Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

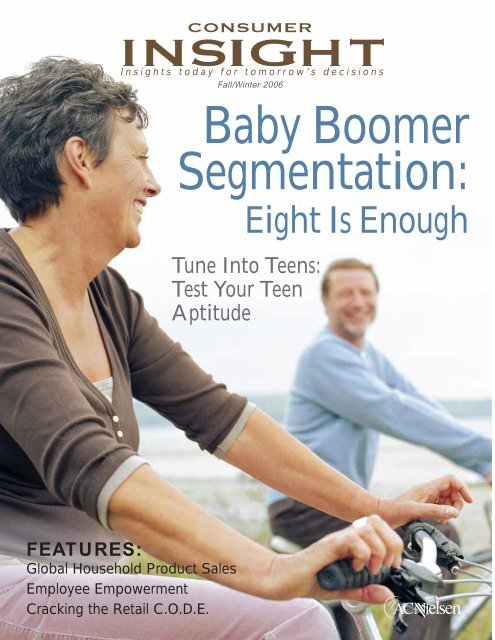

CONSUMER<br />

Insights today for tomorrow’s decisions<br />

Fall/Winter 2006<br />

<strong>Baby</strong> <strong>Boomer</strong><br />

<strong>Segmentation</strong>:<br />

Eight Is Enough<br />

Tune Into Teens:<br />

Test Your Teen<br />

Aptitude<br />

FEATURES:<br />

Global Household Product Sales<br />

Employee Empowerment<br />

Cracking the Retail C.O.D.E.

Consumer<br />

Insight:<br />

Seeing Tomorrow…Today<br />

In every issue…<br />

Volume 8, No. 3<br />

Trendwatch<br />

Walk-In Retail Clinics: A Healthy Savings Idea<br />

Publisher<br />

ACNielsen<br />

Editors<br />

Laurel Kennedy<br />

Kathy Mancini<br />

Design & Layout<br />

Blue Lemon Design<br />

Editorial Board<br />

Joe Bucherer<br />

Carolyn Calzavara<br />

Mark Chesney<br />

Tiffany Graves<br />

Todd Hale<br />

Laurel Kennedy<br />

Dan Lyman<br />

Kathy Mancini<br />

Troy Noble<br />

Danell O’Neill<br />

Tom Pirovano<br />

Lori Tanking<br />

Contributing Writers<br />

Doug Anderson<br />

Research & Development<br />

ACNielsen Homescan & Spectra<br />

Joe Bucherer<br />

<strong>Segmentation</strong> Analytics<br />

ACNielsen Homescan & Spectra<br />

Jon Busman<br />

Marketing<br />

ACNielsen Homescan & Spectra<br />

Mark Chesney<br />

Communications<br />

ACNielsen Global Services<br />

Russell Evans<br />

Business Technology Solutions<br />

ACNielsen<br />

Todd Hale<br />

Thought Leadership<br />

ACNielsen Homescan & Spectra<br />

Laurel Kennedy<br />

Marketing Strategy<br />

Age Lessons<br />

Jane Perrin<br />

Communications<br />

ACNielsen Global Services<br />

Tom Pirovano<br />

Retailing Insights<br />

ACNielsen<br />

Bill Rouse<br />

Wal-Mart Analytics<br />

ACNielsen Homescan & Spectra<br />

For More Information<br />

ACNielsen U.S.<br />

150 North Martingale Road<br />

Schaumburg, IL 60173<br />

800.988.4ACN<br />

www.acnielsen.com/ci<br />

Copyright © 2006 ACNielsen. Printed in USA. All rights reserved. ACNielsen, ACNielsen with<br />

globe design, ACNielsen Answers, Homescan, LabelTrends and Scantrack are trademarks or<br />

registered trademarks of ACNielsen (US), Inc. Spectra and Consumer Trade Areas are trademarks<br />

or registered trademarks of Spectra Marketing Systems, Inc. Other brand, product or<br />

service names are trademarks or registered trademarks of their respective companies.

4<br />

On<br />

the Cover:<br />

<strong>Baby</strong> <strong>Boomer</strong><br />

<strong>Segmentation</strong><br />

contents<br />

4 <strong>Baby</strong> <strong>Boomer</strong> <strong>Segmentation</strong>: Eight is Enough<br />

Given its relative size and influence on U.S. consumer markets,<br />

surprisingly little formal, quantitative segmentation work has been<br />

conducted on <strong>Baby</strong> <strong>Boomer</strong>s. The question remains: how to right-size<br />

the huge <strong>Boomer</strong> cohort? How many segments would capture the<br />

important often subtle nuances that can spell the difference between a<br />

successful new product launch or marketing campaign and a complete<br />

misfire? Turns out, eight segments is enough.<br />

20<br />

Global<br />

Household<br />

Product Sales:<br />

Innovative Items<br />

Clean Up<br />

12<br />

12 Global Household Product Sales:<br />

Innovative Items Clean Up<br />

Analyzing household products on a global scale involves a pretty big<br />

bucket of categories and countries. What’s Hot Around the Globe—<br />

Insights on Growth in Household Products, one in a series of ACNielsen<br />

reports on the fastest-growing products and category drivers, encompasses<br />

66 markets and 29 household product areas.<br />

20 Tune Into Teens: Test Your Teen Aptitude<br />

Teens are a moving target. They were born and raised during a digitized<br />

age where change happens rapidly. Born into the MTV generation where<br />

the rally cry was “I want my MTV”, they have learned that what they want,<br />

they get. In their world, everything is immediate. From instant messaging<br />

to microwave meals, instant gratification is their mantra.<br />

28 Employee Empowerment:<br />

The Key to Capturing Productivity<br />

Ask any successful salesperson, and they’ll tell you that timely, accurate<br />

information represents the best armor they’ve got in the profit wars.<br />

The bulletproof concept resonates with every salesperson who has<br />

ever had to sell-in a new product, argue a price increase or stave off a<br />

competitive threat. To be effective in today’s hyper-charged, customized,<br />

store-level–focused retail environment, salespeople need a virtual arsenal<br />

of presentations capable of being refreshed with current data at the<br />

touch of a button.<br />

34 Gas Price Hikes Put Brakes on Spending<br />

Crude oil prices ignited again this summer, surpassing the $70 a barrel<br />

threshold and pushing prices at the pump to an inflammatory $3+ per<br />

gallon. Factors like market speculation, refinery capacity shortages and<br />

a pronounced decline in spare global oil production converged, leaving<br />

cash-strapped consumers scrambling to adjust budgets and spending<br />

accordingly.<br />

Tune Into Teens: Test<br />

Your Teen Aptitude<br />

34<br />

Gas Price Hikes<br />

Put Brakes on<br />

Spending<br />

28<br />

Employee<br />

Empowerment:<br />

The Key to<br />

Capturing<br />

Productivity<br />

42 Cracking the Retail C.O.D.E.<br />

Winning at retail is enabled by applying a simple, systematic four-step<br />

process that we call “Cracking the Retail C.O.D.E.” The methodology<br />

employs a series of critical steps to optimize brand or product success<br />

in the marketplace. This consumer-centric approach links actions in the<br />

store—where they matter the most—back to the consumers most likely<br />

to purchase your brand.<br />

50 Trendwatch—Walk-In Retail Clinics:<br />

A Healthy Savings Idea<br />

“Would you like some chicken soup with that prescription?” While grocery<br />

stores have always stocked this form of “liquid penicillin”, today they’re<br />

home to the real deal—walk-in clinics staffed by nurse practitioners<br />

licensed to diagnose and treat common conditions such as allergies,<br />

bladder infections, bronchitis, ear infections, the flu, heartburn, muscle<br />

pain, pink eye, minor burns and rashes.

