You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

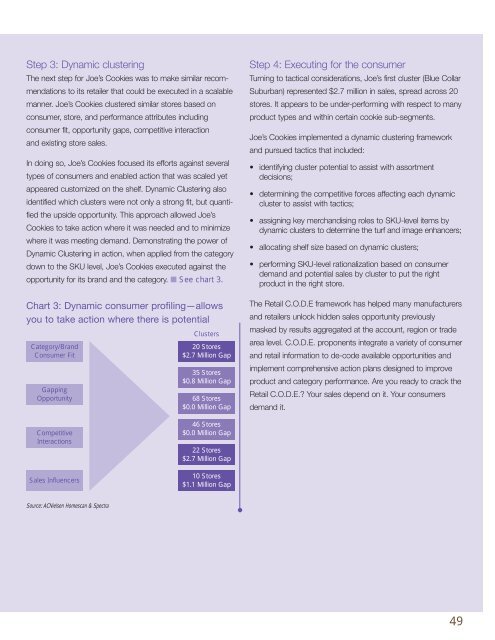

Step 3: Dynamic clustering<br />

The next step for Joe’s Cookies was to make similar recommendations<br />

to its retailer that could be executed in a scalable<br />

manner. Joe’s Cookies clustered similar stores based on<br />

consumer, store, and performance attributes including<br />

consumer fit, opportunity gaps, competitive interaction<br />

and existing store sales.<br />

In doing so, Joe’s Cookies focused its efforts against several<br />

types of consumers and enabled action that was scaled yet<br />

appeared customized on the shelf. Dynamic Clustering also<br />

identified which clusters were not only a strong fit, but quantified<br />

the upside opportunity. This approach allowed Joe’s<br />

Cookies to take action where it was needed and to minimize<br />

where it was meeting demand. Demonstrating the power of<br />

Dynamic Clustering in action, when applied from the category<br />

down to the SKU level, Joe’s Cookies executed against the<br />

opportunity for its brand and the category. ■ See chart 3.<br />

Chart 3: Dynamic consumer profiling—allows<br />

you to take action where there is potential<br />

Category/Brand<br />

Consumer Fit<br />

Gapping<br />

Opportunity<br />

Clusters<br />

20 Stores<br />

$2.7 Million Gap<br />

35 Stores<br />

$0.8 Million Gap<br />

68 Stores<br />

$0.0 Million Gap<br />

Step 4: Executing for the consumer<br />

Turning to tactical considerations, Joe’s first cluster (Blue Collar<br />

Suburban) represented $2.7 million in sales, spread across 20<br />

stores. It appears to be under-performing with respect to many<br />

product types and within certain cookie sub-segments.<br />

Joe’s Cookies implemented a dynamic clustering framework<br />

and pursued tactics that included:<br />

• identifying cluster potential to assist with assortment<br />

decisions;<br />

• determining the competitive forces affecting each dynamic<br />

cluster to assist with tactics;<br />

• assigning key merchandising roles to SKU-level items by<br />

dynamic clusters to determine the turf and image enhancers;<br />

• allocating shelf size based on dynamic clusters;<br />

• performing SKU-level rationalization based on consumer<br />

demand and potential sales by cluster to put the right<br />

product in the right store.<br />

The Retail C.O.D.E framework has helped many manufacturers<br />

and retailers unlock hidden sales opportunity previously<br />

masked by results aggregated at the account, region or trade<br />

area level. C.O.D.E. proponents integrate a variety of consumer<br />

and retail information to de-code available opportunities and<br />

implement comprehensive action plans designed to improve<br />

product and category performance. Are you ready to crack the<br />

Retail C.O.D.E.? Your sales depend on it. Your consumers<br />

demand it.<br />

Competitive<br />

Interactions<br />

Sales Influencers<br />

46 Stores<br />

$0.0 Million Gap<br />

22 Stores<br />

$2.7 Million Gap<br />

10 Stores<br />

$1.1 Million Gap<br />

Source: ACNielsen Homescan & Spectra<br />

49