Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Buyout<br />

Investors<br />

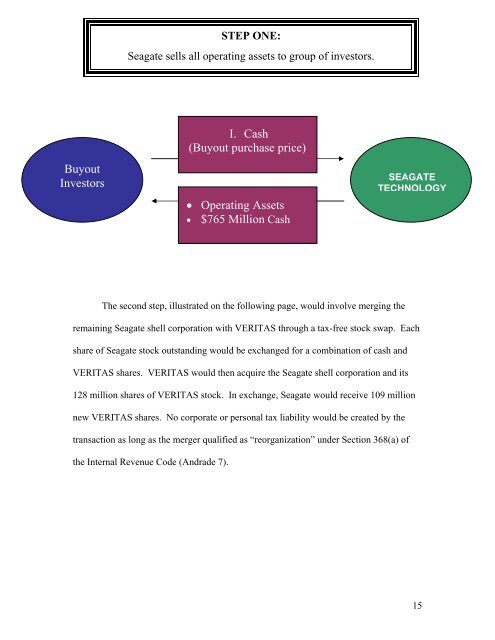

The second step, illustrated on the following page, would involve merging the<br />

remaining Seagate shell corporation with VERITAS through a tax-free stock swap. Each<br />

share of Seagate stock outstanding would be exchanged for a combination of cash and<br />

VERITAS shares. VERITAS would then acquire the Seagate shell corporation and its<br />

128 million shares of VERITAS stock. In exchange, Seagate would receive 109 million<br />

new VERITAS shares. No corporate or personal tax liability would be created by the<br />

transaction as long as the merger qualified as “reorganization” under Section 368(a) of<br />

the Internal Revenue Code (Andrade 7).<br />

STEP ONE:<br />

Seagate sells all operating assets to group of investors.<br />

I. Cash<br />

(Buyout purchase price)<br />

• Operating Assets<br />

• $765 Million Cash<br />

SEAGATE<br />

TECHNOLOGY<br />

15