Overview<br />

ACNielsen recently completed the 15th edition of its annual<br />

Trade Promotion Practices Study which has traced industry<br />

promotion budget and allocation trends on the manufacturer<br />

side for 15 years, and corresponding retailer practices for nine<br />

years. The longitudinal view of spending habits and preferences<br />

affords unique insights into the ebb and flow of promotional<br />

methods through time, and an enlightened look at the similarities<br />

and differences between these trade partners.<br />

Conducted via the Internet, the online survey polled senior sales<br />

and marketing executives from 61 manufacturers and 38 retailer<br />

organizations. The electronic field work was supplemented<br />

with in-depth telephone interviews to more fully develop areas<br />

of special interest. The Trade Promotion Practices Study has<br />

been distributed to ACNielsen clients and is available for purchase<br />

on our website at http://www.acnielsen.com/store.<br />

Benchmarking performance<br />

Perennial favorite topics up for debate include the efficacy of<br />

frequent shopper programs and an assessment of which elements<br />

in the category management tool kit (assortment planning,<br />

promotional planning, shelf management, category business<br />

planning, everyday low pricing, frequent shopper/loyalty<br />

programs, micro-merchandising and micro-marketing) have<br />

gained or lost favor in the calendar year.<br />

A matter of opinion<br />

While retailers and manufacturers disagreed on any number of<br />

issues ranging from the sufficiency of trade promotion dollars<br />

to the effectiveness of shelf management, there were five areas<br />

of accord. The following topics were identified by both groups<br />

as critical success factors important to their business:<br />

1. understanding consumers<br />

2. new product introductions/implementation<br />

3. category management<br />

4. promotion efficiency/effectiveness<br />

5. variety and assortment<br />

Additionally, each faction identified important subjects specific<br />

to their operations. In the case of retailers, those subjects<br />

included private label activities and customer loyalty/retention<br />

programs. In the case of manufacturers, those subjects included<br />

trade partners, vendor relationships and category management.<br />

Tailoring content<br />

With study input available to guide editorial selections, the<br />

Fall/Winter issue of Consumer Insight magazine serves up a<br />

number of articles that directly address the top-ranked concerns<br />

of retailers and manufacturers. When it comes to understanding<br />

consumers (factor 1), the publication places the two largest<br />

age cohorts in the U.S. squarely in the crosshairs—<strong>Baby</strong><br />

<strong>Boomer</strong>s and Millennials.<br />

The article titled “<strong>Baby</strong> <strong>Boomer</strong> <strong>Segmentation</strong>: Eight is<br />

Enough” introduces a robust segmentation model from<br />

ACNielsen Homescan & Spectra, based on the single<br />

most influential determinant of consumer purchase behavior—<br />

household composition, and in particular, presence of<br />

children in the home.<br />

The mantra “it’s all good” describes the teen scene in the article<br />

titled “Tune into Teens” for marketers who take the time to<br />

understand the zeitgeist of Millennials and their propensity for<br />

electronic multi-tasking. While teens may not have the bank<br />

accounts to purchase big ticket items, their influence over<br />

household spending decisions is undeniable.<br />

New product intros<br />

Opening a window onto the global new product scene<br />

(factor 2), the article titled “Global Household Product Sales:<br />

Innovative Items Clean Up” analyzes the packaging, ingredient<br />

and social trends that contribute to successful new product<br />

uptake. Cleaning products with oxidizing properties swept<br />

the worldwide sales ratings, along with so-called system<br />

approaches to cleaning like the innovative Swiffer line.<br />

C.O.D.E. breakers<br />

For a comprehensive view of consumer-driven micromarketing,<br />

readers will want to spend time with the article<br />

titled “Cracking the Retail C.O.D.E.”, which touches on<br />

each of the critical success factors from the Trade Promotion<br />

Practices Study. Expanded, the acronym C.O.D.E. stands for<br />

2 Fall/Winter 2006

1. Consumer Profiling—accurately captures the<br />

demographic profile of the brand’s consumer.<br />

2. Opportunity Gapping—quantifies store-level<br />

opportunities based on consumer demand potential<br />

and diagnoses the prospect.<br />

3. Dynamic Clustering—groups similar stores using<br />

multiple store attributes, including shopper demographics,<br />

the competitive set, and upside opportunity.<br />

4. Executing for the Consumer—takes findings from steps<br />

1–3 and develops store-level tactical plans, giving<br />

the field force the right information to optimize<br />

in-store presence.<br />

Forward-looking insights<br />

With winter and the annual Consumer and Market Trends<br />

Report release approaching, more than the ambient<br />

temperature is dropping. The VNU Retailer Sentiment<br />

Index (RSI) saw a continuation of the downtrend which<br />

started in January 2005.<br />

Comprising monthly polls of roughly 500 retailers about<br />

current and future economic conditions, the VNU Retailer<br />

Sentiment Index also takes into account indicators such as<br />

store openings, hiring, earnings and general economic trends,<br />

synthesizing the input into a comprehensive view of current<br />

and future conditions.<br />

Traditionally, retailers cited the competitive environment as<br />

their top concern since the inception of the RSI. By midyear<br />

2006, for the first time, the overall economy knocked<br />

competition out of the top spot.<br />

Social responsibility<br />

This year’s Consumer and Market Trends Report exhibits a<br />

decidedly altruistic bent, delivered by two articles. One article<br />

outlines the rise in organic products and the downstream<br />

influence of Wal-Mart’s green commitment on the environment.<br />

The second article discusses how corporate sustainability and<br />

consumer pressure for environmental responsibility is sweeping<br />

through board rooms.<br />

True blue<br />

Segueing from the green theme, the Consumer and Market<br />

Trends Report will also cover the subject of true blue customers<br />

in a detailed article on the subject of loyalty marketing. The<br />

article walks through a framework for integrating a broad<br />

range of data from loyalty programs and POS numbers, to<br />

demographic profiles, attitudinal studies, share of wallet and<br />

promotional responsiveness to convert regular shoppers into<br />

loyal, high value customers.<br />

Classic updates<br />

Now in its tenth year, the Consumer and Market Trends<br />

Report will include updates on classic measures of industry<br />

performance including channel blurring and category summaries.<br />

The channel blurring article investigates the impact<br />

of consolidation on channel dominance and the behavior of<br />

valuable multi-channel shoppers, while the category review<br />

article examines results from the convenience channel.<br />

Pricing it right<br />

Price compression and assortment expansion are two opposing<br />

forces that define the fast-moving consumer goods climate of<br />

today. From our custom analytical group comes a detailed<br />

discussion of a repertoire modeling approach for simulating the<br />

impact of a price change on volume, share, revenue and profit.<br />

It’s all about you<br />

By lifting the curtain on this and future Consumer Insight<br />

articles, we hope to have piqued your interest in the publication,<br />

while demonstrating that we practice what we preach.<br />

You are our readers. You are our customers. And our goal is<br />

to provide customer-centric editorial content that addresses<br />

the fundamental needs of your business.<br />

To make sure that we stay on point, you can e-mail our<br />

editor at ConsumerInsight@acnielsen.com or contact<br />

your client service representative any time to make a<br />

suggestion that will improve our core product set or<br />

thought leadership publications. We’re listening. C i<br />

3

<strong>Baby</strong> <strong>Boomer</strong><br />

<strong>Segmentation</strong>:<br />

Eight Is Enough<br />

by: Doug Anderson<br />

Research & Development<br />

ACNielsen Homescan & Spectra<br />

Laurel Kennedy<br />

Marketing Strategy<br />

Age Lessons<br />

“The most important thing to remember about <strong>Boomer</strong>s is<br />

that they are rule breakers. Individuality over conformity is<br />

a consistent <strong>Boomer</strong> pattern. They always have done it<br />

differently than the way it was done before, and as they<br />

get older, they will continue to demand products that fit<br />

their individuality.”<br />

–From Rocking The Ages:<br />

The Yankelovich Report on Generational Marketing<br />

by J. Walker Smith & Ann Clurman<br />

Given its relative size and influence on U.S. consumer markets,<br />

surprisingly little formal, quantitative segmentation<br />

work has been conducted on <strong>Baby</strong> <strong>Boomer</strong>s. The question<br />

remains: how to right-size the huge <strong>Boomer</strong> cohort? How<br />

many segments would capture the important, often subtle,<br />

nuances that can spell the difference between a successful<br />

new product launch or marketing campaign and a complete<br />

misfire? Turns out, eight segments is enough.<br />

Often, when shaping products or programs for <strong>Boomer</strong>s,<br />

marketers have viewed this generation as a single, monolithic<br />

entity with lockstep needs and purchasing patterns. Akin to<br />

a “big gulp” theory, this framework poured every <strong>Boomer</strong><br />

into one purchasing pool of interchangeable consumers.<br />

That theory just doesn’t hold water.<br />

At best, marketers acknowledged the sweeping 19-year age<br />

span of 1946–1964, and using a little rough justice, split the<br />

segment in half or thirds, addressing campaigns to older or<br />

younger <strong>Boomer</strong>s. In this generational approach, age serves<br />

as an overly simplistic proxy for the correct measure—<br />

household composition.<br />

Under the generations method, rather than directly measuring<br />

the elements of household composition, observed differences<br />

in purchasing behavior are wrongly attributed to some<br />

underlying, shared social/political/cultural touchpoints.<br />

That theory is out of touch with marketplace realities.<br />

■ See chart 1.<br />

Chart 1: Finding the years of the <strong>Baby</strong> Boom is pretty easy…<br />

