Wedding Industry - IBISWorld

Wedding Industry - IBISWorld

Wedding Industry - IBISWorld

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Clearly, all of these categories have a sizable<br />

sensitivity to wedding demand drivers such as<br />

number of engagements, per capita disposable<br />

income, unemployment levels and job security,<br />

and consumer confidence. At the same time, each<br />

of the seven revenue sources has unique risks and<br />

key success factors. The wedding industry cannot<br />

be grouped into a single frame when determining<br />

how much a lender may need to financially support<br />

a business. Rather, each sector must be reviewed<br />

individually and its operators evaluated in terms of<br />

other sources of revenue and the competition from<br />

other industries providing similar services.<br />

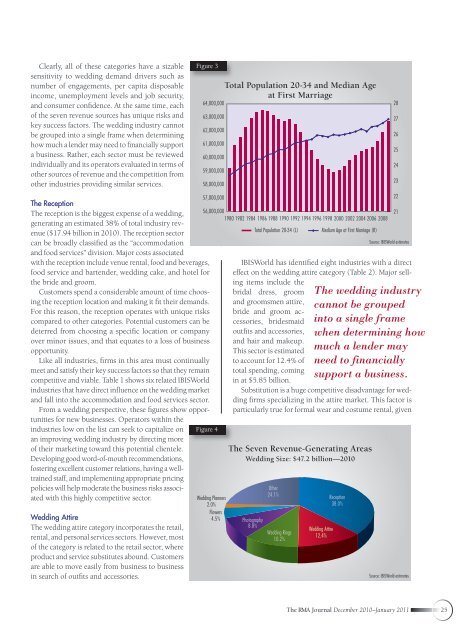

Figure 3<br />

64,000,000<br />

63,000,000<br />

62,000,000<br />

61,000,000<br />

60,000,000<br />

59,000,000<br />

58,000,000<br />

Total Population 20-34 and Median Age<br />

at First Marriage<br />

28<br />

27<br />

26<br />

25<br />

24<br />

23<br />

The Reception<br />

The reception is the biggest expense of a wedding,<br />

generating an estimated 38% of total industry revenue<br />

($17.94 billion in 2010). The reception sector<br />

can be broadly classified as the “accommodation<br />

and food services” division. Major costs associated<br />

with the reception include venue rental, food and beverages,<br />

food service and bartender, wedding cake, and hotel for<br />

the bride and groom.<br />

Customers spend a considerable amount of time choosing<br />

the reception location and making it fit their demands.<br />

For this reason, the reception operates with unique risks<br />

compared to other categories. Potential customers can be<br />

deterred from choosing a specific location or company<br />

over minor issues, and that equates to a loss of business<br />

opportunity.<br />

Like all industries, firms in this area must continually<br />

meet and satisfy their key success factors so that they remain<br />

competitive and viable. Table 1 shows six related <strong>IBISWorld</strong><br />

industries that have direct influence on the wedding market<br />

and fall into the accommodation and food services sector.<br />

From a wedding perspective, these figures show opportunities<br />

for new businesses. Operators within the<br />

industries low on the list can seek to capitalize on<br />

an improving wedding industry by directing more<br />

of their marketing toward this potential clientele.<br />

Developing good word-of-mouth recommendations,<br />

fostering excellent customer relations, having a welltrained<br />

staff, and implementing appropriate pricing<br />

policies will help moderate the business risks associated<br />

with this highly competitive sector.<br />

<strong>Wedding</strong> Attire<br />

The wedding attire category incorporates the retail,<br />

rental, and personal services sectors. However, most<br />

of the category is related to the retail sector, where<br />

product and service substitutes abound. Customers<br />

are able to move easily from business to business<br />

in search of outfits and accessories.<br />

57,000,000<br />

56,000,000<br />

1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008<br />

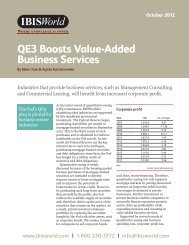

Figure 4<br />

Total Population 20-34 (L)<br />

<strong>IBISWorld</strong> has identified eight industries with a direct<br />

effect on the wedding attire category (Table 2). Major selling<br />

items include the<br />

bridal dress, groom<br />

and groomsmen attire,<br />

bride and groom accessories,<br />

bridesmaid<br />

outfits and accessories,<br />

and hair and makeup.<br />

This sector is estimated<br />

to account for 12.4% of<br />

total spending, coming<br />

in at $5.85 billion.<br />

Medium Age at First Marriage (R)<br />

Substitution is a huge competitive disadvantage for wedding<br />

firms specializing in the attire market. This factor is<br />

particularly true for formal wear and costume rental, given<br />

The Seven Revenue-Generating Areas<br />

<strong>Wedding</strong> Size: $47.2 billion—2010<br />

<strong>Wedding</strong> Planners<br />

2.0%<br />

Flowers<br />

4.5% Photography<br />

8.8%<br />

Other<br />

24.1%<br />

<strong>Wedding</strong> Rings<br />

10.2%<br />

22<br />

21<br />

Source: <strong>IBISWorld</strong> estimates<br />

The wedding industry<br />

cannot be grouped<br />

into a single frame<br />

when determining how<br />

much a lender may<br />

need to financially<br />

support a business.<br />

<strong>Wedding</strong> Attire<br />

12.4%<br />

Reception<br />

38.0%<br />

Source: <strong>IBISWorld</strong> estimates<br />

The RMA Journal December 2010–January 2011 25