U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

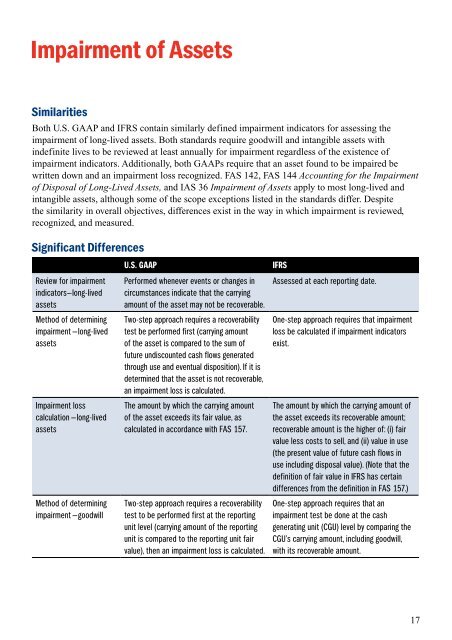

Impairment of Assets<br />

Similarities<br />

Both U.S. <strong>GAAP</strong> and <strong>IFRS</strong> contain similarly defined impairment indicators for assessing the<br />

impairment of long-lived assets. Both standards require goodwill and intangible assets with<br />

indefinite lives to be reviewed at least annually for impairment regardless of the existence of<br />

impairment indicators. Additionally, both <strong>GAAP</strong>s require that an asset found to be impaired be<br />

written down and an impairment loss recognized. FAS 142, FAS 144 Accounting for the Impairment<br />

of Disposal of Long-Lived Assets, and IAS Impairment of Assets apply to most long-lived and<br />

intangible assets, although some of the scope exceptions listed in the standards differ. Despite<br />

the similarity in overall objectives, differences exist in the way in which impairment is reviewed,<br />

recognized, and measured.<br />

Significant Differences<br />

Review for impairment<br />

indicators–-long-lived<br />

assets<br />

Method of determining<br />

impairment — long-lived<br />

assets<br />

Impairment loss<br />

calculation — long-lived<br />

assets<br />

Method of determining<br />

impairment — goodwill<br />

U.S. <strong>GAAP</strong> <strong>IFRS</strong><br />

Performed whenever events or changes in<br />

circumstances indicate that the carrying<br />

amount of the asset may not be recoverable.<br />

Two-step approach requires a recoverability<br />

test be performed first (carrying amount<br />

of the asset is compared to the sum of<br />

future undiscounted cash flows generated<br />

through use and eventual disposition). If it is<br />

determined that the asset is not recoverable,<br />

an impairment loss is calculated.<br />

<strong>The</strong> amount by which the carrying amount<br />

of the asset exceeds its fair value, as<br />

calculated in accordance with FAS 157.<br />

Two-step approach requires a recoverability<br />

test to be performed first at the reporting<br />

unit level (carrying amount of the reporting<br />

unit is compared to the reporting unit fair<br />

value), then an impairment loss is calculated.<br />

Assessed at each reporting date.<br />

One-step approach requires that impairment<br />

loss be calculated if impairment indicators<br />

exist.<br />

<strong>The</strong> amount by which the carrying amount of<br />

the asset exceeds its recoverable amount;<br />

recoverable amount is the higher of: (i) fair<br />

value less costs to sell, and (ii) value in use<br />

(the present value of future cash flows in<br />

use including disposal value). (Note that the<br />

definition of fair value in <strong>IFRS</strong> has certain<br />

differences from the definition in FAS 157.)<br />

One-step approach requires that an<br />

impairment test be done at the cash<br />

generating unit (CGU) level by comparing the<br />

CGU’s carrying amount, including goodwill,<br />

with its recoverable amount.<br />

17