Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

Melissa Bockhold Heather Coddington - Franklin College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

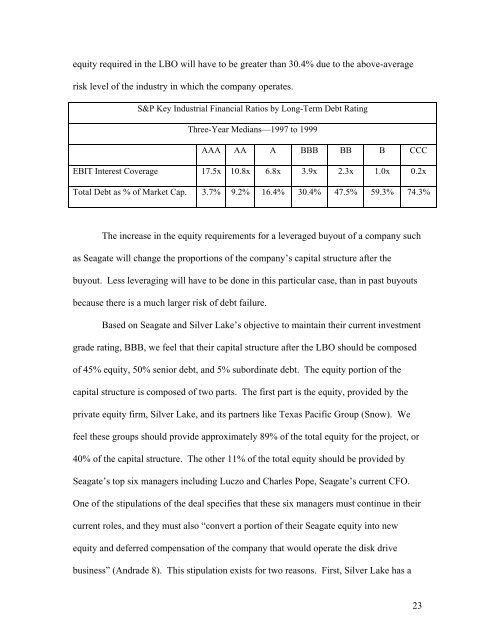

equity required in the LBO will have to be greater than 30.4% due to the above-average<br />

risk level of the industry in which the company operates.<br />

S&P Key Industrial Financial Ratios by Long-Term Debt Rating<br />

Three-Year Medians—1997 to 1999<br />

AAA AA A BBB BB B CCC<br />

EBIT Interest Coverage 17.5x 10.8x 6.8x 3.9x 2.3x 1.0x 0.2x<br />

Total Debt as % of Market Cap. 3.7% 9.2% 16.4% 30.4% 47.5% 59.3% 74.3%<br />

The increase in the equity requirements for a leveraged buyout of a company such<br />

as Seagate will change the proportions of the company’s capital structure after the<br />

buyout. Less leveraging will have to be done in this particular case, than in past buyouts<br />

because there is a much larger risk of debt failure.<br />

Based on Seagate and Silver Lake’s objective to maintain their current investment<br />

grade rating, BBB, we feel that their capital structure after the LBO should be composed<br />

of 45% equity, 50% senior debt, and 5% subordinate debt. The equity portion of the<br />

capital structure is composed of two parts. The first part is the equity, provided by the<br />

private equity firm, Silver Lake, and its partners like Texas Pacific Group (Snow). We<br />

feel these groups should provide approximately 89% of the total equity for the project, or<br />

40% of the capital structure. The other 11% of the total equity should be provided by<br />

Seagate’s top six managers including Luczo and Charles Pope, Seagate’s current CFO.<br />

One of the stipulations of the deal specifies that these six managers must continue in their<br />

current roles, and they must also “convert a portion of their Seagate equity into new<br />

equity and deferred compensation of the company that would operate the disk drive<br />

business” (Andrade 8). This stipulation exists for two reasons. First, Silver Lake has a<br />

23