Quanto Adjustments in the Presence of Stochastic Volatility

Quanto Adjustments in the Presence of Stochastic Volatility

Quanto Adjustments in the Presence of Stochastic Volatility

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

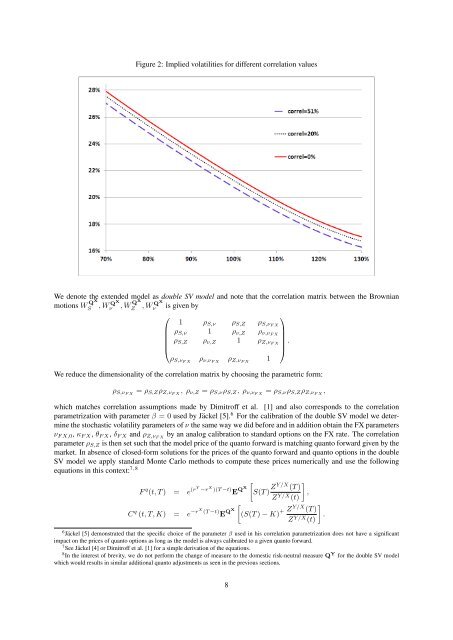

Figure 2: Implied volatilities for different correlation values<br />

We denote <strong>the</strong> extended model as double SV model and note that <strong>the</strong> correlation matrix between <strong>the</strong> Brownian<br />

motions W QX QX<br />

S , Wν , W QX QX<br />

Z , Wν is given by<br />

⎛<br />

⎞<br />

1 ρS,ν ρS,Z ρS,νF X<br />

⎜ ρS,ν ⎜ 1 ρν,Z ρν,νF<br />

⎟<br />

X ⎟<br />

⎜ ρS,Z ρν,Z ⎜<br />

1 ρZ,νF<br />

⎟<br />

X ⎟<br />

⎝<br />

⎠ .<br />

ρS,νF X ρν,νF X ρZ,νF X 1<br />

We reduce <strong>the</strong> dimensionality <strong>of</strong> <strong>the</strong> correlation matrix by choos<strong>in</strong>g <strong>the</strong> parametric form:<br />

ρS,νF X = ρS,ZρZ,νF X , ρν,Z = ρS,νρS,Z, ρν,νF X = ρS,νρS,ZρZ,νF X ,<br />

which matches correlation assumptions made by Dimitr<strong>of</strong>f et al. [1] and also corresponds to <strong>the</strong> correlation<br />

parametrization with parameter β = 0 used by Jäckel [5]. 6 For <strong>the</strong> calibration <strong>of</strong> <strong>the</strong> double SV model we determ<strong>in</strong>e<br />

<strong>the</strong> stochastic volatility parameters <strong>of</strong> ν <strong>the</strong> same way we did before and <strong>in</strong> addition obta<strong>in</strong> <strong>the</strong> FX parameters<br />

νF X,0, κF X, θF X, δF X and ρZ,νF by an analog calibration to standard options on <strong>the</strong> FX rate. The correlation<br />

X<br />

parameter ρS,Z is <strong>the</strong>n set such that <strong>the</strong> model price <strong>of</strong> <strong>the</strong> quanto forward is match<strong>in</strong>g quanto forward given by <strong>the</strong><br />

market. In absence <strong>of</strong> closed-form solutions for <strong>the</strong> prices <strong>of</strong> <strong>the</strong> quanto forward and quanto options <strong>in</strong> <strong>the</strong> double<br />

SV model we apply standard Monte Carlo methods to compute <strong>the</strong>se prices numerically and use <strong>the</strong> follow<strong>in</strong>g<br />

equations <strong>in</strong> this context: 7,8<br />

F q (t, T ) = e (rY −r X )(T −t) E Q X<br />

C q (t, T, K) = e −rX (T −t) E Q X<br />

�<br />

S(T ) ZY/X (T )<br />

ZY/X �<br />

,<br />

(t)<br />

�<br />

(S(T ) − K) + Z Y/X (T )<br />

Z Y/X (t)<br />

6 Jäckel [5] demonstrated that <strong>the</strong> specific choice <strong>of</strong> <strong>the</strong> parameter β used <strong>in</strong> his correlation parametrization does not have a significant<br />

impact on <strong>the</strong> prices <strong>of</strong> quanto options as long as <strong>the</strong> model is always calibrated to a given quanto forward.<br />

7 See Jäckel [4] or Dimitr<strong>of</strong>f et al. [1] for a simple derivation <strong>of</strong> <strong>the</strong> equations.<br />

8 In <strong>the</strong> <strong>in</strong>terest <strong>of</strong> brevity, we do not perform <strong>the</strong> change <strong>of</strong> measure to <strong>the</strong> domestic risk-neutral measure Q Y for <strong>the</strong> double SV model<br />

which would results <strong>in</strong> similar additional quanto adjustments as seen <strong>in</strong> <strong>the</strong> previous sections.<br />

8<br />

�<br />

.