The State of Canada's Cities and Communities 2012 - FCM

The State of Canada's Cities and Communities 2012 - FCM

The State of Canada's Cities and Communities 2012 - FCM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 1<br />

Page 9<br />

not available for other uses. When the costs are<br />

spread out over time, a significant portion <strong>of</strong> the<br />

local budget becomes a fixed obligation, <strong>and</strong><br />

debt charges can constrain local fiscal flexibility.<br />

Moreover, less-indebted governments tend to be<br />

more highly rated by the bond-rating agencies,<br />

<strong>and</strong> thus face lower borrowing costs. A municipality<br />

with low debt also has more flexibility<br />

in responding to unanticipated future events. 9<br />

Nevertheless, borrowing by local governments<br />

to meet at least some capital expenditure<br />

requirements is certainly justified. As Casey<br />

V<strong>and</strong>er Ploeg notes, “a completely debt-free city<br />

should not be the ultimate goal <strong>of</strong> fiscal policy,<br />

regardless <strong>of</strong> how well it plays out politically.<br />

This is especially the case if the trade-<strong>of</strong>f is an<br />

under-funded capital stock.” 10<br />

4.<br />

EXPENDITURE TRENDS AMONG<br />

FEDERAL AND PROVINCIAL/<br />

TERRITORIAL GOVERNMENTS<br />

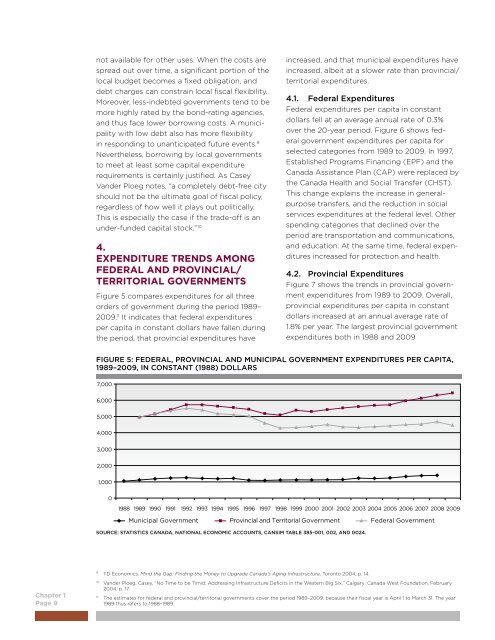

Figure 5 compares expenditures for all three<br />

orders <strong>of</strong> government during the period 1989–<br />

2009. 11 It indicates that federal expenditures<br />

per capita in constant dollars have fallen during<br />

the period, that provincial expenditures have<br />

9 TD Economics. Mind the Gap: Finding the Money to Upgrade Canada’s Aging Infrastructure, Toronto 2004, p. 14.<br />

increased, <strong>and</strong> that municipal expenditures have<br />

increased, albeit at a slower rate than provincial/<br />

territorial expenditures.<br />

4.1. Federal Expenditures<br />

Federal expenditures per capita in constant<br />

dollars fell at an average annual rate <strong>of</strong> 0.3%<br />

over the 20-year period. Figure 6 shows federal<br />

government expenditures per capita for<br />

selected categories from 1989 to 2009. In 1997,<br />

Established Programs Financing (EPF) <strong>and</strong> the<br />

Canada Assistance Plan (CAP) were replaced by<br />

the Canada Health <strong>and</strong> Social Transfer (CHST).<br />

This change explains the increase in generalpurpose<br />

transfers, <strong>and</strong> the reduction in social<br />

services expenditures at the federal level. Other<br />

spending categories that declined over the<br />

period are transportation <strong>and</strong> communications,<br />

<strong>and</strong> education. At the same time, federal expenditures<br />

increased for protection <strong>and</strong> health.<br />

4.2. Provincial Expenditures<br />

Figure 7 shows the trends in provincial government<br />

expenditures from 1989 to 2009. Overall,<br />

provincial expenditures per capita in constant<br />

dollars increased at an annual average rate <strong>of</strong><br />

1.8% per year. <strong>The</strong> largest provincial government<br />

expenditures both in 1988 <strong>and</strong> 2009<br />

FIGURE 5: FEDERAL, PROVINCIAL AND MUNICIPAL GOVERNMENT EXPENDITURES PER CAPITA,<br />

1989–2009, IN CONSTANT (1988) DOLLARS<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

10 V<strong>and</strong>er Ploeg, Casey, “No Time to be Timid: Addressing Infrastructure Deficits in the Western Big Six,” Calgary: Canada West Foundation, February<br />

2004, p. 17.<br />

1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Municipal Government Provincial <strong>and</strong> Territorial Government Federal Government<br />

SOURCE: STATISTICS CANADA, NATIONAL ECONOMIC ACCOUNTS, CANSIM TABLE 385-001, 002, AND 0024.<br />

11 <strong>The</strong> estimates for federal <strong>and</strong> provincial/territorial governments cover the period 1989–2009, because their fiscal year is April 1 to March 31. <strong>The</strong> year<br />

1989 thus refers to 1988–1989.