CAFR - Fairfax County Public Schools

CAFR - Fairfax County Public Schools

CAFR - Fairfax County Public Schools

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Introduction<br />

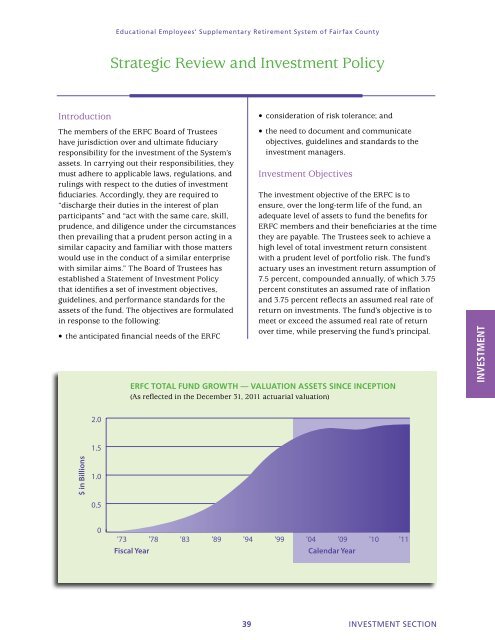

$ in Billions<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0<br />

Educational Employees’ Supplementary Retirement System of <strong>Fairfax</strong> county<br />

Strategic Review and Investment Policy<br />

The members of the ERFC Board of Trustees<br />

have jurisdiction over and ultimate fiduciary<br />

responsibility for the investment of the System’s<br />

assets. In carrying out their responsibilities, they<br />

must adhere to applicable laws, regulations, and<br />

rulings with respect to the duties of investment<br />

fiduciaries. Accordingly, they are required to<br />

“discharge their duties in the interest of plan<br />

participants” and “act with the same care, skill,<br />

prudence, and diligence under the circumstances<br />

then prevailing that a prudent person acting in a<br />

similar capacity and familiar with those matters<br />

would use in the conduct of a similar enterprise<br />

with similar aims.” The Board of Trustees has<br />

established a Statement of Investment Policy<br />

that identifies a set of investment objectives,<br />

guidelines, and performance standards for the<br />

assets of the fund. The objectives are formulated<br />

in response to the following:<br />

• the anticipated financial needs of the ERFC<br />

• consideration of risk tolerance; and<br />

• the need to document and communicate<br />

objectives, guidelines and standards to the<br />

investment managers.<br />

Investment Objectives<br />

The investment objective of the ERFC is to<br />

ensure, over the long-term life of the fund, an<br />

adequate level of assets to fund the benefits for<br />

ERFC members and their beneficiaries at the time<br />

they are payable. The Trustees seek to achieve a<br />

high level of total investment return consistent<br />

with a prudent level of portfolio risk. The fund’s<br />

actuary uses an investment return assumption of<br />

7.5 percent, compounded annually, of which 3.75<br />

percent constitutes an assumed rate of inflation<br />

and 3.75 percent reflects an assumed real rate of<br />

return on investments. The fund’s objective is to<br />

meet or exceed the assumed real rate of return<br />

over time, while preserving the fund’s principal.<br />

ERFC ToTal Fund GRowTh — ValuaTion assETs sinCE inCEpTion<br />

(As reflected in the December 31, 2011 actuarial valuation)<br />

'73 '78 '83 '89 '94 '99 '04 '09<br />

Fiscal Year Calendar Year<br />

39 INVESTMENT SEcTIoN<br />

'10<br />

'11<br />

INVESTMENT