LEONG HUP HOLDINGS BERHAD - Announcements

LEONG HUP HOLDINGS BERHAD - Announcements

LEONG HUP HOLDINGS BERHAD - Announcements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(b)<br />

(c)<br />

LHM will set off the Set-Off Amount against Amalan and the outstanding loans<br />

from LHM to Amalan shall be correspondingly reduced by the Set-Off Amount.<br />

As at 15 May 2001, the outstanding loans from LHM to Amalan amounted to<br />

RM21.707 million. The balance after setting off the Set-Off Amount on<br />

completion and taking into account real property gains tax payable by Amalan, is<br />

expected to be approximately RM10.357 million; and<br />

Thereafter, the purchase consideration for the Second Proposed Acquisition of<br />

Budiman Shares and Amalan’s Advances shall be deemed to have been paid and<br />

fully settled by LHHB to Amalan.<br />

In view of the above, the Second Proposed Acquisition of Budiman Shares will also not<br />

have any effect on the LHHB Group’s liquidity position.<br />

8.4 Financial Effects of the Proposals<br />

(a)<br />

Share Capital<br />

The Proposals will not have any effect on the share capital of LHHB as they do not<br />

involve the issuance of any Shares by LHHB.<br />

(b)<br />

Substantial Shareholders<br />

The Proposals will not have any effect on the substantial shareholders of LHHB as<br />

they do not involve the issuance of any Shares by LHHB.<br />

(c)<br />

Earnings<br />

The Proposals are expected to be completed in the financial year ending 31 March<br />

2002, in the third quarter of the calendar year 2001. On completion of the<br />

Proposals, LHHB is expected to realise an estimated gain of approximately<br />

RM3.631 million at the LHHB Group level. This will translate into an increase of<br />

approximately 1.55 sen in LHHB’s consolidated net EPS for the financial year<br />

ending 31 March 2002.<br />

(d)<br />

NTA and Gearing<br />

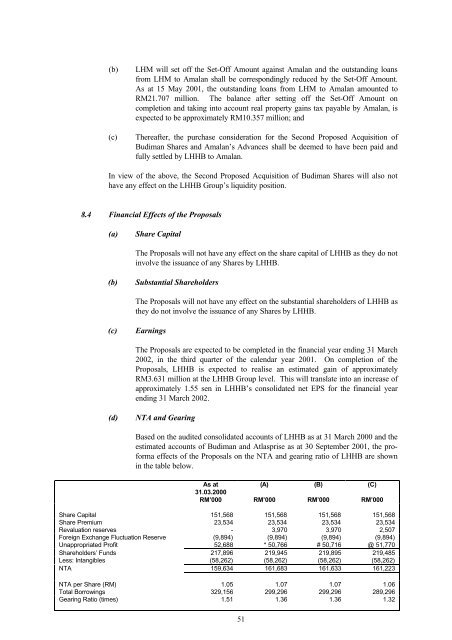

Based on the audited consolidated accounts of LHHB as at 31 March 2000 and the<br />

estimated accounts of Budiman and Atlasprise as at 30 September 2001, the proforma<br />

effects of the Proposals on the NTA and gearing ratio of LHHB are shown<br />

in the table below.<br />

As at<br />

(A) (B) (C)<br />

31.03.2000<br />

RM’000 RM’000 RM’000 RM’000<br />

Share Capital 151,568 151,568 151,568 151,568<br />

Share Premium 23,534 23,534 23,534 23,534<br />

Revaluation reserves - 3,970 3,970 2,507<br />

Foreign Exchange Fluctuation Reserve (9,894) (9,894) (9,894) (9,894)<br />

Unappropriated Profit 52,688 * 50,766 # 50,716 @ 51,770<br />

Shareholders’ Funds 217,896 219,945 219,895 219,485<br />

Less: Intangibles (58,262) (58,262) (58,262) (58,262)<br />

NTA 159,634 161,683 161,633 161,223<br />

NTA per Share (RM) 1.05 1.07 1.07 1.06<br />

Total Borrowings 329,156 299,296 299,296 289,296<br />

Gearing Ratio (times) 1.51 1.36 1.36 1.32<br />

51