Preparing the Statement of Cash Flows

Preparing the Statement of Cash Flows

Preparing the Statement of Cash Flows

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

114 PART ONE Introduction to Managerial Finance<br />

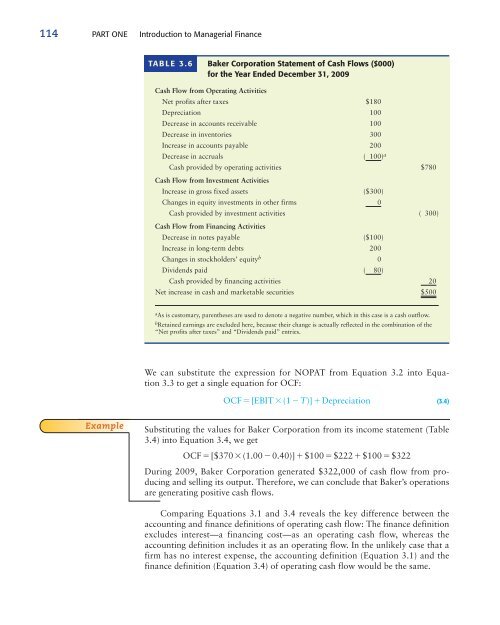

TABLE 3.6<br />

Baker Corporation <strong>Statement</strong> <strong>of</strong> <strong>Cash</strong> <strong>Flows</strong> ($000)<br />

for <strong>the</strong> Year Ended December 31, 2009<br />

<strong>Cash</strong> Flow from Operating Activities<br />

Net pr<strong>of</strong>its after taxes $180<br />

Depreciation 100<br />

Decrease in accounts receivable 100<br />

Decrease in inventories 300<br />

Increase in accounts payable 200<br />

Decrease in accruals ( 100) a<br />

<strong>Cash</strong> provided by operating activities $780<br />

<strong>Cash</strong> Flow from Investment Activities<br />

Increase in gross fixed assets ($300)<br />

Changes in equity investments in o<strong>the</strong>r firms<br />

0<br />

<strong>Cash</strong> provided by investment activities ( 300)<br />

<strong>Cash</strong> Flow from Financing Activities<br />

Decrease in notes payable ($100)<br />

Increase in long-term debts 200<br />

Changes in stockholders’ equity b 0<br />

Dividends paid ( 80)<br />

<strong>Cash</strong> provided by financing activities<br />

Net increase in cash and marketable securities<br />

20<br />

$500<br />

a As is customary, paren<strong>the</strong>ses are used to denote a negative number, which in this case is a cash outflow.<br />

b Retained earnings are excluded here, because <strong>the</strong>ir change is actually reflected in <strong>the</strong> combination <strong>of</strong> <strong>the</strong><br />

“Net pr<strong>of</strong>its after taxes” and “Dividends paid” entries.<br />

We can substitute <strong>the</strong> expression for NOPAT from Equation 3.2 into Equation<br />

3.3 to get a single equation for OCF:<br />

OCF [EBIT(1 T)] Depreciation (3.4)<br />

Example<br />

Substituting <strong>the</strong> values for Baker Corporation from its income statement (Table<br />

3.4) into Equation 3.4, we get<br />

OCF [$370(1.00 0.40)] $100$222$100$322<br />

During 2009, Baker Corporation generated $322,000 <strong>of</strong> cash flow from producing<br />

and selling its output. Therefore, we can conclude that Baker’s operations<br />

are generating positive cash flows.<br />

Comparing Equations 3.1 and 3.4 reveals <strong>the</strong> key difference between <strong>the</strong><br />

accounting and finance definitions <strong>of</strong> operating cash flow: The finance definition<br />

excludes interest—a financing cost—as an operating cash flow, whereas <strong>the</strong><br />

accounting definition includes it as an operating flow. In <strong>the</strong> unlikely case that a<br />

firm has no interest expense, <strong>the</strong> accounting definition (Equation 3.1) and <strong>the</strong><br />

finance definition (Equation 3.4) <strong>of</strong> operating cash flow would be <strong>the</strong> same.