2 | Rapporto di sostenibilita? ING:Layout 1 - Fiat SpA

2 | Rapporto di sostenibilita? ING:Layout 1 - Fiat SpA

2 | Rapporto di sostenibilita? ING:Layout 1 - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Raw materials<br />

EN1 (core) Material used by weight or volume.<br />

Annually, <strong>Fiat</strong> Group purchases are valued 33 billion euros,<br />

85% of which for <strong>di</strong>rect materials and the remainder for in<strong>di</strong>rect<br />

materials, services, plants and machinery. 86% of <strong>di</strong>rect<br />

material procurement is carried out through purchasing<br />

organisations present in Europe and North America, and the<br />

remainder in Latin America. Purchases of <strong>di</strong>rect materials are<br />

as follows: 51% metals, 26% electrical and 23% chemicals.<br />

EN2 (core) Percentage of materials used that are recycled input<br />

materials.<br />

On September 18, 2000, EU Directive 2000/53/EC was adopted<br />

by the European Parliament and the Council of the European<br />

Union in order to prevent waste from vehicles by promoting<br />

the reuse, recycling and other forms of recovery of end-of-life<br />

vehicles (ELV), and to improve the environmental performance<br />

of all economic operators involved in the life cycle of vehicles,<br />

and especially carmakers, <strong>di</strong>smantlers and shredders.<br />

Since then, nearly all European Union member states have<br />

transposed the ELV Directive into their own national law.<br />

Current legislation establishes that the last owner of an<br />

end-of-life vehicle can deliver it to an authorised treatment<br />

facility at no cost, and is applicable starting on January 1, 2007<br />

to all vehicles in circulation. In this connection, European<br />

regulation has made vehicle manufacturers responsible for<br />

organising <strong>di</strong>smantling networks where the last owner of an<br />

end-of-life vehicle can deliver it for treatment at no charge.<br />

The form these networks take may vary from country to<br />

country. Thus, setting up an efficient network with high quality<br />

standards and sufficient geographical coverage is the sine qua<br />

non for dealing effectively with end-of-life vehicles. Both<br />

independently and in cooperation with other operators<br />

involved in recycling, <strong>Fiat</strong> Group Automobiles created networks<br />

of <strong>di</strong>smantlers throughout Europe where all vehicles of its<br />

brands are collected at no cost to the owner. The <strong>Fiat</strong> networks<br />

comply with applicable regulations, and they will be<br />

continuously monitored to guarantee that they provide both<br />

the geographical coverage and the quality standards required<br />

by the law. <strong>Fiat</strong> Group Automobiles has made available to its<br />

customers adequate communication through the Internet,<br />

multi-language call centres, owner’s handbooks, and<br />

signboards identifying authorised treatment facilities.<br />

End-of-life vehicles contain many <strong>di</strong>fferent types of material:<br />

steel, plastics, rubber and a whole list of others. In Italy,<br />

around 1.5 million vehicles are scrapped every year, with<br />

over 1.2 million tons of material that must be <strong>di</strong>sposed of.<br />

These figures clearly highlight the value inherent in these ELVs.<br />

For today’s automakers, then, producing vehicles for truly<br />

sustainable mobility is not just a question of reducing tailpipe<br />

emissions or investing in alternative propulsion systems,<br />

it also means designing vehicles and dealing with them at the<br />

end of their life cycle in a way that ensures maximum recovery<br />

of materials, maximum optimisation of energy, and the<br />

48 Performance in<strong>di</strong>cators Environmental performance in<strong>di</strong>cators<br />

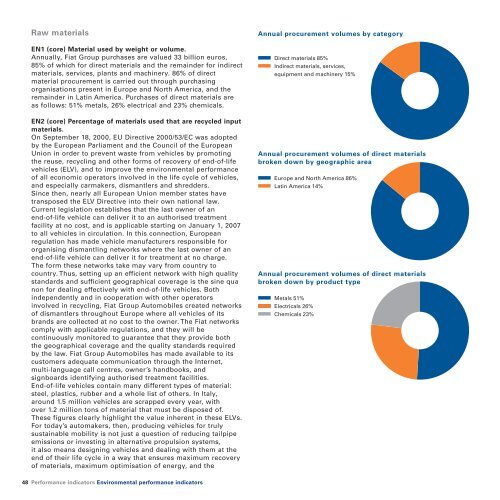

Annual procurement volumes by category<br />

Direct materials 85%<br />

In<strong>di</strong>rect materials, services,<br />

equipment and machinery 15%<br />

Annual procurement volumes of <strong>di</strong>rect materials<br />

broken down by geographic area<br />

Europe and North America 86%<br />

Latin America 14%<br />

Annual procurement volumes of <strong>di</strong>rect materials<br />

broken down by product type<br />

Metals 51%<br />

Electricals 26%<br />

Chemicals 23%