Answers to Selected Problems

Answers to Selected Problems

Answers to Selected Problems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

E-32<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong><br />

<strong>Problems</strong><br />

I know the answer! The answer lies within the heart of all mankind! The answer is twelve?<br />

I think I’m in the wrong building. —Charles Schultz<br />

Chapter 2<br />

1.1 The demand curve for pork is Q = 171 - 20p +<br />

20pb + 3pc + 2Y. As a result, 0Q/0Y = 2. A $100<br />

increase in income causes the quantity demanded <strong>to</strong><br />

increase by 0.2 million kg per year.<br />

1.2 To solve this problem, we first rewrite the inverse<br />

demand functions as demand functions and then add<br />

them <strong>to</strong>gether. The <strong>to</strong>tal demand function is Q =<br />

Q1 + Q2 = (120 - p) + 160 - 1<br />

2 p2 = 180 - 1.5p.<br />

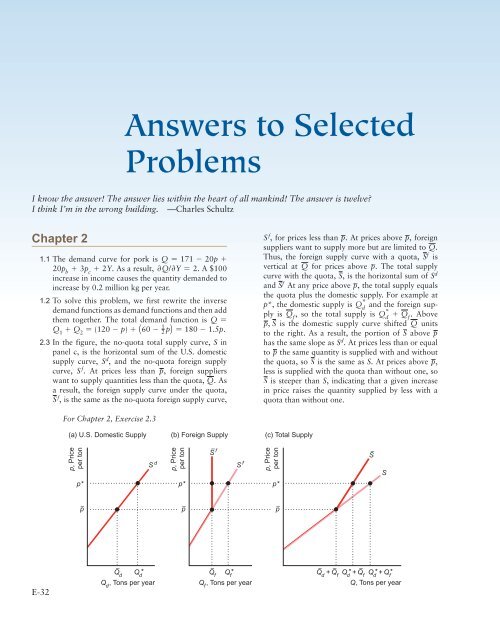

2.3 In the figure, the no-quota <strong>to</strong>tal supply curve, S in<br />

panel c, is the horizontal sum of the U.S. domestic<br />

supply curve, Sd , and the no-quota foreign supply<br />

curve, S f . At prices less than p, foreign suppliers<br />

want <strong>to</strong> supply quantities less than the quota, Q. As<br />

a result, the foreign supply curve under the quota,<br />

S f , is the same as the no-quota foreign supply curve,<br />

For Chapter 2, Exercise 2.3<br />

(a) U.S. Domestic Supply (b) Foreign Supply (c) Total Supply<br />

p, Price<br />

per <strong>to</strong>n<br />

S d<br />

p, Price<br />

per <strong>to</strong>n<br />

S f , for prices less than p. At prices above p, foreign<br />

suppliers want <strong>to</strong> supply more but are limited <strong>to</strong> Q.<br />

Thus, the foreign supply curve with a quota, Sf is<br />

vertical at Q for prices above p. The <strong>to</strong>tal supply<br />

curve with the quota, S, is the horizontal sum of Sd and Sf At any price above p, the <strong>to</strong>tal supply equals<br />

the quota plus the domestic supply. For example at<br />

p*, the domestic supply is Q * d and the foreign supply<br />

is Qf , so the <strong>to</strong>tal supply is Q * d + Qf . Above<br />

p, S is the domestic supply curve shifted Q units<br />

<strong>to</strong> the right. As a result, the portion of S above p<br />

has the same slope as Sd . At prices less than or equal<br />

<strong>to</strong> p the same quantity is supplied with and without<br />

the quota, so S is the same as S. At prices above p,<br />

less is supplied with the quota than without one, so<br />

S is steeper than S, indicating that a given increase<br />

in price raises the quantity supplied by less with a<br />

quota than without one.<br />

p, Price<br />

per <strong>to</strong>n<br />

p* p* p*<br />

p –<br />

–<br />

Qd Q *<br />

d<br />

–<br />

Qf Q *<br />

f<br />

Qd , Tons per year Qf , Tons per year<br />

p –<br />

S f –<br />

S f<br />

p –<br />

S –<br />

S<br />

– –<br />

Qd + Qf –<br />

Q * + Q d f Q * + Q *<br />

d f<br />

Q, Tons per year

3.1 The statement “Talk is cheap because supply exceeds<br />

demand” makes sense if we interpret it <strong>to</strong> mean that<br />

the quantity of talk supplied exceeds the quantity<br />

demanded at a price of zero. Imagine a downwardsloping<br />

demand curve that hits the horizontal, quantity<br />

axis <strong>to</strong> the left of where the upward-sloping<br />

supply curve hits the axis. (The correct aphorism is<br />

“Talk is cheap until you hire a lawyer.”)<br />

3.3 Equating the right-hand sides of the <strong>to</strong>ma<strong>to</strong> supply<br />

and demand functions and using algebra, we find<br />

that ln p = 3.2 + 0.2 ln p t . We then set p t = 110,<br />

solve for ln p, and exponentiate ln p <strong>to</strong> obtain the<br />

equilibrium price, p L $62.80 per <strong>to</strong>n. Substituting<br />

p in<strong>to</strong> the supply curve and exponentiating, we<br />

determine the equilibrium quantity, Q L 11.91 million<br />

short <strong>to</strong>ns per year.<br />

4.3 To determine the equilibrium price, we equate the<br />

right-hand sides of the supply function, Q = 20 +<br />

3p - 20r, and the demand function, Q =<br />

220 - 2p, <strong>to</strong> obtain 20 + 3p - 20r = 220 - 2p.<br />

Using algebra, we can rewrite the equilibrium price<br />

equation as p = 40 + 4r. Substituting this expression<br />

in<strong>to</strong> the demand function, we learn that the<br />

equilibrium quantity is Q = 220 - 2(40 + 4r), or<br />

Q = 140 - 8r. By differentiating our two equilibrium<br />

conditions with respect <strong>to</strong> r, we obtain our comparative<br />

statics results: dp/dr = 4 and dQ/dr = -8.<br />

4.7 The graph reproduces the no-quota <strong>to</strong>tal American<br />

supply curve of steel, S, and the <strong>to</strong>tal supply curve<br />

under the quota, S, which we derived in the answer<br />

<strong>to</strong> Exercise 2.3. At a price below p, the two supply<br />

curves are identical because the quota is not binding:<br />

It is greater than the quantity foreign firms want <strong>to</strong><br />

supply. Above p, S lies <strong>to</strong> the left of S. Suppose that<br />

the American demand is relatively low at any given<br />

price so that the demand curve, D l , intersects both<br />

the supply curves at a price below p. The equilibria<br />

For Chapter 2, Exercise 4.7<br />

p, Price of steel per <strong>to</strong>n<br />

p3 p2 p<br />

p1 –<br />

Q 1<br />

e 1<br />

e 3<br />

D l (low)<br />

e2<br />

Q 3 Q 2<br />

–<br />

S (quota)<br />

S (no quota)<br />

D h (high)<br />

Q,Tons of steel<br />

per year<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

E-33<br />

both before and after the quota is imposed are at e1 ,<br />

where the equilibrium price, p1 , is less than p. Thus,<br />

if the demand curve lies near enough <strong>to</strong> the origin<br />

that the quota is not binding, the quota has no effect<br />

on the equilibrium. With a relatively high demand<br />

curve, Dh , the quota affects the equilibrium. The<br />

no-quota equilibrium is e2 , where Dh intersects the<br />

no-quota <strong>to</strong>tal supply curve, S. After the quota is<br />

imposed, the equilibrium is e3 , where Dh intersects<br />

the <strong>to</strong>tal supply curve with the quota, S. The quota<br />

raises the price of steel in the United States from p2 <strong>to</strong> p3 and reduces the quantity from Q2 <strong>to</strong> Q3 .<br />

5.8 The elasticity of demand is (dQ/dp)(p/Q) = (-9.5<br />

thousand metric <strong>to</strong>ns per year per cent) * (45./1,275<br />

thousand metric <strong>to</strong>ns per year) L -0.34. That is,<br />

for every 1% fall in the price, a third of a percent<br />

more coconut oil is demanded. The cross-price<br />

elasticity of demand for coconut oil with respect<br />

<strong>to</strong> the price of palm oil is (dQ/dpp )(pp /Q) =<br />

16.2 * (31/1,275) L 0.39.<br />

6.4 We showed that, in a competitive market, the effect<br />

of a specific tax is the same whether it is placed on<br />

suppliers or demanders. Thus, if the market for milk<br />

is competitive, consumers will pay the same price in<br />

equilibrium regardless of whether the government<br />

taxes consumers or s<strong>to</strong>res.<br />

6.8 Differentiating quantity, Q(p(τ)), with respect <strong>to</strong><br />

τ, we learn that the change in quantity as the tax<br />

changes is (dQ/dp)(dp/dτ). Multiplying and dividing<br />

this expression by p/Q, we find that the change<br />

in quantity as the tax changes is ε(Q/p)(dp/dτ).<br />

Thus, the closer ε is <strong>to</strong> zero, the less the quantity<br />

falls, all else the same.<br />

Because R = p(τ)Q(p(τ)), an increase in the tax<br />

rate changes revenues by<br />

dR<br />

dτ<br />

dR<br />

dτ<br />

dp dQ<br />

= Q + p<br />

dτ dp dp<br />

dτ ,<br />

using the chain rule. Using algebra, we can rewrite<br />

this expression as<br />

= dp<br />

dτ<br />

dQ dp dQ<br />

¢Q + p ≤ = Q¢1 +<br />

dp dτ<br />

dp p dp<br />

≤ = Q(1 + ε).<br />

Q dτ<br />

Thus, the effect of a change in τ on R depends on<br />

the elasticity of demand, ε. Revenue rises with the<br />

tax if demand is inelastic (-1 6 ε 6 0) and falls if<br />

demand is elastic (ε 6 -1).<br />

7.3 A usury law is a price ceiling, which causes the<br />

quantity that firms want <strong>to</strong> supply <strong>to</strong> fall.<br />

