Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management <strong>Report</strong><br />

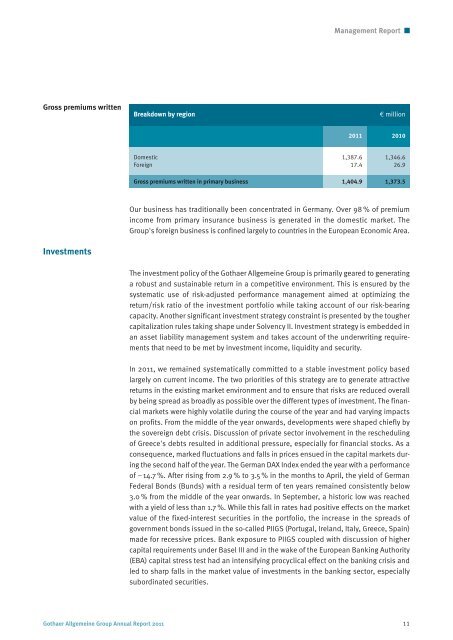

Gross premiums written<br />

Breakdown by region<br />

€ million<br />

2011 2010<br />

Domestic 1,387.6 1,346.6<br />

Foreign 17.4 26.9<br />

Gross premiums written in primary business 1,404.9 1,373.5<br />

Our business has traditionally been concentrated in Germany. Over 98 % of premium<br />

income from primary insurance business is generated in the domestic market. The<br />

<strong>Group</strong>'s <strong>for</strong>eign business is confined largely to countries in the European Economic Area.<br />

Investments<br />

The investment policy of the <strong>Gothaer</strong> <strong>Allgemeine</strong> <strong>Group</strong> is primarily geared to generating<br />

a robust and sustainable return in a competitive environment. This is ensured by the<br />

systematic use of risk-adjusted per<strong>for</strong>mance management aimed at optimizing the<br />

return/risk ratio of the investment portfolio while taking account of our risk-bearing<br />

capacity. Another significant investment strategy constraint is presented by the tougher<br />

capitalization rules taking shape under Solvency II. Investment strategy is embedded in<br />

an asset liability management system and takes account of the underwriting requirements<br />

that need to be met by investment income, liquidity and security.<br />

In 2011, we remained systematically committed to a stable investment policy based<br />

largely on current income. The two priorities of this strategy are to generate attractive<br />

returns in the existing market environment and to ensure that risks are reduced overall<br />

by being spread as broadly as possible over the different types of investment. The financial<br />

markets were highly volatile during the course of the year and had varying impacts<br />

on profits. From the middle of the year onwards, developments were shaped chiefly by<br />

the sovereign debt crisis. Discussion of private sector involvement in the rescheduling<br />

of Greece's debts resulted in additional pressure, especially <strong>for</strong> financial stocks. As a<br />

consequence, marked fluctuations and falls in prices ensued in the capital markets during<br />

the second half of the year. The German DAX Index ended the year with a per<strong>for</strong>mance<br />

of –14.7 %. After rising from 2.9 % to 3.5 % in the months to April, the yield of German<br />

Federal Bonds (Bunds) with a residual term of ten years remained consistently below<br />

3.0 % from the middle of the year onwards. In September, a historic low was reached<br />

with a yield of less than 1.7 %. While this fall in rates had positive effects on the market<br />

value of the fixed-interest securities in the portfolio, the increase in the spreads of<br />

government bonds issued in the so-called PIIGS (Portugal, Ireland, Italy, Greece, Spain)<br />

made <strong>for</strong> recessive prices. Bank exposure to PIIGS coupled with discussion of higher<br />

capital requirements under Basel III and in the wake of the European Banking Authority<br />

(EBA) capital stress test had an intensifying procyclical effect on the banking crisis and<br />

led to sharp falls in the market value of investments in the banking sector, especially<br />

subordinated securities.<br />

<strong>Gothaer</strong> <strong>Allgemeine</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> 2011 11