Answers to Selected Problems

Answers to Selected Problems

Answers to Selected Problems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

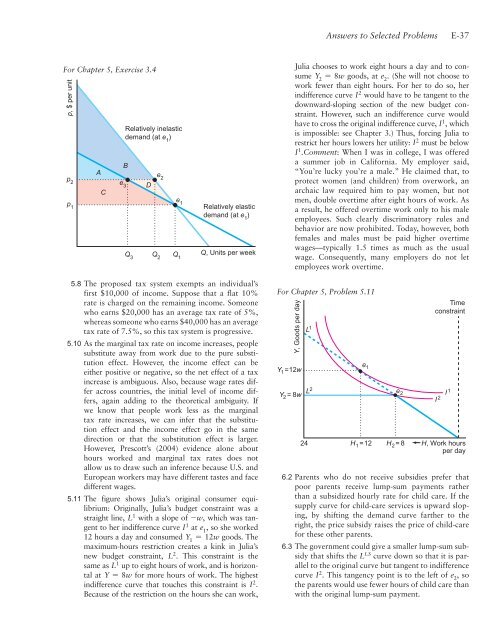

For Chapter 5, Exercise 3.4<br />

p, $ per unit<br />

p 2<br />

p 1<br />

A<br />

C<br />

Relatively inelastic<br />

demand (at e 1 )<br />

B<br />

e 3 D<br />

Q 3<br />

e 2<br />

Q 2<br />

Q, Units per week<br />

5.8 The proposed tax system exempts an individual’s<br />

first $10,000 of income. Suppose that a flat 10%<br />

rate is charged on the remaining income. Someone<br />

who earns $20,000 has an average tax rate of 5%,<br />

whereas someone who earns $40,000 has an average<br />

tax rate of 7.5%, so this tax system is progressive.<br />

5.10 As the marginal tax rate on income increases, people<br />

substitute away from work due <strong>to</strong> the pure substitution<br />

effect. However, the income effect can be<br />

either positive or negative, so the net effect of a tax<br />

increase is ambiguous. Also, because wage rates differ<br />

across countries, the initial level of income differs,<br />

again adding <strong>to</strong> the theoretical ambiguity. If<br />

we know that people work less as the marginal<br />

tax rate increases, we can infer that the substitution<br />

effect and the income effect go in the same<br />

direction or that the substitution effect is larger.<br />

However, Prescott’s (2004) evidence alone about<br />

hours worked and marginal tax rates does not<br />

allow us <strong>to</strong> draw such an inference because U.S. and<br />

European workers may have different tastes and face<br />

different wages.<br />

5.11 The figure shows Julia’s original consumer equilibrium:<br />

Originally, Julia’s budget constraint was a<br />

straight line, L1 with a slope of -w, which was tangent<br />

<strong>to</strong> her indifference curve I1 at e1 , so she worked<br />

12 hours a day and consumed Y1 = 12w goods. The<br />

maximum-hours restriction creates a kink in Julia’s<br />

new budget constraint, L2 . This constraint is the<br />

same as L1 up <strong>to</strong> eight hours of work, and is horizontal<br />

at Y = 8w for more hours of work. The highest<br />

indifference curve that <strong>to</strong>uches this constraint is I2 .<br />

Because of the restriction on the hours she can work,<br />

e 1<br />

Q 1<br />

Relatively elastic<br />

demand (at e 1 )<br />

<strong>Answers</strong> <strong>to</strong> <strong>Selected</strong> <strong>Problems</strong><br />

E-37<br />

Julia chooses <strong>to</strong> work eight hours a day and <strong>to</strong> consume<br />

Y 2 = 8w goods, at e 2 . (She will not choose <strong>to</strong><br />

work fewer than eight hours. For her <strong>to</strong> do so, her<br />

indifference curve I 2 would have <strong>to</strong> be tangent <strong>to</strong> the<br />

downward-sloping section of the new budget constraint.<br />

However, such an indifference curve would<br />

have <strong>to</strong> cross the original indifference curve, I 1 , which<br />

is impossible: see Chapter 3.) Thus, forcing Julia <strong>to</strong><br />

restrict her hours lowers her utility: I 2 must be below<br />

I 1 .Comment: When I was in college, I was offered<br />

a summer job in California. My employer said,<br />

“You’re lucky you’re a male.” He claimed that, <strong>to</strong><br />

protect women (and children) from overwork, an<br />

archaic law required him <strong>to</strong> pay women, but not<br />

men, double overtime after eight hours of work. As<br />

a result, he offered overtime work only <strong>to</strong> his male<br />

employees. Such clearly discrimina<strong>to</strong>ry rules and<br />

behavior are now prohibited. Today, however, both<br />

females and males must be paid higher overtime<br />

wages—typically 1.5 times as much as the usual<br />

wage. Consequently, many employers do not let<br />

employees work overtime.<br />

For Chapter 5, Problem 5.11<br />

Y, Goods per day<br />

Y1 = 12w<br />

Y 2 = 8w<br />

L 1<br />

L2<br />

e 1<br />

Time<br />

constraint<br />

I 1<br />

I 2<br />

24 H1 = 12 H2 = 8 H, Work hours<br />

per day<br />

6.2 Parents who do not receive subsidies prefer that<br />

poor parents receive lump-sum payments rather<br />

than a subsidized hourly rate for child care. If the<br />

supply curve for child-care services is upward sloping,<br />

by shifting the demand curve farther <strong>to</strong> the<br />

right, the price subsidy raises the price of child-care<br />

for these other parents.<br />

6.3 The government could give a smaller lump-sum subsidy<br />

that shifts the L LS curve down so that it is parallel<br />

<strong>to</strong> the original curve but tangent <strong>to</strong> indifference<br />

curve I 2 . This tangency point is <strong>to</strong> the left of e 2 , so<br />

the parents would use fewer hours of child care than<br />

with the original lump-sum payment.<br />

e 2