Financial Stability Report - Financial Risk and Stability Network

Financial Stability Report - Financial Risk and Stability Network

Financial Stability Report - Financial Risk and Stability Network

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Some relief may come<br />

from the unfreezing of<br />

general government<br />

payments<br />

Looking ahead, rms’ liquidity<br />

situation will benet from<br />

the new allocation of €10<br />

billion that Cassa Depositi e<br />

Prestiti has made available to<br />

banks to nance small <strong>and</strong> medium-sized enterprises<br />

<strong>and</strong> from the unfreezing of a rst tranche of general<br />

government payments of commercial debts to<br />

suppliers (see the box “e macroeconomic impact<br />

of the unfreezing of general government debts”,<br />

Economic Bulletin, April 2013). e recent<br />

Government measure provides for €20 billion of<br />

payments this year <strong>and</strong> the same amount in 2014;<br />

rapid implementation of this provision is vital to<br />

ease rms’ nancial constraints. Going forward, it<br />

will be crucial to guarantee faster general government<br />

payments within the limits of 30-60 days imposed<br />

by EU Directive 2011/7 of 16 February 2011,<br />

which entered into force last January.<br />

The risks derive<br />

from the recession<br />

<strong>and</strong> difficulties in<br />

accessing credit<br />

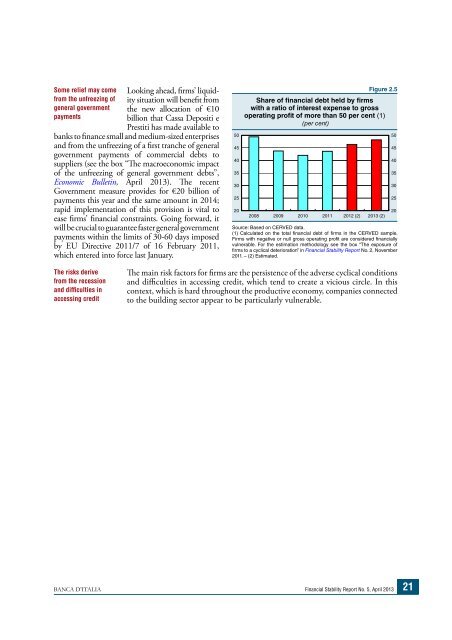

Figure 2.5<br />

Share of nancial debt held by rms<br />

with a ratio of interest expense to gross<br />

operating prot of more than 50 per cent (1)<br />

(per cent)<br />

e main risk factors for rms are the persistence of the adverse cyclical conditions<br />

<strong>and</strong> diculties in accessing credit, which tend to create a vicious circle. In this<br />

context, which is hard throughout the productive economy, companies connected<br />

to the building sector appear to be particularly vulnerable.<br />

BANCA D’ITALIA <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong> No. 5, April 2013 21<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

2008 2009 2010 2011 2012 (2) 2013 (2)<br />

Source: Based on CERVED data.<br />

(1) Calculated on the total nancial debt of rms in the CERVED sample.<br />

Firms with negative or null gross operating prot are considered nancially<br />

vulnerable. For the estimation methodology see the box “The exposure of<br />

rms to a cyclical deterioration” in <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong> No. 2, November<br />

2011. – (2) Estimated.<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20