7.4 We can determine how the <strong>to</strong>tal wage payment,<br />

W = wL(w), varies with respect <strong>to</strong> w by differentiating.<br />

We then use algebra <strong>to</strong> express this result in<br />

terms of an elasticity:<br />

dW<br />

dw<br />

dL<br />

dL<br />

= L + w = L¢1 +<br />

dw dw w<br />

L<br />

≤ = L(1 + ε),

E-34 <strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

where ε is the elasticity of demand of labor. The sign<br />

of dW/dw is the same as that of 1 + ε. Thus, <strong>to</strong>tal<br />

labor payment decreases as the minimum wage forces<br />

up the wage if labor demand is elastic, ε 6 -1, and<br />

increases if labor demand is inelastic, ε 7 -1.<br />

9.2 Shifts of both the U.S. supply and U.S. demand curves<br />

affected the U.S. equilibrium. U.S. beef consumers’<br />

fear of mad cow disease caused their demand curve<br />

in the figure <strong>to</strong> shift slightly <strong>to</strong> the left from D1 <strong>to</strong><br />

D2 . In the short run, <strong>to</strong>tal U.S. production was essentially<br />

unchanged. Because of the ban on exports, beef<br />

that would have been sold in Japan and elsewhere<br />

was sold in the United States, causing the U.S. supply<br />

curve <strong>to</strong> shift <strong>to</strong> the right from S1 <strong>to</strong> S2 . As a<br />

result, the U.S. equilibrium changed from e1 (where<br />

S1 intersects D1 ) <strong>to</strong> e2 (where S2 intersects D2 ). The<br />

U.S. price fell 15% from p1 <strong>to</strong> p2 = 0.85p1 , while<br />

the quantity rose 43% from Q1 <strong>to</strong> Q2 = 1.43Q1 .<br />

Comment: Depending on exactly how the U.S. supply<br />

and demand curves had shifted, it would have been<br />

possible for the U.S. price and quantity <strong>to</strong> have both<br />

fallen. For example, if D2 had shifted far enough left,<br />

it could have intersected S2 <strong>to</strong> the left of Q1 , and the<br />

equilibrium quantity would have fallen.<br />

For Chapter 2, Exercise 9.2<br />

p, Price per pound<br />

p 1<br />

p 2 = 0.85p 1<br />

Chapter 3<br />

e 1<br />

S 1<br />

D 1<br />

D 2<br />

Q 1 Q 2 = 1.43Q 1<br />

Q, Tons of beef per year<br />

1.5 If the neutral product is on the vertical axis, the<br />

indifference curves are parallel vertical lines.<br />

2.2 Sofia’s indifference curves are right angles (as in panel b<br />

of Figure 3.5). Her utility function is U = min(H, W),<br />

where min means the minimum of the two arguments,<br />

H is the number of units of hot dogs, and W is the<br />

number of units of whipped cream.<br />

2.4 If we apply the transformation function F(x) = x ρ<br />

<strong>to</strong> the original utility function, we obtain the new<br />

utility function V(q 1 , q 2 ) = F(U(q 1 , q 2 )) = [(q 1 ρ +<br />

e 2<br />

S 2<br />

q 2 ρ ) 1/ρ ] ρ = q1 ρ + q2 ρ , which has the same preference<br />

properties as does the original function.<br />

2.5 Given the original utility function, U, the consumer’s<br />

marginal rate of substitution is -U 1 /U 2 . If V(q 1 ,<br />

q 2 ) = F(U(q 1 , q 2 )), the new marginal rate of substitution<br />

is -V 1 /V 2 = -[(dF/dU)U 1 ]/[(dF/dU)U 2 ] =<br />

-U 1 /U 2 , which is the same as originally.<br />

2.6 By differentiating we know that<br />

U1 = a(aqρ 1 + [1 - a]qρ 2 )(1 - ρ)/ρqρ - 1<br />

1 and<br />

U2 = [1 - a](aqρ 1 + [1 - a]qρ 2 )(1 - ρ)/ρqρ - 1<br />

2 .<br />

Thus, MRS = -U1 /U2 = -[(1 - a)/a](q1 /q2 ) ρ - 1 .<br />

3.1 Suppose that Dale purchases two goods at prices<br />

p 1 and p 2 . If her original income is Y, the intercept<br />

of the budget line on the Good 1 axis (where the<br />

consumer buys only Good 1) is Y/p 1 . Similarly, the<br />

intercept is Y/p 2 on the Good 2 axis. A 50% income<br />

tax lowers income <strong>to</strong> half its original level, Y/2. As a<br />

result, the budget line shifts inward <strong>to</strong>ward the origin.<br />

The intercepts on the Good 1 and Good 2 axes<br />

are Y/(2p 1 ) and Y/(2p 2 ), respectively. The opportunity<br />

set shrinks by the area between the original<br />

budget line and the new line.<br />

3.3 In the figure, the consumer can afford <strong>to</strong> buy up <strong>to</strong><br />

12 thousand gallons of water a week if not constrained.<br />

The opportunity set, area A and B, is<br />

bounded by the axes and the budget line. A vertical<br />

line at 10 thousand on the water axis indicates the<br />

quota. The new opportunity set, area A, is bounded<br />

by the axes, the budget line, and the quota line.<br />

Because of the rationing, the consumer loses part<br />

of the original opportunity set: the triangle B <strong>to</strong> the<br />

right of the 10-thousand-gallons quota line. The consumer<br />

has fewer opportunities because of rationing.<br />

For Chapter 3, Exercise 3.3<br />

Other goods per week<br />

Budget line<br />

Quota<br />

A B<br />

0 10 12<br />

Water, thousand gallons per month<br />

4.3 Andy’s marginal utility of apples divided by the<br />

price of apples is 3/2 = 1.5. The marginal utility<br />

for kumquats is 5/4 = 1.2. That is, a dollar spent

on apples gives him more extra utils than a dollar<br />

spent on kumquats. Thus, Andy maximizes his utility<br />

by spending all his money on apples and buying<br />

40/2 = 20 pounds of apples.<br />

4.14 David’s marginal utility of q 1 is 1 and his marginal util-<br />

ity of q2 is 2. The slope of David’s indifference curve is<br />

-U1 /U2 = - 1<br />

2 . Because the marginal utility from one<br />

extra unit of q2 = 2 is twice that from one extra unit<br />

of q1 , if the price of q2 is less than twice that of q1 ,<br />

David buys only q2 = Y/p2 , where Y is his income and<br />

p2 is the price. If the price of q2 is more than twice that<br />

of q1 , David buys only q1 . If the price of q2 is exactly<br />

twice as much as that of q1 , he is indifferent between<br />

buying any bundle along his budget line.<br />

4.15 Vasco determines his optimal bundle by equating<br />

the ratios of each good’s marginal utility <strong>to</strong> its price.<br />

a. At the original prices, this condition is<br />

U1 /10 = 2q1q2 = 2q2 1 = U2 /5. Thus, by dividing<br />

both sides of the middle equality by 2q1 ,<br />

we know that his optimal bundle has the property<br />

that q1 = q2 . His budget constraint is<br />

90 = 10q1 + 5q2 . Substituting q2 for q1 , we find<br />

that 15q2 = 90, or q2 = 6 = q1 .<br />

b. At the new price, the optimum condition<br />

requires that U1 /10 = 2q1q2 = 2q2 1 = U2 /10, or<br />

2q2 = q1 . By substituting this condition in<strong>to</strong> his<br />

budget constraint, 90 = 10q1 + 10q2 , and solving,<br />

we learn that q2 = 3 and q1 = 6. Thus, as<br />

the price of chickens doubles, he cuts his consumption<br />

of chicken in half but does not change<br />

how many slabs of ribs he eats.<br />

6.2 Change the labels on the figure in the Challenge<br />

Solution <strong>to</strong> illustrate the answer <strong>to</strong> this question:<br />

When the price in Canada is relative low, the mo<strong>to</strong>rist<br />

buys gasoline in Canada, and vice versa.<br />

Chapter 4<br />

1.7 The figure shows that the price-consumption curve<br />

is horizontal. The demand for CDs depends only on<br />

income and the own price, q 1 = 0.6Y/p 1 .<br />

2.2 Guerdon’s utility function is U(q 1 , q 2 ) = min<br />

(0.5q 1 , q 2 ). To maximize his utility, he always picks<br />

a bundle at the corner of his right-angle indifference<br />

curves. That is, he chooses only combinations of the<br />

two goods such that 0.5q 1 = q 2 . Using that expression<br />

<strong>to</strong> substitute for q 2 in his budget constraint, we<br />

find that<br />

Y = p 1 q 1 + p 2 q 2 = p 1 q 1 + p 2 q 1 /2 = (p 1 + 0.5p 2 )q 1 .<br />

Thus, his demand curve for bananas is q 1 = Y/(p 1 +<br />

0.5p 2 ). The graph of this demand curve is downward<br />

sloping and convex <strong>to</strong> the origin (similar <strong>to</strong> the Cobb-<br />

