LEONG HUP HOLDINGS BERHAD - Announcements

LEONG HUP HOLDINGS BERHAD - Announcements

LEONG HUP HOLDINGS BERHAD - Announcements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

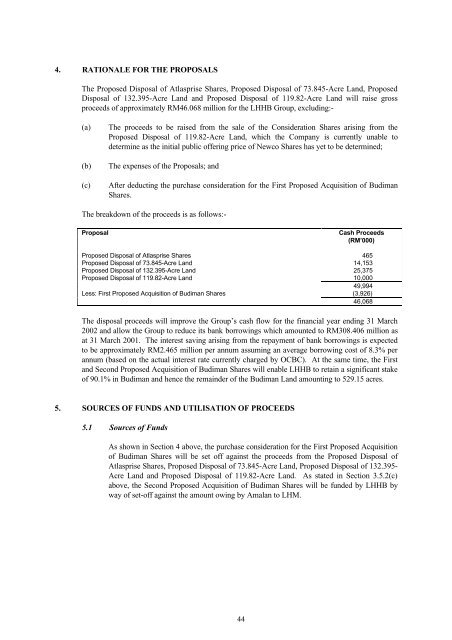

4. RATIONALE FOR THE PROPOSALS<br />

The Proposed Disposal of Atlasprise Shares, Proposed Disposal of 73.845-Acre Land, Proposed<br />

Disposal of 132.395-Acre Land and Proposed Disposal of 119.82-Acre Land will raise gross<br />

proceeds of approximately RM46.068 million for the LHHB Group, excluding:-<br />

(a)<br />

(b)<br />

(c)<br />

The proceeds to be raised from the sale of the Consideration Shares arising from the<br />

Proposed Disposal of 119.82-Acre Land, which the Company is currently unable to<br />

determine as the initial public offering price of Newco Shares has yet to be determined;<br />

The expenses of the Proposals; and<br />

After deducting the purchase consideration for the First Proposed Acquisition of Budiman<br />

Shares.<br />

The breakdown of the proceeds is as follows:-<br />

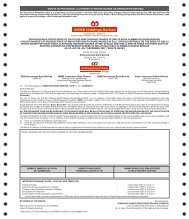

Proposal<br />

Cash Proceeds<br />

(RM’000)<br />

Proposed Disposal of Atlasprise Shares 465<br />

Proposed Disposal of 73.845-Acre Land 14,153<br />

Proposed Disposal of 132.395-Acre Land 25,375<br />

Proposed Disposal of 119.82-Acre Land 10,000<br />

49,994<br />

Less: First Proposed Acquisition of Budiman Shares (3,926)<br />

46,068<br />

The disposal proceeds will improve the Group’s cash flow for the financial year ending 31 March<br />

2002 and allow the Group to reduce its bank borrowings which amounted to RM308.406 million as<br />

at 31 March 2001. The interest saving arising from the repayment of bank borrowings is expected<br />

to be approximately RM2.465 million per annum assuming an average borrowing cost of 8.3% per<br />

annum (based on the actual interest rate currently charged by OCBC). At the same time, the First<br />

and Second Proposed Acquisition of Budiman Shares will enable LHHB to retain a significant stake<br />

of 90.1% in Budiman and hence the remainder of the Budiman Land amounting to 529.15 acres.<br />

5. SOURCES OF FUNDS AND UTILISATION OF PROCEEDS<br />

5.1 Sources of Funds<br />

As shown in Section 4 above, the purchase consideration for the First Proposed Acquisition<br />

of Budiman Shares will be set off against the proceeds from the Proposed Disposal of<br />

Atlasprise Shares, Proposed Disposal of 73.845-Acre Land, Proposed Disposal of 132.395-<br />

Acre Land and Proposed Disposal of 119.82-Acre Land. As stated in Section 3.5.2(c)<br />

above, the Second Proposed Acquisition of Budiman Shares will be funded by LHHB by<br />

way of set-off against the amount owing by Amalan to LHM.<br />

44