total reported cash flow (as is assumed throughout<br />

13 See Penman (2004) for instance; <strong>and</strong> for more detailed <strong>and</strong> comprehensive analyses on <strong>the</strong> impacts of accounting<br />

distortions on performance measures, please refer to Lai (2009).<br />

(9)<br />

20