Douglas demand curve in panel a of Figure 4.1).<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

For Chapter 4, Exercise 1.7<br />

(a) Indifference Curves and Budget Constraints<br />

q 2 , Movie DVDs, Units per year<br />

6<br />

45<br />

15<br />

6<br />

E-35<br />

L<br />

0<br />

1<br />

L2 L3 I 1<br />

I 2<br />

4 12<br />

(b) CD Demand Curve<br />

30 q1 , Music CDs,<br />

Units per year<br />

p 1 , $ per units<br />

e 1<br />

E 1<br />

e 2<br />

E 2<br />

0 4 12 30<br />

2.4 Barbara’s demand for CDs is q1 = 0.6Y/p1 . Consequently,<br />

her Engel curve is a straight line with a<br />

slope of dq1 /dY = 0.6/p1 .<br />

3.2 An opera performance must be a normal good for<br />

Don because he views the only other good he buys<br />

as an inferior good. To show this result in a graph,<br />

draw a figure similar <strong>to</strong> Figure 4.4, but relabel the<br />

vertical “Housing” axis as “Opera performances.”<br />

Don’s equilibrium will be in the upper-left quadrant<br />

at a point like a in Figure 4.4.<br />

3.5 On a graph show L f , the budget line at the fac<strong>to</strong>ry<br />

s<strong>to</strong>re, and L o , the budget constraint at the outlet<br />

s<strong>to</strong>re. At the fac<strong>to</strong>ry s<strong>to</strong>re, the consumer maximum<br />

occurs at ef on indifference curve If . Suppose that<br />

we increase the income of a consumer who shops<br />

at the outlet s<strong>to</strong>re <strong>to</strong> Y* so that the resulting budget<br />

e 3<br />

E 3<br />

Priceconsumption<br />

curve<br />

I 3<br />

CD<br />

demand<br />

curve<br />

q 1 , Music CDs,<br />

Units per year

E-36 <strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

line L* is tangent <strong>to</strong> the indifference curve If . The<br />

consumer would buy Bundle e*. That is, the pure<br />

substitution effect (the movement from ef <strong>to</strong> e*)<br />

causes the consumer <strong>to</strong> buy relatively more firsts.<br />

The <strong>to</strong>tal effect (the movement from ef <strong>to</strong> eo ) reflects<br />

both the substitution effect (firsts are now relatively<br />

less expensive) and the income effect (the consumer<br />

is worse off after paying for shipping). The<br />

income effect is small if (as seems reasonable) the<br />

budget share of plates is small. An ad valorem tax<br />

has qualitatively the same effect as a specific tax<br />

because both taxes raise the relative price of firsts <strong>to</strong><br />

seconds.<br />

3.7 We can determine the optimal bundle, e1 , at the<br />

original prices p1 = p2 = 1 by using the demand<br />

equation from Table 4.1: q1 = 4(p2 /p1 ) 2 = 4 and<br />

q2 = Y/p2 - 4(p2 /p1 ) = 10 - 4 = 6. This optimal<br />

bundle is on an indifference curve where<br />

U = 4(4) 0.5 + 6 = 14.<br />

At the new bundle, e2 , where p1 = 2 and p2 = 1,<br />

q1 = 4(1/2) 2 = 1, and q2 = 10 - 4(1) = 8. This<br />

optimal bundle is on an indifference curve where<br />

U = 4(1) 0.5 + 8 = 12.<br />

To determine e*, we want <strong>to</strong> stay on the original<br />

indifference curve. We know that the tangency<br />

condition will give the same q1 as at e2 because q1 depends on only the relative prices, so q1 = 1. The<br />

question is what Y will compensate Phillip for the<br />

higher price so that he can stay on the original indifference<br />

curve. Because q2 = Y - 4(1/2) = Y - 4,<br />

the utility is U = 1 + (Y - 4) = Y - 3. So the Y<br />

that results in U = 14 is Y = 17. Thus, the substitution<br />

effect is -3 (based on the movement from<br />

e1 <strong>to</strong> e*) and the income effect is 0 (the movement<br />

from e* <strong>to</strong> e2 ), so the <strong>to</strong>tal effect is -3 (movement<br />

from e1 <strong>to</strong> e2 ).<br />

3.9 At Sylvia’s optimal bundle, q1 = jq2 (see Chapter 3).<br />

Otherwise, she could reduce her expenditure on<br />

one of the goods and attain the same level of utility.<br />

Because at the optimal bundle U = min(q1 , jq2 ), the<br />

Hicksian demands are q1 = H1 (p1 , p2 , U) = U and<br />

q2 = H2 (p1 , p2 , U) = U/j. The expenditure function<br />

is E = p1q1 + p2q2 = p1U + p2U/j = (p1 + p2 /j)U.<br />

4.1 The CPI accurately reflects the true cost of living<br />

because Alix does not substitute between the goods<br />

as the relative prices change.<br />

Chapter 5<br />

1.1 At a price of 30, the quantity demanded is 30, so the<br />

consumer surplus is 1<br />

2 (30 * 30) = 450, because the<br />

demand curve is linear.<br />

1.4 Hong and Wolak (2008) estimate that Area A is<br />

$215 million and area B is $118 (= 333 - 215)<br />

million (as you should have shown in your figure in<br />

the answer <strong>to</strong> Exercise 1.3).<br />

a. Given that the demand function is Q = Xp -1.6 ,<br />

the revenue function is R(p) = pQ = Xp -0.6 .<br />

Thus, the change in revenue, -$215 million,<br />

equals R(39) - R(37) = X(39) -0.6 - X(37) -0.6 L<br />

-0.00356X. Solving -0.00356X = -215, we<br />

find that X L 60,353.<br />

b. We follow the process in Solved Problem 5.1<br />

39<br />

60,353p-1.6dp1 = 60,353<br />

0.6 p-0.6 2 39<br />

∆CS = -<br />

L37<br />

37<br />

L 100,588(39-0.6 - 37-0.6 )<br />

L 100,588 * (-0.00356) L -358.<br />

This <strong>to</strong>tal consumer surplus loss is larger than<br />

the one estimated by Hong and Wolak (2008)<br />

because they used a different demand function.<br />

Given this <strong>to</strong>tal consumer surplus loss, area B is<br />

$146 (= 358 - 215) million.<br />

2.2 Because the good is inferior, the compensated demand<br />

curves cut the uncompensated demand curve, D,<br />

from below as the figure shows. Consequently,<br />

CV = A, ∆CS = A + B, EV = A + B + C.<br />

CV 6 ∆CS 6 EV .<br />

For Chapter 5, Exercise 2.2<br />

p, $ per unit<br />

p 2<br />

p 1<br />

A<br />

e 2<br />

B<br />

e 1<br />

C<br />

D<br />

H EV<br />

H CV<br />

q 1 , Units per quarter<br />

3.4 The two demand curves cross at e 1 in the diagram.<br />

The price elasticity of demand, ε = (dQ/dp)(p/Q),<br />

equals 1 over the slope of the demand curve, dp/dQ,<br />

times the ratio of the price <strong>to</strong> the quantity. Thus, at e 1<br />

where both demand curves have the same price, p 1 ,<br />

and the same quantity, Q 1 , the steeper the demand<br />

curve, the lower the elasticity of demand. If the<br />

price rises from p 1 <strong>to</strong> p 2 , the consumer surplus falls<br />

from A + C <strong>to</strong> A with the relatively elastic demand<br />

curve (a loss of C) and from A + B + C + D <strong>to</strong><br />

A + B (a loss of C + D) with the relatively inelastic<br />

demand curve.

For Chapter 5, Exercise 3.4<br />

p, $ per unit<br />

p 2<br />

p 1<br />

A<br />

C<br />

Relatively inelastic<br />

demand (at e 1 )<br />

B<br />

e 3 D<br />

Q 3<br />

e 2<br />

Q 2<br />

Q, Units per week<br />

5.8 The proposed tax system exempts an individual’s<br />

first $10,000 of income. Suppose that a flat 10%<br />

rate is charged on the remaining income. Someone<br />

who earns $20,000 has an average tax rate of 5%,<br />

whereas someone who earns $40,000 has an average<br />

tax rate of 7.5%, so this tax system is progressive.<br />

5.10 As the marginal tax rate on income increases, people<br />

substitute away from work due <strong>to</strong> the pure substitution<br />

effect. However, the income effect can be<br />

either positive or negative, so the net effect of a tax<br />

increase is ambiguous. Also, because wage rates differ<br />

across countries, the initial level of income differs,<br />

again adding <strong>to</strong> the theoretical ambiguity. If<br />

we know that people work less as the marginal<br />

tax rate increases, we can infer that the substitution<br />

effect and the income effect go in the same<br />

direction or that the substitution effect is larger.<br />

However, Prescott’s (2004) evidence alone about<br />

hours worked and marginal tax rates does not<br />

allow us <strong>to</strong> draw such an inference because U.S. and<br />

European workers may have different tastes and face<br />

different wages.<br />

5.11 The figure shows Julia’s original consumer equilibrium:<br />

Originally, Julia’s budget constraint was a<br />

straight line, L1 with a slope of -w, which was tangent<br />

<strong>to</strong> her indifference curve I1 at e1 , so she worked<br />

12 hours a day and consumed Y1 = 12w goods. The<br />

maximum-hours restriction creates a kink in Julia’s<br />

new budget constraint, L2 . This constraint is the<br />

same as L1 up <strong>to</strong> eight hours of work, and is horizontal<br />

at Y = 8w for more hours of work. The highest<br />

indifference curve that <strong>to</strong>uches this constraint is I2 .<br />

Because of the restriction on the hours she can work,<br />

e 1<br />

Q 1<br />

Relatively elastic<br />

demand (at e 1 )<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

E-37<br />

Julia chooses <strong>to</strong> work eight hours a day and <strong>to</strong> consume<br />

