Answers to Selected Problems

Answers to Selected Problems

Answers to Selected Problems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

we learn that p J = $2,000 and p A = $2,500.<br />

As the chapter shows, the elasticities of demand<br />

are ε J = p/(MC - p) = 2,000/(500 - 2,000) = - 4<br />

3<br />

and ε A = 2,500/(500 - 2,500) = - 5<br />

4<br />

tion 12.9, we find that<br />

p J<br />

p A<br />

= 2,000<br />

2,500<br />

5<br />

1 + 1/1 - 42<br />

= 0.8 =<br />

1 + 1/1 - 4<br />

. Using Equa-<br />

32 = 1 + 1/εA .<br />

1 + 1/εJ The profit in Japan is (pJ - m)QJ = ($2,000 -<br />

$500) * 3,000 = $4.5 million, and the U.S. profit is<br />

$4 million. The deadweight loss is greater in Japan,<br />

$2.25 million 1 = 1<br />

2 * $1,500 * 3,0002, than in the<br />

United States, $2 million 1 = 1<br />

2 * $2,000 * 2,0002.<br />

3.6 By differentiating, we find that the American marginal<br />

revenue function is MRA = 100 - 2QA , and<br />

the Japanese one is MRJ = 80 - 4QJ. To determine<br />

how many units <strong>to</strong> sell in the United States, the<br />

monopoly sets its American marginal revenue equal<br />

<strong>to</strong> its marginal cost, MRA = 100 - 2QA = 20,<br />

and solves for the optimal quantity, QA = 40 units.<br />

Similarly, because MRJ = 80 - 4QJ = 20, the optimal<br />

quantity is QJ = 15 units in Japan. Substituting<br />

QA = 40 in<strong>to</strong> the American demand function,<br />

we find that pA = 100 - 40 = $60. Similarly, substituting<br />

QJ = 15 units in<strong>to</strong> the Japanese demand<br />

function, we learn that pJ = 80 - (2 * 15) = $50.<br />

Thus, the price-discriminating monopoly charges<br />

20% more in the United States than in Japan. We<br />

can also show this result using elasticities. Because<br />

dQA /dpA = -1 the elasticity of demand is εA =<br />

-pA /QA in the United States and εJ = - 1<br />

2 PJ /QJ in<br />

Japan. In the equilibrium, εA = -60/40 = -3/2<br />

and εJ = -50/(2 * 15) = -5/3. As Equation<br />

12.9 shows, the ratio of the prices depends on the<br />

relative elasticities of demand: pA /pJ = 60/50 =<br />

(1 + 1/εJ )/(1 + 1/εA ) = (1 - 3/5)/(1 - 2/3) = 6/5.<br />

3.8 From the problem, we know that the profitmaximizing<br />

Chinese price is p = 3 and that the<br />

quantity is Q = 0.1 (million). The marginal cost<br />

is m = 1. Using Equation 11.11, (pC - m)/pC =<br />

(3 - 1)/3 = -1/εC , so εC = -3/2. If the Chinese<br />

inverse demand curve is p = a - bQ, then<br />

the corresponding marginal revenue curve is<br />

MR = a - 2bQ. Warner maximizes its profit<br />

where MR = a - 2bQ = m = 1, so its optimal<br />

Q = (a - 1)/(2b). Substituting this expression<br />

in<strong>to</strong> the inverse demand curve, we find that its<br />

optimal p = (a + 1)/2 = 3, or a = 5. Substituting<br />

that result in<strong>to</strong> the output equation, we have<br />

Q = (5 - 1)/(2b) = 0.1 (million). Thus, b = 20,<br />

the inverse demand function is p = 5 - 20Q, and<br />

the marginal revenue function is MR = 5 - 40Q.<br />

Using this information, you can draw a figure<br />

similar <strong>to</strong> Figure 12.3.<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

