Consumer protection diagnostic study - FSD Kenya

Consumer protection diagnostic study - FSD Kenya

Consumer protection diagnostic study - FSD Kenya

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8 • CONSUMER PROTECTION DIAGNOSTIC STUDY: KENYA<br />

Nyamithi who was unable to pay for the loan so (the MFI) went to their place<br />

to get the things so they could auction them. On hearing that since the person<br />

also owed (another MFI) some money they also decided to go to the home. So<br />

both groups met and took everything.” This was consistent across semi-formal<br />

and formal lenders.<br />

4.4 INSURANCE<br />

According to the consumer <strong>protection</strong> survey, 26% of respondents held life<br />

insurance, 3% medical insurance, 6% house-building or contents insurance<br />

and a negligible percentage auto insurance. 12<br />

Most FGD respondents did not have experience with insurance. Among those<br />

that did, the experience was often not positive. Most complaints that surfaced<br />

in the FGDs centered on salespeople not clearly explaining the products,<br />

resulting in users not receiving the package they had envisioned. As one man<br />

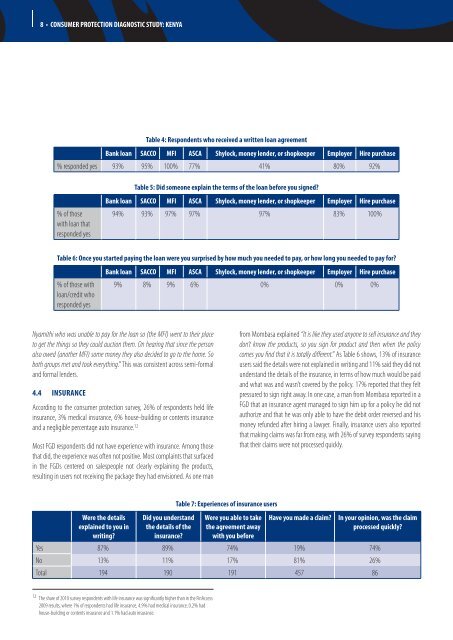

Table 4: Respondents who received a written loan agreement<br />

Bank loan SACCO MFI ASCA Shylock, money lender, or shopkeeper Employer Hire purchase<br />

% responded yes 93% 95% 100% 77% 41% 80% 92%<br />

% of those<br />

with loan that<br />

responded yes<br />

Table 5: Did someone explain the terms of the loan before you signed?<br />

Bank loan SACCO MFI ASCA Shylock, money lender, or shopkeeper Employer Hire purchase<br />

Table 6: Once you started paying the loan were you surprised by how much you needed to pay, or how long you needed to pay for?<br />

% of those with<br />

loan/credit who<br />

responded yes<br />

Were the details<br />

explained to you in<br />

writing?<br />

94% 93% 97% 97% 97% 83% 100%<br />

Bank loan SACCO MFI ASCA Shylock, money lender, or shopkeeper Employer Hire purchase<br />

9% 8% 9% 6% 0% 0% 0%<br />

Did you understand<br />

the details of the<br />

insurance?<br />

Table 7: Experiences of insurance users<br />

Were you able to take<br />

the agreement away<br />

with you before<br />

from Mombasa explained “It is like they used anyone to sell insurance and they<br />

don’t know the products, so you sign for product and then when the policy<br />

comes you find that it is totally different.” As Table 6 shows, 13% of insurance<br />

users said the details were not explained in writing and 11% said they did not<br />

understand the details of the insurance, in terms of how much would be paid<br />

and what was and wasn’t covered by the policy. 17% reported that they felt<br />

pressured to sign right away. In one case, a man from Mombasa reported in a<br />

FGD that an insurance agent managed to sign him up for a policy he did not<br />

authorize and that he was only able to have the debit order reversed and his<br />

money refunded after hiring a lawyer. Finally, insurance users also reported<br />

that making claims was far from easy, with 26% of survey respondents saying<br />

that their claims were not processed quickly.<br />

Have you made a claim? In your opinion, was the claim<br />

processed quickly?<br />

Yes 87% 89% 74% 19% 74%<br />

No 13% 11% 17% 81% 26%<br />

Total 194 190 191 457 86<br />

12 The share of 2010 survey respondents with life insurance was significantly higher than in the FinAccess<br />

2009 results, where 1% of respondents had life insurance, 4.9% had medical insurance, 0.2% had<br />

house-building or contents insurance and 1.1% had auto insurance.