AGRICULTURAL VALUe ChAIn FInAnCInG In KenYA

AGRICULTURAL VALUe ChAIn FInAnCInG In KenYA

AGRICULTURAL VALUe ChAIn FInAnCInG In KenYA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14 • <strong>AGRICULTURAL</strong> VALUE CHAIN FINANCING IN KENYA: ASSESSMENT OF POTENTIAL OPPORTUNITIES FOR GROWTH<br />

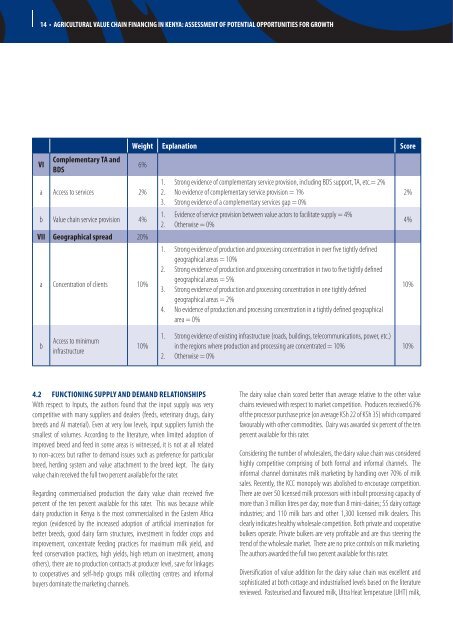

VI<br />

Complementary Ta and<br />

BDS<br />

Weight Explanation Score<br />

6%<br />

a Access to services 2%<br />

b Value chain service provision 4%<br />

VII Geographical spread 20%<br />

a Concentration of clients 10%<br />

b<br />

Access to minimum<br />

infrastructure<br />

10%<br />

4.2 FUNCTIONING SUPPLY aND DEMaND RELaTIONSHIPS<br />

With respect to <strong>In</strong>puts, the authors found that the input supply was very<br />

competitive with many suppliers and dealers (feeds, veterinary drugs, dairy<br />

breeds and AI material). Even at very low levels, input suppliers furnish the<br />

smallest of volumes. According to the literature, when limited adoption of<br />

improved breed and feed in some areas is witnessed, it is not at all related<br />

to non-access but rather to demand issues such as preference for particular<br />

breed, herding system and value attachment to the breed kept. The dairy<br />

value chain received the full two percent available for the rater.<br />

Regarding commercialised production the dairy value chain received five<br />

percent of the ten percent available for this rater. This was because while<br />

dairy production in Kenya is the most commercialised in the Eastern Africa<br />

region (evidenced by the increased adoption of artificial insemination for<br />

better breeds, good dairy farm structures, investment in fodder crops and<br />

improvement, concentrate feeding practices for maximum milk yield, and<br />

feed conservation practices, high yields, high return on investment, among<br />

others), there are no production contracts at producer level, save for linkages<br />

to cooperatives and self-help groups milk collecting centres and informal<br />

buyers dominate the marketing channels.<br />

1.<br />

2.<br />

3.<br />

1.<br />

2.<br />

1.<br />

2.<br />

3.<br />

4.<br />

1.<br />

2.<br />

Strong evidence of complementary service provision, including BDS support, TA, etc.= 2%<br />

No evidence of complementary service provision = 1%<br />

Strong evidence of a complementary services gap = 0%<br />

Evidence of service provision between value actors to facilitate supply = 4%<br />

Otherwise = 0%<br />

Strong evidence of production and processing concentration in over five tightly defined<br />

geographical areas = 10%<br />

Strong evidence of production and processing concentration in two to five tightly defined<br />

geographical areas = 5%<br />

Strong evidence of production and processing concentration in one tightly defined<br />

geographical areas = 2%<br />

No evidence of production and processing concentration in a tightly defined geographical<br />

area = 0%<br />

Strong evidence of existing infrastructure (roads, buildings, telecommunications, power, etc.)<br />

in the regions where production and processing are concentrated = 10%<br />

Otherwise = 0%<br />

2%<br />

4%<br />

10%<br />

10%<br />

The dairy value chain scored better than average relative to the other value<br />

chains reviewed with respect to market competition. Producers received 63%<br />

of the processor purchase price (on average KSh 22 of KSh 35) which compared<br />

favourably with other commodities. Dairy was awarded six percent of the ten<br />

percent available for this rater.<br />

Considering the number of wholesalers, the dairy value chain was considered<br />

highly competitive comprising of both formal and informal channels. The<br />

informal channel dominates milk marketing by handling over 70% of milk<br />

sales. Recently, the KCC monopoly was abolished to encourage competition.<br />

There are over 50 licensed milk processors with inbuilt processing capacity of<br />

more than 3 million litres per day; more than 8 mini-dairies; 55 dairy cottage<br />

industries; and 110 milk bars and other 1,300 licensed milk dealers. This<br />

clearly indicates healthy wholesale competition. Both private and cooperative<br />

bulkers operate. Private bulkers are very profitable and are thus steering the<br />

trend of the wholesale market. There are no price controls on milk marketing.<br />

The authors awarded the full two percent available for this rater.<br />

Diversification of value addition for the dairy value chain was excellent and<br />

sophisticated at both cottage and industrialised levels based on the literature<br />

reviewed. Pasteurised and flavoured milk, Ultra Heat Temperature (UHT) milk,