Y 2 = 8w goods, at e 2 . (She will not choose <strong>to</strong><br />

work fewer than eight hours. For her <strong>to</strong> do so, her<br />

indifference curve I 2 would have <strong>to</strong> be tangent <strong>to</strong> the<br />

downward-sloping section of the new budget constraint.<br />

However, such an indifference curve would<br />

have <strong>to</strong> cross the original indifference curve, I 1 , which<br />

is impossible: see Chapter 3.) Thus, forcing Julia <strong>to</strong><br />

restrict her hours lowers her utility: I 2 must be below<br />

I 1 .Comment: When I was in college, I was offered<br />

a summer job in California. My employer said,<br />

“You’re lucky you’re a male.” He claimed that, <strong>to</strong><br />

protect women (and children) from overwork, an<br />

archaic law required him <strong>to</strong> pay women, but not<br />

men, double overtime after eight hours of work. As<br />

a result, he offered overtime work only <strong>to</strong> his male<br />

employees. Such clearly discrimina<strong>to</strong>ry rules and<br />

behavior are now prohibited. Today, however, both<br />

females and males must be paid higher overtime<br />

wages—typically 1.5 times as much as the usual<br />

wage. Consequently, many employers do not let<br />

employees work overtime.<br />

For Chapter 5, Problem 5.11<br />

Y, Goods per day<br />

Y1 = 12w<br />

Y 2 = 8w<br />

L 1<br />

L2<br />

e 1<br />

Time<br />

constraint<br />

I 1<br />

I 2<br />

24 H1 = 12 H2 = 8 H, Work hours<br />

per day<br />

6.2 Parents who do not receive subsidies prefer that<br />

poor parents receive lump-sum payments rather<br />

than a subsidized hourly rate for child care. If the<br />

supply curve for child-care services is upward sloping,<br />

by shifting the demand curve farther <strong>to</strong> the<br />

right, the price subsidy raises the price of child-care<br />

for these other parents.<br />

6.3 The government could give a smaller lump-sum subsidy<br />

that shifts the L LS curve down so that it is parallel<br />

<strong>to</strong> the original curve but tangent <strong>to</strong> indifference<br />

curve I 2 . This tangency point is <strong>to</strong> the left of e 2 , so<br />

the parents would use fewer hours of child care than<br />

with the original lump-sum payment.<br />

e 2

E-38 <strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

Chapter 6<br />

3.1 One worker produces one unit of output, two workers<br />

produce two units of output, and n workers produce<br />

n units of output. Thus, the <strong>to</strong>tal product of<br />

labor equals the number of workers: q = L. The<br />

<strong>to</strong>tal product of labor curve is a straight line with a<br />

slope of 1. Because we are <strong>to</strong>ld that each extra worker<br />

produces one more unit of output, we know that the<br />

marginal product of labor, dq/dL, is 1. By dividing<br />

both sides of the production function, q = L, by L,<br />

we find that the average product of labor, q/L, is 1.<br />

3.4 (a) Given that the production function is<br />

q = L 0.75 K 0.25 , the average product of labor, holding<br />

capital fixed at K, is AP L = q/L = L -0.25 K 0.25 =<br />

(K/L) 0.25 . (b) The marginal product of labor<br />

is MP L = dq/dL = 3<br />

4 (K/L)0.25 . (c) At K = 16,<br />

AP L = 2L 0.25 and MP L = 1.5L 0.25 .<br />

4.4 The isoquant looks like the “right angle” ones in<br />

panel b of Figure 6.3 because the firm cannot substitute<br />

between discs and machines but must use<br />

them in equal proportions: one disc and one hour of<br />

machine services.<br />

4.8 Using Equation 6.8, we know that the marginal<br />

rate of technical substitution is MRTS =<br />

-MPL /MPK = - 2<br />

3 .<br />

4.9 The isoquant for q = 10 is a straight line that hits<br />

the B axis at 10 and the G axis at 20. The marginal<br />

product of B is MPB = 0q/ 0B = 1 everywhere<br />

along the isoquant. Similarly, MPG = 0.5. Given that<br />

B is on the horizontal axis, MRTS = -MPB /MPG = -1/0.5 = -2.<br />

5.4 This production function is a Cobb-Douglas production<br />

function. Even though it has three inputs<br />

instead of two, the same logic applies. Thus, we can<br />

calculate the returns <strong>to</strong> scale as the sum of the exponents:<br />

γ = 0.27 + 0.16 + 0.61 = 1.04. That is, it<br />

has (nearly) constant returns <strong>to</strong> scale. The marginal<br />

product of material is<br />

0q/0M = 0.61L 0.27 K 0.16 M -0.39 = 0.61q/M.<br />

6.4 The marginal product of labor of Firm 1 is only 90%<br />

of the marginal product of labor of Firm 2 for a particular<br />

level of inputs. Using calculus, we find that<br />

the MPL of Firm 1 is 0q1 /0L = 0.9 0f(L, K)/0L<br />

= 0.9 0q2 /0L.<br />

7.2 We do not have enough information <strong>to</strong> answer this<br />

question. If we assume that Japanese and American<br />

firms have identical production functions and produce<br />

using the same ratio of fac<strong>to</strong>rs during good<br />

times, Japanese firms will have a lower average<br />

product of labor during recessions because they are<br />

less likely <strong>to</strong> lay off workers. However, it is not clear<br />

how Japanese and American firms expand output<br />

during good times: Do they hire the same number of<br />

extra workers? As a result, we cannot predict which<br />

country has the higher average product of labor.<br />

Chapter 7<br />

1.3 If the plane cannot be resold, its purchase price is<br />

a sunk cost, which is unaffected by the number of<br />

times the plane is flown. Consequently, the average<br />

cost per flight falls with the number of flights, but<br />

the <strong>to</strong>tal cost of owning and operating the plane<br />

rises because of extra consumption of gasoline<br />

and maintenance. Thus, the more frequently someone<br />

has a reason <strong>to</strong> fly, the more likely that flying<br />

one’s own plane costs less per flight than a ticket<br />

on a commercial airline. However, by making extra<br />

(“unnecessary”) trips, Mr. Agassi raises his <strong>to</strong>tal<br />

cost of owning and operating the airplane.<br />

2.5 The <strong>to</strong>tal cost of building a 1-cubic-foot crate is $6.<br />

It costs four times as much <strong>to</strong> build an 8-cubic-foot<br />

crate, $24. In general, as the height of a cube increases,<br />

the <strong>to</strong>tal cost of building it rises with the square of the<br />

height, but the volume increases with the cube of the<br />

height. Thus, the cost per unit of volume falls.<br />

2.12 Because the franchise tax is a lump-sum tax that does<br />

not vary with output, the more the firm produces,<br />

the less tax it pays per unit, l/q. The firm’s after-tax<br />

average cost, ACa , is the sum of its before-tax average<br />

cost, ACb , and its average tax payment per unit, l/q.<br />

Because the franchise tax does not vary with output,<br />

it does not affect the marginal cost curve. The marginal<br />

cost curve crosses both average cost curves from<br />

below at their minimum points. The quantity, qa ,<br />

at which the after-tax average cost curve reaches its<br />

minimum, is larger than the quantity qb at which the<br />

before-tax average cost curve achieves a minimum.<br />

For Chapter 7, Exercise 2.12<br />

Costs per unit, $<br />

/q<br />

q b<br />

q a<br />

MC<br />

AC a = AC b + /q<br />

AC b<br />

q, Units per day

3.1 Let w be the cost of a unit of L and r be the cost<br />

of a unit of K. Because the two inputs are perfect<br />

substitutes in the production process, the firm uses<br />

only the less expensive of the two inputs. Therefore,<br />

the long-run cost function is C(q) = wq if w … r;<br />

otherwise, it is C(q) = rq.<br />

3.2 According <strong>to</strong> Equation 7.11, if the firm were minimizing<br />

its cost, the extra output it gets from the last<br />

dollar spent on labor, MPL /w = 50/200 = 0.25,<br />

should equal the extra output it derives from the last<br />

dollar spent on capital, MPK /r = 200/1,000 = 0.2.<br />

Thus, the firm is not minimizing its costs. It would<br />

save money if it used relatively less capital and more<br />

labor, from which it gets more extra output from<br />

the last dollar spent.<br />

3.4 You produce your output, exam points, using as<br />

inputs the time spent on Question 1, t1 , and the time<br />

spent on Question 2, t2 . If you have diminishing marginal<br />

returns <strong>to</strong> extra time on each problem, your<br />

isoquants have the usual shapes: They curve away<br />

from the origin. You face a constraint that you may<br />

spend no more than 60 minutes on the two questions:<br />

60 = t1 + t2 . The slope of the 60-minute isocost<br />

curve is -1: For every extra minute you spend<br />

on Question 1, you have one less minute <strong>to</strong> spend on<br />

Question 2. To maximize your test score, given that<br />

you can spend no more than 60 minutes on the exam,<br />

you want <strong>to</strong> pick the highest isoquant that is tangent<br />

<strong>to</strong> your 60-minute isocost curve. At the tangency, the<br />

slope of your isocost curve, -1, equals the slope of<br />

your isoquant, -MP1 /MP2 . That is, your score on<br />

the exam is maximized when MP1 = MP2 , where the<br />

last minute spent on Question 1 would increase your<br />

score by as much as spending it on Question 2 would.<br />

Therefore, you’ve allocated your time on the exam<br />

wisely if you are indifferent as <strong>to</strong> which question <strong>to</strong><br />

work on during the last minute of the exam.<br />

3.6 From the information given and assuming that<br />

there are no economies of scale in shipping baseballs,<br />

it appears that balls are produced using a<br />

constant returns <strong>to</strong> scale, fixed-proportion production<br />

function. The corresponding cost function is<br />

C(q) = (w + s + m)q, where w is the wage for the<br />

time period it takes <strong>to</strong> stitch one ball, s is the cost of<br />

shipping one ball, and m is the price of all material <strong>to</strong><br />

produce one ball. Because the cost of all inputs other<br />

than labor and transportation are the same everywhere,<br />

the cost difference between Georgia and Costa<br />

Rica depends on w + s in both locations. As firms<br />

choose <strong>to</strong> produce in Costa Rica, the extra shipping<br />

cost must be less than the labor savings in Costa Rica.<br />

4.2 The average cost of producing one unit is α (regardless<br />

of the value of β). If β = 0, the average cost<br />

does not change with volume. If learning by doing<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