Annual Birth Rate of the United States<br />

35<br />

30<br />

25<br />

20<br />

15<br />

Small cohort of young<br />

post war adults<br />

+<br />

Higher incomes and a<br />

prosperous economy<br />

=<br />

Higher consumption—<br />

especially housing, autos,<br />

homes and appliances<br />

&<br />

Lots of children<br />

10<br />

1900<br />

1914<br />

1920<br />

1926<br />

1932<br />

1938<br />

1944<br />

1950<br />

1956<br />

1962<br />

1968<br />

1974<br />

1980<br />

1986<br />

1992<br />

1998<br />

4 Fall/Winter 2006

Simply put, there is no shared cultural milieu that resonates<br />

with all <strong>Baby</strong> <strong>Boomer</strong>s. Many age cohort members were neither<br />

born in the United States, nor grew up here, leaving the<br />

shared culture concept significantly diluted.<br />

Size matters<br />

When people hear the term <strong>Baby</strong> Boom generation, the first<br />

thing that comes to mind is its massive size. The second<br />

thing is its unabated appetite for conspicuous consumption.<br />

<strong>Boomer</strong>s have been tagged with superlatives since birth,<br />

re-shaping American culture and institutions to reflect their<br />

unique zeitgeist. Today, this age cohort is defined as follows:<br />

• The biggest age band in history, numbering some 77<br />

million persons<br />

Chart 2: Percent of <strong>Baby</strong> <strong>Boomer</strong> households<br />

by the behavioral consumer segments<br />

Trailing Edge<br />

Couples<br />

Leading Edge<br />

Couples<br />

Single<br />

<strong>Boomer</strong>s<br />

15.5<br />

22.1<br />

11.5<br />

New Family<br />

Frontiers<br />

11.3<br />

5.1<br />

9.3<br />

15.5<br />

9.8<br />

Ready to<br />

Launch<br />

Late Blooming<br />

<strong>Boomer</strong>s<br />

Trailing Edge<br />

Families<br />

Leading Edge<br />

Families<br />

• The highest earners, with a median household income of<br />

$54,170; 55% greater than post-<strong>Boomer</strong>s and 61% more<br />

than pre-<strong>Boomer</strong>s<br />

No Kids<br />

Source: ACNielsen Homescan & Spectra<br />

Kids

Chart 3: Segmenting <strong>Baby</strong> <strong>Boomer</strong> households with<br />

children less than 18<br />

Total <strong>Baby</strong><br />

<strong>Boomer</strong> HHs<br />

with Children<br />

Smaller Families<br />

Size 2–3<br />

Larger Families<br />

Size 4+<br />

Younger<br />

Children<br />

< 12 Only<br />

Late Blooming<br />

<strong>Boomer</strong>s<br />

Source: ACNielsen Homescan & Spectra<br />

Older<br />

Children<br />

12 +<br />

Ready to<br />

Launch<br />

Trailing Edge<br />

HOH<br />

Age 42–48<br />

Trailing Edge<br />

Families<br />

Leading Edge<br />

HOH<br />

Age 49–60<br />

Leading Edge<br />

Families<br />

Kid stuff<br />

Marketing to the <strong>Boomer</strong> segments with children is anything<br />

but child’s play. It requires an understanding of the nuances<br />

between the four groups. For example, highly educated Late<br />

Blooming <strong>Boomer</strong>s may have made the choice to start families<br />

later in life or are the by-product of divorce. As a result,<br />

Late Blooming <strong>Boomer</strong>s have smaller, younger families comprising<br />

one to two children under the age of 12. A single<br />

parent heads fully one-third of Late Blooming households,<br />

which also index above average for African-American and<br />

Asian ethnicities, but below average for Hispanics.<br />

Late Blooming heads of household span the entire <strong>Baby</strong><br />

<strong>Boomer</strong> age group. Since education correlates strongly with<br />

income, any attempt to divide <strong>Boomer</strong>s on the basis of age<br />

alone would clearly miss the mark here, and leave out a<br />

significant number of affluent Late Blooming households.<br />

■ See chart 3.<br />

Trailing Edge Families comprise larger, stable households<br />

of 4+ persons who have lived at the same address for more<br />

than five years. Unlike Late Blooming <strong>Boomer</strong>s, Trailing<br />

Edge heads of household fall into a narrow age parameter,<br />

sharing a birth date between the years 1958 and 1964.<br />

Averaging 2.5 children per household, they have far fewer<br />

(less than half as many) adult children than Leading Edge<br />

families, which appears to be a direct function of<br />

parental age.<br />

The least educated of any <strong>Boomer</strong> group, Trailing Edgers<br />

are even less educated than the post-<strong>Baby</strong> Boom cohort.<br />

Another note of internal segment consistency demarcating<br />

Trailing Edgers is the above average concentration of<br />

Hispanics populating the group, the most of any <strong>Boomer</strong><br />

sub-segment.<br />

Older, not necessarily wiser, kids<br />

Leading Edge Families feature older parents born between<br />

1946 and 1957, large households averaging 2.4 children,<br />

with approximately one “adult child” for every four children<br />

under age 18. As one might expect from the doting<br />

parents who pioneered those ubiquitous baby-on-board<br />

signs, the apron strings are proving hard to cut—or perhaps<br />

just more elastic—as young adult children bounce back to<br />

the security of home.<br />

The purse strings to Junior are even harder to untie. As a<br />

consequence, <strong>Boomer</strong> offspring are returning to the nest<br />

after college in record numbers, or remaining at home while<br />

getting their start in the working world. According to 2000<br />

U.S. Census figures, 56% of men and 43% of women in the<br />

18–24 age bracket reside with a parent, and 65% of recent<br />

college grads enjoy the largesse of Mom & Dad’s hospitality.<br />

While better educated than pre-and post-<strong>Boomer</strong>s, Leading<br />

Edge Families fall into the lower tier of academic accomplishment<br />

compared with other <strong>Boomer</strong> segments. After<br />

Trailing Edge Families, Leading Edge Families are the most<br />

Hispanic-dominant of any <strong>Boomer</strong> group and far and away<br />

the “most married.” Seven in ten Leading Edge Family<br />

households are headed by married couples.<br />

7

Chart 4: Segmenting <strong>Baby</strong> <strong>Boomer</strong> households<br />

without children<br />

Single<br />

<strong>Boomer</strong>s<br />

Single<br />

Person HHs<br />

Trailing Edge<br />

HOH<br />

Age 42–54<br />

Trailing Edge<br />

Couples<br />

Source: ACNielsen Homescan & Spectra<br />

Total <strong>Baby</strong><br />

<strong>Boomer</strong> HHs<br />

without Children<br />

Two<br />

Person HHs<br />

Leading Edge<br />

HOH<br />

Age 55–60<br />

Leading Edge<br />

Couples<br />

Three +<br />

Person HHs<br />

New Family<br />

Frontiers<br />

By contrast, the Ready-to-Launch segment weighs in with<br />

the lowest incidence of Hispanics and the highest incidence<br />

of African-Americans among <strong>Boomer</strong>s. All Ready-to-Launch<br />

households have at least one child over 12, and for the most<br />

part, only children over twelve, skewing toward the late<br />

teens. The Ready-to-Launch segment splits roughly in half<br />

between couples with one child and single parents with one<br />

or two children. Heads of household can be any age within<br />

the <strong>Boomer</strong> bandwidth, and there are few adult children<br />

in view.<br />

Adults only<br />

Apparently Single <strong>Boomer</strong>s hit the books in college, tying<br />

Late Bloomers for the title of “most educated.” Some 41%<br />

of Single <strong>Boomer</strong>s never opted for marriage, and established<br />

single households. Half of the Single segment unpacked<br />

their bags five or more years ago and still call the same<br />

residence home today. ■ See chart 4.<br />

Working<br />

Retirements<br />

Work long and prosper. That’s the new mantra of the <strong>Boomer</strong><br />

generation as it edges toward Social Security eligibility and<br />

retirement age. So hold on to those gold watches, because the<br />

<strong>Boomer</strong>s plan on retiring the traditional concept of retirement<br />

with a characteristically bold move that will surprise detractors<br />

and benefit—rather than hijack—the economic future of the<br />

generations that follow.<br />

The idea is simplicity itself: keep on working, earning and<br />

contributing to the economy for as long as one is able and<br />

enabled. Driven by a host of motivations ranging from selfactualization<br />

to financial need, many <strong>Boomer</strong>s reject the idea of<br />

a leisurely retirement and plan to work well into their 70s and<br />

beyond. In a 2006 Merrill Lynch study, 71% of adults envision<br />

working in retirement, and half of those said they intended to<br />

work as long as they were physically and intellectually able.<br />

Companies need the workers<br />

While the statistics vary dramatically (estimates of a labor shortage<br />

as early as 2010 range from 800,000 workers to almost<br />

10 million), the inescapable fact remains that the “baby bust”<br />

generation numbers 11 million fewer bodies than the <strong>Boomer</strong>s.<br />

