U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

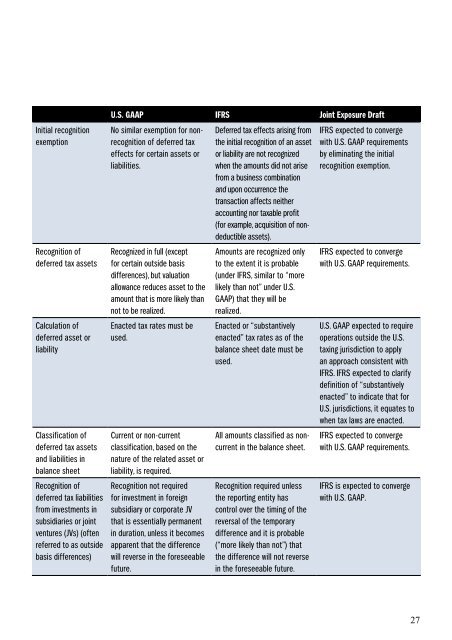

Initial recognition<br />

exemption<br />

Recognition of<br />

deferred tax assets<br />

Calculation of<br />

deferred asset or<br />

liability<br />

Classification of<br />

deferred tax assets<br />

and liabilities in<br />

balance sheet<br />

Recognition of<br />

deferred tax liabilities<br />

from investments in<br />

subsidiaries or joint<br />

ventures (JVs) (often<br />

referred to as outside<br />

basis differences)<br />

U.S. <strong>GAAP</strong> <strong>IFRS</strong> Joint Exposure Draft<br />

No similar exemption for nonrecognition<br />

of deferred tax<br />

effects for certain assets or<br />

liabilities.<br />

Recognized in full (except<br />

for certain outside basis<br />

differences), but valuation<br />

allowance reduces asset to the<br />

amount that is more likely than<br />

not to be realized.<br />

Enacted tax rates must be<br />

used.<br />

Current or non-current<br />

classification, based on the<br />

nature of the related asset or<br />

liability, is required.<br />

Recognition not required<br />

for investment in foreign<br />

subsidiary or corporate JV<br />

that is essentially permanent<br />

in duration, unless it becomes<br />

apparent that the difference<br />

will reverse in the foreseeable<br />

future.<br />

Deferred tax effects arising from<br />

the initial recognition of an asset<br />

or liability are not recognized<br />

when the amounts did not arise<br />

from a business combination<br />

and upon occurrence the<br />

transaction affects neither<br />

accounting nor taxable profit<br />

(for example, acquisition of nondeductible<br />

assets).<br />

Amounts are recognized only<br />

to the extent it is probable<br />

(under <strong>IFRS</strong>, similar to “more<br />

likely than not” under U.S.<br />

<strong>GAAP</strong>) that they will be<br />

realized.<br />

Enacted or “substantively<br />

enacted” tax rates as of the<br />

balance sheet date must be<br />

used.<br />

All amounts classified as noncurrent<br />

in the balance sheet.<br />

Recognition required unless<br />

the reporting entity has<br />

control over the timing of the<br />

reversal of the temporary<br />

difference and it is probable<br />

(“more likely than not”) that<br />

the difference will not reverse<br />

in the foreseeable future.<br />

<strong>IFRS</strong> expected to converge<br />

with U.S. <strong>GAAP</strong> requirements<br />

by eliminating the initial<br />

recognition exemption.<br />

<strong>IFRS</strong> expected to converge<br />

with U.S. <strong>GAAP</strong> requirements.<br />

U.S. <strong>GAAP</strong> expected to require<br />

operations outside the U.S.<br />

taxing jurisdiction to apply<br />

an approach consistent with<br />

<strong>IFRS</strong>. <strong>IFRS</strong> expected to clarify<br />

definition of “substantively<br />

enacted” to indicate that for<br />

U.S. jurisdictions, it equates to<br />

when tax laws are enacted.<br />

<strong>IFRS</strong> expected to converge<br />

with U.S. <strong>GAAP</strong> requirements.<br />

<strong>IFRS</strong> is expected to converge<br />

with U.S. <strong>GAAP</strong>.<br />

27