E-39<br />

increases with volume, β 6 0, so the average cost<br />

falls with volume. Here, the average cost falls<br />

exponentially (a smooth curve that asymp<strong>to</strong>tically<br />

approaches the quantity axis).<br />

6.1 If -w/r is the same as the slope of the line segment<br />

connecting the wafer-handling stepper and the stepper<br />

technologies, then the isocost will lie on that line<br />

segment, and the firm will be indifferent between<br />

using either of the two technologies (or any combination<br />

of the two). In all the isocost lines in the<br />

figure, the cost of capital is the same, and the wage<br />

varies. The wage such that the firm is indifferent lies<br />

between the relatively high wage on the C 2 isocost<br />

line and the lower wage on the C 3 isocost line.<br />

6.3 The firm chooses its optimal labor-capital ratio using<br />

Equation 7.11: MPL /w = MPK /r. That is, 1<br />

2q/(wL) =<br />

1<br />

2q/(rK), or L/K = r/w. In the United States where<br />

w = r = 10, the optimal L/K = 1, or L = K.<br />

The firm produces where q = 100 = L0.5K0.5 =<br />

K0.5K0.5 = K. Thus, q = K = L = 100. The cost is<br />

C = wL + rK = 10 * 100 + 10 * 100 = 2,000.<br />

At its Asian plant, the optimal input ratio is<br />

L*/K* = 1.1r/(w/1.1) = 11/(10/1.1) = 1.21. That<br />

is, L* = 1.21K*. Thus, q = (1.21K*) 0.5 (K*) 0.5 =<br />

1.1K*. So K* = 100/1.1 and L* = 110. The cost is<br />

C* = [(10/1.1) * 110] + [11 * (100/1.1)] = 2,000.<br />

That is, the firm will use a different fac<strong>to</strong>r ratio in<br />

Asia, but the cost will be the same. If the firm could<br />

not substitute <strong>to</strong>ward the less expensive input, its<br />

cost in Asia would be C** = [(10/1.1) * 100] +<br />

[11 * 100] = 2,009.09.<br />

Chapter 8<br />

2.3 How much the firm produces and whether it shuts<br />

down in the short run depend only on the firm’s variable<br />

costs. (The firm picks its output level so that<br />

its marginal cost—which depends only on variable<br />

costs—equals the market price, and it shuts down<br />

only if market price is less than its minimum average<br />

variable cost.) Learning that the amount spent<br />

on the plant was greater than previously believed<br />

should not change the output level that the manager<br />

chooses. The change in the bookkeeper’s valuation<br />

of the his<strong>to</strong>rical amount spent on the plant<br />

may affect the firm’s short-run business profit but<br />

does not affect the firm’s true economic profit. The<br />

economic profit is based on opportunity costs—the<br />

amount for which the firm could rent the plant <strong>to</strong><br />

someone else—and not on his<strong>to</strong>rical payments.<br />

2.5 The first-order condition <strong>to</strong> maximize profit is the<br />

derivative of the profit function with respect <strong>to</strong> q<br />

set equal <strong>to</strong> zero: 120 - 40 - 20q = 0. Thus,

E-40 <strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

profit is maximized where q = 4, so that R(4) =<br />

120 * 4 = 480, VC(4) = (40 * 4) + (10 * 16) =<br />

320, π(4) = R(4) - VC(4) - F = 480 - 320 - 200 =<br />

-40. The firm should operate in the short run<br />

because its revenue exceeds its variable cost:<br />

480 7 320.<br />

3.9 Some farmers did not pick apples so as <strong>to</strong> avoid<br />

incurring the variable cost of harvesting apples.<br />

These farmers left open the question of whether they<br />

would harvest in the future if the price rose above<br />

the shutdown level. Other, more pessimistic farmers<br />

did not expect the price <strong>to</strong> rise anytime soon,<br />

so they bulldozed their trees, leaving the market for<br />

good. (Most farmers planted alternative apples such<br />

as Granny Smith and Gala, which are more popular<br />

with the public and sell at a price above the minimum<br />

average variable cost.)<br />

3.11 The competitive firm’s marginal cost function is found<br />

by differentiating its cost function with respect <strong>to</strong><br />

quantity: MC(q) = dC(q)/dq = b + 2cq + 3dq2 .<br />

The firm’s necessary profit-maximizing condition is<br />

p = MC = b + 2cq + 3dq2 . We can use the quadratic<br />

formula <strong>to</strong> solve this equation for q for a specific<br />

price <strong>to</strong> determine its profit-maximizing output.<br />

3.13 Suppose that a U-shaped marginal cost curve cuts<br />

a competitive firm’s demand curve (price line) from<br />

above at q1 and from below at q2 . By increasing output<br />

<strong>to</strong> q1 + 1, the firm earns extra profit because<br />

the last unit sells for price p, which is greater than<br />

the marginal cost of that last unit. Indeed, the price<br />

exceeds the marginal cost of all units between q1 and q2 , so it is more profitable <strong>to</strong> produce q2 than<br />

q1 . Thus, the firm should either produce q2 or shut<br />

down (if it is making a loss at q2 ). We can derive this<br />

result using calculus. The second-order condition<br />

for a competitive firm requires that marginal cost<br />

cut the demand line from below at q*, the profitmaximizing<br />

quantity: dMC(q*)/dq 7 0.<br />

4.2 The shutdown notice reduces the firm’s flexibility,<br />

which matters in an uncertain market. If conditions<br />

suddenly change, the firm may have <strong>to</strong> operate at<br />

a loss for six months before it can shut down. This<br />

potential extra expense of shutting down may discourage<br />

some firms from entering the market initially.<br />

4.5 To derive the expression for the elasticity of the residual<br />

or excess supply curve in Equation 8.17, we differentiate<br />

the residual supply curve, Equation 8.16,<br />

Sr (p) = S(p) - Do (p), with respect <strong>to</strong> p <strong>to</strong> obtain<br />

dS r<br />

dp<br />

dS dDo<br />

= -<br />

dp dp .<br />

Let Q r = S r (p), Q = S(p), and Q o = D(p). We<br />

multiply both sides of the differentiated expression<br />

by p/Q r , and for convenience, we also multiply<br />

the second term by Q/Q = 1 and the last term by<br />

Q o /Q o = 1:<br />

dSr dp p<br />

=<br />

Qr dS<br />

dp p<br />

Qr Q dDo<br />

-<br />

Q dp p<br />

Qr Q o<br />

Q o<br />

We can rewrite this expression as Equation 8.17 by<br />

noting that ηr = (dSt /dp)(p/Qr ) is the residual supply<br />

elasticity, η = (dS/dp)(p/Q) is the market supply<br />

elasticity, εo = (dDo /dp)(p/Qo ) is the demand<br />

elasticity of the other countries, and θ = Qr /Q is<br />

the residual country’s share of the world’s output<br />

(hence 1 - θ = Qo /Q is the share of the rest of the<br />

world). If there are n countries with equal outputs,<br />

then 1/θ = n, so this equation can be rewritten as<br />

ηr = nη - (n - 1)εo .<br />

4.6 a. The incidence of the federal specific tax is shared<br />

equally between consumers and firms, whereas<br />

firms bear virtually none of the incidence of the<br />

state tax (they pass the tax on <strong>to</strong> consumers).<br />

b. From Chapter 2, we know that the incidence of<br />

a tax that falls on consumers in a competitive<br />

market is approximately η/(η - ε). Although the<br />

national elasticity of supply may be a relatively<br />

small number, the residual supply elasticity facing<br />

a particular state is very large. Using the analysis<br />

about residual supply curves, we can infer that<br />

the supply curve <strong>to</strong> a particular state is likely <strong>to</strong><br />

be nearly horizontal—nearly perfectly elastic. For<br />

example, if the price in Maine rises even slightly<br />

relative <strong>to</strong> the price in Vermont, suppliers in Vermont<br />

will be willing <strong>to</strong> shift their entire supply <strong>to</strong><br />

Maine. Thus, we expect the nearly full incidence <strong>to</strong><br />

fall on consumers from a state tax but less from a<br />

federal tax, consistent with the empirical evidence.<br />

c. If all 50 states were identical, we could write<br />

the residual elasticity of supply, Equation 8.17,<br />

as ηr = 50η - 49εo . Given this equation, the<br />

residual supply elasticity <strong>to</strong> one state is at least 50<br />

times larger than the national elasticity of supply,<br />

ηr Ú 50η, because εo 6 0, so the -49εo term is<br />

positive and increases the residual supply elasticity.<br />

5.5 Because the clinics are operating at minimum average<br />

cost, a lump-sum tax that causes the minimum<br />

average cost <strong>to</strong> rise by 10% would cause the market<br />

price of abortions <strong>to</strong> rise by 10%. Based on the estimated<br />

price elasticity of between -0.70 and -0.99,<br />

the number of abortions would fall <strong>to</strong> between<br />

7% and 10%. A lump-sum tax shifts upward the<br />

average cost curve but does not affect the marginal<br />

cost curve. Consequently, the market supply curve,<br />

which is horizontal and the minimum of the average<br />

cost curve, shifts up in parallel.<br />

5.6 Each competitive firm wants <strong>to</strong> choose its output q <strong>to</strong><br />

maximize its after-tax profit: π = pq - C(q) - l.<br />

.

