Financial Stability Report - Financial Risk and Stability Network

Financial Stability Report - Financial Risk and Stability Network

Financial Stability Report - Financial Risk and Stability Network

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

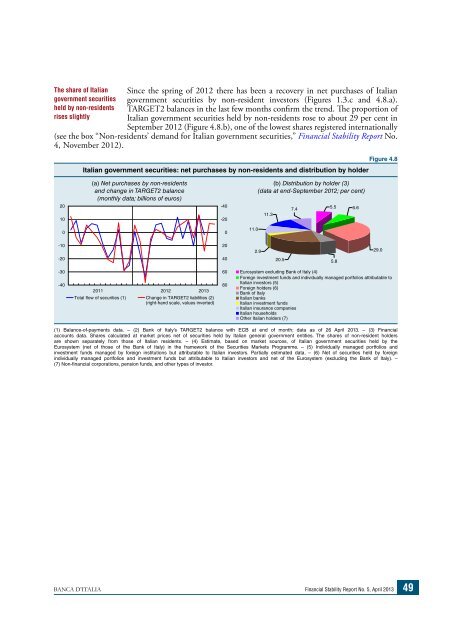

The share of Italian<br />

government securities<br />

held by non-residents<br />

rises slightly<br />

Since the spring of 2012 there has been a recovery in net purchases of Italian<br />

government securities by non-resident investors (Figures 1.3.c <strong>and</strong> 4.8.a).<br />

TARGET2 balances in the last few months conrm the trend. e proportion of<br />

Italian government securities held by non-residents rose to about 29 per cent in<br />

September 2012 (Figure 4.8.b), one of the lowest shares registered internationally<br />

(see the box “Non-residents’ dem<strong>and</strong> for Italian government securities,” <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong> No.<br />

4, November 2012).<br />

Italian government securities: net purchases by non-residents <strong>and</strong> distribution by holder<br />

(a) Net purchases by non-residents<br />

<strong>and</strong> change in TARGET2 balance<br />

(monthly data; billions of euros)<br />

20 -40<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

2011 2012 2013<br />

Total flow of securities (1) Change in TARGET2 liabilities<br />

(right-h<strong>and</strong> scale, values inverted)<br />

-20<br />

0<br />

20<br />

40<br />

60<br />

80<br />

(b) Distribution by holder (3)<br />

(data at end-September 2012; per cent)<br />

Figure 4.8<br />

BANCA D’ITALIA <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong> No. 5, April 2013 49<br />

11.0<br />

2.9<br />

11.3<br />

7.4<br />

5.5<br />

20.5 5.8<br />

6.6<br />

29.0<br />

Eurosystem excluding Bank of Italy ()<br />

Foreign investment funds <strong>and</strong> individually managed portfolios attributable to<br />

Italian investors (5)<br />

Foreign holders ()<br />

Bank of Italy<br />

Italian banks<br />

Italian investment funds<br />

Italian insurance companies<br />

Italian households<br />

Other Italian holders ()<br />

(1) Balance-of-payments data. – (2) Bank of Italy’s TARGET2 balance with ECB at end of month; data as of 26 April 2013. – (3) <strong>Financial</strong><br />

accounts data. Shares calculated at market prices net of securities held by Italian general government entities. The shares of non-resident holders<br />

are shown separately from those of Italian residents. – (4) Estimate, based on market sources, of Italian government securities held by the<br />

Eurosystem (net of those of the Bank of Italy) in the framework of the Securities Markets Programme. – (5) Individually managed portfolios <strong>and</strong><br />

investment funds managed by foreign institutions but attributable to Italian investors. Partially estimated data. – (6) Net of securities held by foreign<br />

individually managed portfolios <strong>and</strong> investment funds but attributable to Italian investors <strong>and</strong> net of the Eurosystem (excluding the Bank of Italy). –<br />

(7) Non-nancial corporations, pension funds, <strong>and</strong> other types of investor.