Even with productivity gains, process changes, outsourcing<br />

options and immigration inflows, there simply may not be<br />

enough workers to fill available jobs. The obvious solution:<br />

retain the ones you’ve got.<br />

Progressive employers are experimenting with any number of<br />

riffs on the traditional consulting contracts or part-time positions<br />

available to retired employees. Among the more innovative<br />

working retirement ideas:<br />

• capability-specific personnel banks of skilled temporary<br />

workers;<br />

• roadblocking schedules, where retirees rotate between time<br />

on/off the job for a pre-determined time increment (e.g.,<br />

three months on/off);<br />

• job sharing, reviving what <strong>Boomer</strong> women elevated to an art<br />

form; two individuals sharing a job, salary and performance<br />

expectations;<br />

8 Fall/Winter 2006

Trailing Edge Couples carved their own path on the matrimonial<br />

front, and report the highest rate of unmarried<br />

partners living together. Trailing Edge Couples typically<br />

are headed by a person born in the 1952–1964 period,<br />

who have occupied the same house for the past five years,<br />

find themselves situated in the bottom <strong>Boomer</strong> tier on the<br />

education dimension, and have fewer than expected<br />

Hispanic and African-American members.<br />

The social vanguard<br />

Leading Edge Couples, with a head of household born<br />

between 1946 and 1951, represent the first group of the<br />

<strong>Boomer</strong> generation to serve as social change agents. One<br />

of the top three best-educated <strong>Boomer</strong> segments, Leading<br />

Edge Couples exhibit just half the unmarried rate of Trailing<br />

Edge Couples and two-thirds have shared a residence for<br />

five or more years. Less ethnically diverse than other<br />

<strong>Boomer</strong> strata, Leading Edge Couples report a low incidence<br />

of Hispanics and the lowest African-American incidence of<br />

all <strong>Boomer</strong> groups.<br />

One of the most interesting segments to emerge from the<br />

<strong>Boomer</strong> study was the New Family Frontiers faction, characterized<br />

by three or more adults sharing a household. The<br />

typical New Family Frontiers household encompasses 1.1<br />

children between the ages of 18 and 24, with 40% claiming<br />

another resident relative such as a parent (1/3 of such family<br />

units) or adult siblings.<br />

From an economic perspective, it is worthwhile to note that<br />

54% of New Family Frontiers households have three or<br />

more employed workers in the home. Among the highest<br />

earning households, New Family Frontiers do a pretty<br />

good job of hanging on to what they make, second only<br />

to Leading Edge Couples on the savings front.<br />

■ See chart 5 on page 10.<br />

• seasonal positions that follow employees who split time<br />

between two geographical locations (e.g., New York and<br />

Florida);<br />

• sampling arrangements that enable a worker to move<br />

across departments for a new challenge.<br />

<strong>Boomer</strong>s need the money<br />

It’s a good thing that <strong>Boomer</strong>s say they want to work, because<br />

it’s clear that many will have to work for financial reasons. One<br />

factor that impacted even diligent savers was the stock market<br />

decline of 2001–2003 that eradicated roughly $7–8 trillion in<br />

shareholder wealth, much of it held by <strong>Boomer</strong>s.<br />

In the process, the dot-com crash ate away some $279 billion<br />

in 401(k) assets and huge chunks of other retirement savings.<br />

<strong>Boomer</strong>s dialed-in to the nuances of finance recognize that<br />

401(k) and IRA/retirement money statements can create a false<br />

sense of wealth, since these amounts will be federally taxed on<br />

withdrawal (with the exception of Roth IRAs).<br />

Everybody wins<br />

Working <strong>Boomer</strong> retirees will have more discretionary income<br />

to continue fueling the economic engine, less need to draw<br />

down savings and liquidate investments, and can readily fill the<br />

emerging labor gap by staying employed. Meaningful employment<br />

enables critical knowledge transfer from highly skilled<br />

<strong>Boomer</strong>s to other workers, and keeps older employees mentally<br />

and physically engaged.<br />

At the same time, employers access a labor pool of proven<br />

workers with the flexibility to calibrate hours to match demand.<br />

In a Center for Retirement Research survey, older workers<br />

earned consistently higher marks than younger counterparts<br />

from employers for their “knowledge of procedures and other<br />

job aspects” and “ability to interact with customers”. Overall,<br />

older workers were seen as more productive based on their<br />

accumulated institutional knowledge and efficient work habits.<br />

Retailers like CVS Pharmacy, Home Depot and Borders have<br />

already tapped the retiree talent vein with outstanding results.<br />

When it comes to the workplace, some things apparently do<br />

get better with age.<br />

9

Chart 5: New family configurations have new numbers of workers<br />

100<br />

80<br />

Percent of HHs<br />

60<br />

40<br />

20<br />

0<br />

Post <strong>Baby</strong> Boom<br />

Late Blooming <strong>Boomer</strong>s<br />

Trailing Edge Families<br />

Leading Edge Families<br />

Ready to Launch<br />

Single <strong>Boomer</strong>s<br />

Trailing Edge Couples<br />

Leading Edge Couples<br />

New Family Frontiers<br />

Pre <strong>Baby</strong> Boom<br />

No Workers One Worker Two Workers Three or More Workers<br />

Source: ACNielsen Homescan & Spectra<br />

Gray matters<br />

The shift towards adult-only households will continue as<br />

<strong>Boomer</strong>s age. By 2007, fewer than 30% of <strong>Boomer</strong> households<br />

will have children under 18 at home. By 2010, that<br />

number will have declined again to just 20%. By 2014,<br />

fewer than 10% of all <strong>Boomer</strong> households will include<br />

children under 18. Americans are getting older, living<br />

longer and having fewer children.<br />

An 85+ population growing eight times faster than the<br />

country as a whole will throw a new wrinkle into longstanding<br />

assumptions which form the underpinnings of<br />

social services programs. In 1995, Federal spending per<br />

child under 18 years of age was $1,693 per child. For the<br />

same period, per capita spending on each 65+ adult was<br />

$15,636. The combined effect of population trends and<br />

federal spending patterns results in a double whammy—<br />

fewer wage earners paying into a system serving an<br />

exploding population base.<br />

Golden, global concerns<br />

Not only is the U.S. population aging, the very old component<br />

is growing at an even faster rate. In 2000, there were<br />

approximately 72,000 centenarians in the U.S. By 2050,<br />

using mid-range Census Bureau estimates, that number will<br />

increase fourteen-fold, exceeding 834,000. To get a relative<br />

sense of size, it would take a city as large as Detroit to<br />

house all the people older than 100 at the mid-century point.<br />

Concerns about aging are not confined within the borders<br />

of the United States. Worldwide, the current ratio between<br />

the young (under 20) and the old (over 65) is roughly 3:1.<br />

By 2050, that ratio will recalibrate to equilibrium at 1:1.<br />

At that point, older people will outnumber younger ones<br />

for the first time in recorded history.<br />

Spending shifts<br />

Consumption and spending patterns mirror changes in the<br />

<strong>Boomer</strong> demographic. Food away from home eats up a<br />

larger share of <strong>Boomer</strong> budgets when the need to stage a<br />

nightly family dinner with the kids goes away. Beer and<br />

wine top off the shopping list for those <strong>Boomer</strong>s furthest<br />

from child-rearing responsibilities. Alcoholic beverage marketers<br />

can expect to tap into this bottled-up demand in the<br />

future as consumption levels are expected to maintain even<br />

as <strong>Boomer</strong>s age.<br />

When it comes to home improvements, <strong>Boomer</strong>s gravitate<br />

toward household textiles and furniture, outspending other<br />

segments. Staying connected to friends and families is a<br />

10 Fall/Winter 2006

It is not uncommon to find a <strong>Boomer</strong> parent liquidating<br />

retirement savings or mortgaging their home to subsidize<br />

their child’s college tuition. Despite years of denying themselves<br />

luxuries, they will indulge an offspring’s demands for<br />

a car, expensive vacation or the latest and greatest in consumer<br />

electronics.<br />

A perfect storm<br />

The graying of America presents a number of questions such<br />

as the prospective impact of impending retirements on:<br />

1. financial markets, as <strong>Boomer</strong>s prepare to liquidate equity<br />