Its necessary condition <strong>to</strong> maximize profit is that<br />

price equals marginal cost: p - dC(q)/dq = 0.<br />

Industry supply is determined by entry, which occurs<br />

until profits are driven <strong>to</strong> zero (we ignore the problem<br />

of fractional firms and treat the number of firms, n,<br />

as a continuous variable): pq - [C(q) + l] = 0. In<br />

equilibrium, each firm produces the same output, q,<br />

so market output is Q = nq, and the market inverse<br />

demand function is p = p(Q) = p(nq). By substituting<br />

the market inverse demand function in<strong>to</strong> the<br />

necessary and sufficient condition, we determine the<br />

market equilibrium (n*, q*) by the two conditions:<br />

p(n*q*) - dC(q*)/dq = 0,<br />

p(n*q*)q* - [C(q*) + l] = 0.<br />

For notational simplicity, we henceforth leave<br />

off the asterisks. To determine how the equilibrium<br />

is affected by an increase in the lump-sum tax,<br />

we evaluate the comparative statics at l = 0. We<br />

<strong>to</strong>tally differentiate our two equilibrium equations<br />

with respect <strong>to</strong> the two endogenous variables, n and<br />

q, and the exogenous variable, l:<br />

dq(n[dp(nq)/dQ] - d2C(q)/dq2 )<br />

+ dn(q[dp(nq)/dQ]) + dl (0) = 0,<br />

dq(n[qdp(nq)/dQ] + p(nq) - dC/dq)<br />

+ dn(q2 [dp(nq)/dQ]) - dl = 0.<br />

We can write these equations in matrix form (noting<br />

that p - dC/dq = 0 from the necessary condition) as<br />

n<br />

4<br />

dp<br />

dQ - d2C dq2 nq dp<br />

dQ<br />

q dp<br />

dQ<br />

dp<br />

q2 dQ<br />

4 J dq<br />

R = J0<br />

dn 1 Rdl.<br />

There are several ways <strong>to</strong> solve these equations.<br />

One is <strong>to</strong> use Cramer’s rule. Define<br />

n<br />

D = 4<br />

dp<br />

dQ - d2C dq2 nq dp<br />

dQ<br />

q dp<br />

dQ<br />

4<br />

dp<br />

q2 dQ<br />

= ¢n dp<br />

dQ - d2C dp<br />

≤q2<br />

dq2 dQ<br />

= - d2C dp<br />

q2 7 0,<br />

dq2 dQ<br />

dp dp<br />

- q ¢nq<br />

dQ dQ ≤<br />

where the inequality follows from each firm’s sufficient<br />

condition. Using Cramer’s rule:<br />

dq<br />

dl =<br />

0 q<br />

4<br />

dp<br />

dQ<br />

4<br />

dp<br />

2 1 q<br />

dQ<br />

=<br />

D<br />

-q dp<br />

dQ<br />

D<br />

7 0,<br />

dn<br />

dl =<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

n<br />

4<br />

dp<br />

dQ - d2C dq2 nq dp<br />

dQ<br />

D<br />

The change in price is<br />

dp(nq)<br />

dl<br />

Chapter 9<br />

0<br />

4<br />

1<br />

=<br />

dp dn dq<br />

= Jq + n<br />

dQ dl dl R<br />

= dp<br />

dQ D<br />

¢n dp<br />

dQ - d2C dq<br />

D<br />

= dp<br />

dQ §<br />

- d2C q<br />

2 dq<br />

D<br />

n dp<br />

dQ - d2 C<br />

dq 2<br />

2 ≤q<br />

¥ 7 0.<br />

D<br />

-<br />

E-41<br />

6 0.<br />

nq dp<br />

dQ<br />

D T<br />

5.5 The specific subsidy shifts the supply curve, S in<br />

the figure, down by s = 11., <strong>to</strong> the curve labeled<br />

S - 11.. Consequently, the equilibrium shifts from<br />

e1 <strong>to</strong> e2 , so the quantity sold increases (from 1.25<br />

<strong>to</strong> 1.34 billion rose stems per year), the price that<br />

consumers pay falls (from 30¢ <strong>to</strong> 28¢ per stem),<br />

and the amount that suppliers receive, including the<br />

subsidy, rises (from 30¢ <strong>to</strong> 39¢), so that the differential<br />

between what the consumers pay and what<br />

the producers receive is 11¢. Consumers and producers<br />

of roses are delighted <strong>to</strong> be subsidized by<br />

other members of society. Because the price <strong>to</strong> cus<strong>to</strong>mers<br />

drops, consumer surplus rises from A + B<br />

<strong>to</strong> A + B + D + E. Because firms receive more<br />

per stem after the subsidy, producer surplus rises<br />

from D + G <strong>to</strong> B + C + D + G (the area under<br />

the price they receive and above the original supply<br />

curve). Because the government pays a subsidy<br />

of 11¢ per stem for each stem sold, the government’s<br />

expenditures go from zero <strong>to</strong> the rectangle<br />

B + C + D + E + F. Thus, the new welfare is the<br />

sum of the new consumer surplus and producer surplus<br />

minus the government’s expenses. Welfare falls<br />

from A + B + D + G <strong>to</strong> A + B + D + G - F.<br />

The deadweight loss, this drop in welfare<br />

∆W = -F, results from producing <strong>to</strong>o much: The<br />

marginal cost <strong>to</strong> producers of the last stem, 39¢,<br />

exceeds the marginal benefit <strong>to</strong> consumers, 28¢.<br />

5.7 If the tax is based on economic profit, the tax has<br />

no long-run effect because the firms make zero economic<br />

profit. If the tax is based on business profit

E-42 <strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

For Chapter 9, Problem 5.5<br />

s = 11¢<br />

p, ¢ per stem<br />

39¢<br />

30¢<br />

28¢<br />

and business profit is greater than economic profit,<br />

the profit tax raises firms’ after-tax costs and results<br />

in fewer firms in the market. The exact effect of<br />

the tax depends on why business profit is less than<br />

economic profit. For example, if the government<br />

ignores opportunity labor cost but includes all capital<br />

cost in computing profit, firms will substitute<br />

<strong>to</strong>ward labor and away from capital.<br />

5.8 The Challenge Solution in Chapter 8 shows the<br />

long-run effect of a lump-sum tax in a competitive<br />

market. Consumer surplus falls by more than tax<br />

revenue increases, and producer surplus remains<br />

zero, so welfare falls.<br />

5.10 a. The initial equilibrium is determined by equating<br />

the quantity demanded <strong>to</strong> the quantity supplied:<br />

100 - 10p = 10p. That is, the equilibrium is<br />

p = 5 and Q = 50. At the support price, the<br />

quantity supplied is Qs = 60. The market clearing<br />

price was p = 4. The deficiency payment<br />

was D = (p - p)Qs = (6 - 4)60 = 120.<br />

b. Consumer surplus rises from CS1 = 1<br />

2 (10 - 5)<br />

50 = 125 <strong>to</strong> CS2 = 1<br />

2 (10 - 4)60 = 180. Producer<br />

surplus rises from PS1 = 1<br />

2 (5 - 0)50 = 125<br />

<strong>to</strong> PS2 = 1<br />

2 * (6 - 0)60 = 180. Welfare falls<br />

from CS1 + PS1 = 125 + 125 = 250 <strong>to</strong> CS2 +<br />

PS2 - D = 180 + 180 - 120 = 240. Thus, the<br />

deadweight loss is 10.<br />

6.5 Without the tariff, the U.S. supply curve of oil<br />

is horizontal at a price of $14.70 (S 1 in Figure<br />

9.9), and the equilibrium is determined by the<br />

A<br />

B<br />

G<br />

D<br />

intersection of this horizontal supply curve with the<br />

demand curve. With a new, small tariff of τ, the U.S.<br />

supply curve is horizontal at $14.70 + τ, and the<br />

new equilibrium quantity is determined by substituting<br />

p = 14.70 + τ in<strong>to</strong> the demand function:<br />

Q = 35.41(14.70 + τ)p -0.37 . Evaluated at τ = 0,<br />

the equilibrium quantity remains at 13.1. The deadweight<br />

loss is the area <strong>to</strong> the right of the domestic<br />

supply curve and <strong>to</strong> the left of the demand curve<br />

between $14.70 and $14.70 + τ (area C + D + E<br />

in Figure 9.9) minus the tariff revenues (area D):<br />

14.70 + τ<br />

DWL = L<br />

dDWL<br />

dτ<br />

C<br />

s = 11¢<br />

1.25 1.34<br />

Q, Billions of rose stems per year<br />

14.70<br />

14.70 + τ<br />

= L<br />

14.70<br />

e 1<br />

[D(p) - S(p)]dp - τ[D(p + τ) - S(p + τ)]<br />

33.54p -0.67 - 3.35p 0.33 4dp<br />

-τ33.54(p + τ) -0.67 - 3.35(p + τ) 0.33 4.<br />

To see how a change in τ affects welfare, we differentiate<br />

DWL with respect <strong>to</strong> τ:<br />

14.70 + τ<br />

= d<br />

dτ b L<br />

14.70<br />

E<br />

F<br />

e2 Demand<br />

[D(p) - S(p)]dp<br />

- τ[D(14.70 + τ) - S(14.70 + τ)] r<br />

S<br />

S − 11¢<br />

= [D(14.70 + τ) - S(14.70 + τ)] - [D(14.70 + τ)

