Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

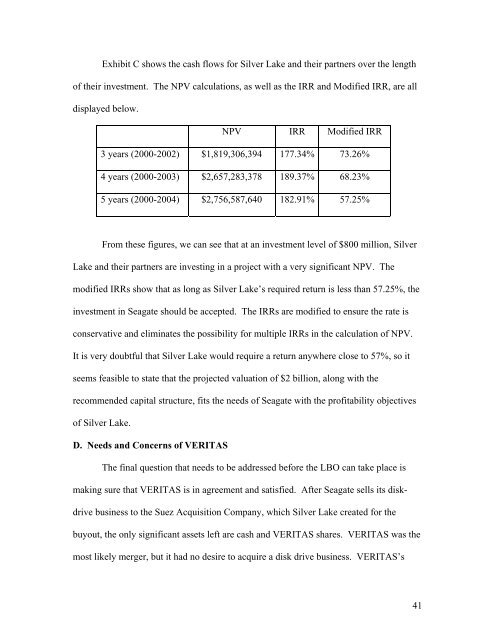

Exhibit C shows the cash flows for Silver Lake and their partners over the length<br />

of their investment. The NPV calculations, as well as the IRR and Modified IRR, are all<br />

displayed below.<br />

NPV IRR Modified IRR<br />

3 years (2000-2002) $1,819,306,394 177.34% 73.26%<br />

4 years (2000-2003) $2,657,283,378 189.37% 68.23%<br />

5 years (2000-2004) $2,756,587,640 182.91% 57.25%<br />

From these figures, we can see that at an investment level of $800 million, Silver<br />

Lake and their partners are investing in a project with a very significant NPV. The<br />

modified IRRs show that as long as Silver Lake’s required return is less than 57.25%, the<br />

investment in Seagate should be accepted. The IRRs are modified to ensure the rate is<br />

conservative and eliminates the possibility for multiple IRRs in the calculation of NPV.<br />

It is very doubtful that Silver Lake would require a return anywhere close to 57%, so it<br />

seems feasible to state that the projected valuation of $2 billion, along with the<br />

recommended capital structure, fits the needs of Seagate with the profitability objectives<br />

of Silver Lake.<br />

D. Needs and Concerns of VERITAS<br />

The final question that needs to be addressed before the LBO can take place is<br />

making sure that VERITAS is in agreement and satisfied. After Seagate sells its disk-<br />

drive business to the Suez Acquisition Company, which Silver Lake created for the<br />

buyout, the only significant assets left are cash and VERITAS shares. VERITAS was the<br />

most likely merger, but it had no desire to acquire a disk drive business. VERITAS’s<br />

41