Talk Business

Are you seeking finance? Have you approached financiers and been turned away? With a number of ‘Sources of Finance’ now available to SMEs, it is important to ensure the right finance is sought for the business. Successfully securing finance comes down to a few key considerations whether the financier is a Bank, a Business Angel, or a Crowd. The Seminar will discuss key points to address when approaching various financiers. We’ll be on Stand 556. Talk to us about your business needs and let us help your venture succeed. Tweet us now @NoorBiz using #BeBizSmart and let us know you’ll be dropping by. See you there!

Are you seeking finance? Have you approached financiers and been turned

away? With a number of ‘Sources of Finance’ now available to SMEs, it is

important to ensure the right finance is sought for the business. Successfully

securing finance comes down to a few key considerations whether the

financier is a Bank, a Business Angel, or a Crowd. The Seminar will discuss

key points to address when approaching various financiers.

We’ll be on Stand 556. Talk to us about your business needs and let us help

your venture succeed. Tweet us now @NoorBiz using #BeBizSmart and let

us know you’ll be dropping by. See you there!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

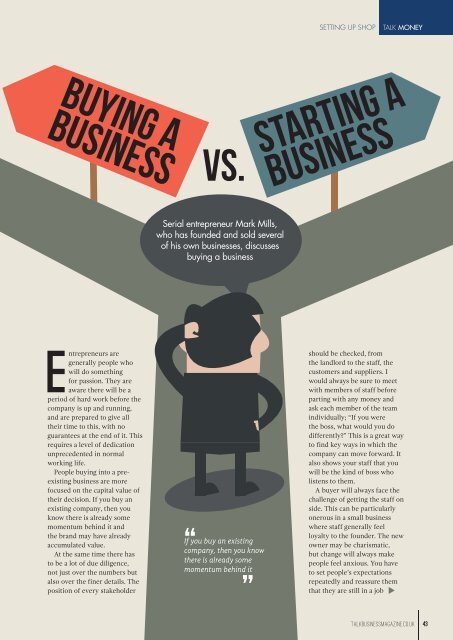

SETTING UP SHOP<br />

TALK MONEY<br />

Buying a<br />

business<br />

vs.<br />

starting a<br />

business<br />

Serial entrepreneur Mark Mills,<br />

who has founded and sold several<br />

of his own businesses, discusses<br />

buying a business<br />

Entrepreneurs are<br />

generally people who<br />

will do something<br />

for passion. They are<br />

aware there will be a<br />

period of hard work before the<br />

company is up and running,<br />

and are prepared to give all<br />

their time to this, with no<br />

guarantees at the end of it. This<br />

requires a level of dedication<br />

unprecedented in normal<br />

working life.<br />

People buying into a preexisting<br />

business are more<br />

focused on the capital value of<br />

their decision. If you buy an<br />

existing company, then you<br />

know there is already some<br />

momentum behind it and<br />

the brand may have already<br />

accumulated value.<br />

At the same time there has<br />

to be a lot of due diligence,<br />

not just over the numbers but<br />

also over the finer details. The<br />

position of every stakeholder<br />

If you buy an existing<br />

company, then you know<br />

there is already some<br />

momentum behind it<br />

should be checked, from<br />

the landlord to the staff, the<br />

customers and suppliers. I<br />

would always be sure to meet<br />

with members of staff before<br />

parting with any money and<br />

ask each member of the team<br />

individually; “If you were<br />

the boss, what would you do<br />

differently?” This is a great way<br />

to find key ways in which the<br />

company can move forward. It<br />

also shows your staff that you<br />

will be the kind of boss who<br />

listens to them.<br />

A buyer will always face the<br />

challenge of getting the staff on<br />

side. This can be particularly<br />

onerous in a small business<br />

where staff generally feel<br />

loyalty to the founder. The new<br />

owner may be charismatic,<br />

but change will always make<br />

people feel anxious. You have<br />

to set people’s expectations<br />

repeatedly and reassure them<br />

that they are still in a job<br />

talkbusinessmagazine.co.uk<br />

43