Modelling the accruals process and assessing unexpected accruals*

Modelling the accruals process and assessing unexpected accruals*

Modelling the accruals process and assessing unexpected accruals*

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

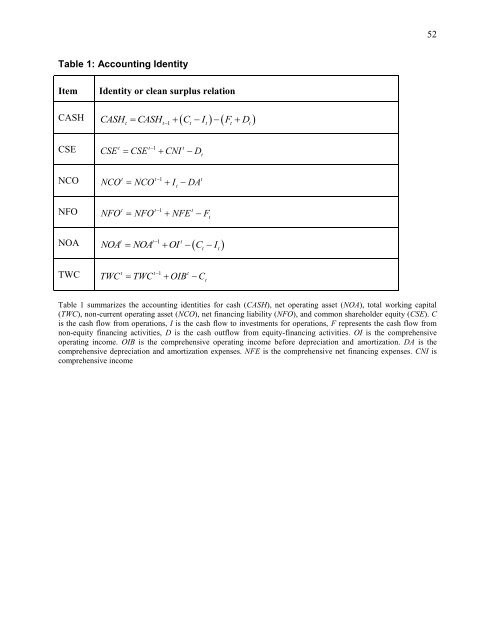

Table 1: Accounting Identity<br />

Item Identity or clean surplus relation<br />

CASH CASH CASH C I F D <br />

CSE<br />

NCO<br />

NFO<br />

t t1 t t t t<br />

t t1 t<br />

CSE CSE CNI Dt<br />

NCO NCO I DA<br />

t t1 t<br />

t<br />

t t1 t<br />

NFO NFO NFE Ft<br />

NOA t t1 t<br />

NOA NOA OI C I <br />

TWC<br />

t t1 t<br />

TWC TWC OIB Ct<br />

t t<br />

Table 1 summarizes <strong>the</strong> accounting identities for cash (CASH), net operating asset (NOA), total working capital<br />

(TWC), non-current operating asset (NCO), net financing liability (NFO), <strong>and</strong> common shareholder equity (CSE). C<br />

is <strong>the</strong> cash flow from operations, I is <strong>the</strong> cash flow to investments for operations, F represents <strong>the</strong> cash flow from<br />

non-equity financing activities, D is <strong>the</strong> cash outflow from equity-financing activities. OI is <strong>the</strong> comprehensive<br />

operating income. OIB is <strong>the</strong> comprehensive operating income before depreciation <strong>and</strong> amortization. DA is <strong>the</strong><br />

comprehensive depreciation <strong>and</strong> amortization expenses. NFE is <strong>the</strong> comprehensive net financing expenses. CNI is<br />

comprehensive income<br />

52