dD(14.70 + τ)<br />

-S(14.70 + τ)] - τ J -<br />

dτ<br />

dS(14.70 + τ)<br />

dD(14.70 + τ)<br />

= -τ J<br />

dτ<br />

- dS(14.70 + τ)<br />

R.<br />

dτ<br />

R<br />

dτ<br />

If we evaluate this expression at τ = 0, we find that<br />

dDWL/dτ = 0. In short, applying a small tariff <strong>to</strong><br />

the free-trade equilibrium has a negligible effect on<br />

quantity and deadweight loss. Only if the tariff is<br />

larger—as in Figure 9.9—do we see a measurable<br />

effect.<br />

Chapter 10<br />

1.7 A subsidy is a negative tax. Thus, we can use the<br />

same analysis that we used in Solved Problem 10.1<br />

<strong>to</strong> answer this question by reversing the signs of the<br />

effects.<br />

4.1 If you draw the convex production possibility frontier<br />

on Figure 10.5, you will see that it lies strictly<br />

inside the concave production possibility frontier.<br />

Thus, more output can be obtained if Jane and<br />

Denise use the concave frontier. That is, each should<br />

specialize in producing the good for which she has a<br />

comparative advantage.<br />

4.2 As Chapter 4 shows, the slope of the budget constraint<br />

facing an individual equals the negative of<br />

that person’s wage. Panel a of the figure illustrates<br />

that Pat’s budget constraint is steeper than Chris’s<br />

because Pat’s wage is larger than Chris’s. Panel b<br />

shows their combined budget constraint after they<br />

marry. Before they marry, each spends some time<br />

in the marketplace earning money and other time<br />

at home cooking, cleaning, and consuming leisure.<br />

After they marry, one of them can specialize in<br />

earning money and the other at working at home.<br />

If they are both equally skilled at household work<br />

For Chapter 10, Exercise 4.2<br />

(a) Unmarried<br />

Y, Goods per day<br />

L P<br />

L C<br />

Time constraint<br />

24 0<br />

H, Work hours per day<br />

(b) Married<br />

Y, Goods per day<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

E-43<br />

(or if Chris is better), then Pat has a comparative<br />

advantage (see Figure 10.5) in working in the marketplace,<br />

and Chris has a comparative advantage<br />

in working at home. Of course, if both enjoy consuming<br />

leisure, they may not fully specialize. As an<br />

example, suppose that, before they got married,<br />

Chris and Pat each spent 10 hours a day in sleep and<br />

leisure activities, 5 hours working in the marketplace,<br />

and 9 hours working at home. Because Chris<br />

earns $10 an hour and Pat earns $20 an hour, they<br />

collectively earned $150 a day and worked 18 hours<br />

a day at home. After they marry, they can benefit<br />

from specialization. If Chris works entirely at home<br />

and Pat works 10 hours in the marketplace and the<br />

rest at home, they collectively earn $200 a day (a<br />

one-third increase) and still have 18 hours of work<br />

at home. If they do not need <strong>to</strong> spend as much time<br />

working at home because of economies of scale, one<br />

or both could work more hours in the marketplace,<br />

and they will have even greater disposable income.<br />

Chapter 11<br />

1.4 For a general linear inverse demand function,<br />

p(Q) = a - bQ, dQ/dp = -1/b, so the elasticity is<br />

ε = -p/(bQ). The demand curve hits the horizontal<br />

(quantity) axis at a/b. At half that quantity (the midpoint<br />

of the demand curve), the quantity is a/(2b),<br />

and the price is a/2. Thus, the elasticity of demand is<br />

ε = -p/(bQ) = -(a/2)/[ab/(2b)] = -1 at the midpoint<br />

of any linear demand curve. As the chapter<br />

shows, a monopoly will not operate in the inelastic<br />

section of its demand curve, so a monopoly will not<br />

operate in the right half of its linear demand curve.<br />

2.2 Amazon’s Lerner Index was (p - MC)/p =<br />

(359 - 159)/359 L 0.557. Using Equation 11.11,<br />

we know that (p - MC)/p L 0.557 = -1/ε, so<br />

ε L -1.795.<br />

L Combined<br />

Time constraint<br />

48 24<br />

0<br />

H, Work hours per day

E-44 <strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

2.4 Given that Apple’s marginal cost was constant, its<br />

average variable cost equaled its marginal cost,<br />

$200. Its average fixed cost was its fixed cost<br />

divided by the quantity produced, 736/Q. Thus,<br />

its average cost was AC = 200 + 736/Q. Because<br />

the inverse demand function was p = 600 - 25Q,<br />

Apple’s revenue function was R = 600Q - 25Q2 ,<br />

so MR = dR/dQ = 600 - 50Q. Apple maximized<br />

its profit where MR = 600 - 50Q = 200 = MC.<br />

Solving this equation for the profit-maximizing<br />

output, we find that Q = 8 million units. By substituting<br />

this quantity in<strong>to</strong> the inverse demand<br />

equation, we determine that the profit-maximizing<br />

price was p = $400 per unit, as the figure shows.<br />

The firm’s profit was π = (p - AC)Q = [400 -<br />

(200 + 736/8)]8 = $864 million. Apple’s Lerner<br />

Index was (p - MC)/p = [400 - 200]/400 = 1<br />

2 .<br />

According <strong>to</strong> Equation 11.11, a profit-maximizing<br />

monopoly operates where (p - MC)/p = -1/ε.<br />

Combining that equation with the Lerner Index<br />

from the previous step, we learn that 1<br />

2 = -1/ε, or<br />

ε = -2.<br />

3.4 A tax on economic profit (of less than 100%) has<br />

no effect on a firm’s profit-maximizing behavior.<br />

Suppose the government’s share of the profit is β.<br />

Then the firm wants <strong>to</strong> maximize its after-tax profit,<br />

which is (1 - γ)π. However, whatever choice of Q<br />

(or p) maximizes π will also maximize (1 - γ)π.<br />

Figure 19.3 gives a graphical example where γ = 1<br />

3 .<br />

Consequently, the tribe’s behavior is unaffected by<br />

a change in the share that the government receives.<br />

We can also answer this problem using calculus.<br />

The before-tax profit is πB = R(Q) - C(Q), and<br />

the after-tax profit is πA = (1 - γ)[R(Q) - C(Q)].<br />

For both, the first-order condition is marginal revenue<br />

equals marginal cost: dR(Q)/dQ = dC(Q)/dQ.<br />

4.1 Yes. The demand curve could cut the average cost<br />

curve only in its downward-sloping section. Consequently,<br />

the average cost is strictly downward sloping<br />

in the relevant region.<br />

6.1 Given the demand curve is p = 10 - Q, its marginal<br />

revenue curve is MR = 10 - 2Q. Thus, the output<br />

that maximizes the monopoly’s profit is determined<br />

by MR = 10 - 2Q = 2 = MC, or Q* = 4. At<br />

that output level, its price is p* = 6 and its profit<br />

is π* = 16. If the monopoly chooses <strong>to</strong> sell 8 units<br />

in the first period (it has no incentive <strong>to</strong> sell more),<br />

its price is $2 and it makes no profit. Given that<br />

the firm sells 8 units in the first period, its demand<br />

curve in the second period is p = 10 - Q/β, so its<br />

marginal revenue function is MR = 10 - 2Q/β.<br />

The output that leads <strong>to</strong> its maximum profit is<br />

determined by MR = 10 - 2Q/β = 2 = MC, or<br />

its output is 4β. Thus, its price is $6 and its profit is<br />

16β. It pays for the firm <strong>to</strong> set a low price in the first<br />

period if the lost profit, 16, is less than the extra<br />

profit in the second period, which is 16(β - 1).<br />

Thus, it pays <strong>to</strong> set a low price in the first period if<br />

16 6 16(β - 1), or 2 6 β.<br />

7.6 If a firm has a monopoly in the output market and<br />

is a monopsony in the labor market, its profit is<br />

π = p(Q(L))Q(L) - w(L)L,where Q(L) is the production<br />

function, p(Q)Q is its revenue, and w(L)L—<br />

the wage times the number of workers—is its cost of<br />

production. The firm maximizes its profit by setting<br />

the derivative of profit with respect <strong>to</strong> labor equal <strong>to</strong><br />