holdings and supplement retirement savings;<br />

2. real estate markets, as <strong>Boomer</strong>s prepare to trade down<br />

from large homes—a flurry of sales may add momentum<br />

to the imploding housing market;<br />

3. employment issues, as <strong>Boomer</strong>s exit the workplace and<br />

the baby bust generation comes up 11 million people<br />

short of available openings;<br />

4. consumer spending, as <strong>Boomer</strong>s retire or are forced into<br />

second careers, part-time or lower paying positions;<br />

<strong>Boomer</strong> imperative, accounting for their 50% higher spending<br />

rate on cellular phones and pagers. Plugged in to electronic<br />

entertainment media, <strong>Boomer</strong> spending rates outpace<br />

the average for audio equipment, televisions and radios.<br />

The <strong>Boomer</strong> obsession with health and wellness extends to<br />

their extended family—including the four-footed, finned and<br />

winged members. <strong>Boomer</strong>s willingly open their wallets for<br />

veterinary care and other pet services such as grooming and<br />

doggie day care.<br />

Family finances<br />

The <strong>Boomer</strong> relationship with money is complicated and<br />

convoluted. Shaped by parental stories of the Depression<br />

and WWII deprivation, <strong>Boomer</strong>s learned to respect money,<br />

save money, value work over leisure and savings over debt.<br />

They look askance at credit issuers who mail out unsolicited<br />

cards to college students, in the hopes they’ll be used. All<br />

in all, one could say <strong>Boomer</strong>s are a fiscally conservative<br />

bunch—except when it comes to their kids.<br />

5. healthcare system, as <strong>Boomer</strong>s begin to experience the<br />

inevitable decline of physical vigor and the onset of<br />

chronic illnesses like high blood pressure and diabetes.<br />

An uncertain outcome<br />

Some pundits ponder these issues and see the makings of<br />

a perfect storm capable of capsizing the U.S. economy.<br />

Others see the opportunity to extend the consumer use-life<br />

by extending the <strong>Boomer</strong> work-life from an arbitrary retirement<br />

at age 65, to an open-ended employment contract that<br />

keeps people working, and earning, for as long as they are<br />

physically able. ■ See sidebar on “Working Retirements”<br />

on pages 8 and 9.<br />

Society has never been asked to solve a socioeconomic equation<br />

with so many unknown variables before. There simply<br />

have never been so many old people, living so long and<br />

staying so healthy.<br />

From a marketing perspective, one thing is certain. Older<br />

<strong>Boomer</strong>s represent both a viable market and one too large<br />

to ignore. C i<br />

11

Global Household<br />

Product Sales:<br />

Innovative Items Clean Up<br />

by: Jane Perrin<br />

Communications<br />

ACNielsen Global Services<br />

Mark Chesney<br />

Communications<br />

ACNielsen Global Services<br />

Analyzing household products on a global scale involves a<br />

pretty big bucket of categories and countries. What’s Hot<br />

Around the Globe: Insights on Growth in Household<br />

Products, one in a series of ACNielsen reports on the<br />

fastest-growing products and category drivers, encompasses<br />

66 markets and 29 household product areas.<br />

Findings surfaced by the study identified four major trends<br />

responsible for growth: new product innovation, health and<br />

wellness concerns, convenient delivery systems and developing<br />

country contributions. Aggregated 2005 sales growth<br />

remained consistent with other reports in the series covering<br />

food and beverages and personal care products, showing<br />

4% growth.<br />

Regional results<br />

On an upbeat note, there were several regional pockets of<br />

double-digit growth. Emerging markets posted a 13%<br />

increase and Latin America an 11% jump in household<br />

product sales, leading Asia Pacific, North America and<br />

Europe results. Romania and Russia, both classified as<br />

emerging markets, reported impressive category expansion<br />

rates of 25%. ■ See chart 1.<br />

The complexity of dissecting regional and country contributions<br />

is illustrated by Asia Pacific, a sector comprising both<br />

emerging and developed markets, where the modest 4%<br />

gain in Japan blended with the momentum of a 14% jump<br />

in China. Turning from percentages to the absolute dollar<br />

metric, Asia Pacific achieved the largest dollar value growth<br />

overall at just under $U.S. 1 billion in 2005.<br />

Chart 1: Global findings<br />

Value Sales (U.S.$M) in<br />

Household Products*<br />

Global Growth in<br />

Household Products* (2004–2005)<br />

Global (66)<br />

Global (66)<br />

4%<br />

Europe (19)<br />

Europe (19)<br />

0%<br />

North America (2)<br />

North America (2)<br />

3%<br />

Asia Pacific (15)<br />

Asia Pacific (15)<br />

6%<br />

Latin America (12)<br />

Latin America (12)<br />

11%<br />

Emerging Markets (18)<br />

Emerging Markets (18)<br />

13%<br />

0 $50,000 $100,000<br />

0%<br />

5%<br />

10%<br />

15%<br />

*Based on number of countries measured (Number of countries in parentheses)<br />

