U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

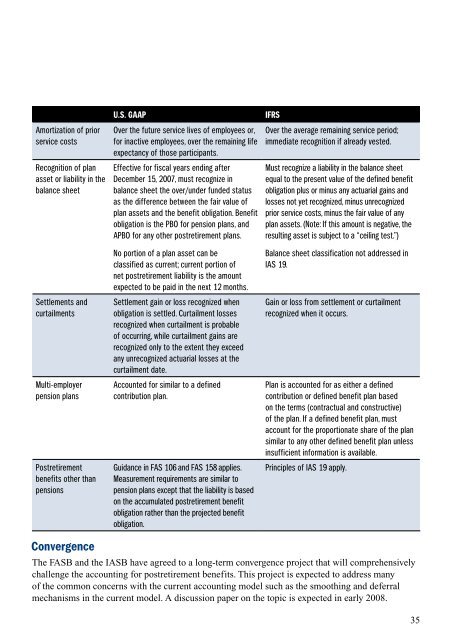

Amortization of prior<br />

service costs<br />

Recognition of plan<br />

asset or liability in the<br />

balance sheet<br />

Settlements and<br />

curtailments<br />

Multi-employer<br />

pension plans<br />

Postretirement<br />

benefits other than<br />

pensions<br />

Convergence<br />

U.S. <strong>GAAP</strong> <strong>IFRS</strong><br />

Over the future service lives of employees or,<br />

for inactive employees, over the remaining life<br />

expectancy of those participants.<br />

Effective for fiscal years ending after<br />

December 15, 2007, must recognize in<br />

balance sheet the over/under funded status<br />

as the difference between the fair value of<br />

plan assets and the benefit obligation. Benefit<br />

obligation is the PBO for pension plans, and<br />

APBO for any other postretirement plans.<br />

No portion of a plan asset can be<br />

classified as current; current portion of<br />

net postretirement liability is the amount<br />

expected to be paid in the next 12 months.<br />

Settlement gain or loss recognized when<br />

obligation is settled. Curtailment losses<br />

recognized when curtailment is probable<br />

of occurring, while curtailment gains are<br />

recognized only to the extent they exceed<br />

any unrecognized actuarial losses at the<br />

curtailment date.<br />

Accounted for similar to a defined<br />

contribution plan.<br />

Guidance in FAS 106 and FAS 158 applies.<br />

Measurement requirements are similar to<br />

pension plans except that the liability is based<br />

on the accumulated postretirement benefit<br />

obligation rather than the projected benefit<br />

obligation.<br />

Over the average remaining service period;<br />

immediate recognition if already vested.<br />

Must recognize a liability in the balance sheet<br />

equal to the present value of the defined benefit<br />

obligation plus or minus any actuarial gains and<br />

losses not yet recognized, minus unrecognized<br />

prior service costs, minus the fair value of any<br />

plan assets. (Note: If this amount is negative, the<br />

resulting asset is subject to a “ceiling test.”)<br />

Balance sheet classification not addressed in<br />

IAS 19.<br />

Gain or loss from settlement or curtailment<br />

recognized when it occurs.<br />

Plan is accounted for as either a defined<br />

contribution or defined benefit plan based<br />

on the terms (contractual and constructive)<br />

of the plan. If a defined benefit plan, must<br />

account for the proportionate share of the plan<br />

similar to any other defined benefit plan unless<br />

insufficient information is available.<br />

Principles of IAS 19 apply.<br />

<strong>The</strong> FASB and the IASB have agreed to a long-term convergence project that will comprehensively<br />

challenge the accounting for postretirement benefits. This project is expected to address many<br />

of the common concerns with the current accounting model such as the smoothing and deferral<br />

mechanisms in the current model. A discussion paper on the topic is expected in early 2008.<br />

5