U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Foreign Currency Matters<br />

Similarities<br />

FAS 52 Foreign Currency Translation and IAS 21 <strong>The</strong> Effects of Changes in Foreign Exchange<br />

Rates are quite similar in their approach to foreign currency translation. While the guidance<br />

provided by each for evaluating the functional currency of an entity is different, it generally results<br />

in the same determination (that is, the currency of the entity’s primary economic environment). Both<br />

<strong>GAAP</strong>s generally consider the same economies to be hyperinflationary, although the accounting for<br />

an entity operating in such an environment can be very different.<br />

Both <strong>GAAP</strong>s require foreign currency transactions of an entity to be remeasured into its functional<br />

currency with amounts resulting from changes in exchange rates being reported in income. Once a<br />

subsidiary’s financial statements are remeasured into its functional currency, both standards require<br />

translation into its parent’s functional currency with assets and liabilities being translated at the<br />

period-end rate, and income statement amounts generally at the average rate, with the exchange<br />

differences reported in equity. Both standards also permit the hedging of that net investment with<br />

exchange differences from the hedging instrument offsetting the translation amounts reported in<br />

equity. <strong>The</strong> cumulative translation amounts reported in equity are reflected in income when there is<br />

a sale, or complete liquidation or abandonment of the foreign operation, but there are differences<br />

between the two standards when the investment in the foreign operation is reduced through<br />

dividends or repayment of long-term advances as indicated below.<br />

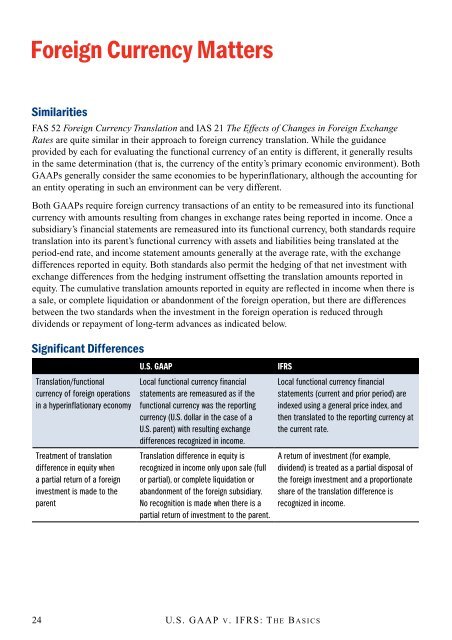

Significant Differences<br />

Translation/functional<br />

currency of foreign operations<br />

in a hyperinflationary economy<br />

Treatment of translation<br />

difference in equity when<br />

a partial return of a foreign<br />

investment is made to the<br />

parent<br />

U.S. <strong>GAAP</strong> <strong>IFRS</strong><br />

Local functional currency financial<br />

statements are remeasured as if the<br />

functional currency was the reporting<br />

currency (U.S. dollar in the case of a<br />

U.S. parent) with resulting exchange<br />

differences recognized in income.<br />

Translation difference in equity is<br />

recognized in income only upon sale (full<br />

or partial), or complete liquidation or<br />

abandonment of the foreign subsidiary.<br />

No recognition is made when there is a<br />

partial return of investment to the parent.<br />

24 u.s. gaaP v. iFrs: t h E <strong>Basics</strong><br />

Local functional currency financial<br />

statements (current and prior period) are<br />

indexed using a general price index, and<br />

then translated to the reporting currency at<br />

the current rate.<br />

A return of investment (for example,<br />

dividend) is treated as a partial disposal of<br />

the foreign investment and a proportionate<br />

share of the translation difference is<br />

recognized in income.