12 Fall/Winter 2006

Leading categories<br />

Among the 29 categories studied, only nine grew faster than<br />

the global average, five paced the 4% rate; and the rest<br />

lagged behind. In prior studies, the fastest-growing categories<br />

were also among the smallest in dollar sales. That was not<br />

the case in 2005. Five categories in the fastest-growing top<br />

nine—garbage bags, household cleaners, air fresheners,<br />

insect control and fabric softener—also registered among<br />

the top 10 categories in value sales. ■ See chart 2.<br />

Chart 2: Only nine categories grew<br />

faster than 4%<br />

Top No. of Markets Category Category<br />

Growing Growing/ Growth Rate Growth Value<br />

Categories Measured 04–05 $000<br />

1. Abrasive Cleaning Pads 13 of 23 13% 129,215<br />

2. Disinfectants 18 of 26 13% 81,148<br />

3. Garbage Bags* 15 of 19 8% 209,806<br />

4. Laundry Stain Remover/Booster 30 of 37 6% 82,876<br />

5. Household Cleaners* 55 of 65 6% 338,553<br />

6. Air Fresheners* 50 of 61 5% 244,081<br />

7. Insect Control* 28 of 47 5% 168,489<br />

8. Plastic Storage Bags 28 of 34 5% 78,040<br />

9. Fabric Softener* 44 of 58 5% 255,008<br />

*Also among the largest 10 categories in value sales<br />

The remaining top performers included abrasive cleaning<br />

pads, which shared top billing with disinfectants at 13%,<br />

laundry stain removers/boosters at 6% and plastic storage<br />

bags at 5%.<br />

Performance enhancers<br />

On closer examination, specific sub-segments accounted for<br />

the strong overall showing in some categories. For example,<br />

battery-operated freshening systems powered up a 191%<br />

sales increase, and air sanitizing sprays vaporized the<br />

category with their supercharged growth in sales of 36%.<br />

Similarly, the power cleaning sub-segment of household<br />

cleaners (75%) and those products with oxidizing ingredients<br />

for stain removal (11%) wiped up the rest of the category.<br />

The cleaning system concept debuted by Swiffer, comprising<br />

a re-useable element such as a handle with disposable<br />

cloths, sponges or brushes, has been syndicated to other categories<br />

including bathroom cleaners, toilet bowl cleaners,<br />

dusters, air care and insect control. The jury is still out on<br />

whether or not the consumer uptake on systems and onestep,<br />

multi-use products will successfully cross category<br />

boundaries.<br />

Worthy of consideration<br />

Consumer health concerns gave a shot in the arm to household<br />

cleaner and disinfectant category results. Both recorded<br />

higher than average growth rates, which may indicate a shift<br />

in the type of products used to clean around the world.<br />

While the discussion to date has surrounded growth rates, it<br />

is worthwhile to note that even though laundry detergent<br />

only expanded at the average pace, it represents the largest<br />

category overall and contributed more than any other category<br />

to global growth.<br />

continued on page 16<br />

Chart 3: Top 10 categories and growth rate by region<br />

Europe<br />

Total Household Care (0%)<br />

North America<br />

Total Household Care (3%)<br />

Asia Pacific<br />

Total Household Care (6%)<br />

Latin America<br />

Total Household Care (11%)<br />

Emerging Markets<br />

Total Household Care (13%)<br />

Brooms, Brushes, Mops (10%)<br />

Disinfectants (23%)<br />

Auto Dish Detergent (17%)<br />

Abrasive Cleaning Pads (74%)<br />

Fabric Fresheners (277%)<br />

Disinfectants (3%)<br />

Laundry Stain Remover (12%)<br />

Auto Dish Additives (16%)<br />

Laundry Stain Remover (36%)<br />

Carpet/Rug Cleaner (37%)<br />

Household Cleaners (3%)<br />

Garbage Bags (12%)<br />

Abrasive Cleaning Pads (14%)<br />

Air Fresheners (16%)<br />

Waste Pipe Openers (37%)<br />

Laundry Stain Remover (3%)<br />

Abrasive Cleaning Pads (7%)<br />

Fabric Fresheners (10%)<br />

Bleach/Ammonia (15%)<br />

Air Fresheners (23%)<br />

Garbage Bags (3%)<br />

Toilet Care (7%)<br />

Air Fresheners (10%)<br />

Plastic Storage Bags (14%)<br />

Laundry Water Softeners (21%)<br />

Auto Dish Detergent (2%)<br />

Kitchen Paper/Towel (7%)<br />

Plastic Storage Bags (9%)<br />

Fabric Softener (14%)<br />

Auto Dish Detergent (20%)<br />

Auto Dish Additives (2%)<br />

Air Fresheners (5%)<br />

Fabric Softener (9%)<br />

Insect Control (13%)<br />

Cleaning Cloths/Sponges (19%)<br />

Plastic Storage Bags (2%)<br />

Plastic Storage Bags (5%)<br />

Batteries (8%)<br />

Aluminum Foil (13%)<br />

Household Cleaners (17%)<br />

Batteries (2%)<br />

Household Cleaners (5%)<br />

Garbage Bags (8%)<br />

Toilet Care (12%)<br />

Fabric Softener (16%)<br />

Waste Pipe Openers (2%)<br />

Aluminum Foil (4%)<br />

Brooms, Brushes, Mops (8%)<br />

Household Cleaners (11%)<br />

Laundry Stain Remover (16%)<br />

14 Fall/Winter 2006

Stepping Outside Your<br />

Own Borders?<br />

Use the right marketing information to<br />

make your expansion decisions.<br />

Contact ACNielsen Global Services at 847-605-5904.<br />

Global Services

Global Household Product Trends continued from page 14<br />

Different strokes<br />

The top ten categories within each region differ significantly,<br />

and none of the overall fastest-growing products shows up<br />

in every regional ranking. In Europe, only the leading category—<br />

brooms, brushes and mops—charted 2005 results<br />

that bettered the global average. ■ See chart 3, page 14.<br />

In North America, disinfectants killed off any competition<br />

in the top ten with a 23% annual growth rate. Only the<br />

laundry stain remover and garbage bag categories also posted<br />

double digit regional growth at 12%.<br />

Automatic dish detergents and automatic dish additives<br />

floated to the top of the Asia Pacific top ten list. In Latin<br />

America, every top ten contender boasted double-digit<br />

growth, but abrasive cleaning pad results scoured all comers<br />

with a whopping 74%. Laundry stain removers were a<br />

distant second in the line-up at 36%.<br />

The Emerging Markets’ winning entry, fabric fresheners,<br />

was in a class by itself with a 277% annual growth rate.<br />

Carpet/rug cleaners and waste pipe openers trailed with<br />

strong 37% increases.<br />

Coming clean<br />

Abrasive cleaning pads, the runaway category growth winner<br />

in Latin America, owes its phenomenal success to a single<br />

country: Brazil. This one country accounted for more<br />

than 95% of category sales, divided among three brands.<br />

Aggressive media support generated a 45% increase for the<br />

leading brand, with the number two and three brands each<br />

expanding by more than 200%.<br />

Global brand dominance was more diffused than in Latin<br />

America, with the top three brands comprising 65% of<br />

category sales and private label brands absorbing an additional<br />

16%.<br />

Hygienic habits<br />

Germ-aphobic Americans kicked their cleaning standards<br />

up a notch, striving for a sanitized—versus merely clean—<br />

household. This microbe-free goal resulted in a 23% regional<br />

category sales increase. As always, convenience played into<br />

consumer decision-making, explaining why 80% of the<br />

absolute dollar growth in U.S. sales (excluding Wal-Mart)<br />

derived from a 60% increase in wipes.<br />

Disinfectant wipes, measured in only five markets, mopped<br />

up consumer dollars on a global basis for a 35% growth in<br />

sales. Their counterpart, disinfectant sprays, expanded at<br />

an average 10% rate in 12 of 19 markets measured. Brand<br />

sales are so heavily concentrated in this category that three<br />

brands accounted for 71% of dollar sales on a global basis.<br />

It’s worthy of note that although only 8% of sales can be<br />

ascribed to private label brands, their sales expanded by<br />

26% in 2005.<br />

Tying up sales<br />

Garbage bag sales expanded at an 8% annual rate, twice the<br />

global tempo, with North America the sole region to wrap the<br />

year with double digit growth (12%). For such a seemingly<br />

mundane category, garbage bags represent an endless source<br />

of innovative benefits from anti-odor attributes to a host of<br />

tying options to stretch-and-flex fabrics that won’t rip.<br />

New features, coupled with raw material cost increases for<br />

the oil-based resins used in manufacturing, combined to<br />

justify the higher retail prices that raised dollar value sales.<br />

Private label products captured a significant share of<br />

16 Fall/Winter 2006

garbage bag sales (40%), almost enveloping the 49% sales<br />

component contributed by the top three brands. Both private<br />

label and branded offerings increased by 8%.<br />

Spotless outcomes<br />

Both the pre-wash and in-wash products that compose the<br />

laundry stain remover category captured double-digit sales<br />

in three of five regions, with four of five regions ranking<br />

the category among the top ten. Tepid Asia Pacific results<br />

of 1% growth dampened the overall category average.<br />

“Oxi” products cleaned up in the category, spreading in<br />

seven of the 10 markets measured at an 11% overall rate.<br />

No-wash stain removers, including pen delivery systems,<br />

achieved explosive sales of 200% over the prior year. Key<br />

manufacturers virtually own the category, with the top three<br />

brands accounting for 72% of sales.<br />

Shipshape results<br />

Convenient, effective household cleaners were swept off<br />

