Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Seagate<br />

Averages (1981-<br />

1999)<br />

Disk Drive Industry<br />

Median Averages (1981-<br />

1999)<br />

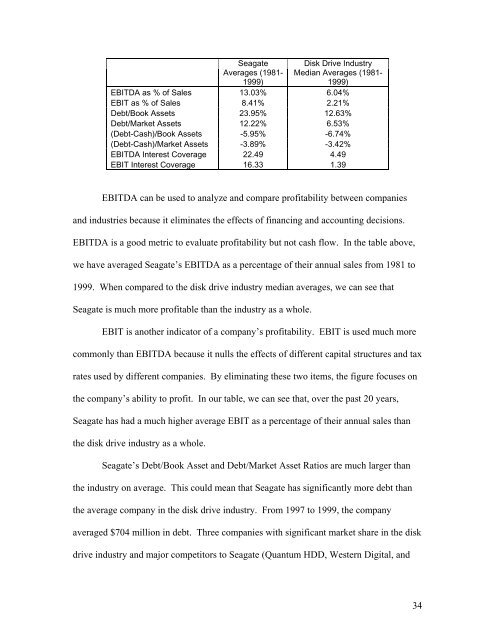

EBITDA as % of Sales 13.03% 6.04%<br />

EBIT as % of Sales 8.41% 2.21%<br />

Debt/Book Assets 23.95% 12.63%<br />

Debt/Market Assets 12.22% 6.53%<br />

(Debt-Cash)/Book Assets -5.95% -6.74%<br />

(Debt-Cash)/Market Assets -3.89% -3.42%<br />

EBITDA Interest Coverage 22.49 4.49<br />

EBIT Interest Coverage 16.33 1.39<br />

EBITDA can be used to analyze and compare profitability between companies<br />

and industries because it eliminates the effects of financing and accounting decisions.<br />

EBITDA is a good metric to evaluate profitability but not cash flow. In the table above,<br />

we have averaged Seagate’s EBITDA as a percentage of their annual sales from 1981 to<br />

1999. When compared to the disk drive industry median averages, we can see that<br />

Seagate is much more profitable than the industry as a whole.<br />

EBIT is another indicator of a company’s profitability. EBIT is used much more<br />

commonly than EBITDA because it nulls the effects of different capital structures and tax<br />

rates used by different companies. By eliminating these two items, the figure focuses on<br />

the company’s ability to profit. In our table, we can see that, over the past 20 years,<br />

Seagate has had a much higher average EBIT as a percentage of their annual sales than<br />

the disk drive industry as a whole.<br />

Seagate’s Debt/Book Asset and Debt/Market Asset Ratios are much larger than<br />

the industry on average. This could mean that Seagate has significantly more debt than<br />

the average company in the disk drive industry. From 1997 to 1999, the company<br />

averaged $704 million in debt. Three companies with significant market share in the disk<br />

drive industry and major competitors to Seagate (Quantum HDD, Western Digital, and<br />

34