zero (if the second-order condition holds):<br />

¢p + Q(L) dp dQ<br />

≤<br />

dQ dL<br />

dw<br />

- w(L) - L = 0.<br />

dL<br />

Rearranging terms in the first-order condition, we<br />

find that the maximization condition is that the<br />

marginal revenue product of labor,<br />

MRPL = MR * MPL = ¢p + Q(L) dp dQ<br />

≤<br />

dQ dL<br />

= p¢1 + 1 dQ<br />

≤<br />

ε dL ,<br />

equals the marginal expenditure,<br />

ME = w(L) + dw<br />

L<br />

L = w(L)¢1 +<br />

dL w dw<br />

dL ≤<br />

= w(L)¢1 + 1<br />

η ≤,<br />

where ε is the elasticity of demand in the output<br />

market and η is the supply elasticity of labor.<br />

Chapter 12<br />

1.3 This policy allows the firm <strong>to</strong> maximize its profit by<br />

price discriminating if people who put a lower value<br />

on their time (so are willing <strong>to</strong> drive <strong>to</strong> the s<strong>to</strong>re and<br />

transport their purchases themselves) have a higher<br />

elasticity of demand than people who want <strong>to</strong> order<br />

by phone and have the goods delivered.<br />

1.4 The colleges may be providing scholarships as a<br />

form of charity, or they may be price discriminating<br />

by lowering the final price for less wealthy families<br />

(who presumably have higher elasticities of demand).<br />

3.5 See MyEconLab, Chapter Resources, Chapter 12,<br />

“Aibo,” for more details. The two marginal<br />

revenue curves are MRJ = 3,500 - QJ and<br />

MRA = 4,500 - 2QA . Equating the marginal<br />

revenues with the marginal cost of $500, we find<br />

that QJ = 3,000 and QA = 2,000. Substituting<br />

these quantities in<strong>to</strong> the inverse demand curves,

we learn that p J = $2,000 and p A = $2,500.<br />

As the chapter shows, the elasticities of demand<br />

are ε J = p/(MC - p) = 2,000/(500 - 2,000) = - 4<br />

3<br />

and ε A = 2,500/(500 - 2,500) = - 5<br />

4<br />

tion 12.9, we find that<br />

p J<br />

p A<br />

= 2,000<br />

2,500<br />

5<br />

1 + 1/1 - 42<br />

= 0.8 =<br />

1 + 1/1 - 4<br />

. Using Equa-<br />

32 = 1 + 1/εA .<br />

1 + 1/εJ The profit in Japan is (pJ - m)QJ = ($2,000 -<br />

$500) * 3,000 = $4.5 million, and the U.S. profit is<br />

$4 million. The deadweight loss is greater in Japan,<br />

$2.25 million 1 = 1<br />

2 * $1,500 * 3,0002, than in the<br />

United States, $2 million 1 = 1<br />

2 * $2,000 * 2,0002.<br />

3.6 By differentiating, we find that the American marginal<br />

revenue function is MRA = 100 - 2QA , and<br />

the Japanese one is MRJ = 80 - 4QJ. To determine<br />

how many units <strong>to</strong> sell in the United States, the<br />

monopoly sets its American marginal revenue equal<br />

<strong>to</strong> its marginal cost, MRA = 100 - 2QA = 20,<br />

and solves for the optimal quantity, QA = 40 units.<br />

Similarly, because MRJ = 80 - 4QJ = 20, the optimal<br />

quantity is QJ = 15 units in Japan. Substituting<br />

QA = 40 in<strong>to</strong> the American demand function,<br />

we find that pA = 100 - 40 = $60. Similarly, substituting<br />

QJ = 15 units in<strong>to</strong> the Japanese demand<br />

function, we learn that pJ = 80 - (2 * 15) = $50.<br />

Thus, the price-discriminating monopoly charges<br />

20% more in the United States than in Japan. We<br />

can also show this result using elasticities. Because<br />

dQA /dpA = -1 the elasticity of demand is εA =<br />

-pA /QA in the United States and εJ = - 1<br />

2 PJ /QJ in<br />

Japan. In the equilibrium, εA = -60/40 = -3/2<br />

and εJ = -50/(2 * 15) = -5/3. As Equation<br />

12.9 shows, the ratio of the prices depends on the<br />

relative elasticities of demand: pA /pJ = 60/50 =<br />

(1 + 1/εJ )/(1 + 1/εA ) = (1 - 3/5)/(1 - 2/3) = 6/5.<br />

3.8 From the problem, we know that the profitmaximizing<br />

Chinese price is p = 3 and that the<br />

quantity is Q = 0.1 (million). The marginal cost<br />

is m = 1. Using Equation 11.11, (pC - m)/pC =<br />

(3 - 1)/3 = -1/εC , so εC = -3/2. If the Chinese<br />

inverse demand curve is p = a - bQ, then<br />

the corresponding marginal revenue curve is<br />

MR = a - 2bQ. Warner maximizes its profit<br />

where MR = a - 2bQ = m = 1, so its optimal<br />

Q = (a - 1)/(2b). Substituting this expression<br />

in<strong>to</strong> the inverse demand curve, we find that its<br />

optimal p = (a + 1)/2 = 3, or a = 5. Substituting<br />

that result in<strong>to</strong> the output equation, we have<br />

Q = (5 - 1)/(2b) = 0.1 (million). Thus, b = 20,<br />

the inverse demand function is p = 5 - 20Q, and<br />

the marginal revenue function is MR = 5 - 40Q.<br />

Using this information, you can draw a figure<br />

similar <strong>to</strong> Figure 12.3.<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

E-45<br />

3.11 If a monopoly manufacturer can price discriminate,<br />

its price is p i = m/(1 + 1/ε i ) in Country i, i = 1, 2. If<br />

the monopoly cannot price discriminate, it charges<br />

everyone the same price. Its <strong>to</strong>tal demand is Q =<br />

Q 1 + Q 2 = n 1 p ε 1 + n 2 p ε 2. Differentiating with<br />

respect <strong>to</strong> p, we obtain dQ/dp = ε 1 Q 1 /p + ε 2 Q 2 /p.<br />

Multiplying through by p/Q, we learn that the<br />

weighted sum of the two groups’ elasticities is<br />

ε = s 1 ε 1 + s 2 ε 2 , where s i = Q i /Q. Thus, a profitmaximizing,<br />

single-price monopoly charges p =<br />

m/(1 + 1/ε).<br />

Chapter 13<br />

1.1 The payoff matrix in this prisoners’ dilemma game is<br />

Larry<br />

Squeal<br />

Silent<br />

–2<br />

–5<br />

Duncan<br />

Squeal Silent<br />

–2 –5<br />

If Duncan stays silent, Larry gets 0 if he squeals and<br />

-1 (a year in jail) if he stays silent. If Duncan confesses,<br />

Larry gets -2 if he squeals and -5 if he does<br />

not. Thus, Larry is better off squealing in either<br />

case, so squealing is his dominant strategy. By the<br />

same reasoning, squealing is also Duncan’s dominant<br />

strategy. As a result, the Nash equilibrium is<br />

for both <strong>to</strong> confess.<br />

1.3 No strategies are dominant, so we use the bestresponse<br />

approach <strong>to</strong> determine the pure-strategy<br />

Nash equilibria. First, identify each firm’s best<br />

responses given each of the other firms’ strategies<br />

(as we did in Solved Problem 13.1). This game has<br />

two Nash equilibria: (a) Firm 1 medium and Firm 2<br />

low, and (b) Firm 1 low and Firm 2 medium.<br />

1.8 Let the probability that a firm sets a low price be<br />

θ1 for Firm 1 and θ2 for Firm 2. If the firms choose<br />

their prices independently, then θ1θ2 is the probability<br />

that both set a low price, (1 - θ1 )(1 - θ2 ) is the<br />

probability that both set a high price, θ1 (1 - θ2 )<br />

is the probability that Firm 1 prices low and Firm 2<br />

prices high, and (1 - θ1 )θ2 is the probability that Firm<br />

1 prices high and Firm 2 prices low. Firm 2’s expected<br />

payoff is E(π2 ) = 2θ1θ2 + (0)θ1 (1 - θ2 ) + (1 - θ1 )θ2 + 6(1 - θ1 )(1 - θ2 ) = (6 - 6θ1 ) - (5 - 7θ1 )θ2 .<br />

Similarly, Firm 1’s expected payoff is E(π1 ) =<br />

(0)θ1θ2 + 7θ1 (1 - θ2 ) + 2(1 - θ1 )θ2 + 6(1 - θ1 )(1 - θ2 )<br />

= (6 - 4θ2 ) - (1 - 3θ2 )θ1 . Each firm forms a<br />

0<br />

0 –1<br />

–1

E-46 <strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

belief about its rival’s behavior. For example, suppose<br />

that Firm 1 believes that Firm 2 will choose a<br />

low price with a probability θn 2 . If θn 1<br />

2 is less than 3<br />

(Firm 2 is relatively unlikely <strong>to</strong> choose a low price),<br />

it pays for Firm 1 <strong>to</strong> choose the low price because<br />

the second term in E(π1 ), (1 - 3θn 2 )θ1 , is positive, so<br />

as θ1 increases, E(π1 ) increases. Because the highest<br />

possible θ1 is 1, Firm 1 chooses the low price with<br />

certainty. Similarly, if Firm 1 believes θn 2 is greater<br />

than 1<br />

3 , it sets a high price with certainty (θ1 = 0).<br />

If Firm 2 believes that Firm 1 thinks θn 2 is slightly<br />

below 1<br />

3 , Firm 2 believes that Firm 1 will choose a low<br />

price with certainty, and hence Firm 2 will also choose<br />

a low price. That outcome, θ2 = 1, however, is not<br />

consistent with Firm 1’s expectation that θn 2 is a fraction.<br />