shelves by tidy consumers, with Emerging Market and<br />

Latin America households setting the pace. The two<br />

attributes dominating product selection were convenience<br />

and effectiveness.<br />

Major multinationals entered the power cleaning competitive<br />

fray, where sales velocity reached 75% last year. Sprayons<br />

earned high marks on the convenience criteria, and at<br />

11% represented one of the fastest-growing segments.<br />

Product proliferation served to modulate the trend toward<br />

brand dominance observed in other categories, with the top<br />

three branded household cleaners garnering 43%, private<br />

label 9% and other products 48% of sales.<br />

Something in the air<br />

Air freshener sales caught a favorable updraft in Emerging<br />

Markets, Latin America and Asia Pacific, where 2005 consumption<br />

increased by 23%, 16% and 10%, respectively.<br />

Recent new product entries have kept sales aloft and in the<br />

top-ten tiers for four of five regions studied.<br />

Battery air fresheners, unveiled just last year, saw 2005 sales<br />

rocket into the stratosphere at a 150% rate. Air sanitizers<br />

eliminated odors and obstacles to consumer trial, hitting a<br />

respectable 36% growth number. Air freshener candle sales,<br />

reinvigorated by the introduction of scented oils, achieved<br />

an 8% growth rate, double that of the global average.<br />

Abuzz with potential<br />

Insect control, the eighth fastest-growing category, owed<br />

its 5% expansion to Latin America, a region where bugs<br />

are more than a nuisance; they carry potentially harmful<br />

diseases such as dengue fever and malaria. Product refinements,<br />

such as electrically-powered items, command a price<br />

premium reflected in sales results.<br />

The North American no-growth scenario masks a 7% spike<br />

from Canada, possibly reflecting that country’s concern with<br />

the mosquito-borne West Nile virus. Private Label products<br />

barely show up on the radar screen in the insect control<br />

Chart 4: Private Label growth by category<br />

Private Label Private Label Manufacturer<br />

Product Area Share Growth Growth<br />

1 Aluminum Foil 43% 0% 3%<br />

2 Plastic Storage Bags* 41% 8% 3%<br />

3 Garbage Bags* 40% 8% 8%<br />

4 Kitchen Paper/Towel 28% 5% 3%<br />

5 Cleaning Cloths/Sponges 26% 7% 1%<br />

6 Auto Dish Additives 22% 1% 4%<br />

7 Plastic Wrap 19% 4% -3%<br />

8 Auto Dish Detergent 18% 4% 4%<br />

9 Bleach/Ammonia 17% 4% 5%<br />

10 Abrasive Cleaning Pads* 16% 4% 15%<br />

11 Laundry Water Softeners 16% -18% 6%<br />

12 Toilet Care 12% 4% 2%<br />

13 Brooms, Brushes, Mops 11% 18% 1%<br />

14 Fabric Softener* 11% 4% 5%<br />

15 Batteries 10% 3% 2%<br />

16 Hand Dish Detergent 10% 5% 4%<br />

17 Household Cleaners* 9% 5% 6%<br />

18 Disinfectant* 8% 26% 12%<br />

19 Oven Cleaners 7% 5% -1%<br />

20 Laundry Starch 7% -16% 0%<br />

21 Carpet/Rug Cleaner 6% 6% -4%<br />

22 Laundry Detergent 6% 1% 4%<br />

23 Air Fresheners* 6% 1% 6%<br />

24 Laundry Stain Remover* 5% 16% 6%<br />

25 Fabric Fresheners 5% -5% -8%<br />

26 Furniture Polish 5% 6% -4%<br />

27 Waste Pipe Openers 4% 13% 2%<br />

28 Floor Polish/Wax 2% -12% -2%<br />

29 Insect Control* 2% -4% 5%<br />

*Fastest Growing Categories<br />

Manufacturer brands growing faster than Private Label<br />

17

category with a miniscule 2% of sales; the top three brands<br />

and all others split the rest of the category sales evenly at<br />

49% apiece.<br />

In the bag<br />

Plastic storage bag sales did slightly better at 5% than the<br />

global all-product average, with pockets of strength in Latin<br />

America (14%) and Asia Pacific (9%). Interestingly, private<br />

label sales for this category (8%) bested manufacturer brand<br />

performance of 3%. The private label preference was clearly<br />

strongest in Europe, North America and Emerging Markets,<br />

but picking up in Asia Pacific.<br />

A soft touch<br />

New product formulations, improved distribution, increased<br />

advertising penetration and price reductions contributed to<br />

the fabric softener category sales increases in Emerging<br />

Markets (16%) and Latin America (14%). Of note, in<br />

Mexico, products such as Downy Libre Enjuague (Rinse-<br />

Free) reduced the hassle factor for consumers who hand<br />

wash by eliminating the rinse step.<br />

The top three brands occupy the number 1, 2 and 3 positions<br />

across the majority of markets studied and together<br />

claim 68% of category sales.<br />

Commodity concerns<br />

While private label offerings earned a 12% share of global<br />

household product sales, that penetration level underperformed<br />

the norm reported in the ACNielsen 2005 study,<br />

The Power of Private Label. However, the private label<br />

expansion velocity equaled that of manufacturer branded<br />

household products (4%), so private label neither gain nor<br />

lost ground in relative terms.<br />

Private label share and growth figures varied widely by category,<br />

from a 43% share in aluminum foil with zero growth,<br />

to an 8% share in disinfectants with a 26% growth rate.<br />

Regional considerations such as economic development and<br />

lifestyles influenced product uptake and utilization figures.<br />

■ See chart 4, page 17.<br />

Home basics<br />

Household products weighed in with overall global growth<br />

rates consistent with other fast moving consumer product<br />

areas. There is no denying the influence of Emerging<br />

Markets as a factor in household product category growth,<br />

alongside a continuous stream of product innovations that<br />

keep consumers engaged and prices on the rise. Uniformly,<br />

consumers across the world gravitate to products that deliver<br />

against two key benefits: value and convenience. C i<br />

About the Study<br />

This survey of Household Products included 66 markets around the world and 29 categories. These 66 markets account for<br />

more than 90% of the world’s GDP and over 75% of the world’s population. The markets have been grouped regionally into<br />

five areas: Asia Pacific, Emerging Markets, Europe, Latin America and North America. For the purposes of this study, Mexico<br />

has been included in Latin America.<br />

ACNielsen analyzed data across 29 Household Products categories, comparing year-ending data from December 2005 with<br />

December 2004. Within these 29 categories, ACNielsen reviewed subcategories of products, which for the purposes of this study<br />

are called “segments.” This study looks at some of these key segments to understand the changes impacting the categories.<br />

New to the study this year is the inclusion and analysis of private label products within each category. ACNielsen Global<br />

Services intends to include private label information in future reports on product areas, to show the impact of both manufacturer<br />

and retailer products as drivers of consumer purchasing behavior.<br />

As with Global Services’ other studies, this report is based on purchasing information from retailers in grocery, drug and mass<br />

merchandise outlets and generally excludes kiosks or vending machines. In a few markets, sales from convenience stores<br />

may be included. Within the United States, data from the ACNielsen Homescan consumer panel service has been included<br />

to provide a total market read that includes Wal-Mart information.<br />

18 Fall/Winter 2006

Identify and Target High Opportunity<br />

Beauty Care Consumer Segments<br />

Look at the world of beauty care through the<br />

eyes of a consumer and what do you see? A<br />

world filled with choice. As new products and<br />

efficacy claims proliferate and the retail landscape<br />

becomes increasingly fragmented, marketers<br />

are challenged to find a complete measure<br />

of their brands’ performance and identify<br />

high opportunity consumer segments and new<br />

product opportunities.<br />

ACNielsen’s Beauty Care Panel provides<br />

the most complete, accurate and actionable<br />

view of beauty care consumers across all<br />

categories and channels. From massmarket<br />

to high-end/prestige brands and from<br />

supermarkets to specialty beauty stores, the<br />

Homescan ® Beauty Care Panel provides data<br />

at the most granular level to help you effectively<br />

target consumers and maximize sales opportunities<br />

in these channels.<br />

The Beauty Care Panel will help you:<br />

• Identify high opportunity distribution channels and quantify the<br />

sales opportunity of gaining distribution there.<br />

• Identify “white space” in the marketplace and quantify new product<br />

development opportunities.<br />

• Evaluate new product performance and quantify cannibalization.<br />

• Target high opportunity consumers and monitor your performance<br />

across all channels.<br />

The Beauty Care Panel gives you:<br />

• The most comprehensive measurement of Beauty Care purchase<br />

behavior across all channels in 32 beauty care categories, including:<br />

–Make-up/Color Cosmetics<br />

–Facial Skin Care<br />

–Hand & Body Skin Care<br />

–Self-Tanning<br />

–Bath & Shower<br />

–Men’s & Women’s Fragrance<br />

• The Spectra BehaviorScape Framework, which helps you<br />

increase the effectiveness of your marketing dollars.<br />

To learn more about the Beauty Care Panel, please contact your ACNielsen Client Service or Retail Services representative<br />

or visit our web site at www.acnielsen.com.

