LEONG HUP HOLDINGS BERHAD - Announcements

LEONG HUP HOLDINGS BERHAD - Announcements

LEONG HUP HOLDINGS BERHAD - Announcements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(b)<br />

Two (2) pieces of freehold land held under E.M.R. 494, Lot No. 375 and<br />

Certificate of Title 6387, Lot No. 1732 in Mukim of Pengerang, District of Kota<br />

Tinggi, State of Johor measuring in total approximately 112.125 acres<br />

(“Agricultural Land”). Atlasprise had obtained the approval in principle of the<br />

Johor State Authority on 19 August 1999 for a leisure farm development on the<br />

Agricultural Land.<br />

The proposed development on the Industrial Land comprises a total of 62 detached and<br />

semi-detached industrial lots, whilst the proposed development on the Agricultural Land<br />

comprises 90 homestead lots. The respective proposed developments have yet to<br />

commence as the time of their commencement would depend on the conditions in the<br />

property market.<br />

The Industrial Land and the Agricultural Land shall hereinafter be collectively referred to<br />

as the “Atlasprise Land”, and the respective approvals in principle of the Johor State<br />

Authority mentioned above shall hereinafter be collectively referred to as the “Atlasprise<br />

Approvals in Principle”.<br />

A valuation of the Atlasprise Land was carried out by Colliers Jordan Lee & Jaafar (JH)<br />

Sdn. Bhd., an independent firm of professional valuers, on 28 February 2001 using the<br />

comparison method, pursuant to which the said firm determined the open market value of<br />

the Atlasprise Land with the benefit of the Atlasprise Approvals in Principle, to be<br />

RM17,000,000 or approximately RM1.70 per square foot. As the unaudited net book<br />

value of the Atlasprise Land as at 30 November 2000 (being the reference date used for<br />

arriving at the consideration for the Proposed Disposal of Atlasprise Shares) was<br />

RM20.660 million, the loss on revaluation amounted to RM3.660 million. The loss on<br />

revaluation will not be incorporated into the accounts of Atlasprise, as the sole purpose of<br />

the revaluation was to establish a market value for the Atlasprise Land and hence the<br />

adjusted NTA value of Atlasprise. The audited net book value of the Atlasprise Land as at<br />

31 March 2000 was RM19.659 million.<br />

The Atlasprise Land is currently charged to Arab-Malaysian Finance Berhad for securing<br />

the credit facilities granted to Atlasprise towards completion of the purchase of the<br />

Atlasprise Land.<br />

Atlasprise does not have any subsidiary or associate company.<br />

The present authorised share capital of Atlasprise is RM5,000,000 comprising 5,000,000<br />

Shares, of which 1,500,000 Shares have been issued and are fully paid-up.<br />

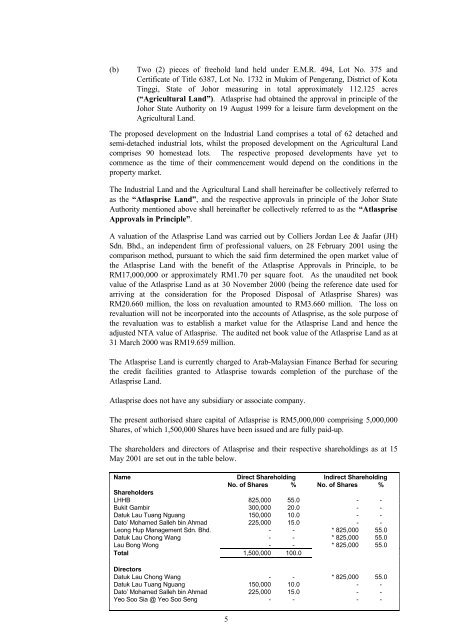

The shareholders and directors of Atlasprise and their respective shareholdings as at 15<br />

May 2001 are set out in the table below.<br />

Name Direct Shareholding Indirect Shareholding<br />

No. of Shares % No. of Shares %<br />

Shareholders<br />

LHHB 825,000 55.0 - -<br />

Bukit Gambir 300,000 20.0 - -<br />

Datuk Lau Tuang Nguang 150,000 10.0 - -<br />

Dato’ Mohamed Salleh bin Ahmad 225,000 15.0 - -<br />

Leong Hup Management Sdn. Bhd. - - * 825,000 55.0<br />

Datuk Lau Chong Wang - - * 825,000 55.0<br />

Lau Bong Wong - - * 825,000 55.0<br />

Total 1,500,000 100.0<br />

Directors<br />

Datuk Lau Chong Wang - - * 825,000 55.0<br />

Datuk Lau Tuang Nguang 150,000 10.0 - -<br />

Dato’ Mohamed Salleh bin Ahmad 225,000 15.0 - -<br />

Yeo Soo Sia @ Yeo Soo Seng - - - -<br />

5