U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

U.S. GAAP v. IFRS: The Basics - Financial Executives International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

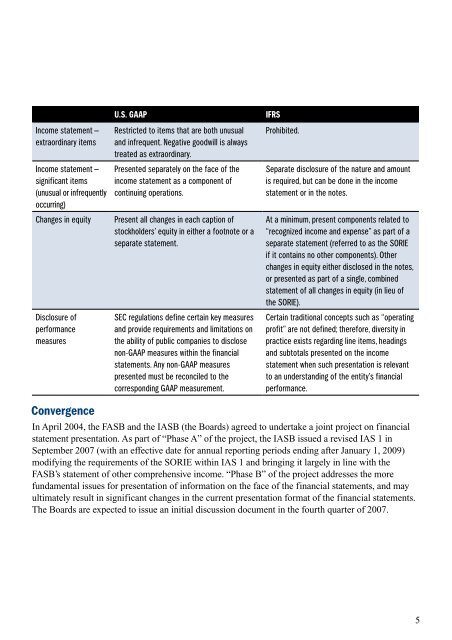

Income statement —<br />

extraordinary items<br />

Income statement —<br />

significant items<br />

(unusual or infrequently<br />

occurring)<br />

U.S. <strong>GAAP</strong> <strong>IFRS</strong><br />

Restricted to items that are both unusual<br />

and infrequent. Negative goodwill is always<br />

treated as extraordinary.<br />

Presented separately on the face of the<br />

income statement as a component of<br />

continuing operations.<br />

Changes in equity Present all changes in each caption of<br />

stockholders’ equity in either a footnote or a<br />

separate statement.<br />

Disclosure of<br />

performance<br />

measures<br />

Convergence<br />

SEC regulations define certain key measures<br />

and provide requirements and limitations on<br />

the ability of public companies to disclose<br />

non-<strong>GAAP</strong> measures within the financial<br />

statements. Any non-<strong>GAAP</strong> measures<br />

presented must be reconciled to the<br />

corresponding <strong>GAAP</strong> measurement.<br />

Prohibited.<br />

Separate disclosure of the nature and amount<br />

is required, but can be done in the income<br />

statement or in the notes.<br />

At a minimum, present components related to<br />

“recognized income and expense” as part of a<br />

separate statement (referred to as the SORIE<br />

if it contains no other components). Other<br />

changes in equity either disclosed in the notes,<br />

or presented as part of a single, combined<br />

statement of all changes in equity (in lieu of<br />

the SORIE).<br />

Certain traditional concepts such as “operating<br />

profit” are not defined; therefore, diversity in<br />

practice exists regarding line items, headings<br />

and subtotals presented on the income<br />

statement when such presentation is relevant<br />

to an understanding of the entity’s financial<br />

performance.<br />

In April 2004, the FASB and the IASB (the Boards) agreed to undertake a joint project on financial<br />

statement presentation. As part of “Phase A” of the project, the IASB issued a revised IAS 1 in<br />

September 2007 (with an effective date for annual reporting periods ending after January 1, 2009)<br />

modifying the requirements of the SORIE within IAS 1 and bringing it largely in line with the<br />

FASB’s statement of other comprehensive income. “Phase B” of the project addresses the more<br />

fundamental issues for presentation of information on the face of the financial statements, and may<br />

ultimately result in significant changes in the current presentation format of the financial statements.<br />

<strong>The</strong> Boards are expected to issue an initial discussion document in the fourth quarter of 2007.<br />

5