Tune Into Teens:<br />

Test Your Teen Aptitude<br />

by: Tom Pirovano<br />

Retailing Insights<br />

ACNielsen<br />

If you’ve never visited YouTube.com, listened to Gnarls<br />

Barkley or used the acronym ROTFL while instant messaging,<br />

then find yourself a teenager and get educated. Today’s<br />

younger generation, typically called Millennials (born<br />

between 1980 and 2000), represent a group of wellconnected,<br />

over-stimulated, media-savvy consumers who<br />

are open-minded, optimistic and well-educated. They<br />

represent the future. Tune in to what drives this very diverse<br />

group of consumers and you will not only score points on<br />

the “uber-cool” chart, but will also deliver messaging that<br />

resonates with the world they live in.<br />

Test your teen aptitude<br />

If you are thinking that teens do as teens did, then think<br />

again. While it is true that all teens go through the same<br />

growing pains, history tells us that each generation leaves<br />

behind its own distinctive mark (see U.S. Teens Through<br />

the Decades on page 24). To test your knowledge of today’s<br />

teen market, see if you can answer the following questions:<br />

1. Who is one of the lead singers for the Black Eyed Peas?<br />

2. Who said, “Don’t be jealous that I’ve been chatting<br />

online with babes all day”?<br />

3. Who hosted MTV’s 2006 Video Music Awards?<br />

4. What is an emoticon?<br />

5. Who is known for the phrase, “That’s Hot”?<br />

6. What is the starting price for a Tracfone?<br />

7. Billie Joe Armstrong is the lead singer of which band?<br />

So how did you do? If you were able to answer 8 out of<br />

the 10 questions, then you are either: a) the parent of a<br />

teenager, b) an actual teenager, c) a teenager wannabe, or<br />

d) a superbly in-sync teen marketer. However, if you are<br />

like most of us and had some trouble, then it is time to<br />

brush up your knowledge of this influential and lucrative<br />

market segment.<br />

A moving target<br />

Teens are a moving target. They were born and raised during<br />

a digitized age where change happens rapidly. Born into the<br />

MTV generation where the rally cry was “I want my MTV”,<br />

they have learned that what they want, they get. In their<br />

world, everything is immediate. From instant messaging to<br />

microwave meals, instant gratification is their mantra.<br />

Millennials are the first generation of true multi-taskers,<br />

easily balancing e-mail, text messaging, music downloads,<br />

homework and a strict schedule of sporting and other<br />

activities, simultaneously. This generation is more adept at<br />

communications than any of its predecessors. The wireless<br />

Internet is their central nervous system, and simply put, they<br />

just don’t need much else.<br />

If they’re that connected, then connecting with teens should<br />

be simple, right? Not necessarily. While it may seem easy to<br />

develop a systematic marketing plan (if teens = computers,<br />

then website advertising = success), connecting in the right<br />

places at the right time to the right audience is a challenge<br />

at best.<br />

8. What is Naruto?<br />

9. Who is Shiloh?<br />

10.Who are two main characters on “Degrassi the Next<br />

Generation”?<br />

Answers: 1. Will.I.Am or Fergie; 2. Kip Dynamite; 3. Jack Black; 4. Emotion Icon =) made using<br />

punctuation or type; 5. Paris Hilton; 6. $29.99; 7. Green Day; 8. Japanese anime series; 9. Daughter<br />

of Brad Pitt and Angelina Jolie; 10. Emma Nelson, Jimmy Brooks.<br />

20 Fall/Winter 2006

Equally different<br />

All teens are not alike, and grouping them together could be<br />

a roadmap for disaster. Take, for example, a typical eighth<br />

grader compared with a college student. While Disney’s<br />

“High School Musical” is all the rage for one, the other is<br />

much more engaged by the latest drama on MTV’s “The<br />

Real World.”<br />

And don’t discount the hugely important gender differences.<br />

Anybody with kids knows how different boys are from girls.<br />

Therefore, when analyzing teens, boys and girls need to be<br />

viewed separately. For example, girls believe that they are<br />

more grown-up than boys, and spend their money on very<br />

different things, such as jewelry and clothing, while boys’<br />

interests trend toward games and electronics. However, both<br />

spend money on music and movies, which increases as kids<br />

shift from the 12–14 age bracket to the 15–17 one.<br />

It is also important to realize that “what’s hot” can be<br />

polarizing, because for each teen fad with adoring fans,<br />

there is a subset of teens who simply hate it. Finding a teen<br />

idol as a spokesperson for a brand could divide an audience.<br />

For each loyal fan of Justin Timberlake, there is another<br />

teen who simply abhors him. Interestingly, this love/hate<br />

relationship seems to be more common with the “beautiful<br />

people” than with stars like John Heder or Jack Black, who<br />

garner more universal appeal.<br />

Stay ahead of the curve<br />

For the most part, young people take their cues from those<br />

a few years older than themselves for trends. This may be<br />

why the Harry Potter books and movies which feature teens<br />

have their strongest appeal to younger children. Or why<br />

movies with a PG-13 rating are more enticing to teens. Or<br />

why Paris Hilton, who is in her mid-twenties, is a fashion<br />

icon for many teenage girls.<br />

Whether the new fashion is Crocs or Lacoste, whether the<br />

latest video craze is Nintendo DS Lite or GameTap, you<br />

can be sure of one thing: what’s hot today is not tomorrow.<br />

Rather than focusing on what’s hot right now, it is more<br />

important to develop tools and approaches to monitor and<br />

anticipate changes.<br />

For example, tap into the fickle world of teen trends by<br />

checking out websites such as Billboard.com for the most<br />

popular ringtones, which btw, as of this writing, is the<br />

Nintendo Super Mario Brothers Theme by Koji Kondo, or<br />

the hottest digital songs (Fergie’s London Bridge), or number<br />

one album (the self-named Danity Kane), or top single<br />

(Justin Timberlake’s “SexyBack”). Another popular teen<br />

website is MySpace.com, where teens connect with others,<br />

blog, rank music, and much more.<br />

Cash or credit<br />

The fact of the matter is, teenagers represent a powerful<br />

buying force in the U.S. market. According to the 2005<br />

Roper Youth Report, kids are earning $29.20 per week, two<br />

dollars more than in 2004, with 29% of their money coming<br />

straight from parents. Chores (37%) and gifts (23%)<br />

account for other popular sources of teen income. Nearly<br />

one-third (30%) of 8–17-year-olds say they are involved in<br />

making family purchase decisions, up four percentage points<br />

from last year, as parents increasingly turn to their kids for<br />

advice on what to buy. Teens also indicate that they influence<br />

purchase decisions on everything from cell phone service<br />

to the right cable provider.<br />

For better or worse (probably the latter), teens are also<br />

enamored by the magic of credit. According to the<br />

Jump$tart Coalition for Personal Financial Literacy, an educational<br />

organization, nearly a third of high school seniors<br />

reported having a credit card of their own or one co-signed<br />

by a parent.<br />

22 Fall/Winter 2006

Products with appeal<br />

If you live in a household with a teen, get ready to stock<br />

up on deodorants, grooming aids, acne remedies and<br />

other personal care products, instant meals and school<br />

supplies—in that order. According to information from<br />

ACNielsen Homescan, categories such as these are greatly<br />

overdeveloped for the teen market.<br />

While that may not come as a complete shocker, consider<br />

the fact that many of the brands that have risen to the top<br />

of this typical list are those that cater to this trend-conscious<br />

segment by offering something new, different or cutting<br />

edge. Take for example Unilever’s AXE deodorant for men.<br />

Appealing to the raging hormones of boys (and young men),<br />

the product comes complete with its own risqué website<br />

where the “AXE effect” promises to attract the opposite sex<br />

“when used responsibly.” AXE now generates $269 million<br />

per year in the food, drug and mass merchandiser channels<br />

(including Wal-Mart).<br />

Another product high on the dollar volume index scale purchased<br />

by households with teens offering a unique edge is<br />

Hershey’s Ice Breakers gum that explodes with a burst of<br />

mouth-freshening extra mint taste. Cutesy advertising featuring<br />

Hilary and Haylie Duff appeals like a gem to their<br />

target audience.<br />

While these products get high marks for originality, there is<br />

a tremendous untapped opportunity to cross-merchandise.<br />

For example, most cereals are marketed to either young<br />

children or adults, but not teens. Offering a free iTune<br />

download on the package would certainly have more appeal<br />

to this audience than would an action figure from the latest<br />

kid movie.<br />

Chart 1: Boys spend more on video games than girls<br />

LifeStyle<br />

Affluent Struggling Modest Plain<br />

Cosmopolitan Suburban Comfortable Urban Working Rural<br />

BehaviorStage Centers Spreads Country Cores Towns Living Total<br />

Male 12–14 253 234 202 205 215 129 202<br />

Male 15–17 89 144 113 178 97 101 120<br />

Female 12–14 103 45 42 129 38 51 62<br />

Female 15–17 2 4 30 26 8 5 13<br />

Total 114 107 97 138 92 72 100<br />

Source: ACNielsen Homescan & Spectra, Penetration (Population)/% Penetration Index, All Channels/United States, BehaviorScape Framework.<br />

High Consumer, 120–149 Very High Consumer, 150+<br />

Chart 2: Girls spend more on clothes than boys<br />

LifeStyle<br />

Affluent Struggling Modest Plain<br />

Cosmopolitan Suburban Comfortable Urban Working Rural<br />

BehaviorStage Centers Spreads Country Cores Towns Living Total<br />

Male 12–14 56 47 36 86 56 36 50<br />

Male 15–17 50 52 67 82 32 63 58<br />

Female 12–14 186 132 127 122 187 114 141<br />

Female 15–17 97 173 132 123 135 223 156<br />

Total 97 101 90 103 101 108 100<br />

Source: ACNielsen Homescan & Spectra, Penetration (Population)/% Penetration Index, All Channels/United States, BehaviorScape Framework.<br />

23

Aligning the cross hairs<br />

For marketers, targeting households with teens is just a<br />

start. For some products in which consumption is driven by<br />

individuals, however, a more granular approach is necessary.<br />

Using Simmons Teen National Consumer Survey (NCS)<br />

data, Spectra has developed a Teen Targeting Solution that<br />

helps to understand the teen consumer and identify the best<br />