E-45<br />

3.11 If a monopoly manufacturer can price discriminate,<br />

its price is p i = m/(1 + 1/ε i ) in Country i, i = 1, 2. If<br />

the monopoly cannot price discriminate, it charges<br />

everyone the same price. Its <strong>to</strong>tal demand is Q =<br />

Q 1 + Q 2 = n 1 p ε 1 + n 2 p ε 2. Differentiating with<br />

respect <strong>to</strong> p, we obtain dQ/dp = ε 1 Q 1 /p + ε 2 Q 2 /p.<br />

Multiplying through by p/Q, we learn that the<br />

weighted sum of the two groups’ elasticities is<br />

ε = s 1 ε 1 + s 2 ε 2 , where s i = Q i /Q. Thus, a profitmaximizing,<br />

single-price monopoly charges p =<br />

m/(1 + 1/ε).<br />

Chapter 13<br />

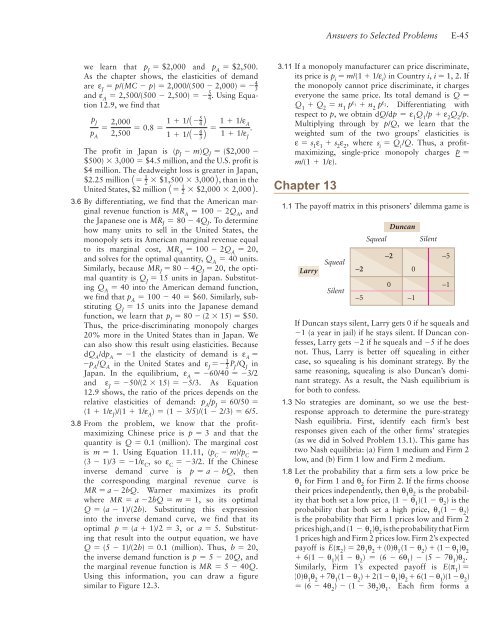

1.1 The payoff matrix in this prisoners’ dilemma game is<br />

Larry<br />

Squeal<br />

Silent<br />

–2<br />

–5<br />

Duncan<br />

Squeal Silent<br />

–2 –5<br />

If Duncan stays silent, Larry gets 0 if he squeals and<br />

-1 (a year in jail) if he stays silent. If Duncan confesses,<br />

Larry gets -2 if he squeals and -5 if he does<br />

not. Thus, Larry is better off squealing in either<br />

case, so squealing is his dominant strategy. By the<br />

same reasoning, squealing is also Duncan’s dominant<br />

strategy. As a result, the Nash equilibrium is<br />

for both <strong>to</strong> confess.<br />

1.3 No strategies are dominant, so we use the bestresponse<br />

approach <strong>to</strong> determine the pure-strategy<br />

Nash equilibria. First, identify each firm’s best<br />

responses given each of the other firms’ strategies<br />

(as we did in Solved Problem 13.1). This game has<br />

two Nash equilibria: (a) Firm 1 medium and Firm 2<br />

low, and (b) Firm 1 low and Firm 2 medium.<br />

1.8 Let the probability that a firm sets a low price be<br />

θ1 for Firm 1 and θ2 for Firm 2. If the firms choose<br />

their prices independently, then θ1θ2 is the probability<br />

that both set a low price, (1 - θ1 )(1 - θ2 ) is the<br />

probability that both set a high price, θ1 (1 - θ2 )<br />

is the probability that Firm 1 prices low and Firm 2<br />

prices high, and (1 - θ1 )θ2 is the probability that Firm<br />

1 prices high and Firm 2 prices low. Firm 2’s expected<br />

payoff is E(π2 ) = 2θ1θ2 + (0)θ1 (1 - θ2 ) + (1 - θ1 )θ2 + 6(1 - θ1 )(1 - θ2 ) = (6 - 6θ1 ) - (5 - 7θ1 )θ2 .<br />

Similarly, Firm 1’s expected payoff is E(π1 ) =<br />

(0)θ1θ2 + 7θ1 (1 - θ2 ) + 2(1 - θ1 )θ2 + 6(1 - θ1 )(1 - θ2 )<br />

= (6 - 4θ2 ) - (1 - 3θ2 )θ1 . Each firm forms a<br />

0<br />

0 –1<br />

–1